2. GHANA

No further extraction of rosewood

The Outgoing Minister of Lands and Natural Resources,

Alhaji Inusah Fuseini, has confirmed that the ban

rosewood harvesting remains in force and has called upon

all Forestry Commission staff to be vigilant and halt the

illegal trade in Ghana rosewood.

A statement signed by the Minister revoked all permits

and licenses issued by the Forestry Commission for the

harvesting of rosewood, including permits and licenses for

the extraction and sale of rosewood from the Bui dam site.

Petrol subsidies removed

The National Petroleum Authority (NPA) has announced

an average 23% increase in the prices of petroleum

products as government subsidies have been withdrawn.

The manufacturing sector is now challenged with trying to

absorb some of the increase in production costs and

wherever possible pass on the cost increase to consumers.

Finance Ministry revises 2014 growth targets

The 2014 growth projections for Ghana‟s economy have

been revised down. The previously forecast GDP of 8

percent has been revised to 7.1 percent, while the end of

year inflation target of 9 percent has also been revised to

13%.

The government plan to cut the budget deficit from 12% in

2013 to 8.5% in 2014 has been thwarted, forcing the

government to set a new target to attain an 8.8% budget

deficit this year.

3. MALAYSIA

Epilogue - MTCS ※acceptance§ in Holland

The Malaysian Timber Certification Council (MTCC) has

confirmed that the PEFC-endorsed Malaysian Timber

Certification Scheme (MTCS) meets the Dutch

government‟s public procurement policy for timber.

The acceptance is for a period of two years and opens the

way for the Dutch timber and construction industry to use

Malaysia‟s PEFC-certified timber and timber products for

public projects.

Furniture industry needs to attract domestic workers

Malaysia‟s Plantation Industries and Commodities

Minister has said the government aims to rebalance the

distribution of foreign and domestic workers in the

country‟s furniture and wood working industries.

At present around 65% of the workers in the timber

industries are foreign and the aim is to increase the

proportion of domestic workers to about 70% by 2020.

The Minister said young people are not keen to work in

the industry which is perceived as tough with difficult

working conditions but mechanisation and automation is

changing the industry such that, with appropriate training,

it may be more attractive to domestic workers.

In related news, a study by the Malaysian Timber Industry

Board (MTIB) has forecast that, if the furniture industry

expands in line with government predictions, the sector

will require an additional 36,000 workers by 2020.

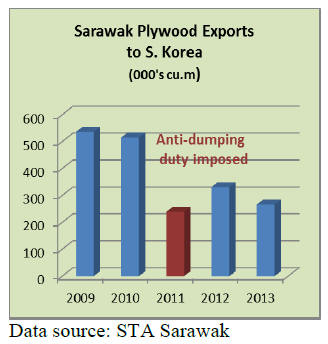

Sarawak plywood exports brace for impact of antidumping

duties

It appears certain that the South Korean government will

endorse the recommendation for an extension of the antidumping

duties on Malaysian plywood.

The anti-dumping duties were first imposed by S. Korea in

2011 and had a dramatic impact on Malaysia‟s plywood

exports to S. Korea as can be seen from the following.

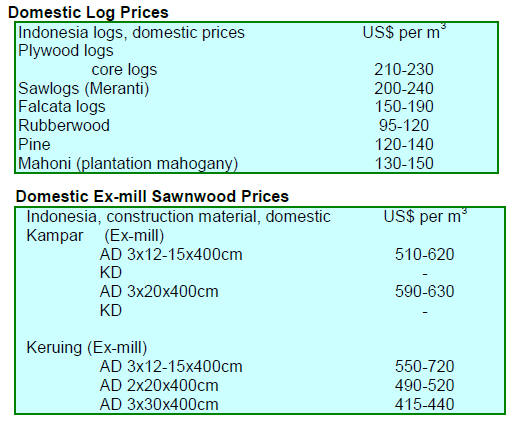

Sarawak plywood export prices

Sarawak plywood traders report the following export

prices.

