|

Report

from

Europe

Sharp rise in EU imports of hardwood plywood

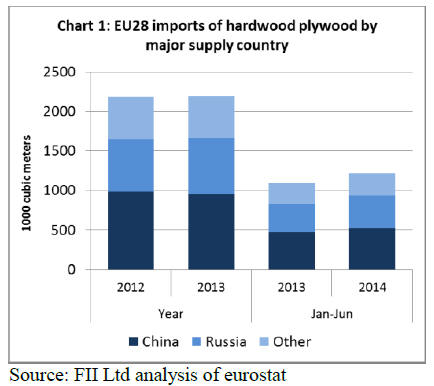

In the first six months of 2014, EU28 imports of hardwood

plywood were 1.21 million cubic metre, 12% more than

the same period the previous year. This follows stable

imports between 2012 and 2013 (Chart 1).

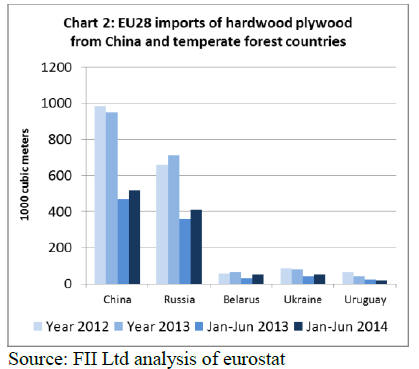

Most of the gains this year have been in imports from

China and temperate forest regions. After declining 3.5%

between 2012 and 2013, EU imports of hardwood

plywood from China increased 11% to 519,000 cubic

metre in the first six months of 2014. Imports from Russia

climbed 15% to 412,000 cubic metre in the first six

months of 2014, building on the 8% rise in imports

recorded the previous year.

Imports in the first six months of 2014 also rose strongly

from Belarus and Ukraine. However imports from

Uruguay have been declining (Chart 2).

¡¡

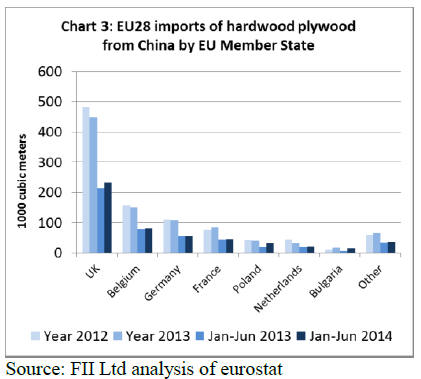

Firm European demand for Chinese hardwood

plywood

There has been firm demand for Chinese hardwood

plywood in Europe this year. Officially reported imports

of Chinese hardwood plywood have risen into all the

leading EU markets during 2014 with the exception of

Germany (Chart 3).

Demand has been particularly strong in the large UK

market, led primarily by strong recovery in construction

and also benefitting from improving sales to the shopfitting,

furniture and packaging sectors. Nevertheless,

there remains considerable resistance to increased prices in

the highly competitive UK market.

This trend has favoured Chinese products which tend to be

more competitively priced than South East Asian products.

China‟s share of the UK market has been rising sharply

this year, mainly at the expense of Malaysia.

While UK buyers often seem more inclined to

compromise on quality rather than on price, some

importers are raising concerns about the quality of Chinese

plywood arriving in the country.

There are reports, for example, of thin and low quality

veneers for plywood products claimed to be compliant

with the BS1088 standard for marine plywood.

The apparent decline in imports of Chinese hardwood

plywood into Germany may be partly due to emerging

signs of weakness in German construction and other

continental European countries in the second quarter of

2014.

However it also reflects the recent practice by German

customs to record some plywood imports from China as

LVL thereby pushing them into a higher tax bracket.

This issue has been raised with the German customs

authorities by the German timber trade association GD

Holz. As a result, some Chinese products currently

included under LVL in German trade statistics may be

reclassified and plywood import statistics for 2013 and

2014 amended.

After a period of tight supply for mixed light hardwood

plywood from China in the first quarter of 2014 due to

restricted availability of eucalyptus and poplar veneer, the

supply situation eased in the second quarter of the year.

Delivery times to Europe currently stand at around 4 to 5

weeks.

FOB prices for mixed light hardwood plywood from

China were holding steady in the three months before the

Chinese New Year, but prices increased in March and

April this year to accommodate rising prices for

eucalyptus and poplar veneer. Prices have since stabilised

at the higher level.

CIF prices for delivery of Chinese plywood to Europe

have been less certain due to continuing fluctuations in

freight rates. After recovering to US$1300 per TEU in

early July, the Shanghai-North Europe freight index

dipped again to US$1,230 at the end of July and then

jumped to US$1,455 in the first week of August.

It remains to be seen whether shipping companies will be

able to maintain these higher rates during the autumn

months.

