US Dollar Exchange Rates of

11th June 2014

China Yuan 6.2283

Report from China

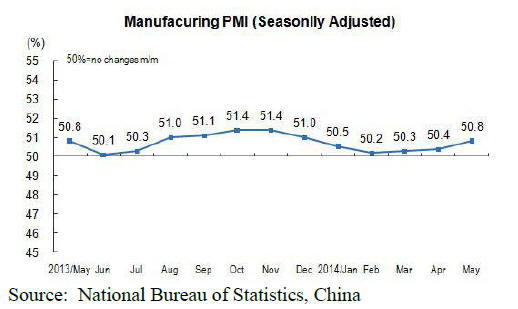

PMI up for 3 consecutive months

In May 2014, China's purchasing managers index (PMI)

for the manufacturing was released by the National Bureau

of Statistics. The May PMI for the sector stood at 50.8, 0.4

points higher than in April. The May figure consolidated

the growth trend for three consecutive months.

For more see:

http://www.stats.gov.cn/english/PressRelease/201406/t201

40604_563603.html

In terms of size of enterprises, the PMI for large-sized

enterprises was 50.9 percent, slightly up month-on-month

and in positive territory. The PMI for medium-sized

enterprises was 51.4, again up on the previous month

while the index for small-sized enterprises was still in

negative territory at 48.8.

In summary, of the five sub-indices comprising the PMI,

three improved and two weakened.

Production index: 52.8 up month-on-month.

New orders index: 52.3up month-on-month.

Raw materials inventory index: 48.0 down on

April.

Employed person index: 48.2 down month-onmonth.

Supplier delivery time index: 50.3 up month on

month.

The new export and import indices reflecting

foreign trade in manufactured goods were 49.3

and 49.0 respectively both in negative territory.

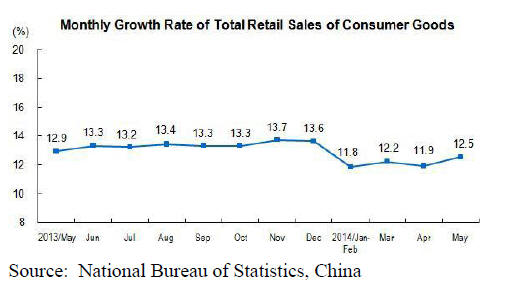

Stimulus measures boost May retail sales

May 2014 retail sales growth beat analyst‟s expectations

by growing by 12.5 percent year-on-year. The government

had recently eased monetary conditions and introduced

other measures aimed at giving the economy a boost. The

„mini‟ stimulus appears to be working given the

improvement in retail sales.

From January to May total retail sales of consumer goods

was yuan 10,303.2 billion, up by 12.1 percent year-onyear.

Online retail sales increased 53.2 percent.

US$ 90 billion outward investment in 2013

Early this year Forest Trends published a report ¡°Chinese

Overseas Investment in Forestry and Industries with High

Impact on Forests: Official Guidelines and Credit Policies

for Chinese Enterprises Operating and Investing Abroad¡±.

The following excerpts draw on this report.

For the full report see http://www.foresttrends.

org/documents/files/doc_4203.pdf

In 2013 Chinese enterprises invested US$90 billion in

5,090 foreign companies in 156 countries, a year on year

increase of 17%.

Of the total, investments in Hong kong, ASEAN, EU,

Australia, USA, Russia and Japan totalled USD65.5

billion around 73% all overseas investments. But

investment flows to Hongkong, the EU and Japan fell in

2013 compared to a year earlier.

The value of China‟s investments grew in Russia (US$4.1

bil.), the US (US$4.2 bil.), Australia (US$3.9 bil.) and

ASEAN (US$5.7 bil.). The greatest increase was seen in

investments in Russian companies.

In terms of investment categories, 90% of China‟s outward

FDI in 2013 was to service industries (33%) followed by

mining (22%), wholesale and retail (15%), manufacturing

(10%), construction (7%) and transportation (3%). The

pace of growth in investment in the construction sector

was particularly high in 2013.

The data from the Ministry of Finance indicates that some

527,000 Chinese workers were sent to foreign companies

in 2013, a year on year increase of 15,000 employees. In

total by the end of 2013, China had around 7 million

people overseas employed in support of its outward

investment.

The majority of China‟s outward FDI originates from

state-owned enterprises (national, provincial, and

municipal) although the government is encouraging

outward FDI by private enterprises.

Geographically, enterprises in the industrial and

commercial centres in the coastal cities and provinces are

responsible for most outward FDI. Provinces where

forestry and wood processing is strong such as Shandong

and Yunnan tend to feature in FDI in the timber sector.

A powerful incentive for outward FDI is provided by the

government in the form of financial backing. Chinese

enterprises on an approved list benefit from the

government‟s financial support in the form of access to

below-market rate loans, direct capital contribution and

subsidies associated with official aid programmes.

The incentives are backed up by various guidelines to

banks and financial institutions to encourage them to

ensure their clients comply with environmental and social

standards, including host-country laws and regulations.

The most recent green credit guidelines (2012) are the

most comprehensive yet, but as with the other f guidelines,

their implementation has so far been patchy. However, the

government has plans to enforce them more strictly. All

guidelines and policies share the basic and fundamental

requirement that host-country laws and regulations must

be followed.

Despite the poor implementation of past guidelines the

most recent environmental protection and green credit

guidelines offer clear opportunities for host-country

governments, NGOs, and campaigners to highlight

occasions where Chinese companies are operating in

breach of their own government‟s regulations and laws.

Direction of outward investments

According to records kept by China‟s Ministry of

Commerce, investments in forestry and other land-use

sectors have been made in the following regions and

countries:

• Africa: Fourteen countries in Africa have received FDI in

agriculture and forestry, in particular Gabon, Zambia,

Equatorial Guinea, Liberia, Republic of Congo and

Cameroon.

• Asia: Outward FDI in logging and processing has been

mainly directed to Laos, Myanmar, Thailand, and Korea.

Efforts have been made to establish plantations in areas

previously under opium poppy cultivation in Laos,

Thailand, and Myanmar.

• Latin America and Caribbean: While less significant

than Africa or Asia, Chinese investments have been

expanding in Brazil, Argentina, Venezuela, Peru and

Guyana.

• Russia: Chinese investment has focused on logging,

timber processing, pulp and paper and other products and

is concentrated in the border areas in Siberia and the

Russian Far East. Chinese outward FDI has been

encouraged by the Russian and Chinese governments

through supportive programmes that began in 1997.

¡¡

|