Japan Wood Products

Prices

Dollar Exchange Rates of

26th June 2014

Japan Yen 101.72

Reports From Japan

Exports drop on weak demand in Asia and US

Data from Japan‟s Ministry of Finance (MoF) is showing

that May exports fell marking the first drop in more than

12 months. In particular, exports to Asian countries and

the US dropped and this makes it even more likely that the

Bank of Japan (BoJ) will come with an additional stimulus

package in the near future.

Overall, May exports fell almost 3% year-on-year

according to the MoF, a sharp reverse on the 5% increase

reported for April. A growth in exports is central to the

plan of the BoJ plan to achieve its inflation goal and to

offset the impact of the consumption tax increase

introduced in April this year.

On the other hand, Japan‟s import bill eased in May,

(another first for almost 2 years) by 3.6% from 2013. The

latest, weaker than expected, import figures helped narrow

the trade deficit which has been made worse because of

energy imports.

For the MoF statistics see:

http://www.customs.go.jp/toukei/srch/indexe.htm

Employment figures moving in the right direction

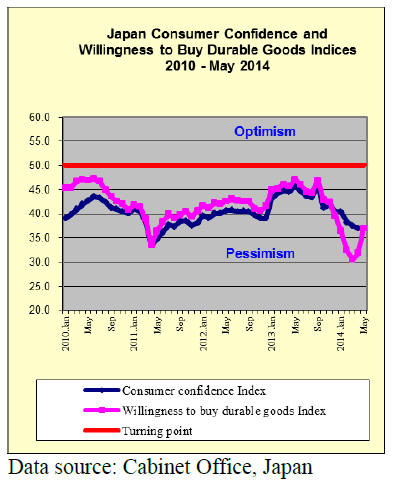

The latest employment figures from Japan‟s Ministry of

Internal Affairs and Communications shows that the

unemployment rate edged down to 3.5% in May from

3.6% in April, a sign that the jobs market is tightening.

Unemployment figures from Japan have been trending

lower since the end of 2013 and this is expected to impact

consumer confidence figures for June.

The encouraging employment figures came in contrast to

data showing household spending fell 8% during the first

five months of the year, much worse than projected.

The decline in spending was due mainly fewer purchases

of cars and household appliances as most consumers had

completed purchases in advance of the consumption tax

increase in April. Analysts expect the economy to have

weaken in the second quarter.

Pace of house building in disaster areas disappointing

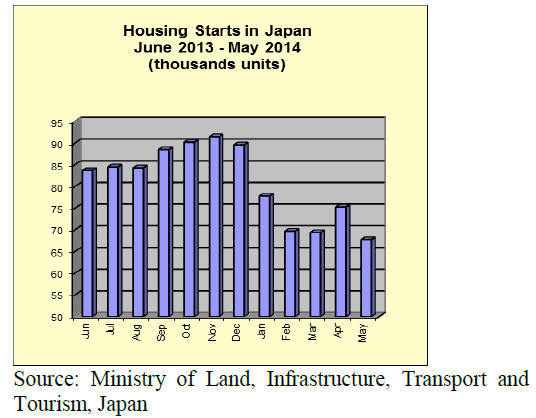

Japan‟s housing starts grew steadily in the final quarter of

2013 but slowed in the first quarter of 2014. While there

are signs that the economy may be improving, not all is

well in the housing sector.

As of the end of April over 60,000 families from the area

surrounding the Fukushima nuclear plant are still living in

temporary accommodation.

It is now three years since they evacuated and while they

were offered free housing for a short period, prospects for

a permanent solution are dim.

The pace of new home building for those in the disaster hit

areas has been slow and now, with construction work for

the 2020 Tokyo Olympics already underway, construction

workers find they can earn more working in Tokyo.

The latest data from the Ministry of Land, Infrastructure,

Transport and Tourism shows that May housing starts fell

15% year on year, much more than forecast.

See:

www.e-stat.go.jp/SG1/estat/NewListE.do?tid=000001016966

‘Third arrow’ of growth plan revealed

The Japanese cabinet has approved and released a growth

strategy aimed at revitalising the economy and restoring

the country's global competitiveness.

The latest of the growth plans is the so-called „third arrow‟

of the prime ministers offencive against deflation. The

plan includes over 240 proposals affecting labour

regulations, government pension fund investments,

corporate governance and tax policies, expanded childcare

to bring more women into the workforce and an

investment boom.

These measures, say the ruling party, are what are needed

to unlock stalled corporate investment and stimulate

innovation.