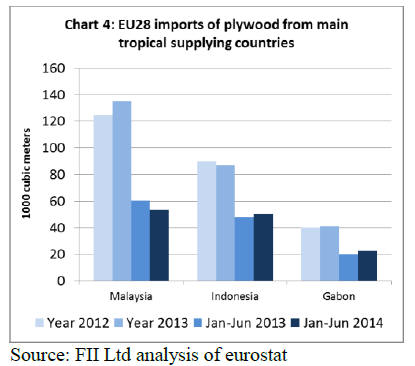

Mixed fortunes for tropical hardwood plywood in

Europe

The fortunes of tropical hardwood plywood in the EU

market have been mixed in 2014 (Chart 4).

Imports from Malaysia declined 12% to 53,300 cubic

metres in the first 6 months of 2014, a turnaround

following a 9% increase in imports from Malaysia the

previous year.

This is partly explained by rising prices for Malaysian

plywood in 2014 due to various factors including: the

increase in GSP duties from 3.5% to 7% on 1 January

2014; higher production and freight costs during 2014; and

robust sales in other parts of the world, including the US

and Middle East.

Prices for Malaysian raw plywood on offer to European

buyers currently stand at around Indo 96+32%.

Higher prices for Malaysian plywood have particularly

undermined demand in the relatively large but price

conscious UK market.

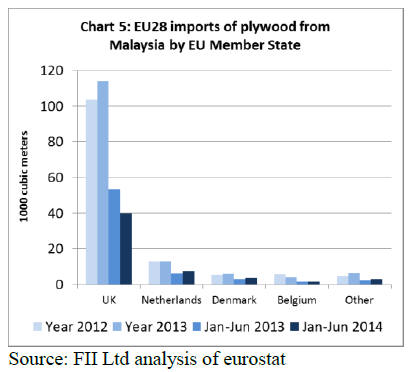

However, imports of Malaysian plywood into the main

continental European markets have increased this year

(Chart 5).

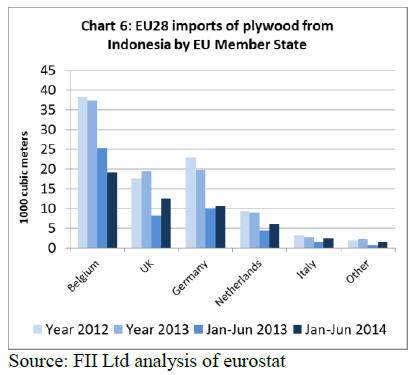

Imports of hardwood plywood from Indonesia were up 5%

in the first six months of 2014 following a decline in

imports the previous year. Imports into Belgium declined

by 25% but this was offset by rising imports into the UK,

Germany, Netherlands, and Italy (Chart 6).

Like Malaysian products, Indonesian plywood prices have

been rising this year and currently stand at around Indo '96

+40% for raw plywood. Much of the gain in prices is due

to rising log costs in Indonesia and higher freight rates,

both for break bulk and container shipment.

However, Indonesian plywood continues to benefit in the

EU market from relatively high prices for competing

Russian and European birch plywood. Break-bulk

shipments of Indonesian plywood to Europe are now

occurring around once every two to three months and are

heavily subscribed.

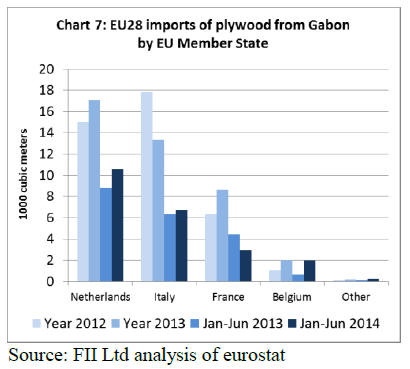

EU plywood imports from Gabon are low but rising

EU imports of hardwood plywood from Gabon were 10%

higher in the first six months of 2014 compared to the

same period the previous year. Imports into France

declined, but this was offset by rising imports into

Netherlands, Italy and Belgium (Chart 7).

This is despite the change in Gabon‟s GSP status which

led to imposition of a 7% tariff on EU imports of

hardwood plywood from Gabon at the start of 2014.

Imports this year have also been disrupted by occasional

strikes by customs officials at Libreville port in Gabon.

Both EU manufacturers and importers report better

demand for okoume plywood in 2014 than in the previous

year. This is driven by improved construction activity in

the opening months of 2014 in Netherlands and Belgium

and, more recently, by rising boat-building in Italy.

However European consumption of okoume plywood is

still very low by historical standards. Much of the existing

demand is for FSC certified products. Apart from

increases due to the imposition of higher export tariffs,

prices for okoume plywood imported from Gabon have

remained stable during the first half of 2014.

Following lobbying by associations representing

European plywood manufacturers, the EU has reduced the

tariff on imports of okoume veneer under product code

4408393010 from 7% to 0%. The tariff reduction was

announced in European Council Regulation No 722/2014

of 24 June 2014 and backdated to 1 January 2014.

