|

Report

from

Europe

EU joinery sector flatlines

A single word describes the current state of the joinery

sector in Europe. That word is ¡°flat¡±. It¡¯s also a

reasonable description of the state of the European

economy as a whole. There are a few bright spots ¨C

notably the UK ¨C but not enough to offset slow demand

elsewhere.

Total GDP across the EU expanded by 0.3% in the third

quarter of 2014, only slightly better than 0.2% growth

recorded in the second quarter (Table 1). Growth in the

UK and Spain was good in Q3 2014.

France recovered sufficiently in Q3 2014 to avoid entering

a technical recession (usually defined by a fall in GDP in

two successive quarters). Germany also avoided this fate,

but just barely. Italy continued to decline.

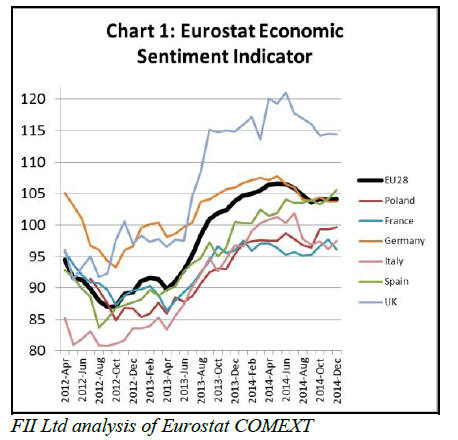

Economic Sentiment in the EU was rising in the first half

of 2014 but falling in the second half of the year (Chart 1).

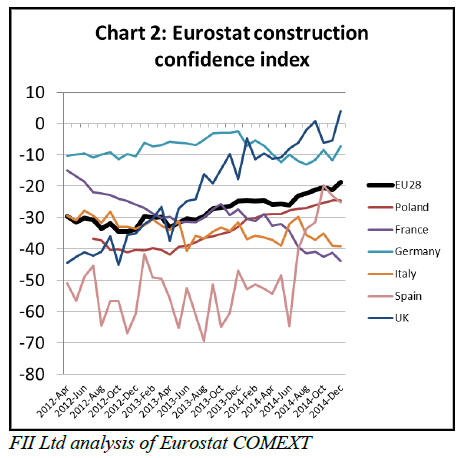

Construction confidence in Europe continued to rise to the

end of 2014 (Chart 2).

However this was mainly on the back of better

performance in the UK and Spain and overall sentiment is

still in negative territory (meaning that a majority of

construction companies still expect order books and

employment levels to fall in the next 3 months).

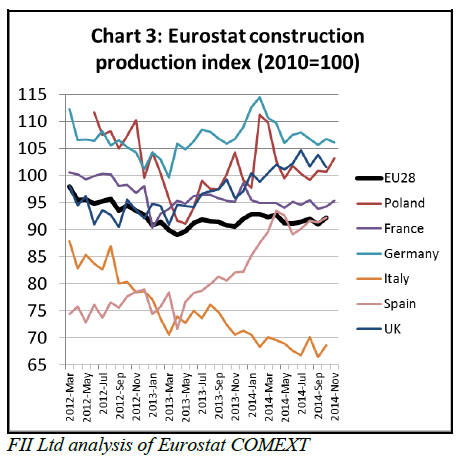

Having recovered a little in the second quarter of 2013,

EU construction production remained stubbornly stuck at

8% below the 2010 level at least until November 2014

(Chart 3).

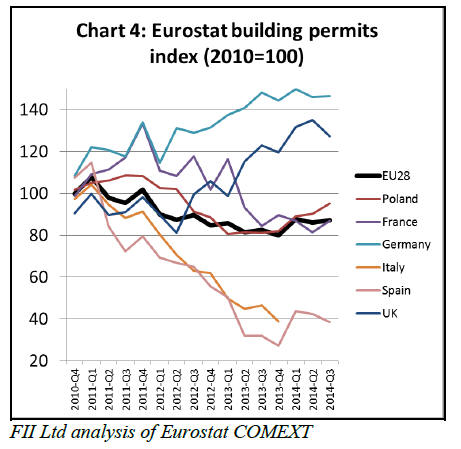

Data on building permits is more encouraging. These

increased across the EU in the first quarter of 2014 and

remained at the higher level in the next 2 quarters (Chart

4).