Floor base (FB) (11.5mm) US$ 635 每 640 FOB

Concrete formboard panels (CP) 3‟x 6‟ US$ 560 FOB

Coated formboard panels (UCP) US$ 640 FOB

Standard plywood:

Middle East (9 每 18mm) US$ 480 FOB

South Korea (8.5 每 17.5mm) US$ 465 FOB

Taiwan P.o.C (8.5 每 17.5mm) US$ 465 FOB

Hong Kong US$ 460 FOB

4. INDONESIA

Timber trade deal with Australia

Trade Minister, Muhammad Lutf,i has revealed that

Indonesia and Australia are exploring the possibility of

creating a bilateral deal on trade in timber taking

advantage of Indonesia‟s legality assurance scheme

(SVLK).

Australia passed into law a Logging Prohibition Act in

November 2012 to eliminate imports of illegal wood

products. The authorities in Indonesia expect that the

SVLK will satisfy the new Australian law and could lead

to greater exports of wood and paper products to Australia.

Indonesia‟s main wood product exports to Australia are

paper, furniture and plywood and exports of wood based

products in 2013 totalled US$188.5 million which is

considered small in terms of the total demand in Australia.

Small timber enterprises need help with SVLK

The Center for International Forestry Research (CIFOR)

has released a report examining ''Timber Legality

Verification and Small-scale Forestry Enterprises in

Indonesia.

See: http://forests-l.iisd.org/news/cifor-seeks-to-improvelegality-

of-timber-from-small-enterprises/

The press release introducing the report says, ※There are

an estimated 700,000 small-scale forest enterprises in

Indonesia.

However, the SVLK (legality assurance scheme) has not

been broadly adopted by small producers and a high level

of illegal production takes place.

Some of the reasons for this lack of application among

small-scale enterprises include high certification costs and

limited verification and certification capacity§.

The report outlines some policy options and suggests

small operators be provided with financial and technical

assistance, that the process of certification be simplified

and that the number and capacity of verification bodies

(private sector organisations authorised by government to

offer SVLK certification services) be increased.

Boosting domestic consumption of locally produced

pulp

The Indonesian Pulp and Paper Association (APKI)

Deputy Chairman, Rusli Tan, has said his members found

it difficult to sell pulp into the domestic market as

domestic paper producers tended to focus on imported

certified pulp.

Indonesian pulp producers comply with the Indonesian

timber legality assurance scheme (SVLK) so APKI is

seeking government support for boosting domestic

consumption of local pulp. Because local producers of

pulp cannot sell into the domestic market they have to rely

on exports.

In related news the Ministry of Trade has identified the

market for Indonesian paper products in Pakistan to be

worth developing further. Currently India is the largest

market for Indonesian paper but Pakistan has potential

said Vice Minister of Trade, Bayu Krisnamurthi, as the

country‟s 2012 imports of paper and paper products was in

the region of 200,000 tonnes of which Indonesia supplied

less than half.

