|

Report from

North America

Demand to be highest for wood/plastic composite and

plastic decking

Wood-plastic and plastic decking is forecast to have the

strongest market growth over the next four years, but

wood will remain the main material on US decks,

according to market research company Freedonia‟s latest

market outlook (Wood & Competitive Decking, Study).

The outlook for tropical hardwood use in decking is

positive. Even when overall decking demand declined

during the downturn in the housing market, demand for

tropical hardwood decking grew.

Homeowners look for low maintenance materials, and

tropical hardwoods offer a natural, attractive appearance

compared to plastic or wood plastic composite. Tropical

hardwood decking is also known to perform well in the

long term, while wood plastic composites had

performance issues in the past. Overall demand for

decking is forecast to grow 2.4% per year between 2013

and 2018.

Total demand is estimated at US$6.5 billion in 2018,

equivalent to 3.5 billion linear feet of decking. The

strongest demand growth will be in wood plastic

composite and plastic decking.

Performance and looks of both types of decking have

improved in recent years with the arrival of capstockcoated

composite decking and cellular PVC decking.

High-end composite and plastic decking is at a similar

price level as tropical wood decking.

The majority of decking will continue to be wood due to

the lower price of treated softwood decking and the large

number of existing wooden decks that are often renovated

with the same material. About 80% of decking by volume

will be treated softwood and tropical hardwood by 2018.

Freedonia predicts an annual growth of 1.1% for wood

decking.Residential decking accounts for about 60% of the

market which is forecast to grow 2.7% annually driven by

higher housing starts and deck renovations. The trend

towards larger decks and greater outdoor living space also

supports growth in decking demand.

Ipe and keruing imports rise

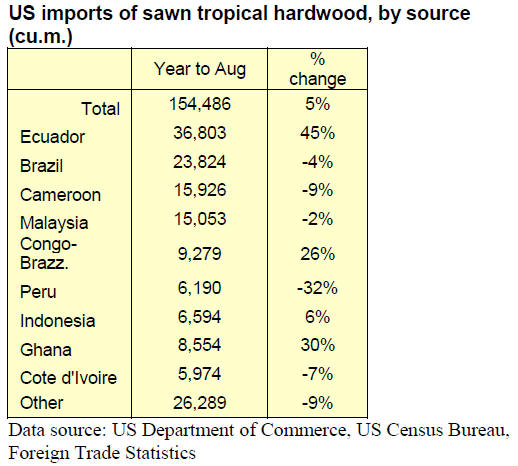

US imports of hardwood sawnwood increased by 35% in

August to 108,384 cu.m. Temperate hardwood imports

grew by 37%, while tropical imports were 27% higher

than in July. Tropical imports were 23,133 cu.m in

August (+5% year-to-date).

Balsa imports declined in August to 3,800 cu.m (-24%),

but other sawnwood imports grew. The largest increase

was in imports from Africa of sapelli (3,591 cu.m) and

acajou d‟Afrique (2,284 cu.m). Imports of ipe (2,309

cu.m), keruing (1,747 cu.m) and virola (2,084 cu.m) also

grew from the previous month.

Imports from Brazil were at their highest level since

January 2013. Brazilian ipe sawnwood shipments to the

US increased by 88% to 2,140 cu.m. US imports of

padauk also grew in August.

Sawnwood imports from Peru greatly increased in August,

but compared year-to-date imports are lower than last

year. The US imported 1,228 cu.m of virola sawnwood

from Peru in August.

Malaysian shipments of keruing to the US grew to 1,485

cu.m in August. Sapelli imports from Congo/Brazzaville

doubled to 1,150 cu.m

Foreign Trade Statistics

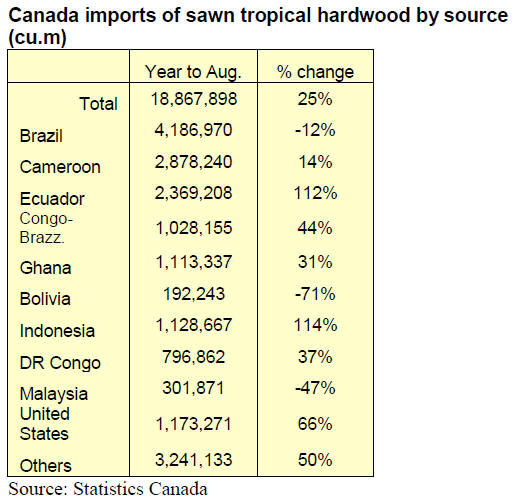

Canada¡¯s year-to-date tropical sawnwood imports

almost 25% higher

Canadian imports of tropical sawn hardwood increased by

36% in August to US$3.1 million (all values in US

dollars). Year-to-date imports in 2014 were almost one

quarter higher than at the same time last year.

The main growth was in imports from Brazil, which

doubled to US$1.4 million in August. However, year-todate

imports remain below 2013 levels.

Imports from Ecuador, Ghana and Indonesia also

increased in August. Both Ecuador and Indonesia shipped

more than double the value of sawn hardwood to Canada

on a year-to-date basis.

Imports from Cameroon, Congo and Malaysia declined in

August, but with the exception of Malaysia and Brazil,

year-to-date imports are higher for all major suppliers to

Canada than in 2013.

Sapelli imports declined again in August to US$346,480

following record imports in spring and summer. Year-todate

imports of sapelli were 50% higher than in August

2013.

Imports of almost all other species grew in August.

Mahogany sawnwood imports were worth US$168,758

(+34%) and meranti imports US$112,202 (+95%).

Canada-EU trade deal expected to boost Canadian

forest industry

The Comprehensive Economic and Trade Agreement

(CETA) with the EU is Canada‟s most ambitious trade

initiative to date. Almost all tariffs between Canada and

the EU will be removed and there will be greater market

access for services and investments.

This Canada-EU trade deal will eventually eliminate

European tariffs of up to 10% on wood composite panels,

including particleboard, OSB and plywood. Europe is

currently the third largest export market for Canadian

producers, after the US and China. Europe accounts for

4% of total exports of wood, pulp and paper products from

Canada.

The Forest Products Association of Canada supports the

trade deal to help develop closer trade relations with

Europe. Non-tariff barriers to trade will also be addressed

in the agreement.

|