There follows more detailed consideration of construction

sector activity at national level in the EU. This draws on

results of the latest European Architects Barometer (EAB)

survey of 1,600 architects undertaken by Archi-Vision in

eight European countries for the third quarter of 2014.

Germany: there are clear signs of slowing growth in both

the national economy and construction sector. The EAB

survey showed only very slow growth in architect‟s order

books and turnover in Q3 2014. All three economic

confidence indicators (consumer, industrial and

construction) declined slightly in Germany during the

same period. Archi-Vision estimates German construction

grew 1% in 2014 and will grow at the same slow rate in

both 2015 and 2016.

UK: the construction sector continued to strengthen in the

second half of 2014 but at a slower pace than in the first

half. Building permits for both residential and nonresidential

construction in the UK are stable, although

some confidence indicators show a slight decrease.

The EAB indicates that UK architectural firms remained

positive in Q3 2014 with strong order books and

expectations of good turnover development. Archi-Vision

estimate that the UK construction market increased 3% in

2014 and will continue to grow at the same rate in 2015.

Growth is forecast to slow only slightly to 2% in 2016.

France: construction sector activity is contracting again.

The EAB indicates architects order books fell sharply in

Q3 2014. Archi-Vision estimates French construction

activity fell 2% in 2014 and will fall another 1% in 2015

before stabilising at the lower level in 2016.

Spain: while well down on pre-recession levels, the

construction market is slowly improving. The Eurostat

construction production index indicates significantly

higher levels of Spanish output in 2014 compared to the

previous year. According to EAB, architects order books

increased in each of the first three quarters of 2014.

However these positive figures do not align to the building

permit trend. Permits for residential construction in Spain

have been stable but there was a fall in non-residential

permits in the second and third quarters of 2014. In

contrast to Eurostat, Archi-Vision reckons that Spanish

construction fell around 4% in 2014. Archi-vision forecast

a further 1% contraction in 2015 and zero growth in 2016.

Italy: the construction market continues to slide and the

outlook remains very poor. The EAB indicates architects

order books were falling in the first three quarters of 2014.

In Q3 2014, 50% of Italian architects reported negative

developments in their order book and only 11% reported

positive developments.

Data on Italian building permits in 2014 has yet to be

published, but data for 2013 showed permits at only 40%

of the 2010 level. This will dampen construction activity

for several years. After declining 11% in 2013, Arch-

Vision estimates that Italy‟s construction market fell 7% in

2014 and will fall a further 4% in 2015 and 1% in 2016.

Netherlands: the construction market is recovering, but

only very slowly. The EAB survey indicates that architects

order books increased again in the third quarter of 2014,

continuing a rising trend which began in the second half of

2013.

Positive architectural sentiment is also reflected in other

economic indicators including consumer, industrial and

construction confidence.

The Eurostat construction production index indicates

activity remained flat at around 90% of the 2010 level

throughout 2014. Archi-Vision estimate that construction

activity in the Netherlands increased by 1% in 2014 and

that growth will pick up to 2% in 2015 and 3% in 2016.

Belgium: the market is slow but tending to rise overall.

However signals from various indicators of construction

activity are mixed. The Eurostat construction production

index shows rising activity between March 2013 and

March 2014, but then a slight decline in activity during the

rest of the year.

In contrast, EAB indicates a marginal improvement in

architects‟ order books in the second and third quarters of

2014.

The building permit figures also show contrasting

developments: a big fall for residential permits but a

steady increase for non-residential. Archi-Vision estimate

2% growth in Belgian construction activity in 2014 and

predict equivalent levels of growth in both 2015 and 2016.

