|

Report from

North America

China¡¯s plywood market share rises

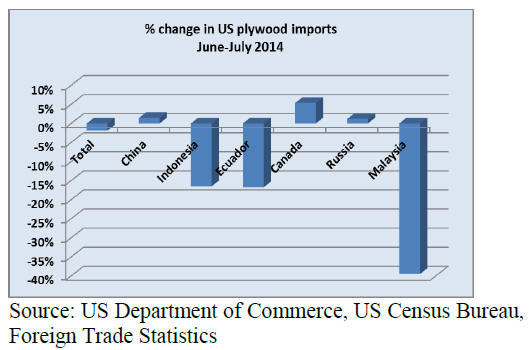

US imports of hardwood plywood declined again in July.

Imports were 265,480 cu.m, down 2% from June. Year-todate

imports were still 9% higher than in July 2013.

Hardwood plywood imports from China increased slightly

(+1%) to 172,757 cu.m. Year-to-date imports from China

were 17% higher than at the same time in 2013.

Hardwood plywood imports from Indonesia, Ecuador and

Malaysia declined in July. Indonesia shipped 19,437 cu.m

(-16%), Ecuador 13,182 cu.m (-17%) and Malaysia 4,417

cu.m (-39%).

July moulding imports highest since 2011

At US$19.8 million, July imports of hardwood moulding

were higher than any time since 2011. Imports increased

by 14% from the previous month and year-to-date imports

were 8% higher than in July 2013.

Hardwood moulding imports from China, Brazil and

Canada rose in July, while Malaysia shipped less.

Moulding imports from China were worth US$6.5 million,

up 8% from June.

Higher hardwood flooring imports from Vietnam and

EU

Imports of hardwood flooring increased by 10% to US$3.1

million in July. China was the largest source of imports in

July at US$723,508 (+24%). However, much of the

growth in overall US imports of hardwood flooring came

from Vietnam and Europe.

Hardwood flooring imports from Indonesia fell by 67%

from June to US$241,920. Malaysian shipments were

worth US$560,209 (-13%).

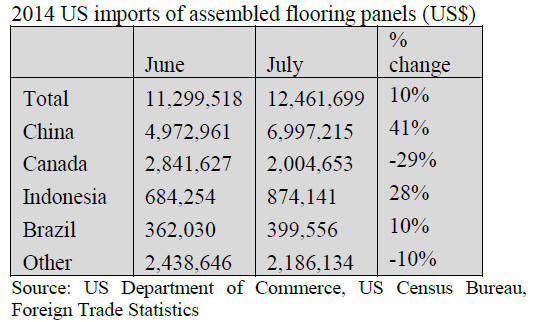

Assembled flooring panel imports were US$12.5 million

in July, up 10% from June. Imports from China jumped by

41% to US$7.0 million, while imports from Canada

declined. Indonesian exports of assembled flooring

increased by 28% in July to US$ 874,141.

NAFTA countries and Vietnam expand furniture

shipments to US

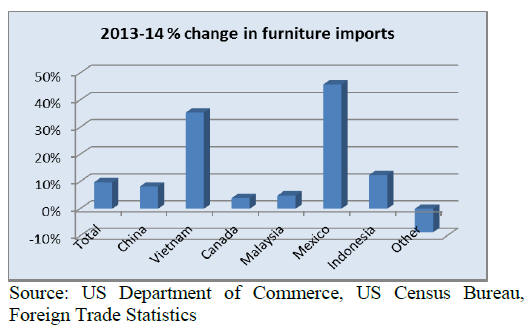

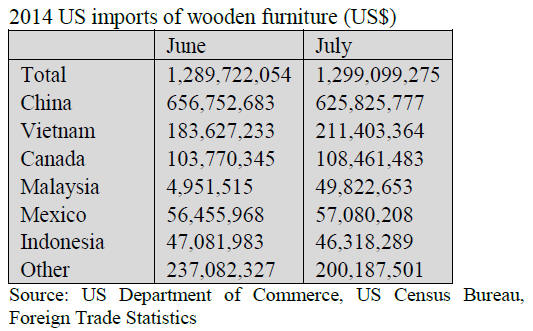

Wooden furniture imports grew slightly (+1%) in July.

Total July imports were worth US$1.30 billion. Year-todate

imports were 10% higher than in 2013.

Imports from Vietnam, Canada and Malaysia increased in

July, while China‟s furniture shipments fell by 5% to

US$625.8 million.

Furniture imports from Vietnam were US$211.4 million in

July, up 15%. Mexican exports to the US were worth

US$57.1 million, almost unchanged from June.

China‟s import share declined by 0.2 percentage points in

July to 48.5%, based on the average in the last twelve

months. The import shares of Vietnam and the NAFTA

partners (Canada and Mexico) increased by 0.1 percentage

points to 16.5% and 12.7%, respectively.

Several other, smaller suppliers increased their wooden

furniture exports to the US in July. Imports from Europe

(Italy and Poland), India and Thailand increased

substantially in July.

Furniture retail sales trends positive

The outlook for the 2014 furniture market remains

positive, despite the slow growth in furniture retail sales.

GDP growth has picked up as expected by analysts. On the

down side, unemployment remains relatively high and

consumer confidence is still not very strong.

However, the growth in housing starts and home sales

should support demand for furniture in the second half of

2014.

Furniture sales (excluding home furnishing) grew by 6%

in July to US$4.4 billion, according to US

Furniture sales 1% higher than in July 2013.

New furniture orders grew by 5% in the first half of 2014

compared to the same period last year. Smith Leonard‟s

furniture survey found that about 60% of companies had

higher orders in the first half of 2014.

