|

Report from

North America

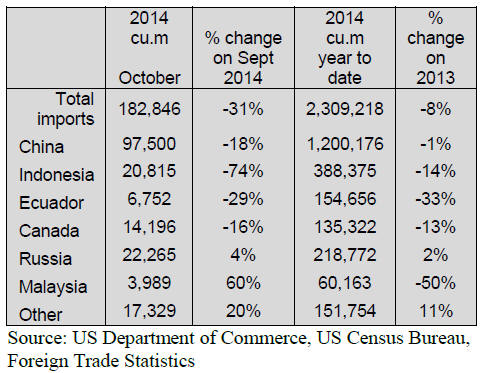

Steep decline in plywood imports in October

US imports of hardwood plywood fell by almost one third

in October. Total imports were 182,846 cu.m. Year-to-date

imports were 1% lower than at the same time last year.

All major suppliers were affected by the decline in

imports, but the strongest decrease was in imports from

Indonesia. Indonesian plywood shipments to the US were

20,815 cu.m., down 74% from September. Year-to-date

imports from Indonesia were 9% lower than in 2013.

Hardwood plywood imports from China decreased by 18%

in October to 97,500 cu.m. Year-to-date imports remain

7% higher than in 2013. Imports from Canada and

Ecuador fell by 16% and 29%, respectively.

Russia‟s hardwood plywood shipments to the US

increased to22,265 cu.m. Year-to-date imports from

Russia were 12% higher than in October 2013.

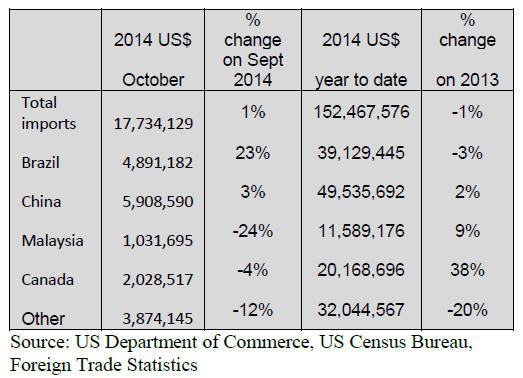

Moulding imports from Brazil up 23%

There was little change in hardwood moulding imports in

October. Total imports were worth US$17.6 million. Yearto-

date imports were 10% higher than in October 2013.

All major suppliers shipped more moulding to the US

compared to October 2013.

Hardwood moulding imports from China increased by 3%

to US$5.9 million in October. Brazil‟s shipments were

worth US$4.9 million, up 23% from September.

Imports from Malaysia fell by 24% in October from the

previous month, but year-to-date imports were 19% higher

than in October 2013.

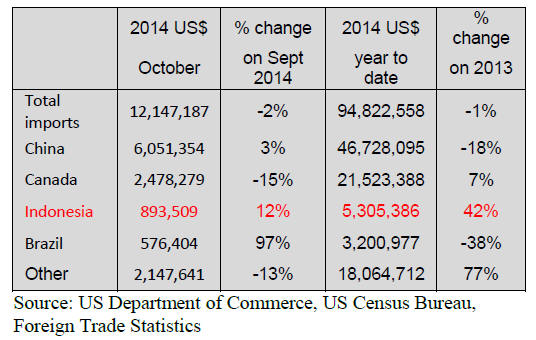

Significant growth in assembled panel flooring imports

from Indonesia

Hardwood flooring imports decreased by 13% to US$3.4

million in October, but on a year-to-date basis imports

remain higher than at the same time last year. Assembled

flooring panel imports declined slightly from September to

US$12.1 million (+11% year-to-date).

The largest fall in hardwood flooring imports was from

Malaysia. Imports fell by 18% to US$928,701. Hardwood

flooring imports from Indonesia declined by 3% to

US$606,766.

Assembled flooring panel imports from China were

US$6.1 million in October, up from the previous month

but lower than in 2013. Imports from Canada and

Indonesia increased in October. Indonesia‟s monthly

shipment value was nearly US$1 million, and year-to-date

imports from Indonesia were 65% higher than in October

2013.

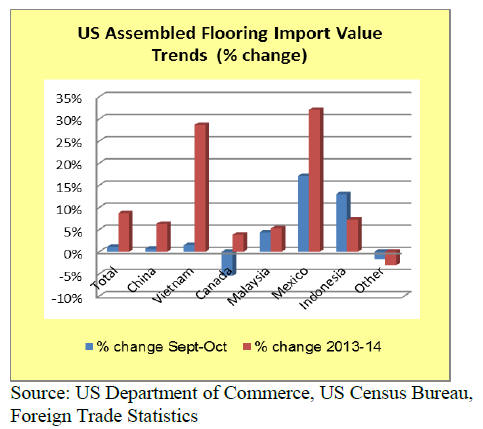

Strong growth in furniture imports from Vietnam and

Mexico

Wooden furniture imports grew by 1% in October and

were worth US$1.28 billion. Year-to-date imports were

9% higher than at the same time in 2013.

Imports from most supplier countries increased in

October, with the exception of Canada. Year-to-date

imports from all major suppliers were higher than in

October 2013. China‟s imports share was 47.5% in

October. Vietnam‟s import share was 18%.

Furniture imports from China were worth US$610 million,

up 1% from September. Vietnam‟s wooden furniture

shipments increased also by 1% to US$232 million. Yearto-

date imports from Vietnam were almost one third

higher than in September last year.

