Japan Wood Products

Prices

Dollar Exchange Rates of

26th June 2014

Japan Yen 101.72

Reports From Japan

Exports drop on weak demand in Asia and US

Data from Japan‟s Ministry of Finance (MoF) is showing

that May exports fell marking the first drop in more than

12 months. In particular, exports to Asian countries and

the US dropped and this makes it even more likely that the

Bank of Japan (BoJ) will come with an additional stimulus

package in the near future.

Overall, May exports fell almost 3% year-on-year

according to the MoF, a sharp reverse on the 5% increase

reported for April. A growth in exports is central to the

plan of the BoJ plan to achieve its inflation goal and to

offset the impact of the consumption tax increase

introduced in April this year.

On the other hand, Japan‟s import bill eased in May,

(another first for almost 2 years) by 3.6% from 2013. The

latest, weaker than expected, import figures helped narrow

the trade deficit which has been made worse because of

energy imports.

For the MoF statistics see:

http://www.customs.go.jp/toukei/srch/indexe.htm

Employment figures moving in the right direction

The latest employment figures from Japan‟s Ministry of

Internal Affairs and Communications shows that the

unemployment rate edged down to 3.5% in May from

3.6% in April, a sign that the jobs market is tightening.

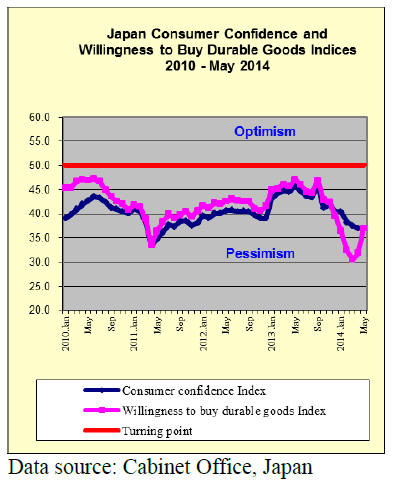

Unemployment figures from Japan have been trending

lower since the end of 2013 and this is expected to impact

consumer confidence figures for June.

The encouraging employment figures came in contrast to

data showing household spending fell 8% during the first

five months of the year, much worse than projected.

The decline in spending was due mainly fewer purchases

of cars and household appliances as most consumers had

completed purchases in advance of the consumption tax

increase in April. Analysts expect the economy to have

weaken in the second quarter.

|