|

Report

from

Europe

EU trade in wood furniture rises in 2014

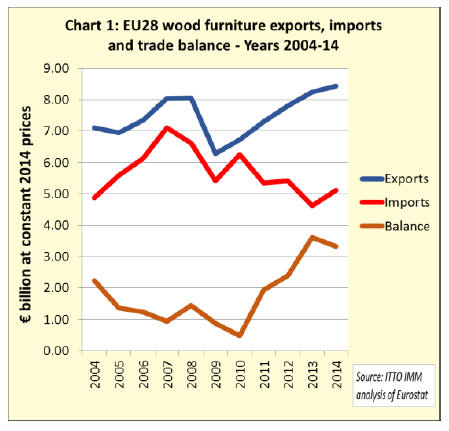

The sharp rise in the EU trade surplus in wooden furniture

between 2010 and 2013 came to a halt last year as the pace

of increase in EU exports slowed while there was an

upturn in imports (Chart 1).

EU28 wooden furniture exports were valued at €8.43

billion in 2014, 2.3% more than in 2013. EU28 imports of

wooden furniture were valued at €5.11 billion in 2014,

10.4% greater than the previous year.

The EU 28‟s trade surplus in wooden furniture fell 8.2%

from €3.62 billion in 2013 to €3.32 billion in 2014.

Nevertheless, the trade surplus remains very high

compared to the boom years prior to the financial crises

when European manufacturers were focusing most of their

attention on domestic sales and external suppliers, notably

in China, were making significant inroads into the market.

Putting these figures into perspective it will be seen that

EU external trade in wooden furniture is relatively small

compared to total consumption, which is about €50 billion

per year most of which is from domestic manufacturers.

Only about one quarter of wooden furniture consumed in

the EU member states ever crosses a national boundary.

Total internal trade in wooden furniture between EU

countries has averaged around €15 billion per year since

2009.

Exports of growing importance for EU furniture

manufacturers

While external trade forms only a small part of the EU

furniture sector, it is becoming much more relevant to

European furniture manufacturers.

During the current recession, manufacturers have become

more focused on improving competitiveness relative to

manufacturers in other countries, particularly China. With

consumption static in domestic markets, European

furniture companies are seeking to increase sales in other

parts of the world.

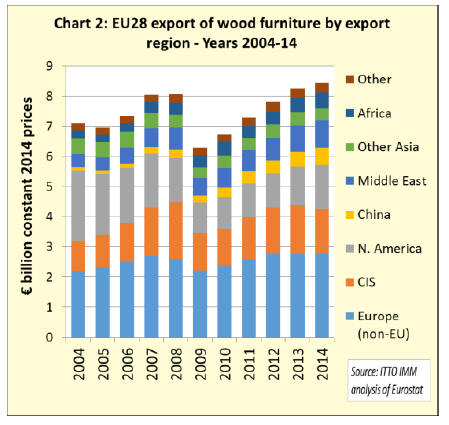

This outward looking strategy has led to a consistent rise

in EU wooden furniture exports over the last five years

(Chart 2). In 2014, EU28 export values increased to North

America (+15% to €1.48 billion), China (+17% to €570

million), the Middle East (+3% to €900 million), and

Africa (+11% to €520 million).

These gains during 2014 offset a 9% decline in exports to

the CIS region to €1.46 billion. Falling exports to the CIS

are due mainly to slowing sales in Russia following

economic sanctions in response to the Ukraine conflict and

declining international prices for Russian oil and gas

which has weakened the economy and affected consumer

spending.

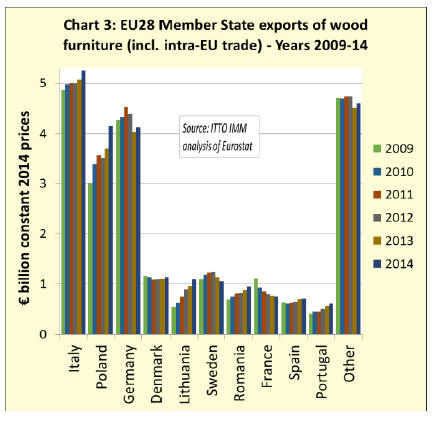

The rise in EU exports of wooden furniture is being led by

manufacturers in Italy, Poland and Germany (Chart 3).

Preliminary data for 2014 indicates that exports of wooden

furniture (including intra-EU trade) increased from Italy

(+4% to €5.25 billion), Poland (+12% to €4.14 billion) and

Germany (+2% to €4.12 billion).