While economists have applauded the concepts in the plan

their fear is that details, like the size and timing of the

changes are either vague or unspecified.

Many of the proposals will only apply to enterprises in the

new "special economic zones" which will be free of much

of the bureaucratic hurdles which constrain the private

sector.

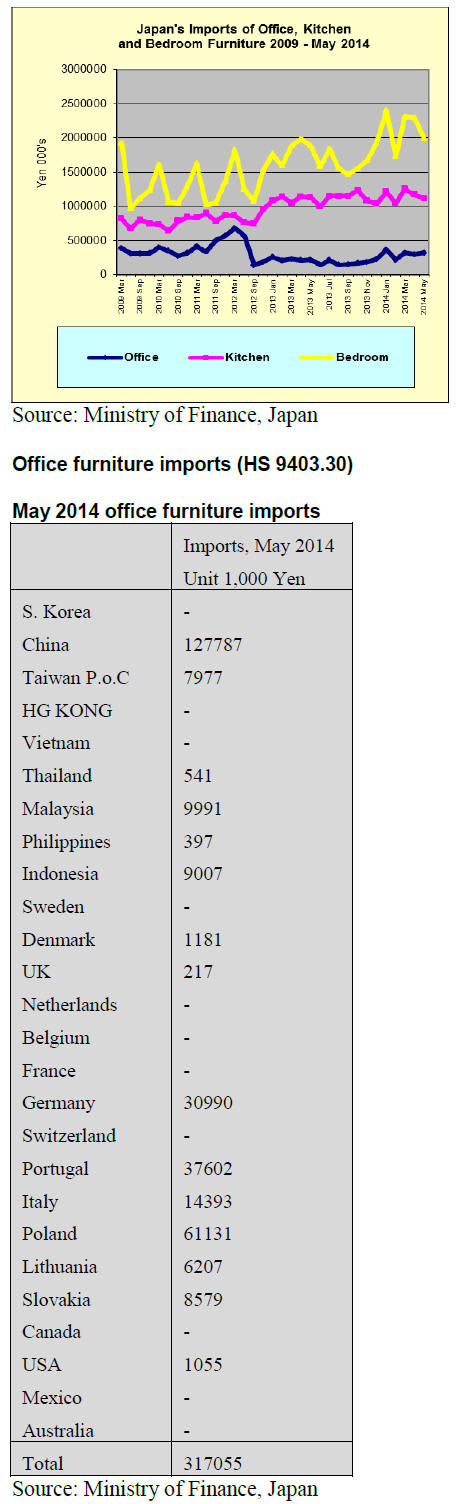

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office kitchen and bedroom furniture imports from

2009 to the end of May 2014 are shown below.

As anticipated, Japan‟s furniture imports eased in May. A

Sharp decline was seen in both kitchen and bedroom

furniture imports with office furniture imports remaining

at about the same level as in April.

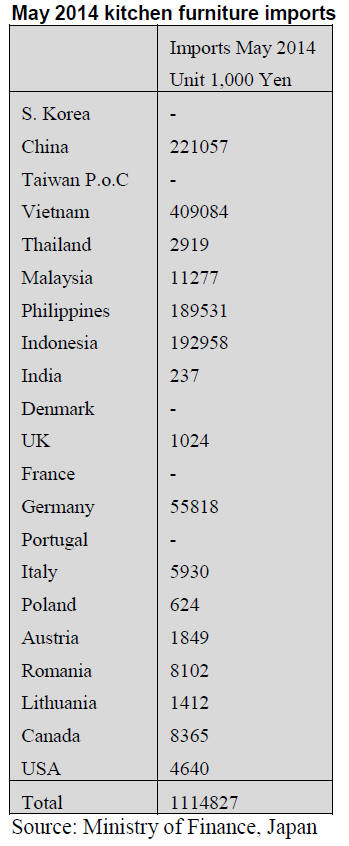

May imports of office furniture into Japan increased 7%

compared to April levels. China maintained its number

one ranking as the main supplier and in May increase

exports to japan by 30%.

Poland was ranked second and Portugal third in terms of

the value of exports of office furniture to Japan. The top

three suppliers accounted for over 70% of all office

furniture imports.

Kitchen furniture imports (HS 9403.40)

The top three suppliers of kitchen furniture to Japan in

May remained Vietnam, 36.7% (39.5% in April), China,

19.8 % (20.1% in April) and Indonesia 17.2% almost the

same as in April.

Of the non-Asian suppliers only Germany fearures

prominently in May, accounting for 5.5% of Japan‟s

kitchen furniture imports. The top three suppliers. plus

Philippines, accounted for around 90% of May kitchen

furniture imports by Japan.

