|

Report from

North America

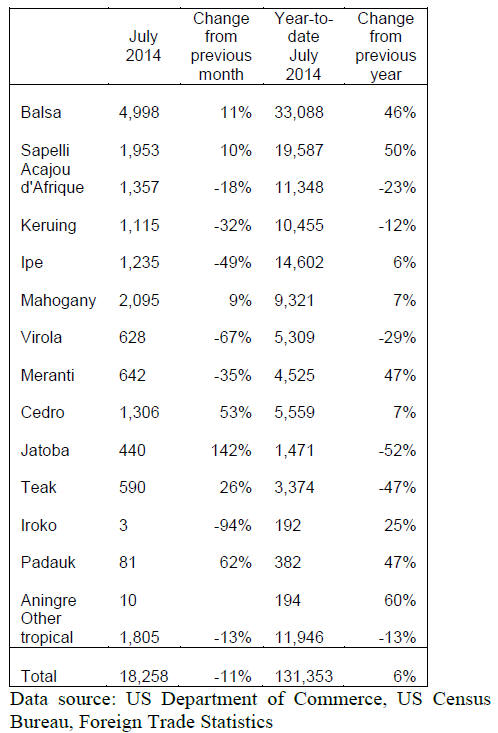

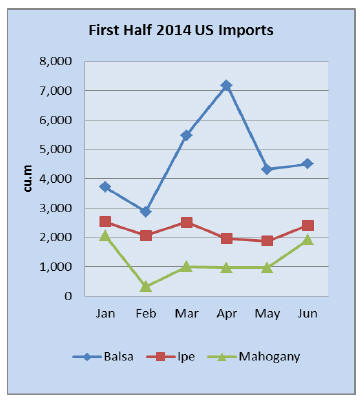

Decline in US imports of ipe and virola sawnwood

US imports of all hardwood sawnwood grew by 6% in

July to 80,280 cu.m. The growth was in temperate species,

while tropical imports declined by 11% to 18,258 cu.m.

Year-to-date tropical imports were 6% higher than in July

2013.

The month-over-month decline was primarily in ipe and

virola sawnwood imports (1,235 cu.m and 628 cu.m

respectively). The largest growth in imports was in cedro

(1,306 cu.m), balsa (4,998 cu.m), jatoba (440 cu.m) and

sapelli (1,953 cu.m).

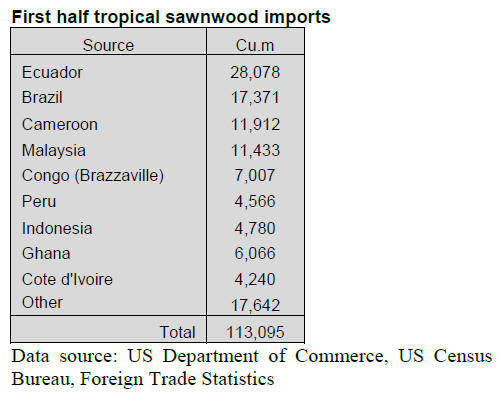

Imports from most major tropical suppliers declined in

July, with the exception of Ecuador, Congo (Brazzaville)

and Cote d‟Ivoire.

Ecuador‟s exports of balsa to the US were 4,980 cu.m, up

10% from June. Compared to last year, balsa imports from

Ecuador increased by 50% to date in 2014.

The growth in wind turbine manufacturing supports US

demand for balsa.

Brazil‟s shipments fell by 27% to 2,458 cu.m in July. The

decline was mainly in ipe sawnwood (1,136 cu.m). Jatoba

sawnwood imports from Brazil increased to 440 cu.m in

July. Peru shipped less virola to the US in July (257 cu.m

with lower virola shipments, down from 1,604 cu.m in

June.

Keruing sawnwood imports from Malaysia decreased by

27% to 1,032 cu.m in July. Overall sawnwood imports

from Malaysia were 1,469 cu.m, down 34% from June.

Imports from Indonesia declined by 11% to 896 cu.m, but

meranti shipments were up in July.

Cameroon shipped 1,349 cu.m of sawnwood to the US in

July. Both sapelli and acajou d‟Afrique imports from

Cameroon were slightly down compared to the previous

month.

Imports from Ghana also declined in July, mainly due to

lower acajou d‟Afrique imports. The US imported 1,272

cu.m of sawnwood from Ghana in July, down 24% from

the previous month but year-to-date imports were one

third higher than in July 2013.

Canadian meranti imports up

Canadian imports of tropical sawn hardwood were worth

US$2.3 million in July, down 24% from June. Year-todate

imports in 2014 remained 18% higher than in July

2013.

Imports from Canada‟s largest supplier countries declined

in July (Brazil, Cameroon, Ecuador and Indonesia), while

imports from Malaysia, Bolivia and Ghana grew.

Sapelli imports fell by 28% to US$503,743 in July, but

year-to-date imports were 55% higher than at the same

time last year. Virola, imbuia and balsa imports

(combined) declined by 8% to US$239,890.

Imports of mahogany were worth US$125,731, up 4%

from June. Meranti imports jumped to US$57,673 with a

recovery in shipments from Malaysia.

Bio-Preferred programme open to wood products

The US Department of Agriculture (USDA) has

eliminated the restrictions on including mature market

wood products in the BioPreferred programme.

The BioPreferred programme is part of the 2014 Farm

Bill. It promotes ¡°biobased products, including forest

products, that apply an innovative approach to growing,

harvesting, sourcing, procuring, processing,

manufacturing, or application of biobased products

regardless of the date of entry into the marketplace."

The BioPreferred programme will be used in procurement

by federal agencies. Voluntary consumer labelling is also

part of the program. The USDA has certified about 1,800

biobased products for the label to date.

Mature market products, with a significant market share

before 1972, were previously excluded from the program.

Now wood product manufacturers can register with the

program if they apply an innovative approach in any part

of the life cycle of their product.

The USDA is now working on defining and evaluating the

eligibility of innovative approaches for the BioPreferred

programme. In the meantime wood product manufacturers

can use interim guidelines regarding innovative

approaches when applying for a BioPreferred label.

Environmental Product Declarations (EPDs) are thought to

help manufacturers prove innovative approaches by

demonstrating the environmental impact of products.

EPDs have been developed for most major wood and

building products in North America.

Promoting US-made building materials in public

buildings

A bill is progressing through the US Senate that would

require the use of US-made building products when public

buildings are built or repaired. The bill applies to all

building products, including wood. It is too early to tell

whether the bill will pass and change current procurement

practices in public construction.

Other levels of government have recently supported

initiatives to increase the use of wood versus other

materials in public buildings, without specifying where the

wood products are manufactured. For example, the state of

Georgia passed a bill in May that allows greater use of

wood in the construction of schools.

In Canada, several provinces and cities went one step

further and implemented the so-called Wood First Act in

recent years. It mandates that where feasible wood has to

be used as a primary building material for all publicly

funded buildings. The province of Quebec also promotes

the use of wood in appearance applications in public

buildings.

A federal bill was defeated in Canadian parliament in 2010

that would have made wood the preferred material in the

construction or repair of federal public buildings. The

construction industry opposed the change.

Canada supports indigenous forest companies

The Canadian government and the province of

Saskatchewan have announced a $1.1 million investment

in the Prince Albert Model Forest Association. The

association will provide guidance to forest companies in

management practices, manufacturing, product

development and marketing for international export.

The assistance will be made available to all forest

companies, but an important goal is to support indigenous

companies owned by First Nations and M¨¦tis. The forest

sector in Saskatchewan generates about $1 billion in sales

every year, and First Nations and M¨¦tis account for over

15% of the workforce.

|