Last year, Poland overtook Germany to become Europe‟s

second largest exporter of wooden furniture. Wooden

furniture exports have also been rising rapidly from

Lithuania, Romania, Spain and Portugal in the last five

years. However exports from Sweden and France have

declined while exports from Denmark have been stable

(Chart 3).

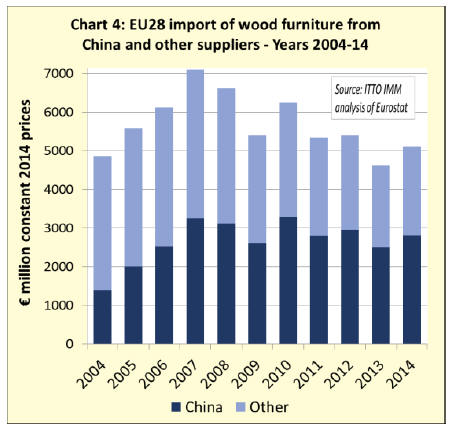

EU wooden furniture imports rebounded in 2014

After falling 14% in 2013, the value of EU wooden

furniture imports rebounded by 10% in 2014 to reach

€5.12 billion (Chart 4). Imports from China fell 16% in

2013 but recovered by 14% to €2.81 billion in 2014.

EU imports from the rest of the world also rebounded in

2014, increasing 8% to €2.3 billion after a 13% decline in

2013.

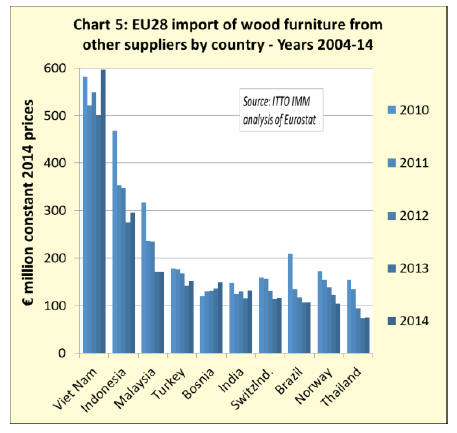

EU imports of wooden furniture from Vietnam increased

strongly last year, rising 19% to €596 million. This

followed a 9% decline in 2013. After several years of

declining sales, Indonesian wooden furniture recovered a

little ground in the EU market in 2014, with imports rising

7% to €296 million.

There was also a 13% rise in imports from India to €132

million. Imports from Malaysia and Brazil remained stable

between 2013 and 2014 at €172 million and €106 million

respectively (Chart 5).

Analysis of economic indicators in Europe does not

provide an obvious explanation for the sharp fall in EU

wooden furniture imports in 2013 and rebound in 2014.

Throughout this period there was slow growth and flat

consumer spending in the EU. Also exchange rates did not

change significantly.

However demand in the UK, which is the largest European

importer of wooden furniture accounting for nearly one

third of all imports from outside the EU, was recovering

more strongly in 2014. There was also a particularly sharp

increase in wooden furniture import penetration into

Germany, France, Italy and Sweden last year.

﹛

The EU wooden furniture import trend in the last two

years may have been affected by supply side issues. Some

new wooden furniture manufacturing capacity has come

on-stream in Eastern Europe 每 notably in Poland,

Lithuania and Romania每 and this may have depressed EU

imports from other regions in 2013.

In 2014, slowing in China‟s domestic market may have reenergised

efforts by Chinese and other Asian

manufacturers to increase sales in Europe.

Another factor is introduction of the EUTR in March 2013

which may have briefly disrupted EU imports of wooden

furniture as retailers struggled to obtain necessary

assurances of legal wood origin from their overseas

suppliers. If so, the rebound in 2014 may be a sign that

overseas suppliers have been able to satisfy these new

regulatory demands.

CSIL reports rise in global furniture trade to US$128

billion

The latest edition of World Furniture

(www.worldfurnitureonline.com), the quarterly journal of

the Italy-based furniture industry research association

CSIL, includes a wide ranging review of recent

developments in the international furniture sector.

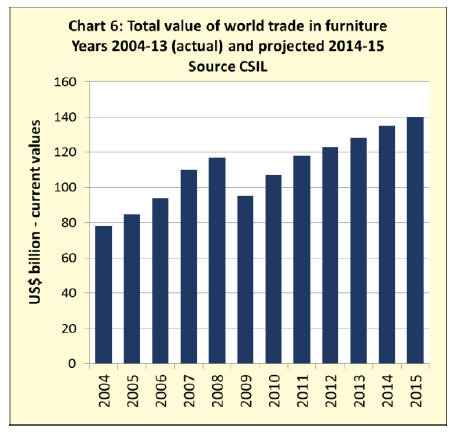

The CSIL analysis of world furniture trade, which draws

on data from the world‟s 70 largest economies, indicates

that total trade value was US$128 billion in 2013, around

1% of all global trade in manufactured products. The

leading furniture importers during the year were the

United States, Germany, France, the UK and Canada.