See: silk.dephut.go.id/index.php/article/vnews/90

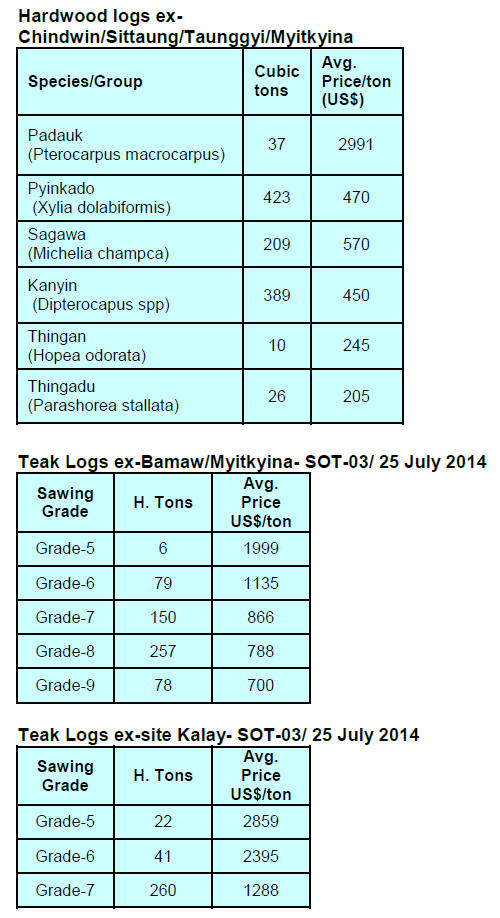

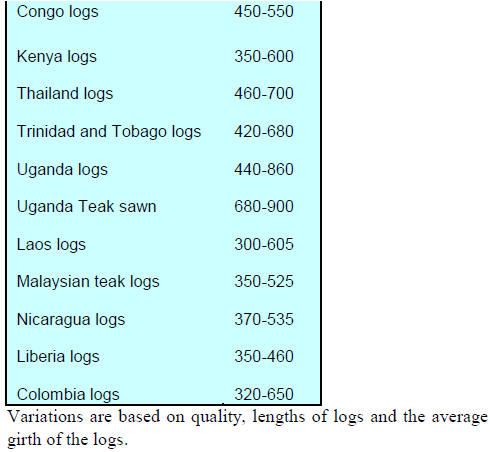

5. MYANMAR

Background to MTE sales

Open tenders by the state run Myanma Timber Enterprise

(MTE) are held by both the Export Department and the

Local Marketing Department.

The Export Department sells mostly teak and sales are

priced in US dollars, on the other hand, the Local

Marketing Department sells mainly non-teak hardwood

timber and their sales are priced in Myanmar Kyats

(MMK).

The Export Department open tenders are usually held

twice a month, one sale event for teak the other for nonteak

hardwoods when they are available. Buyers say that

currently the volume of logs is small at the Export

Department tender sales.

The Local Marketing Department sales are mostly of sawn

non-teak hardwoods and they held across the country

where ever there are MTE sawmills and depots.

Timber purchased from the both the Export and Local

Marketing Departments can be further processed and

exported.

Many of the companies having stocks of logs that missed

the 31 March shipping deadline for export are engaging

local mills to process these logs so the timber meets the

criteria for export.

Prices achieved at the 19 June open tender sale by the

MTE Local Marketing Department in Toung Oo Area,

Bago Division (East) are shown below.

Group 1 includes mainly Pyinkadoe, Thitya, Ingyin,

Others include various species of non-teak hardwoods

other than Group 1.

S= Short lengths= 3' to 9.5'

US= Ultra Shorts= 1.5' to 2.5'

The above length group system is used by the MTE Local

Marketing Department when selling non-teak sawnwood.

In selling teak sawnwood the MTE Local Marketing

Department uses the same nomenclature as is used in the

Export Marketing Department i.e.: L= 6' & up, S= 3' to

5.5' and US=1.5' to 2.5'

The current price per ton for sawn teak and other

hardwoods in Yangon is MMK 2,200,000 to 2,300,000 for

teak and MMK 1,200,000 for Pyinkado per ton. Kanyin

sawnwood is trading at around MMK 670,000. These

prices are quoted for the domestic construction sector.

Vietnam to invest in manufacturing wood products

Vietnam has expressed interest in setting up an industrial

zone in Myanmar to process wood products and gems

according to the local Eleven Media Group.

Myanmar officials said they would welcome such an

investment in line with the country‟s Foreign Investment

Law. Currently, Vietnam is the eighth largest source of

foreign investment in Myanmar.

Myanmar‟s imports from Vietnam include

pharmaceuticals, cement, chemical products, machinery,

electrical products as well as paper, rubber and plastic.

Myanmar‟s exports to Vietnam include teak and other

hardwoods and minerals.

The following prices were obtained during the

Special

Open Tender sales held in Yangon on 25 July 2014.

6.

INDIA

Smart cities 每 Singapore invited

to help

While there is no simple definition for smart cities, the

Smart Cities Council describes them as ※urban space that

is ecologically friendly and technologically integrated and

utilises information technology to improve efficiency‟. See

http://smartcitiescouncil.com/india.

Smart cities are necessary in India say advocates as India‟s

urbanisation is developing such that around 500 million

Indians will be living in cities by 2030, almost double that

at present.

In a recent study the McKinsey Global Institute says that

by 2030 the urban areas will provide the bulk of new jobs

and that almost three quarters of India‟s GDP will be

generated by the city workforce.

In related news, during a meeting with visiting

Singaporean Minister for Foreign Affairs, Singapore was

officially invited to contribute to the Indian government

effort to provide low-cost and affordable housing.

Economy on sounder footing

India's exports grew by more than 10% in June, the second

monthly rise and the latest sign that international markets

are firming which will put the Indian economy on a

stronger foundation. Imports also rose by over 8%

reversing the decline in May.