Poland: construction market activity was only moderate in

2014 but is growing slowly. Unlike other large EU

economies, Poland‟s construction sector relies heavily on

new build which accounts for 73% of total volume.

Eurostat‟s construction production index for Poland

increased sharply between May 2013 and March 2014, but

then slipped in April 2014 before stabilising at a moderate

level for the rest of the year.

The EAB indicates architects order books improved in the

first half of 2014, but weakened a little in the third quarter

of the year.

The Eurostat construction confidence index for Poland

was rising throughout 2014, but still remains in negative

territory.

However there was good growth in building permits in the

first 3 quarters of 2014 suggesting better prospects in

2015. Archi-Vision estimate that construction activity

increased 2% in 2014 and forecast the same rate of growth

in 2015, rising to 3% in 2016.

No change in EU joinery production in third quarter of

2014

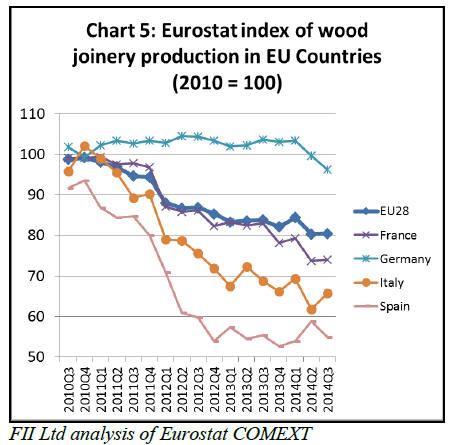

The Eurostat index of joinery production in EU countries

(which excludes flooring but includes doors, windows and

glulam) shows that production was stationary at around

80% of the 2010 level in both the second and third

quarters of 2014 (Chart 5). A slight upturn in production in

Italy and the UK was not sufficient to offset a decline in

Germany and Spain.

Downturn in European window and door market

forecast for 2015

According to an article in EUWID, the European timber

trade journal, the German building fittings producer Roto

Frank AG is forecasting a further downturn in European

window and door markets in 2015.

Roto Frank AG reports that the European window and

door market softened more than expected in 2014. A big

decline in sales in South and Eastern Europe more than

offset slightly higher sales in the UK, Germany and

Switzerland.

Roto Frank AG also reports that growth in window and

door consumption in Germany during 2014 was mainly

supplied by imports from other European countries,

notably Poland.

In 2014, Poland‟s output of windows and doors jumped

sharply despite a fall in the domestic market. As a result

more Polish-made products are now being exported to

other European countries.

Sales by German manufacturers in 2014 were around 6-8

% lower than the previous year. Manufacturers in France

and Italy also posted sharp falls in sales in 2014, while the

Spanish market has stabilised.

With the exception of the UK, Roto Frank AG expects the

European market to stagnate in 2015. The slump in Russia

and Ukraine is expected to intensify.

European joinery product import trends

As noted in previous reports, imports make up only a very

small component of EU consumption of joinery products.

In 2013, only €275 million (4.5%) of the €6.06 billion of

wooden doors supplied to the EU were imported. In the

case of wood windows, €23 million (0.4%) of the €5.96

billion supplied were imported. In 2013, glulam imports

were 112,000 m3, only 4% of the 2.76 million m3

supplied to the EU.