The annual trend in global furniture trade reported by

CSIL is shown in Chart 6. In the period 2004 to 2008,

global trade was rising driven primarily by imports into

the United States, with smaller increases into the United

Kingdom, France, Germany and Canada.

Trade declined during the financial crises in 2009, but

there was uninterrupted growth in the 2010 to 2013 period.

This was driven mainly by recovery in North America and

growth in emerging markets. The European market

remained relatively weak during this period, although

there was some growth in imports into Germany and the

UK.

CSIL estimates that growth in global trade continued into

2014 and projected a further increase to close to US$140

billion in 2015. Import penetration for furniture (measured

as the ratio between imports and consumption) is presently

about 30% on a world scale.

According to CSIL, the main furniture exporting countries

in 2013 were China, Italy, Germany, Poland and the

United States. The relative positions of the main exporting

countries changed considerably between 2004 and 2013.

China has become the world's leading exporter, overtaking

Italy which is currently in second position. Between 2004

and 2013 China increased share of global furniture trade

from 14% to 38%.

Another major change is the rapid emergence of Vietnam,

which jumped from 15th to 6th position in the period 2004

to 2013.

CSIL highlight that a significant proportion of furniture

trade is more accurately described as ※intra-regional§

rather than truly ※international§. This is particularly true

of Europe.

In the EU plus Norway, Switzerland and Iceland, 76% of

trade takes place between countries within the region and

only 24% is with countries in other parts of the world. In

the NAFTA area (USA, Canada and Mexico), about 27%

of foreign furniture trade is within the three countries and

73% is with countries outside the region.

In the Asia and Pacific region, about 39% of furniture

trade is within the region.

Western European furniture market recovers slowly

The latest edition of World Furniture also provides CSIL‟s

update on recent trends in furniture consumption and

production in Western Europe. CSIL note that the region‟s

furniture sector has faced significant difficulties in recent

years but is now slowly recovering.

CSIL estimate that total Western European furniture

market value was €71 billion at producer prices in 2013, a

slight downturn compared to the previous year and below

pre-crises levels.

However the market remains globally significant,

accounting for one quarter of the value of world furniture

consumption, 40% of world furniture import value and

30% of world furniture export value. CSIL estimate that

the market grew by 0.5% in 2014 and project 1% growth

in 2015.

CSIL identify the dominant markets in Western Europe as

Germany, France, the UK and Italy. These four countries

account for two thirds of total furniture demand in the

region.

Market performances have varied widely between

countries. While several markets including Spain, Italy

and France, are still well below pre-recession levels,

others are performing well including Norway, Switzerland

and Sweden.

European specifiers need to be more flexible in their

choice of hardwood

Use of verified sustainable timber could be limited by

specifiers being too restrictive in choice of species and

certification scheme. This was the conclusion of a seminar

on sustainable timber in government projects organised by

the Netherlands Green Deal initiative reported in the

ETTF newsletter.

An alliance of industry, end users, retailers, NGOs and

government including Tropenbos and the Royal

Netherlands Timber Trade Association (NTTA) aims to

make certified sustainable timber the Netherlands market

norm. The seminar, under the title ※Stimulating

Sustainable Forestry§, took place in Tiel at the

Rivierenland Water Board (Waterschap).

Delegates heard that certified sustainable timber has risen

from 58% to 86% of NTTA members‟ total imports since

2008. However, in hardwood certified material‟s share is

only 55%, so ※considerable§ efforts were needed to boost

sales, particularly in Netherland‟s key marine products

sector, said speakers. One route to market growth, it was

suggested, was to give contractors greater specification

freedom.

The Netherlands government‟s Timber Procurement

Assessment Committee (TPAC) accepts FSC, PEFC and

Malaysian MTCS certification as proof of sustainability.

According to Annemieke Visser Winterink of the Probos

forestry foundation, specifiers should therefore opt for

material verified under any of these schemes, and focus on

technical capabilities rather than specific species.

※By adhering to government certification criteria and

specifying physical mechanical properties rather than

species, you give contractors freedom of choice,§ she said.

※That not only potentially increases the quality and cost

effctiveness of the project, but helps broaden use of wood

from sustainably managed forests."

