|

Report from

North America

Industry-funded programmes to increase US wood

consumption

Two industry-funded wood promotion programmes are

underway in the US, both with the goal to increase

demand for US wood products. The programme for

softwood sawnwood was voted in by producers in 2011

and a range of promotion projects are underway.

The second programme, for hardwood, has been more

controversial among the industry, which is much more

fragmented than the softwood industry with many smallsize

businesses. The proposal for the hardwood promotion

programme is still being finalised.

The softwood promotion programme is funding the

following activities in 2014 from a US$17.8 million

budget:

Work on building standards to maintain and expand

acceptance of appearance and structural softwood

sawnwood in the marketplace (through the American

Wood Council, www.awc.org)

Promote the acceptance and expand the use of

softwood sawnwood in post frame construction

(through the National Post Frame Building

Association, www.nfba.org)

Promote the values and benefits of appearance

and structural sawnwood products (through

reTHINK WOOD, www.rethinkwood.org)

Grow the market share for appearance and

structural softwood sawnwood in light

commercial and multi-family construction

(through WoodWorks, www.woodworks.org)

Timber Tower Project: research a composite

building system for mid and high-rise buildings

which relies primarily on softwood sawnwood

products

Appearance Product Promotion: implement a

communications program promoting the use of

softwood lumber in interior and exterior

appearance applications.

More information about the activities is available through

the Softwood Lumber Board which administers the

promotion programme:

www.softwoodlumberboard.org

Cabinet market annual growth forecast at 6% to 2018

US demand for cabinets is project to grow 6.6% per year

to 2018.

According to a market research report by Freedonia,

demand will reach US$16.0 billion in 2018, up from

US$11.6 billion in 2013 (Freedonia, Industry Study

Cabinets, May 2014).

The growth in demand is based on expectations of

growing housing starts, larger kitchens and multiple

bathrooms and more remodeling as sales of existing

homes increase.

Demand for cabinets for residential remodeling accounts

for more than two thirds of total US cabinet consumption.

The two next largest markets are non-residential

remodelers and new home installations.

Freedonia expects the non-residential building sector to

grow in the next four years. Both new construction and

remodeling of office buildings, hotels and healthcare

facilities will increase demand for cabinets.

By cabinet type, kitchen cabinets accounted for 81% of

total US demand in 2013. Kitchen cabinet demand is

projected to grow fastest, reaching $13.1 billion in 2018.

The domestic industry dominates the cabinet market.

Imports accounted for approximately 6% of total demand

in 2013. Even fewer cabinets are exported from the US

(about 1% of total production). Domestic cabinet

production is projected to increase.

Slight increase in April tropical sawnwood imports

Total US sawn hardwood imports were 85,942 cubic

metres in April, up 22% from the previous month but still

below February import volumes. The growth in imports

was mainly in temperate species, while tropical sawnwood

imports increased slightly (+2.7%) in April to 19,886

cubic metres.

However, tropical sawnwood imports were not affected by

the previous month‟s decline and year-to-date tropical

imports were 10% higher than in April 2013.

By species, balsa and sapelli sawnwood showed the

strongest growth in April. All other main tropical species

declined with the exception of jatoba.

Balsa imports from Ecuador grew by 31% to 7,192 cubic

metres in April. Imports from Cameroon doubled from the

previous month to 2,143 cubic metres due to higher sapelli

shipments of 1,601 cubic metres.

Imports from Brazil decreased to 2,534 cubic metres in

April (-28%). Brazilian ipe sawnwood shipments to the

US fell to 1,808 cubic metres, down from 2,348 cubic

metres in March.

Malaysian shipments to the US increased slightly to 1,874

cubic metres in April. Imports of keruing from Malyasia

were up (1,337 cubic metres), while red meranti declined

to just 241 cubic metres.

Imports from Indonesia declined to 906 cubic metres in

April. Unlike Malaysia, Indonesia increased red meranti

shipments (350 cubic metres) while keruing fell to 197

cubic metres.

Canadian April sawn hardwood imports up 15%

The value of Canadian imports of tropical sawn hardwood

increased by 15% from the previous month to US$2.23

million in April. Year-to-date imports were 27% higher in

April than at the same time in 2013.

Cameroon was Canada‟s largest tropical sawnwood

supplier in April with shipments worth US$394,890, up

one third from the previous month. Imports from Ghana

also increased. April imports from Ghana were worth

US$273,933 and year-to-date imports were more than

double from last year.

Imports from Brazil fell by half to US$169,284. Imports

from Ecuador, Congo/Brazzaville and Malaysia also

declined in April.

Lower hardwood plywood imports from China in March

US imports of hardwood plywood decreased by 8% to

220,697 cubic metres in March. Year-to-date imports were

4% lower than in March 2013.

The largest decline was in plywood imports from China.

Hardwood plywood imports from China fell by 33% to

81,692 cubic metres in March. Imports from Indonesia

(25,972 cubic metres) and Malaysia (6,385 cubic metres)

also declined in March. Shipments from Russia, Ecuador

and Canada to the US increased.

Moulding imports from Brazil up

Hardwood moulding imports increased by 12% in March

to $15.4 million. Year-to-date imports were slightly higher

than in 2013.