India's industrial output in June was at a 19 month high

and efforts by the Reserve Bank of India to stem consumer

inflation are taking effect as inflation dropped to the

lowest in two years.

The only negative news is that gold imports jumped 65%

in June to US$3.1 billion creating a risk that the currentaccount

deficit could widen so it is unlikely that the

government will relax the import tax on gold.

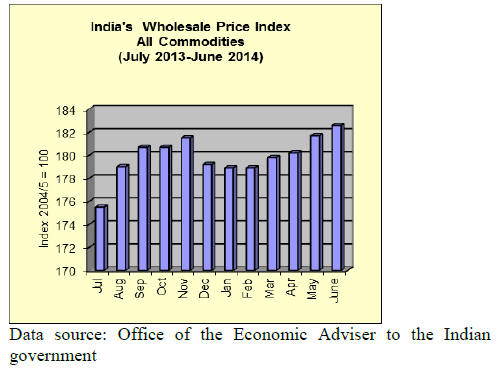

Pace of inflation growth slows

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI). The official Wholesale Price Index for All

Commodities (Base: 2004-05 = 100) for the month of June

2014 rose by 0.5 percent to 182.6 (provisional) from 181.7

(provisional) for the previous month.

Indian inflation slowed in June as food prices eased and

the forecast for a good monsoon resulting in high crop

yields is boosting confidence that the slowing pace of

inflation can be sustained.

The annual rate of inflation based on the June WPI was up

5.3% compared to the previous month See

http://eaindustry.nic.in/cmonthly.pdf

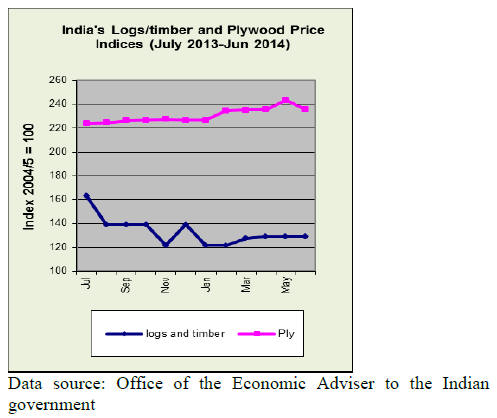

Timber and plywood wholesale price indices

The OEA reports Wholesale Price Indices for a variety of

wood products. The Wholesale Price Indices for

Logs/timber and Plywood are shown below. The June

2014 logs/timber index remains flat and for the first time

in six months the plywood price index dipped in June.

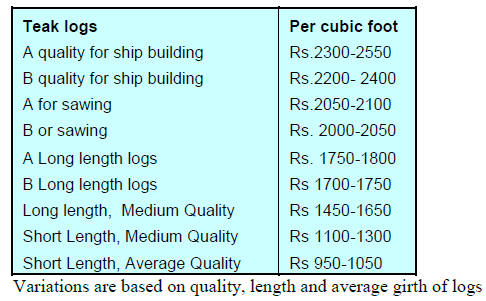

Domestic teak logs attract better prices

During the past auctions at Rani Amba, Raj Pipla and

Valsad forest depots in the Dangs Division, good quality

log lots were available from the Forest Worker‟s Cooperatives.

These logs attracted prices of Rs.100-150 per

cubic foot more than log lots from the Forest Department.

Average prices recorded at the most recent auction are as

follows:

Good quality non-teak hardwood logs of Haldu (Adina

cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium, 3 to 4

metres long having girths of 91cms and above attracted

prices in the range of Rs.750-950.

Medium quality logs of the same species were sold at

between Rs500-600 per cubic foot. The lower quality logs

went around Rs.300-~450 per cft.

The monsoon has become well established in those areas

so auctions will resume in the dry season which begins in

about three months.

Teak sales in Central India forest depots.

Over 20,000 cubic metres of teak logs were sold at

Timarni, Khirakia, Ashapur, Narmada nagar, Betul and

other depots in Central India.

As the volume of teak offered for sale Maharashtra

is

falling auctions in Madhya Pradesh also attract sawmill

owners from the Nagpur area.

Approximately 15-20% of the log lots offered at the

latest

sale remained unsold as the reserve prices were not

achieved.

Plantation teak prices

Prices and deliveries for imported plantation teak are

reported as satisfactory. The slight weakening of the rupee

has had little impact on trade so far. Sales of plantation

timbers tend to slow during the monsoon.