This reverses the increase imposed at the start of the year

due to the change in Gabon‟s GSP status. The reduction

does not apply to plywood imported from Gabon which

continues to be subject to the 7% tariff. Gabon industry

representatives have expressed concern that this measure

favours EU-based over Gabon-based manufacturers.

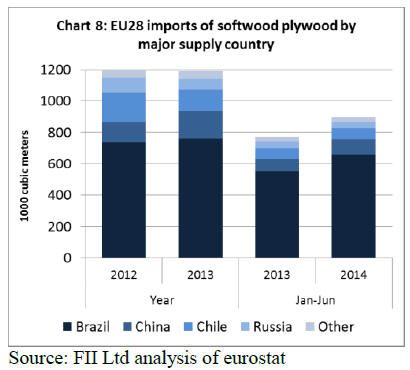

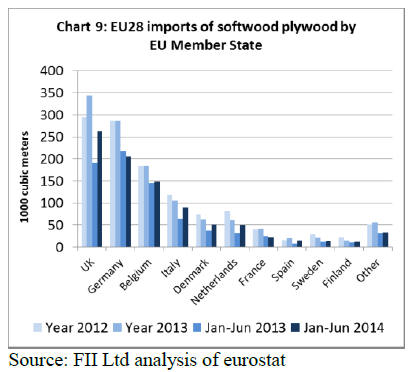

UK demand boost EU imports of softwood plywood

In the first six months of 2014, EU28 imports of softwood

plywood were 898,000 cubic metres, 17% more than the

same period the previous year (Chart 8).

Imports from Brazil increased 19% to 657,000 m3 in the

first half of 2014. There was also a 26% rise in imports

from China to 97,400 cubic metres, and a 5% increase

from Chile to 72,300 cubic metres.

Much of the gain in imports was due to improving market

conditions in the UK. However imports also increased into

Belgium, Italy, Denmark and the Netherlands in the first

half of 2014. Imports into Germany and France have been

weaker this year (Chart 9).

A large proportion of softwood plywood imported into the

EU each year arrives in the first quarter as importers rush

to benefit from the annual duty free quota of 650,000

cubic metres. This year there was a particularly strong

surge in imports in January, but imports slowed

dramatically in February and only recovered a little

ground in the March to June period.

While consumption of softwood plywood has been good

in the UK this year, disappointing construction activity in

the spring months in other European markets has

weakened demand elsewhere. European importers have

been resistant to the higher prices asked by Brazilian

exporters following rapid appreciation of the real

exchange against the dollar in the first four months of this

year. Brazilian exporters have also faced higher log,

energy and wage costs this year.

In previous years, Brazilian suppliers have lowered prices

for softwood plywood in Europe by an amount equivalent

to the 7% duty rate once the duty-free quota is used up.

However this year they have had little incentive to reduce

prices to European buyers at a time of robust demand in

North America.

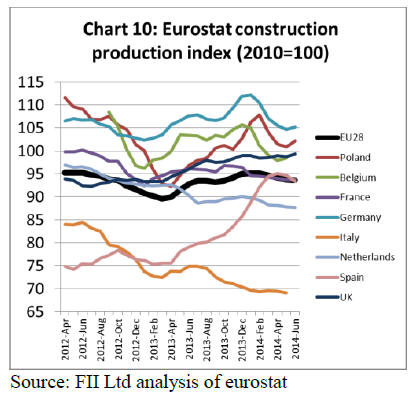

Variable prospects for EU plywood market

While market conditions for plywood in Europe have

improved in 2014, recent construction data and other

economic indices suggest future prospects remain variable

and uncertain. The EU Construction Production Index,

having made gains between March 2013 and January

2014, lost ground in the months to June 2014. The

slowdown was particularly evident in Germany but also

affected Poland, Belgium and Spain (Chart 10).

There are also emerging signs that the recovery in the

broader euro-zone economy may be stalling. The eurozone

recorded zero GDP growth in the second quarter of

2014. It had been expected to grow, if barely, but was

dragged down by worse than expected GDP data from

Germany and France. Germany‟s economy contracted by

0.2% as both its export industry and domestic construction

sector struggled. France registered a second straight

quarter of zero growth.

However prospects remain good in the UK. In August, the

UK Construction Products Association (CPA) revised its

forecast for construction output growth this year to 4.7%,

up from 4.5% forecast in April. The CPA growth forecast

for next year is 4.8%. Growth is expected to be fuelled by

rapid expansion in private housing starts and commercial

offices.

CPA expects private housing starts to grow 18.0% in 2014

and 10.0% in 2015, while commercial offices output are

forecast to grow 10.0% in 2014 and 8.0% in 2015. Overall

levels of UK construction activity will likely match their

2007 peak in 2017.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

|