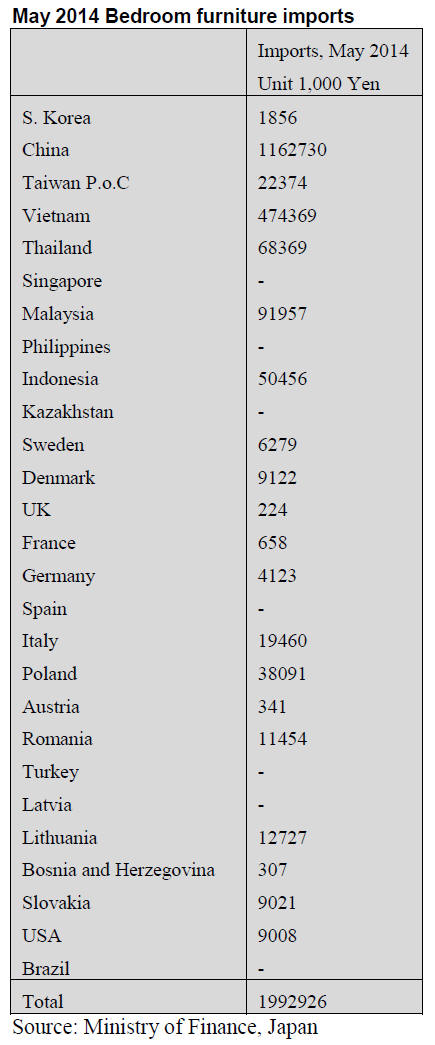

Bedroom furniture imports (HS 9403.50)

April bedroom furniture imports were largely unchanged

and so avoided the downturn seen with office and kitchen

furniture imports however, May figures show a sharp

correction. Japan‟s May imports of bedroom furniture fell

13% with the top three suppliers, China, Vietnam and

Thailand all recording significant declines.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Wood Use Point System

The administration office of the Wood Use Point System

of the Forestry Agency announced on May 29 that it added

three foreign species as qualified species for the system.

They are European spruce, red pine from Sweden and

radiate pine from New Zealand.

Each prefecture needs to approve above added species and

construction method for the system. Newly approved

species and type of construction are as follows:

Prefecture of Gifu, Fukui, Nagano approved post

and beam construction built with majority of

structural members by cedar, cypress, larch, fir,

red pine, black pine, Ryukyu pine and yellow

cedar or American Douglas fir for the system.

Prefecture of Kanagawa, Gifu, Shiga, Fukuoka,

Nagasaki approved log house and platform

construction with cedar, cypress, larch, fir and

American Douglas fir.

Prefecture of Hokkaido, Ibaraki, Tokyo,

Kanagawa, Nagano, Miye, Shiga, Osaka, Hyogo,

Wakayama, Okayama, Hiroshima and

Yamaguchi approved post and beam construction

with cedar, cypress, larch, fir, red pine, black

pine, Ryukyu pine, yellow cedar, American

Douglas fir and Austrian spruce.

By all those approvals, American Douglas fir is qualified

for both post and beam and platform construction in 42

prefectures and log house in 41 prefectures.

April plywood supply

Total supply of plywood in April was 587,700 cbms, 0.8%

more than April last year and 5.3% more than March. This

is the second highest next to last January. In particular,

domestic monthly production was the highest this year but

the inventories were only half month yet. Imported

plywood was also high.

Volume of imported plywood was 325,100 cbms, 3.7%

less and 6.1% more. Monthly average volume in last four

months was 319,200 cbms, 0.2% more than the same

period of last year. Malaysian volume increased by about

20,000 cbms from March to 147,700 cbms, 10.5% less and

15.1% more.

Monthly average for last four months was 137,800 cbms,

7.6% less than the same period of last year. Indonesian

volume was 90,200 cbms, 2.5% less and 7.4% less.

Four month average is 91,300 cbms, 2.0% more. Volume

from China was 74,000 cbms, 1.9% less and 6.2% more.

Four month average was 69,300 cbms, 4.0% more.

Malaysia suffered log shortage since late last year and it is

reported that even major mill had about 20% less

production in February. However, Japan side is cautious in

buying futures with ambiguous market so the arrivals from

Malaysia seem to stay low.

Domestic production in April was 252,500 cbms, 7.4%

more and 4.1% more.

2013 Forestry white paper

The government approved 2013 forestry white paper on

May 30, which contains trend of forest and forest industry

in 2013 and forestry measures for 2014.