Importers have noticed that imported log parcels now have

a higher proportion of small diameter „thinning poles‟ than

previously and this has resulted in the minimum price

offered for log parcels falling.

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

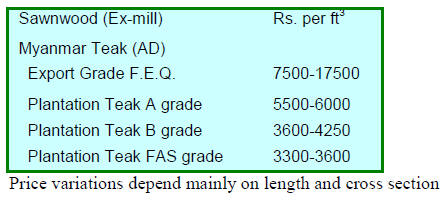

Prices for air dry sawnwood per cubic foot,

ex-sawmill are

shown below.

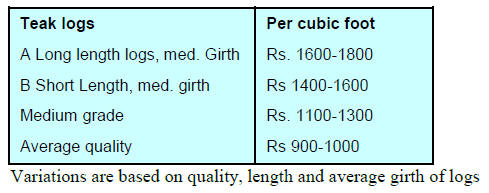

Myanmar teak processed in India

Current prices for air dried Sawn timber per Cubic Foot,

ex-Saw Mill, have remained steady and are as under:

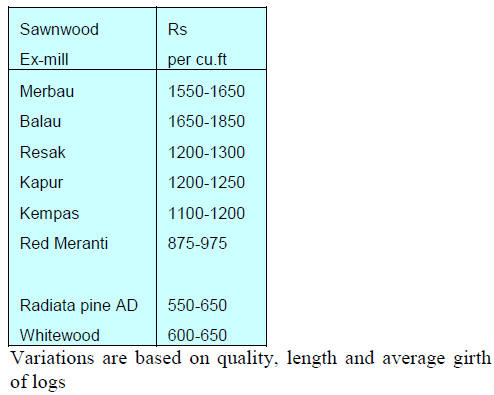

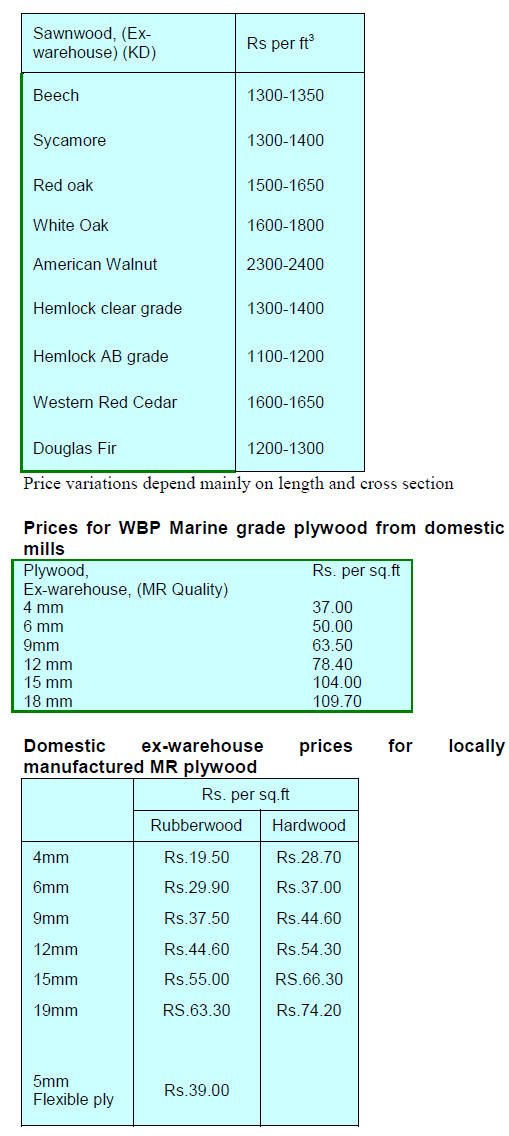

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

﹛

Plywood manufacturers expect better prices as

investment in housing expands

The allocation of Rs.40 billion made to National Housing

Board by the government for building affordable houses in

urban areas, the Rs.80 billion for rural housing and the

Rs.70.6 billion budget allocation for „smart cities‟ has

lifted sentiment in the plywood industry.

In anticipation of firmer demand plywood manufacturers

are already pushing higher prices.

7.

