Japan Wood Products

Prices

Dollar Exchange Rates of

25th February 2015

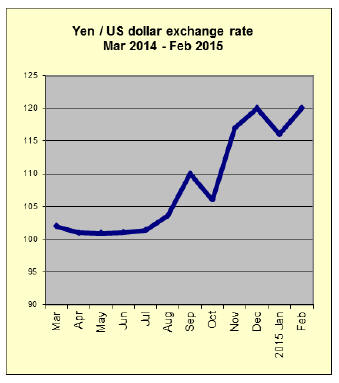

Japan Yen 118.98

Reports From Japan

GDP growth spurred by rising exports

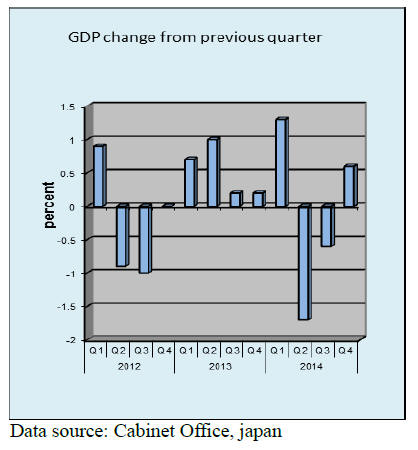

With final quarter 2014 GDP returning to positive territory

the Japanese economy pulled out of recession. Final

quarter 2014 GDP rose 0.6%, a welcome sign but analysts

were expecting a stronger rebound.

The improvement in GDP was achieved on the back of

rising exports. Exports to China are growing as Chinese

consumers are responding to the government‟s efforts to

boost domestic consumption.

First quarter exports to the US, Japan‟s largest export

market, were the best for almost five years. However,

there are risks to sustained growth as the economies of

China and the EU face difficulties.

Japan‟s GDP growth in the final quarter of 2014 was

largely export driven but higher consumer spending will

be the only way for the upward trend to be sustained. In a

note of caution the Bank of Japan said lower energy costs

if sustained will slow progress toward its inflation target of

2%.

SMEs manufacturers cheered by talk of government

support

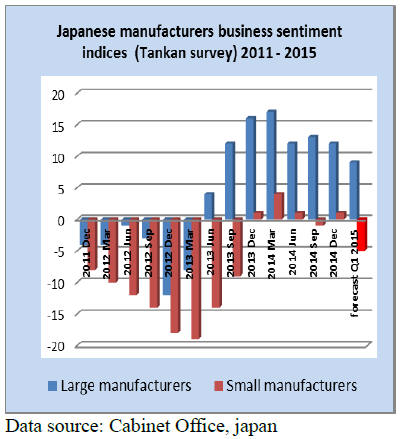

The final quarter 2014 survey of sentiment among Japan's

manufacturers paints a depressing picture with sentiment

amongst the large enterprises slipping by three points

emphasising the pessimistic mood of manufacturers.

However smaller manufacturers were cheered by talk of

government support for small enterprises which lifted the

sentiment index for the small manufacturer group out of

negative territory.

For the first quarter of 2105 the projection provided in the

Tankan suggests a continuing downward trend in

sentiment. This is not a surprise as domestic consumption

remains weak.

Japan‟s annual exports in January jumped the most since

late 2013 in an encouraging sign the weak yen is finally

helping the economy crawl out of recession.

January Housing starts affected by bad weather

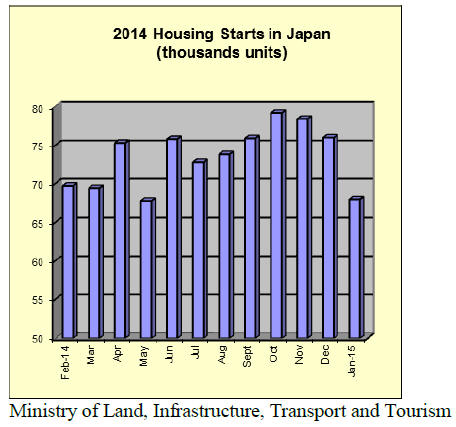

January housing starts totaled 68,000 units, down from the

76,000 units in December 2104, an almost 11% drop. Year

on year, January starts were 13% down.