Imports from Brazil were up 59% from the previous

month at $4.5 million in March. China was the secondlargest

source of hardwood moulding imports at $3.7

million, but imports from China remain below 2013 levels.

Malaysian shipments were below $1 million, down 18%

from February.

Decline in hardwood flooring imports

US flooring imports remain below 2013 levels. The

housing market is still relatively weak, but improving

domestic production also plays a role.

Hardwood flooring imports declined by 20% in March to

$2.3 million. Imports from all major suppliers except

Canada fell. China shipped $0.24 million worth of

hardwood flooring in March, down 71% from the previous

month.

Assembled flooring panel imports grew by 8% to $8.5

million in March. Imports from China declined by 3% to

$3.4 million. Imports of assembled flooring from

Indonesia and Brazil decreased in March, although

Indonesia‟s year-to-date shipments in 2014 are almost

50% higher than last year.

Higher furniture imports from Indonesia, Mexico and

Malaysia

US imports of wooden furniture fell below the $1 billion

mark in March. Imports declined by 5% to $962.8 million.

However, year-to-date imports were 9% higher than in

March 2013.

Imports from China and Vietnam went down in March,

while Canada, Indonesia, Mexico and Malaysia increased

furniture shipments to the US.

Imports from China declined by 22% to $374.1 million in

March. Imports from Vietnam were $157.7 million, down

12% from February.

The largest increase in wooden furniture imports in 2014

to date has been from Mexico and Indonesia. Year-to-date

imports from Mexico were up 84% compared to 2013.

Indonesian shipments were 43% higher than last year.

Furniture, home furnishing retail sales down in April

Retail sales at furniture and home furnishing stores in the

US fell by 7% from March to April, according to US

Census Bureau data. Sales are higher than at the start of

the year, however, and March sales figures were positive.

Slight decline in unemployment rate in April, Q1 GDP

growth just 0.1%

The US economy expanded in April according to the

Institute for Supply Management. Almost all

manufacturing industries reported growth in April,

including furniture and wood products. The furniture

industry grew at a faster rate than wood products. Some

companies reported concern about international political

issues affecting export demand.

The unemployment rate fell by 0.4 percentage points to

6.3% in April. The number of jobs grew across all sectors,

including construction.

The US Department of Commerce‟s first estimate of GDP

growth in the first quarter of 2014 was just 0.1%, down

from 2.4% in the fourth quarter of 2013.

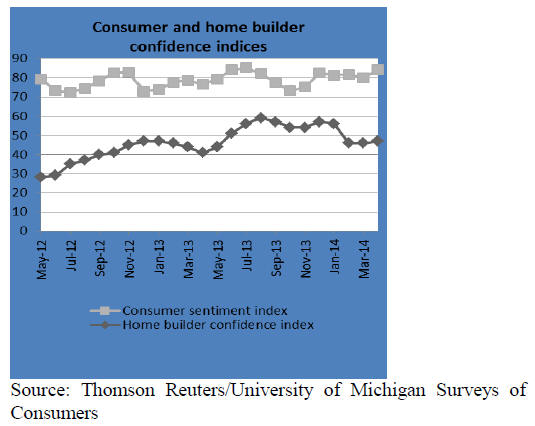

Consumers more confident in US economy

Consumer confidence in the US economy finally

rebounded in April, according to the Thomson

Reuters/University of Michigan consumer sentiment

index. The index increased by 5% from the previous

month, and it was 10% higher than in April 2013.

More Americans are positive about their current personal

financial and the overall economic outlook. Higher income

households plan to make more purchases this year. Despite

an improvement in the short-term economic outlook,

Americans still worry about the longer-term health of the

US economy.

Housing starts up 2.8% in March

Housing starts grew by 2.8% in March, based on the

seasonally adjusted annual rate of 946,000 starts in March

released by the US Census Bureau.

Single-family home starts increased by 6% from the

previous month, while multi-family starts declined by

6.1%. The growth in housing starts was strongest in the

US Northeast and Midwest, where the severe winter

weather had affected construction most.

The number of building permits declined from 1 million

units in February to 990,000 in March (seasonally adjusted

annual rate). The decline in permits was mainly in the US

South. The number of building permits issued is an

indicator of future building activity.

Home builders remain concerned about market for

single-family homes

Home builder confidence in the market for newly built

single-family homes changed little in the last three

months. Last month‟s builder confidence in the market for

newly built single-family homes was revised downwards

by one point.

In April, confidence grew slightly (by one point),

according to the National Association of Home Builders.

When homes sales increase in spring, demand for new

houses is expected to grow.

Commercial building construction only bright spot in

non-residential market

The US non-residential construction market remains weak,

according to US Census Bureau data. Private spending on

non-residential construction in January and February was

revised downwards. From February to March private

spending was practically unchanged.Public spending on

office, commercial, health care and educational buildings

declined by 2.9% in March. The only bright spot was

public spending in commercial construction, which

increased by 3.9% from the previous month.

The American Institute of Architects‟ latest report

confirms the weak market. The construction of

commercial, industrial and institutional buildings lags the

residential construction market. Business conditions are

particularly weak in the Northeast and Midwest.

|