BRAZIL

Tax on furniture makers unchanged

The Industrialized Products tax (IPI) on furniture,

furniture coatings, panels and some other wood products

will be maintained until December 31, 2014.

As a result of this decision the tax on the furniture industry

will remain at 4% which is a welcome relief as there were

plans for the tax to be increased to 5%.

According to the Furniture Industry Association of Rio

Grande do Sul (MOVERGS) and the Union of Furniture

Industries of Bento Gonçalves (SINDMÓVEIS), the

decision to maintain the tax rate at 4% was good as the

furniture industry is facing difficult times and has high

inventories of unsold furniture, at the same time furniture

imports have been increasing.

IBA wants to expand planted forest area in Brazil

The Brazilian Tree Industry Association (IBÁ) has, since

its inception in April, been very active in the Brazilian

forest sector development. The association is comprised of

73 Brazilian companies with a gross revenue of around R$

60 billion (2013 estimate).

According to IBA, Brazil has the largest planted forest

area in the world and for each hectare of plantation one

hectare of natural forest is preserved. It is forecast, that by

2020, the forest sector will have invested US$53 billion to

double the planted forest area in Brazil.

A great part of these investments should be in the southern

region which today accounts for 20% of total pulp

production, 67% of total wood panel production and 42%

of all paper production.

Exports of tropical plywood and sawnwood rise

In June 2014, the value of wood product exports (except

pulp and paper) fell 2.4% compared to June 2013, from

US$205.6 million to US$200.6 million.

However, pine sawnwood exports increased 34.6% in

value in June 2014 compared to June 2013, from US$13.3

million to US$17.9 million. In terms of volume, exports

rose 32%, from 58,100 cu.m to 76,500 cu.m over the same

period.

In a turnaround from the previous month the volume of

tropical sawnwood exports increased 2.3% from 29,900

cu.m in June 2013 to 30,600 cu.m in June 2014. The value

of exports increased a healthy 6.5% from US$15.5 million

to US$16.5 million, over the same period.

﹛

Exports of pine plywood fell 12% largely because of the

impact of the seasonally weaker markets in the US and

Europe. The value of pine plywood exports in June this

year was US$ 29.1 million down from US$ 33.1 million

in June 2013.

On the other hand exports of tropical plywood, while now

very small, increased 2.3% from 4,300 cu.m in June 2013

to 4,400 cu.m in June 2014. In terms of value, tropical

plywood exports increased 12.5%, from US$2.4 million in

June 2013 to US$2.7 million this June.

Direction of Brazilian sawnwood exports

Brazilian tropical sawnwood exports in June 2014

increased 6.5% in value and 2.2% in volume year on year.

The main destinations (in terms of value) in June 2013

were China, the United States, Vietnam, Belgium and

France representing 15.7%, 14.4%, 13.8%, 7.1% and

5.9%, respectively.

For this June there was a change with the United States

becoming the main importer of Brazilian tropical

sawnwood, (18.8%), followed by China (12.2%), France

(10.6%), the Netherlands (10%) and Vietnam (7.9%).

In terms of total volume, June 2013 tropical sawnwood

exports totalled 29,890 cubic metres while for June this

year exports reached 30,558 cubic metres valued at

US$16.5 million.

The states supplying most of the exports of tropical

sawnwood in terms of value, was Par芍, representing 32%,

followed by Mato Grosso (29%), Rondônia (18%) and

Paran芍 (10%).

Slight increase in first half furniture exports

Despite a rather sharp drop (-7.4%) in wooden furniture

exports in June this year, the first half of 2014 saw

furniture exports increase slightly in value, from US$220

million in the first six months of 2013 to US$223 million

in the same period in 2014.

Last year the main destinations for Brazilian furniture (in

terms of value) in the first six months were the United

States, the United Kingdom, Peru, Chile and Uruguay,

representing 18%, 15%, 8%, 7% and 6.9%, respectively.

This year the pattern of trade remained much the same: the

United States (20%), the United Kingdom (18%), Peru

(8%), Chile (6%) and Uruguay (6%).

The state of Santa Catarina contributed the highest to

furniture exports ( 40%, US$89 million) followed by Rio

Grande do Sul (36%, US$80.4 million) and Paran芍

(15%, US$ 34 million).