Analysts were surprised by the sharp drop in January

housing starts even taking into consideration the very bad

weather in northern and western Japan which has brought

construction to a halt.

On the brighter side, construction companies in Japan

reported an increase in orders during January.

Data suggests weaker yen boosted exports

The yen strengthened slightly towards the end of February

as the Bank of Japan announced it has no immediate plans

for further monetary easing.

Recent data suggest that the weaker yen is boosting

exports. January 2015 exports rose at the fastest rate since

late 2013 and exporters are confident on prospects for the

next three months despite a deteriorating global outlook.

The 17% year-on-year increase in January 2015 exports

was the fifth monthly improvement driven by shipments of

vehicles and electronics.

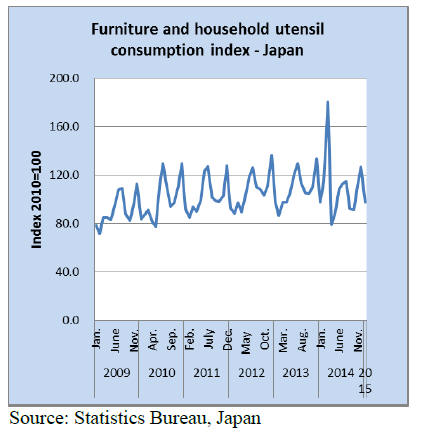

Furniture consumption trends

Japan‟s Statistics Bureau compiles an index on furniture

and household item consumption and the trend is

illustrated below.

Two things are readily apparent; there is a recurring

increase in consumption just after companies in Japan pay

the summer bonuses (June or July) to workers and the

steep rise in furniture consumption just prior to the

increase in consumption tax in April 2014.

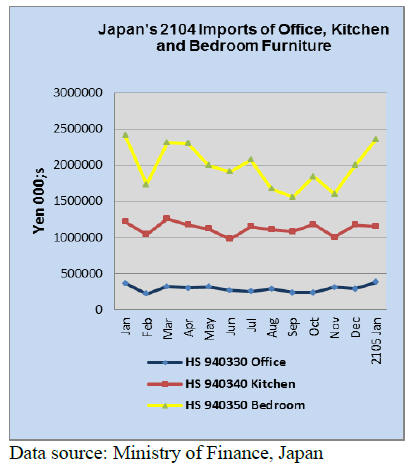

Japan’s furniture imports

2015 got off to a good start for suppliers of bedroom

furniture to Japan. January import statics reveal a sharp

rise in bedroom furniture imports compared to levels in

December, building upon the gain seen at the end of 2014.

In contrast kitchen furniture imports in Janauary 2015

were flat while office furniture imports rose marginally.

In comparison to imports in January 2014, Japan‟s office

furniture imports in January 2015 were up around 4%.

Imports of Kitchen furniture over the same period were

down 5% and bedroom furniture imports were also down

(2%) in January 2015 compared to the same month in

2014.

Office furniture imports (HS 940330)

In January 2015 suppliers in three countries, China,

Portugal, and Italy accounted for around 84% of all office

furniture imports to Japan. Compared to December 2014

imports from China during January Japan‟s imports rose

36%, imports from Portugal fell 15% while imports from

Italy doubled.

Of tropical suppliers only Malaysia, Indonesia and

Vietnam supplied office furniture in January but their

combined contribution to overall imports was just 4%.

Suppliers in the EU, in contrast, accounted for 38% of

Japan‟s office furniture imports.

