|

Report from

North America

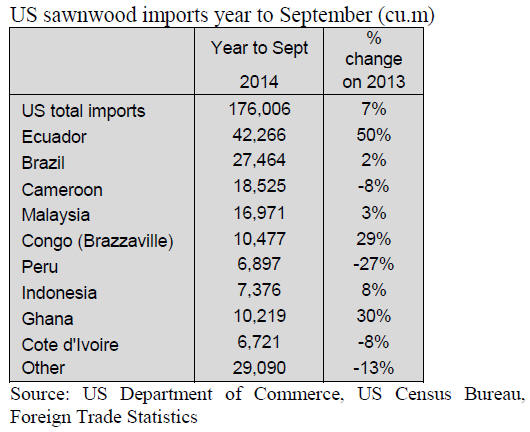

Lower US hardwood sawnwood imports

Compared to a month earlier US imports of hardwood

sawnwood fell by 8% in September to 99,254 cu.m.,

temperate hardwood imports were down 9%, while

tropical imports declined by 8% from August.

However, tropical imports at21,520 cu.m, were up 7%

year-to-date from September 2013.

Sawnwood imports of most tropical species declined in

September. Only imports of balsa, ipe and cedro grew.

Balsa imports from Ecuador were 5,463 cu.m., up 43%

year-to-date from 2013.

Ipe sawnwood imports increased by 19% from August to

2,754 cu.m. (+12% year-to-date). Cedro imports were

1,532 cu.m., up 25% year-to-date from September 2013.

Imports from Brazil declined in September despite higher

ipe shipments. Imports of virola, jatoba and other tropical

sawnwood were lower than in August.

Sawnwood imports from most other major suppliers also

fell from August. Only Ghana increased shipments to

1,665 cu.m. following lower volumes over the summer.

The increase was largely in cedro (933 cu.m.), while

sapelli imports declined.

Imports from Cameroon were down in September, both

year-to-date and compared to the previous month.

However, sapelli sawnwood imports from Cameroon

increased to 1,827 cu.m., while other species declined.

Malaysian shipments decreased by 11% month-overmonth,

but on a year-to-date basis they were 3% higher

than in September 2013. Malaysia exported 1,357 cu.m. of

keruing to the US in September.

Cameroon leads tropical sawnwood shipments to

Canada

The value of Canadian imports of tropical sawn hardwood

fell to US$2.4 million in September, down 22% from

August. The decline in September was mainly in imports

from Brazil, following exceptionally high import levels in

August. Year-to-date imports remain significantly higher

than in 2013 (+21%).

The largest source of Canadian imports was Cameroon at

US$692,425, followed by Ecuador and Brazil. Indonesia‟s

shipment declined slightly in September, but on a year-todate

basis Canada‟s imports from Indonesia have doubled

compared to the same time last year.

Sapelli imports increased to US$586,186, up 69% from

August. Virola, imbuia and balsa (combined) imports also

grew in September, while imports of mahogany, meranti

and other species declined from the previous month.

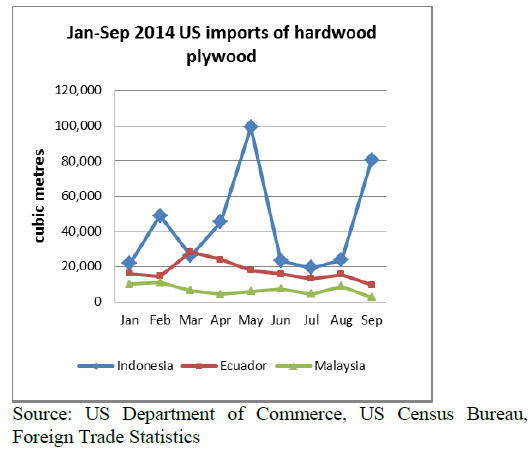

Plywood imports from Indonesia up in September

US imports of most manufactured wood products grew in

September despite the slow recovery in the housing

market and in non-residential construction. Both imports

and domestic production were significantly higher than in

September 2013. As the housing market continues to

expand, producers can look forward to even stronger US

demand.

US imports of hardwood plywood grew in September

following a brief decline in August. Total imports were

265,066 cu.m., up 12% from August. Year-to-date imports

were 6% higher than at the same time last year.

The growth in imports was from Indonesia and Canada.

Imports from other countries declined in September.

Hardwood plywood imports from China fell by 11% to

119,568 cu.m.

Indonesian shipments of hardwood plywood more than

doubled in September to 80,774 cu.m. Imports from

Canada grew by 46% to 16,987 cu.m. Hardwood plywood

imports from Russia, Ecuador and Malaysia decreased in

September.

Higher hardwood moulding imports from Malaysia

Imports of hardwood moulding were steady from the

previous month at US$17.6 million in September. Year-todate

imports were 9% higher than in September 2013.

Hardwood moulding imports from Brazil and China fell,

while imports from Malaysia and Canada grew. China

remained the largest source of supply at US$5.7 million,

down 17% from the previous month.

Malaysian shipments of hardwood moulding were worth

US$1.4 million, up 35%. Year-to-date imports from

Malaysia were 16% higher than in September 2013. Both

hardwood flooring and assembled panel flooring up.

Hardwood flooring imports increased 9% in September

due to higher imports from Malaysia. Assembled flooring

panel imports grew by 10%, with only Brazil shipping less

than last month.

Imports of hardwood flooring were worth US$3.9 million

in September.

Imports from Malaysia more than doubled to US$1.1

million. Year-to-date imports from Malaysia were 18%

higher than in September last year.

Hardwood flooring imports from Indonesia declined (-

13%). China‟s shipments were almost unchanged from the

previous month, but significantly up from 2013.