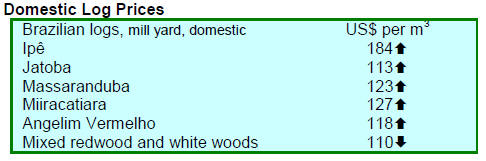

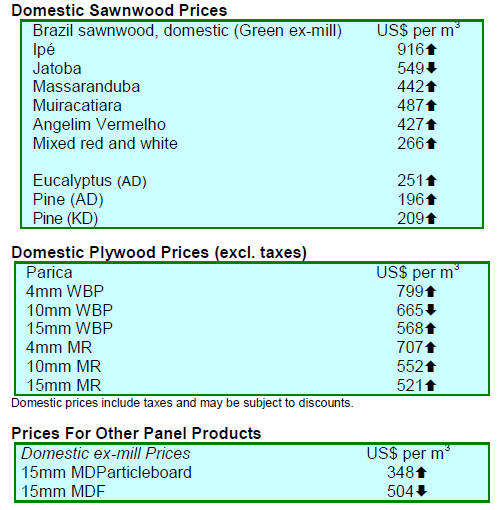

Domestic market prices

Average prices of Brazilian roundwood from natural

forests are ranging from US$ 110/m³ to US$ 184/m³ at

mill yard (US$111 per cubic metre to US$178 in June),

while average prices of Brazilian sawnwood from natural

forests varied from US$ 266/m³ to US$ 916/m³ ex-factory

depending on the species (US$256 per cubic metre to

US$885 in June).

For both cases, highest prices refer to ip那 (Tabebuia sp.)

species, considered noble wood. The average price of

parica WBP glue plywood ranges from US$ 568/m³ to

US$ 799/m³ ex-factory depending on thickness (US$566

per cubic metre to US$768 in June).

Prices for parica MR glue plywood range from US$

521/m³ to US$ 707/m³ ex-factory, according to the

thickness (US$506 per cubic metre to US$684 in June).

﹛

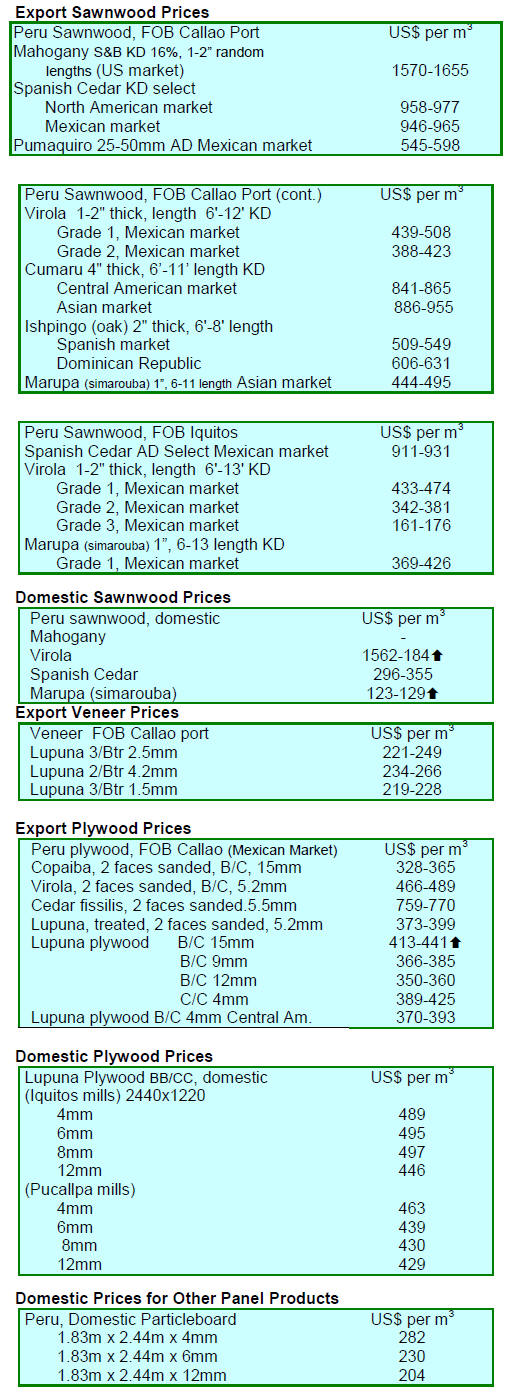

8. PERU

Package of support for forestry

The Ministry of Agriculture and Irrigation (MINAGRI)

will implement a series of measures to boost forestry in

the country. The package proposed includes the

restructuring of at least ten administrative processes in

order to cut the time taken for authorisations to be

released.