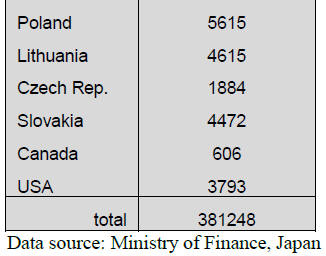

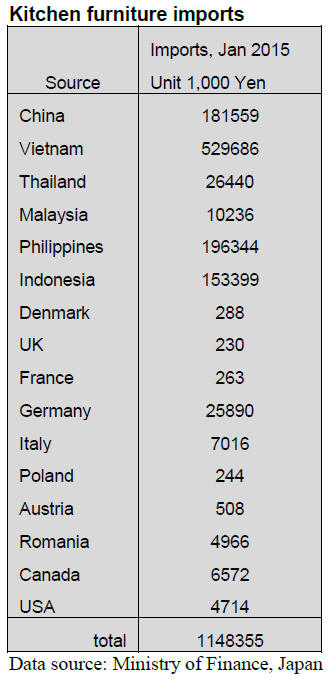

Kitchen furniture imports (HS 940340)

In January this year Vietnam held on to the position of

number one supplier of kitchen furniture to Japan. Imports

from China in January 2015 were up 24% year on year but

Vietnam suppliers could only manage a 6% improvement

on December figures. The other two major suppliers,

Philippines and Indonesia, saw imports fall close to 20%.

The top four suppliers, China, Philippines, Vietnam and

Indonesia accounted for 94% of all Japan‟s January 2015

kitchen furniture imports. Suppliers in SE Asia; Vietnam,

Thailand, Malaysia, Philippines and Indonesia accounted

for 80% of Japan‟s January 2015 kitchen furniture

imports.

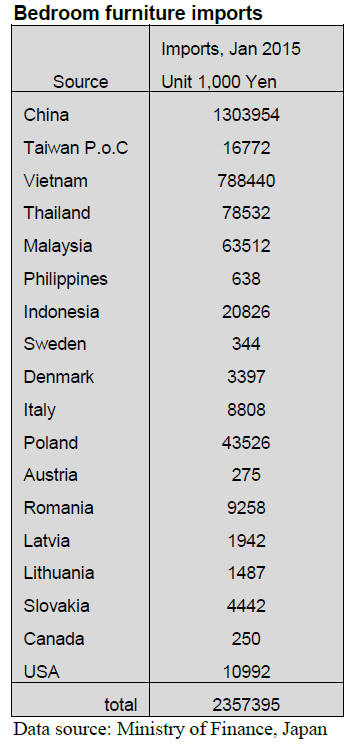

Bedroom furniture imports (HS 940350)

Suppliers in SE Asia accounted for around 40% of Japan‟s

bedroom furniture imports in January 2015. Of the five SE

Asian countries shipping bedroom furniture to Japan the

largest supplier was Vietnam.

Other suppliers were Thailand, Malaysia Philippines and

Indonesia.

Despite the strong performance of SE Asian suppliers,

China dominated January bedroom furniture imports by

Japan where it saw its contribution to total imports climb

14% however, this rise was dwarfed by the massive 58%

increase in supplies from Vietnam.

Both Thailand and Malaysia saw a decline in January 2105

shipments of bedroom furniture to Japan.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

North American log imports in 2014

Total import of North American logs in 2014 was 3,047 M

cbms, 10.8% less than 2013. Log import in 2013 increased

by 14% than 2012 due to rush-in import before the

consumption tax hike so 2014 volume dropped compared

to active import in 2013.

In the first half of 2014, demand was hot and orders

increased and the supply could not catch up busy demand

but in the second half, the demand sharply decreased and

import volume dropped clearly.

At the beginning of last year, general forecast was

reactionary drop of demand related to the increase of

consumption tax should not be so much but foresight went

wrong and the market struggled with heavy inventories in

weak demand. Sawmills and plywood mills could not buy

until their inventories decreased so the purchase volume

dropped.