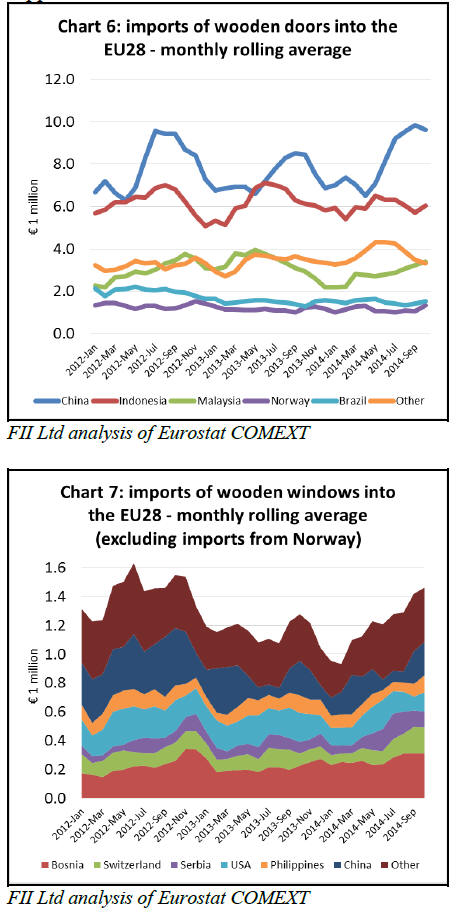

The monthly trend in wooden door imports into the EU

from leading supply countries during the 2012-2014

period is shown in Chart 6. Imports from China, the

largest external supplier to the region, have been volatile

but generally rising during this period.

There was a particularly sharp increase in EU wooden

door imports from China between April 2014 and October

2014. The EU imported doors from China with a total

value of €10 million in both October and November 2014,

the highest level for several years.

EU imports of wood doors from Indonesia, now the

second largest external supply country, have consistently

averaged €6 million per month during the last three years.

Imports from other supply countries have remained

relatively stable at a low level over the same period.

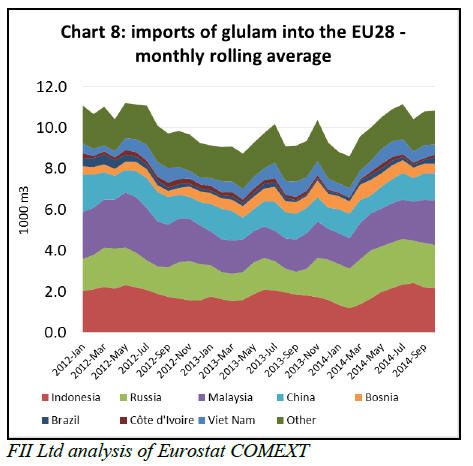

The small quantity of finished wood windows imported

into the EU derive mainly from other European countries

(Chart 7). This highlights the importance of proximity to

the customer in the wood window sector.

Total EU imports of wood windows, which rarely exceed

€1.4 million per month, were rising at the end of 2014,

mainly from Bosnia and Switzerland.

Imports from China are very limited and have declined in

recent years. Most of the small volume of wood windows

imported into the EU from the tropics are from the

Philippines.

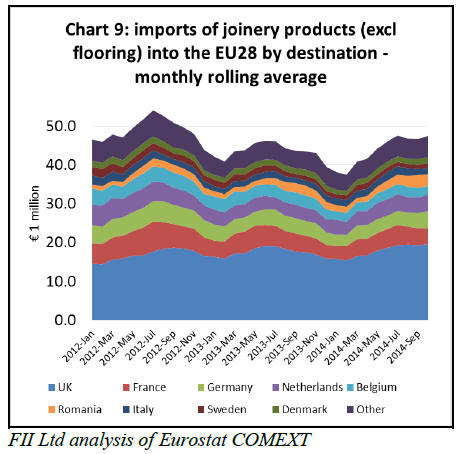

In line with the overall trend in the joinery sector, EU

imports of glulam have remained flat over the last three

years, averaging around 10000 m3 per month (Chart 8).

Much of this product comprises relatively small dimension

glulam for window frames. There was a slight increase in

imports of meranti scantling from Indonesia and Malaysia,

and of Siberian larch scantlings from Russia and China in

the second half of 2014.

Chart 9 shows that much of the recent growth in EU

imports of joinery products from outside the region is

destined for the UK, which alone accounts for around 40%

of all import value.

Of other EU import markets, only Romania showed signs

of growth during 2014. Imports from outside the EU into

France, Belgium, Germany, and the Netherlands were

either stable or slightly declining.

* The market information above has been generously provided by the

Chinese Forest Products Index Mechanism (FPI)

|