The re-organisation of the procedures will be the

responsibility of the new National Forest Service and

Wildlife (SERFOR) which was officially inaugurated 1

July.

SERFOR Executive Director, Fabiola Muñoz, announced

that implementation of the new forest authority procedures

will result in faster and more efficient processing and full

use will be made of online applications for permits or

licenses.

Wooden furniture exports to reach US$ 8 billion this

year

According to a study by the Center for Business

Intelligence and Markets ( MAXIMIXE) 2014 exports of

wooden furniture will have grown by around 2% and

could total US$8 million on the back of the recovery in the

US housing market.

On the other hand furniture imports could expand 12% in

2014 to US$121 million as demand strengthens in Lima

and the provinces. MAXIMIXE points out that furniture

imports from Brazil and China are growing fast.

Competitively priced imports are having a negative effect

on domestic furniture manufacturers which may see a

decline in domestic sales this year.

Spanish trade mission to Peru

Spanish furniture manufacturers recently toured Peru and

Panama. The companies participating in the trade mission

included Furniture Canella, Point, Mobil Fresno, Brothers

Calatayud and Grassoler Amboan.

The mission was organised by the Asociaci車n Nacional de

Fabricantes y Exportadores de Muebles de España

(ANIEME), in collaboration with the Instituto Español de

Comercio Exterior ( ICEX) to promote trade contacts with

importers and help expand demand in the medium-high

and high-end retail market for Spanish cabinetry in Peru.

ANIEME President, Juan Carlos Muñoz said during a

press conference in Lima that Spanish companies need to

diversify their markets and that there are exciting business

opportunities in Latin American countries such as Peru,

Panama, Mexico, Colombia and Chile.

﹛

9.

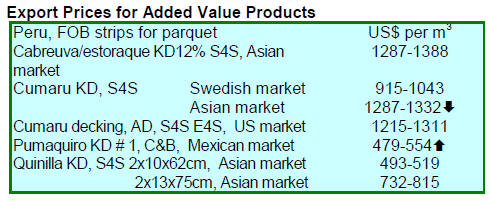

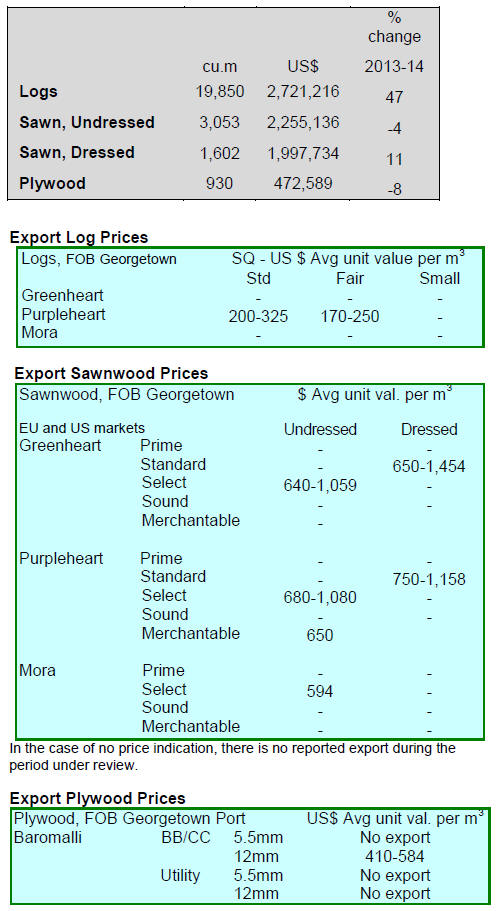

GUYANA

First quarter exports a year-on-year

improvement

Guyana‟s first quarter 2014 wood product exports totalled

US$8.24 million up 8% on the first quarter 2013 (US$7.6

million). As will be seen from the table below the log and

sawnwood exports accounted for the bulk of export

earnings (90%).

Guyana exports a wide range of products including poles

for transmission lines, foundation piling (manly

greenheart), furniture and builders woodwork, charcoal

craft items.

﹛