By unloading port, Kure and Kashima, where Chugoku

Lumber has sawmills, remain top and second but the

volume for Kure decreased by 20.7% from 2013 and the

volume for Kashima also declined by 7.5%.

Ta Ann Plywood builds veneer plant

Ta Ann Plywood (Sibu, Sarawak, Malaysia, K.H.Won,

president) is building veneer plant in Bintulu, which will

start up the operation in June this year. It will use 3,000

cbms of acacia logs as raw material to produce 1,500 cbms

of veneer. Veneer plant is built near acacia plantation and

veneer is hauled to plywood plant to save transportation

cost.

Total production of plywood plant will increase to about

20,0000 cbms a month. Plan is to make concrete forming

panel for coating and structural panel for Japan market.

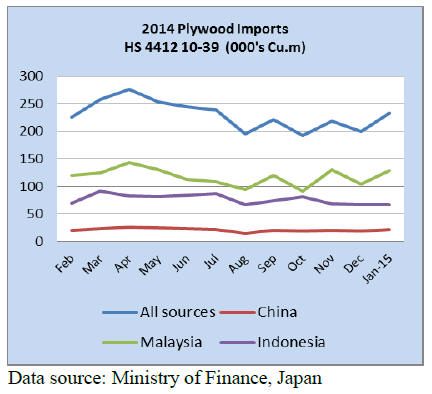

Plywood

Domestic softwood plywood market is weakly holding.

Deliveries of orders in December delayed by truck

shortage but they completed in January so new orders

started in late January.

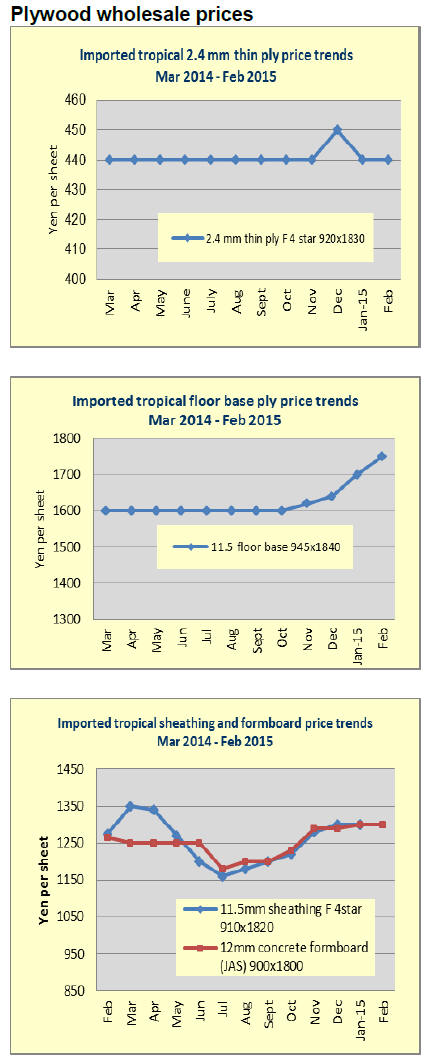

The manufacturers proposed higher prices in late

November and again in December but delay of deliveries

confused the market and dealers were busy finishing order

balances in January.

The movement is slow in the middle of winter and price

quotations by precutting plants and large dealers are

getting severe. Current market prices in Tokyo are 850-

860 yen per sheet delivered, slightly down from last

month.

Total softwood plywood production in 2014 was

2,617,100 cbms, 0.4% less than 2013 and the shipment

was 2,523,400 cbms, 5.6% less. Import plywood market

continues flat since last December. Since late

January, higher cost cargoes started arriving but price

increase is difficult by absence of demand.

Wholesalers, which have low cost inventories, do not have

to increase the sales prices so much based on their cost so

the market prices do not go up.

Since last October, many ships arrived at one time so that

unloading works delayed and port inventories increased.

In Tokyo market, prices of JAS 3x6 concrete forming for

coating are 1,400-1,420 yen per sheet delivered, no change

from January.

|