In assembled flooring panels China maintained its lead in

the US market at US$5.9 million in September. However,

year-to-date imports were 10% lower than at the same

time last year. Imports from Canada and Indonesia

increased month-over-month in September, while Brazil

shipped less.

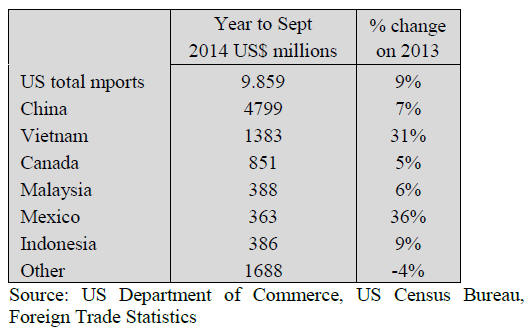

Vietnam and Mexico grow furniture import share

Wooden furniture imports grew by 1% in September after

declining in August. September imports were worth

US$1.27 billion. Year-to-date imports were 9% higher

than in September 2013.

Imports from most countries increased in September with

the exception of Mexico and Indonesia. Furniture imports

from China recovered from the decline in August and

grew 6% to US$605 million.

Vietnam‟s wooden furniture shipments increased 5% to

US$229 million. Year-to-date imports from Vietnam were

almost one third higher than in September last year.

Mexico also expanded its US import share in wooden

furniture in 2014. Year-to-date imports from Mexico were

36% higher in September than last year, despite a monthover-

month decline in September imports.

¡¡

Furniture retail sales declined slightly in September (-2%),

which is not uncommon for this time of the year.

However, sales were 4% higher than in September 2013,

according to the US Census Bureau.

Higher US furniture manufacturing output

Economic activity in the US manufacturing sector grew in

October. The Institute for Supply Management‟s

manufacturing index increased by 2.4 percentage points

from the previous month.

Most companies report generally good business conditions

and growth in production and demand. Almost all

manufacturing industries reported growth in October,

including furniture manufacturing. Wood products

manufacturing companies reported no change in

production from September.

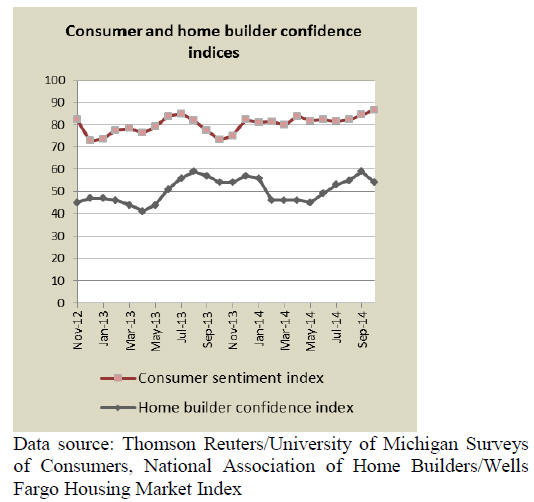

US consumer confidence up

Consumer confidence in the US improved 2.7% from

September to October according to the Thomson

Reuters/University of Michigan consumer sentiment

index. Consumer confidence was at its highest level in

October since July 2007.

Most households expect higher incomes and a stronger US

economy in the year ahead. Most consumers did not worry

about conflicts abroad or a slowdown in the global

economy.

Despite higher consumer confidence, builders‟ confidence

in the market for newly built single-family homes declined

in October. Only in the US South builders were more

confident in market conditions than in September.

The National Association of Home Builders expects the

housing market to grow despite the lower reported

confidence. Conditions for home sales and new

construction are positive, including low mortgage rates

and higher employment

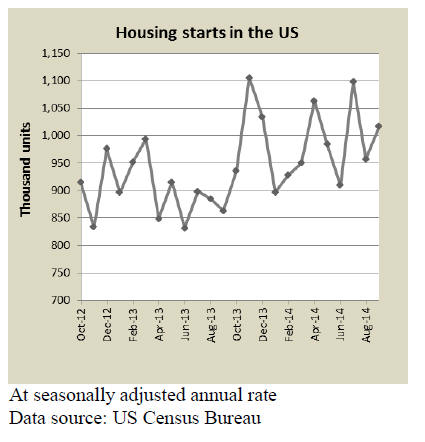

Higher housing starts across the country

Housing starts surpassed the 1 million mark for the third

time this year. Residential construction increased by 6.3%

in September at a seasonally adjusted annual rate. The

growth was mainly in multi-family construction, which

grew by 16.7%. Single-family housing starts increased by

1.1% to 646,000 units. Housing starts grew in all regions

of the country.

The number of building permits gained slightly to 1.018

million at a seasonally adjusted annual rate. Multi-family

permits increased, but permits for new single-family

homes declined. The number of building permits issued is

an indicator of future building activity.

Decline in Canadian housing starts

Non-residential construction spending was stable from

August to September at a seasonally adjusted annual rate.

Private construction decreased slightly (-0.6%) while

public construction grew. Public spending on office and

health care construction saw the greatest gain in

September.

The American Institute of Architects reports better

conditions for architecture firms in September. The most

positive outlook in the non-residential sector has been in

public institutional construction.

Sales of existing homes increased 2.4% in September

following a brief decline in August. Home prices were

5.6% higher than in September 2013. The share of firsttime

home buyers remains lower than average. Less than

one third of all existing homes were bought by first-time

buyers in the last 1.5 years.

Continued growth in office and commercial

construction

Non-residential construction spending decreased slightly

in August at a seasonally adjusted annual rate. Private

construction declined by 1.4% and public spending by

1.1%. However, the drop in public spending was mainly

in educational buildings. Public construction of office and

commercial buildings grew significantly by 11% and 8%,

respectively.

The American Institute of Architects reports a positive

outlook for the coming months.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|