The stock of artificial forest increased by 5.4 times in fifty

years. Timber of more than 45 years old takes a majority

of 5,230,000 hectares so the future subjects are harvest,

utilization and replantation of rejuvenation of matured

forests. Also development of new demand and

establishment of stable supply system are needed.

The paper explained history of forestry after the war.

Increase of stock by aggressive plantation but harvest and

maintenance of forest was not properly done by expansion

of import of foreign logs and lumber by strong yen. It

emphasizes that it is important to have circulation cycle of

planting, harvesting, consuming then replanting.

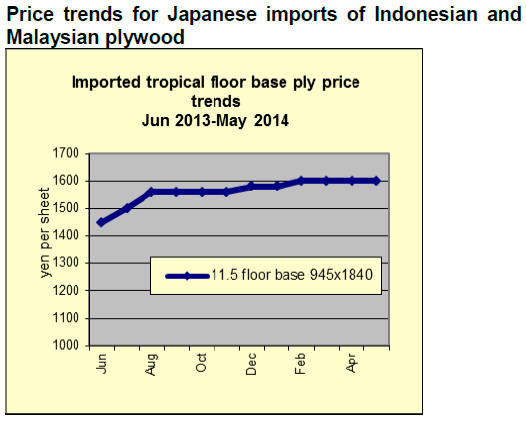

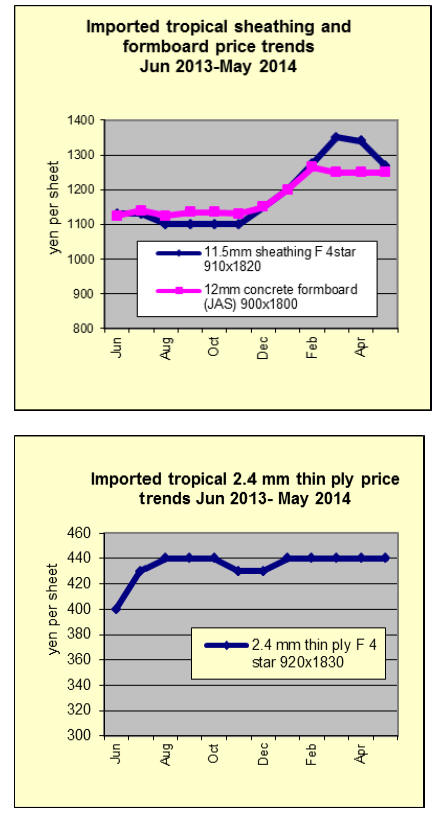

Plywood

Plywood market turned weak since May on both domestic

and imported products. April production of domestic

softwood plywood was 236,300 cbms, 4.2% more than

March, the second highest monthly production next to

October 2013 then the shipment was 218,300 cbms, 1.8%

less than March.

The inventories increased to 114,800 cbms, 19.6% more

than March but they are way shorter than one month

inventory so the manufacturers are not worried and stay

bullish. Meantime, trading firms and wholesalers are

reducing the sales prices to secure sales amount and

protect their market.

Market of imported plywood is also softening. Weakening

softwood plywood market is influencing imported

plywood market and trading is limited in small volume.

In particular, 12 mm structural panel and 3x6 concrete

forming panel are weak. Imported structural panel

supplemented short supplied domestic softwood panels

since late last year but after domestic supply became ample, it finished its

role

and the inventories increased.

Since last April, some trading firms started selling at lower

prices so the prices have been down. Concrete forming

and concrete forming for coating had rather firm market

but since late May, they started weakening.

Production of preserved wood for the first quarter

Japan Wood Preservers Industry Association disclosed

production of pressurized preservative wood for the first

quarter this year is 48,577 cbms, 5.5% higher than the

same period of last year. Production of preserved wood for

sill is up by 3.7%.

Percentage of pressurized preserved wood for residential

housing is 82%, out of which 53% is for ground sill so

consumption of sill has influence on the production.

In the first quarter production, 25,731 cbms is for sill,

3.7% more than the first quarter last year. 14,301 cbms for

housing like post, lintel, furring strip and sheathing for

ceiling, 3.4% more, almost the same growth with sill.

The most grown item is exterior materials like decking,

which was 3,987 cbms, 16.8% more. Also the production

for others like crating, gardening and engineering works

was 2,709 cbms, 43.9% more.Railroad tie and telephone poles, which

used to be the main items for preserved wood declined

after concrete products replaced wood.

Rail tie production was 1,826 cbms, 12% down and

telephone pole was only 23 cbms, 58.9% down.

|