International Hardwood Conference

The ETTF will jointly host the 2015 International

Hardwood Conference in Copenhagen on September 17

2015 with the European Sawmillers Organisation (EOS).

Consequently it will broaden to encompass non-European

species, including tropical, as well as European

hardwoods.

European hardwood trade struggles with low

profitability and investment

The Annual Review published at the turn of the year by

the Germany based EUWID journal provides a wealth of

information on European and North American corporate

investment, divestment and bankruptcies in the forest

products sector during the previous 12 months. As such

it‟s a rare and valuable insight into the underlying

financials and direction of development of the sector as a

whole.

The hardwood sector, being generally dominated by

smaller fragmented firms, does not feature strongly

compared to the much larger more consolidated softwood

and panels industries.

However there are some interesting observations, most

reinforcing the image of an industry struggling with low

levels of investment and innovation and rising levels of

competition.

For example: In the European import trade, the main news

in 2014 identified by EUWID was the break-up of Danish

Group Dalhoff Larsen and Horneman A/S (DLH) which

formerly had several large stock holding operations in

Western Europe and was also a leading distributor of

tropical wood into Eastern Europe.

EUWID note that ※furthermore, other importers of tropical

wood have also experienced economic difficulties. A

prominent example in this context is the Swiss group

Precious Woods Holding AG which in the third quarter of

the year announced that continuation of its business was in

jeopardy.

In February German company B&T Wood Trading

GmbH, Meerbeck, was compelled to submit an application

for insolvency. Dutch company Zuid-Nederlandse

Houtindustrie B.V. terminated its business activities in

Octoner§.

The rate of reduction in European sawmill capacity (both

softwood and hardwood) during 2014 was much lower

than in 2013. EUWID notes that ※the consolidation in the

European sawmill sector which in the estimation of market

participants continues to be necessary has not taken place

this year§.

The implication is that the domestic wood sector continues

to suffer from a degree of over-capacity, always a problem

for external suppliers selling into the market.

On the other hand, nor is there any news of any large new

investments in the European hardwood sawmilling sector

during 2014.

Similarly, there were very few new developments in

European wood-based panel and surfaces sector in 2014

after a large number of transactions in 2013.

The European Luxury Vinyl Tiles (LVT) continues to

expand and, according to EUWID, this is likely at the

expense of other material suppliers to the flooring sector.

The main trend identified in the wood flooring sector is a

continuing shift in production from Western to Eastern

Europe, with reference made to new or expanding

facilities in Lithuania, Romania and the Czech Republic.

WPC taking greater share of European markets important

for tropical wood.

WPC is having a particularly significant impact in markets

for exterior products in Germany, France, UK, Belgium,

Netherlands and Spain. WPC products sold in Europe are

mainly imported from the USA and China.

This data needs to be considered alongside the decline in

EU imports of tropical hardwood decking profiles from

around 747,000 cu.m in 2007 to less than 300,000 cu.m in

2013.

It‟s clear that the expansion in EU consumption of WPC

combined with the installation of around 300,000 cu.m of

capacity for thermal treatment of temperate wood in

Europe, not to mention expansion of capacity for

acetylation and other forms of chemical treatment,

presents a significant challenge to tropical wood in

European markets for exterior products.

AHEC highlight continuing focus on oak and walnut in

European furniture

A recent report from the American Hardwood Export

Council (AHEC) reviews hardwood furniture trends based

on a visit to the annual IMM furniture show in Germany.

From observations and interviews at the show AHEC

suggests that, after more than five years of poor sales and

falling consumption, the market for high-end furniture in

Europe is improving.

As in previous years, designs in oak and walnut were

dominant. Nearly all walnut was from the United States,

while most oak was European. AHEC suggest this is

primarily due to the easy access to European oak by

Central European manufacturers.

These manufacturers are also now able to utilise relatively

low grades and short specifications which can be sourced

very competitively. Increasing use of these grades has

gone hand-in-hand with deliberate marketing of the

※rustic§ look in oak furniture. AHEC also suggest that

solid wood is in vogue and there appears to be less veneer

used than in the past.

AHEC note that the only tropical wood on display was in

the international section and mainly in the Indonesian

pavilion. Temperate species other than oak and walnut

were also not much in evidence. There was some beech,

mostly for chairs and table legs but not for large visual

surfaces of table tops and cabinet doors.

AHEC observed that there was lack of strong

environmental messages and branding at the show,

surprising given that IMM Cologne is the main shop

window for high end commercial furniture sold in Europe.

Most furniture manufacturers apparently have yet to

embrace LCA or EPDs for active market development 每

although some companies are now considering this as a

way to differentiate product in a highly competitive

market.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|