Year-to-date furniture shipments were 4% higher in the

first half of 2014 compared to 2013. Almost 70% percent

of companies reported higher year-to-date shipments in

June.

Inventory levels at distributors and manufacturers

increased more than orders and shipments.

June furniture inventories increased by 9% from the

previous month. The higher inventories may be due to

summer holiday shutdowns, or because furniture retail

sales appear to lag manufacturing and imports.

Growth in domestic furniture and wood product

manufacturing

Economic growth in the second quarter of 2014 was

revised upward to 4.2% in the second estimate by the US

Department of Commerce. In the first quarter, real GDP

decreased by 2.1%.

The manufacturing sector grew again in August, according

to the Institute for Supply Management. Both furniture and

wood product manufacturing reported growth in August.

Labour availability is a challenge for some furniture

producers.

Federal Reserve ends financial asset purchasing

The unemployment rate changed little in August and was

6.1%, according to the US Department of Labor. The

number of long-term unemployed declined. Long-term

unemployed (jobless for 27 weeks or more) accounted for

31% of all unemployed in August.

The US Federal Reserve will soon end its buying of

financial assets, which has been part of the economic

stimulus program since 2008. The second part of the

economic stimulus are low interest rates. The Federal

Reserve will probably keep interest rates low into 2015

because the labour market indicates that the economy is

still fragile.

Growing gap between upper and lower income

households

Consumer confidence in the US economy improved in

August, according to the Thomson Reuters/University of

Michigan consumer sentiment index. Most households

reported that their financial situation improved.

However, the gap between upper income and lower

income households is widening. Upper income households

reported higher incomes and wealth due to higher stock

and asset prices.

Most other Americans reported no net gain in income and

only a small growth in wealth. Stock prices and house

prices have increased, but there is little growth in wages,

which is ultimately needed for a full recovery of the US

economy.

Consumers are not very optimistic about their personal

financial outlook. They expect incomes to increase less in

the year ahead compared to the past year.

Home builders more confident except in US South

Builders‟ confidence in the market for newly built singlefamily

homes increased by two points in August to 55 on

the National Association of Home Builders/Wells Fargo

Housing Market Index. This is the highest confidence

level since January.

Builders‟ confidence grew in all four regions of the

country. The strongest growth was in the Midwest. The

South continues to be the weakest market.

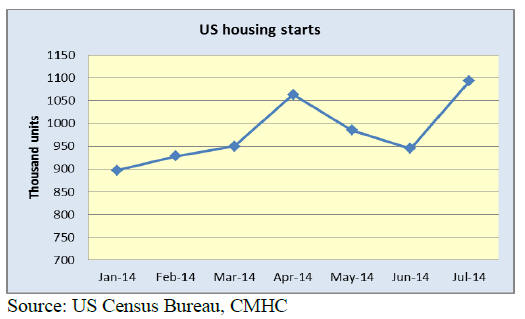

Housing starts surpass 1 million in July

The latest US Census Bureau data release for new

residential construction is more optimistic that in the

previous months. June housing starts were revised upward

to 945,000 (seasonally adjusted rate). In July, housing

starts increased by 16% to over 1 million. July starts were

22% higher than in July last year.

Single-family housing starts increased by 8% in July,

while construction of multi-family units jumped 29%. The

growth in construction was highest in the Northeast.

The number of building permits also increased in July,

mainly due to higher multi-family permits. The total

number of permits was 1.052 million units at a seasonally

adjusted annual rate. The number of building permits

issued is an indicator of future building activity.

Sales of distressed homes down

Sales of existing homes were at their highest this year in

July. However, sales were lower than in July 2013,

according to the National Association of Realtors.

The share of distressed homes sold fell to below 10% for

the first time since the housing market crisis. Distressed

homes are foreclosures and short sales, typically because

the home owner is not able to pay the mortgage.

Growth in non-residential construction

Both private and public expenditures on non-residential

construction increased in July from the previous month.

Private construction spending grew by 2.1%, while public

spending on office, commercial, health care and

educational construction increased by 1.6%.

The American Institute of Architects reports gains in nonresidential

design work in all regions of the country.

Institutional construction is finally improving.

Commercial and industrial projects have gained since the

start of 2014.

Legislation proposed to ban most toxic flameretardants

in furniture

A US senator has introduced a bill that would ban the most

toxic flame-retardants from being used in upholstered

furniture and children‟s products.

Studies have linked the flame-retardants with health

problems in children and firefighters. The legislation

would ban the ten most toxic flame-retardants at the

federal level.

California changed its flame-retardant regulation for

upholstered furniture in 2013. However, manufacturers

may still use flame-retardants to achieve the new

California standard. It is possible to fulfil the new standard

without flame-retardants, but the regulation leaves it to the

manufacturers to let customers know whether or not

flame-retardants are used in furniture.

Retroactive import duty rates for bedroom furniture

from China

The US Department of Commerce has announced final

anti-dumping duty rates for 2012 imports of bedroom

furniture from China. Importers had already paid cash

deposits to US customs, but the Department of Commerce

carried out a review of the rates.

The duty rates range from 0% to 216%, depending on the

manufacturer. Several Chinese manufacturers had their

duty rate reduced based on revised calculations and new

financial statements from the companies. A new exporter

to the US, Dongguan Chengcheng Group, received a 0%

rate.

Furniture producers who did not submit information to the

Department of Commerce that shows they qualify for a

reduced rate, received a rate of 216%.

The list of companies with the 216% rate is available here

(under footnote 5): http://www.gpo.gov/fdsys/pkg/FR-

2014-09-02/pdf/2014-20827.pdf

|