The largest growth in wooden furniture imports compared

to last year was from Mexico. October imports were worth

US$62.3 million. Year-to-date imports from Mexico were

one third higher than in October 2013.

October furniture retail sales down

Furniture retail sales declined by 3% in October, according

to US Census data. However, furniture sales were 1%

higher than in October 2013.

GDP growth revised up, unemployment unchanged

The Department of Commerce has revised upwards its

estimate of GDP growth in the third quarter of 2014, from

previously 3.5% to 3.9%. Growth remains lower than in

the second quarter, but the US economy is now healthier

than most other large economies.

The unemployment rate was unchanged in November at

5.8%. Unemployment decreased by 1.2 percentage points

in the last 12 months, according to the US Department of

Labor. In November, the number of jobs in the

manufacturing sector grew by 20,000. A total of 171,000

manufacturing jobs were added since November 2013.

Growth in domestic furniture production in November

Furniture production was among the fastest growing

manufacturing industries in November. Wood product

manufacturing companies reported no significant change

in production since September.

Both furniture and wood product manufacturers were

generally satisfied with market demand.

US consumer positive about economy

Consumer confidence in the US economy rose in

November to the highest level since July 2007, according

to the Thomson Reuters/University of Michigan consumer

sentiment index.

Consumers said they were more likely to buy larger

household items. Even younger consumers and long

income households expect to buy more in the coming

months. Consumers anticipate lower unemployment and

higher incomes in the year ahead.

US South home builders most confident in market

Builders‟ confidence in the market for newly built singlefamily

homes declined in October, but the home builders‟

outlook was more positive in November.

Growing consumer confidence, higher employment and

low interest rates support home construction and sales.

Builders reported more home buyers and signed contracts

in November.

Home builders in the US South were most positive about

market conditions. Builders in the Northeast were the least

confident.

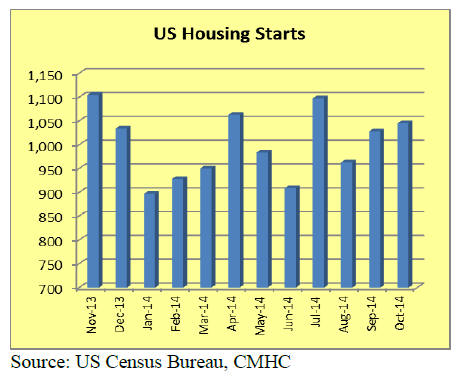

Housing starts over 1 million in October

The housing market was strong in October with over 1

million starts at a seasonally adjusted annual rate. Singlefamily

housing starts grew by 8% from the previous

month. Single-family starts accounted for almost 70%, the

highest share this year to date.

Multi-family construction declined in October. However,

construction of apartment buildings appears to remain

higher than in the past because of high demand for rental

housing.

The growth in residential construction was almost entirely

in the US South.

The number of building permits increased by 5% to 1.08

million at a seasonally adjusted annual rate.

Sales of existing homes increased by 1.5% in October,

according to the National Association of Realtors. Sales

activity was the highest so far in 2014. Homes sales were

also higher than at the same time last year.

Home prices also increased in October. The inventory of

homes available for sale is higher than last fall and winter,

which may prevent the strong price increases seen last

year.

Broad recovery in non-residential construction

expected for 2015

Private non-residential construction spending was

unchanged from the previous month (at seasonally

adjusted annual rate). Public construction grew by 3% in

October.

The strongest growth was in public commercial

construction (+11%) and public office construction (+8%).

Architecture firms remained positive about business

conditions in October. The American Institute of

Architects expects a broad recovery in non-residential

construction.

US-Canada Softwood Lumber Agreement expires in

2015

The agreement for Canadian exports of softwood

sawnwood to the US will expire in October 2015. The

current trade agreement from 2006 was a solution to US

industry claims that Canadian forest policies subsidize

sawnwood production. The agreement specifies higher

duties on Canadian exports when softwood sawnwood

prices are low.

The Canadian industry fears uncertainty if the trade

agreement is not renewed. The US has agreed to not

launch legal battles for twelve months after the current

agreement expires in 2015.

According to reports by the newspaper Vancouver Sun,

the Canadian industry would like to see the current

agreement renewed. US sawmills represented by the US

Lumber Coalition are reported to oppose a renewal.

If Canadian sawmills will have to pay new higher duties

on exports to the US, it is likely to affect trade flows to

other markets including China.

Between 2001 and the signing of the 2006 agreement,

Canadian producers paid CUS$5 billion in export duties to

the US. Most of the duties were returned when the 2006

agreement was signed.

Since 2006 several change have occurred in the industry.

China has become the second largest export market for

Canadian sawnwood producers. The Canadian market

share in the US has fallen from 34% in 2006 to 29% in

2013, partly due to lower US demand.

Forest resources in British Columbia are significantly

lower now because most trees killed by the mountain pine

beetle infestation have been processed.

However, the falling value of the Canadian dollar due to

lower oil prices is a threat to US producers. When the

agreement expires, Canadian sawnwood will likely be

cheaper for US buyers than any time since 2006.

The largest Canadian producers (Canfor, West Fraser

Timber and Interfor) have bought sawmills in the US in

recent years. This mitigates their risk if a new trade

dispute starts after the current trade agreement expires.

* The market information above has been generously provided by the

Chinese Forest Products Index Mechanism (FPI)

|