US Dollar Exchange Rates of

26th

May 2014

China Yuan 6.2395

Report from China

Falling investment in real estate

Total investment in real estate development in the first

four months of 2014 increased 16.4 percent year-on-year

but the pace of investment has been falling since the

beginning of the year.

Of total investment, that in residential buildings was up by

16.6 percent year on year and accounted for 68.5 percent

of all real estate investment.

In the first four months of this year real estate investment

in the eastern region stood at yuan 1,323.0 billion, up by

17.7 percent year-on-year; growth in the central region

stood at yuan 426.8 billion, up by 12.2 percent while in the

western region investment totalled yuan 482.3 billion, up

by 16.6 percent.

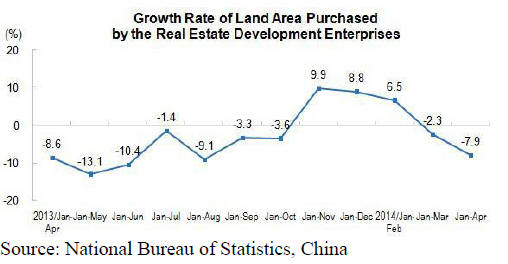

Between January and April this year the land area

purchased by real estate development enterprises totalled

81.30 million square metres, a year-on-year decline of 7.9

percent.

Slower sales of commercial buildings

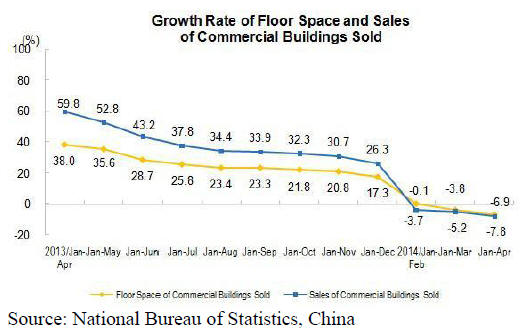

In the first four months of this year sales of commercial

buildings, in terms of floor space, fell almost 7 percent a

year-on-year and sales of commercial buildings (yuan

1,830.7 billion) fell 7.8 percent.

For more see:

http://www.stats.gov.cn/english/PressRelease/201405/t201

40513_552613.html

April prices for residential buildings in medium and

large cities

The National Bureau of Statistics in China has issued a

press release on the prices of newly built residential

buildings (excluding affordable housing).

See:

http://www.stats.gov.cn/english/PressRelease/201405/t201

40519_555182.html

Amongst some 70 cities surveyed prices of newly

constructed residential buildings fell in 8 cities, prices

were unchanged in 18 cities and increased in the other

cities. The highest month-on-month increase was 0.4

percent while the lowest was minus 0.7 percent.

Prices for second-hand residential buildings declined in 22

cities, were unchanged in 13 cities and increased in 35

cities surveyed.

The press release also provides Price Indices of Newly

Constructed Residential Buildings for the 70 cities

included in the survey.

Compared with the same month last year prices of secondhand

residential buildings fell in 2 cities, remained at the

same level in one city and increased in 67 cities.

Private investment in fixed assets

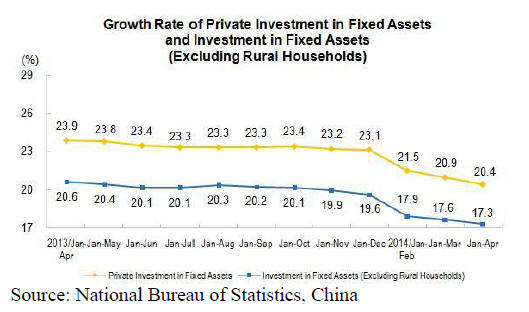

In the first four months of this year private investment in

fixed assets grew 20.4 percent year-on-year but has been

falling since the beginning of the year.

In term of sectors, investment in fixed assets in the

primary industries fell 24.5 percent year-on-year. Fixed

asset investment in secondary industries was down 18.6

percent year-on-year and that in the tertiary industries fell

22.0 percent.

For more see:

http://www.stats.gov.cn/english/PressRelease/201405/t201

40513_552608.html

April consumer goods retail sales improve

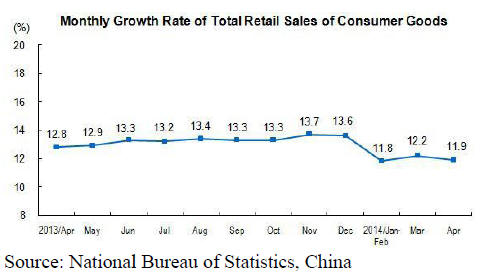

In April retail sales of consumer goods grew 11.9 percent

year-on-year.

From January to April retail sales of consumer goods was

up by 12.0 percent year-on-year, largely unchanged from a

month earlier. There was a stronger growth of retail sales

in the rural areas but sales in the rural areas account for

only about 15 percent of all retail sales.

For more see:

http://www.stats.gov.cn/english/PressRelease/201405/t201

40513_552615.html

Analysis of China¡¯s imported softwood timber

China‟s domestic timber production rose 2% to 83.67

million cubic metres in 2013. Timber imports (logs and

sawnwood) rose 18% to 79.16 million cubic metres log

equivalent and the value of China‟s timber imports grew

26% to US$16.1 billion in 2013.

In terms of volume the proportion of domestic to imported

timber in 2013 was 51:49 which is roughly similar to that

in 2012.

Domestic timber is mainly used for fibreboard, mine

timber and private purposes in rural areas while imported

timber is mainly used for construction, home interior

decoration and improvements and furniture production.

Softwoods dominate China‟s timber imports and have

increased rapidly in recent years. China‟s softwood timber

imports were 57.18 million cubic metres in 2013 and have

been growing at almost 20% per year since 2008.

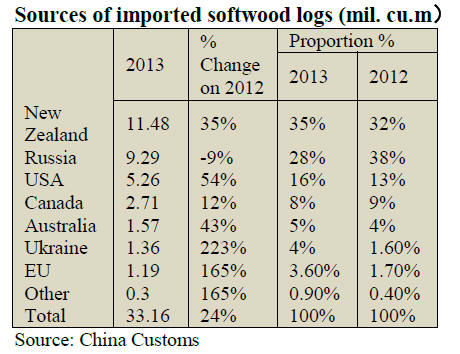

Softwood log imports

Softwood log imports in 2013 amounted to 33.16 million

cubic metres valued at US$5.114 billion, up 24% in

volume and 37% in value over 2012.

China‟s imports of softwood logs are mainly from Russia,

New Zealand, the US, Canada, Australia, Ukraine and

European countries.

The combined imports from these countries accounted for

over 90% of all softwood log imports in 2013.

China‟s softwood log imports in 2013 from the listed

countries increased except for Russia where imports fell

9% to 9.29 million cubic metres yea- on-year.

China‟s softwood log imports from New Zealand, the

largest supplier in 2013, increased by nearly 3 million

cubic metres to 11.48 million cubic metres. In 2013, for

the first time, imports from New Zealand exceeded those

from Russia.

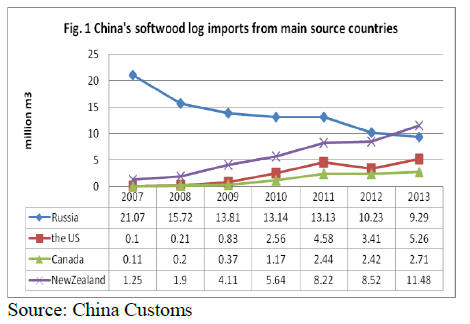

It will be seen from the figure below that there has been a

steady rise in softwood log imports from the USA and

Canada.

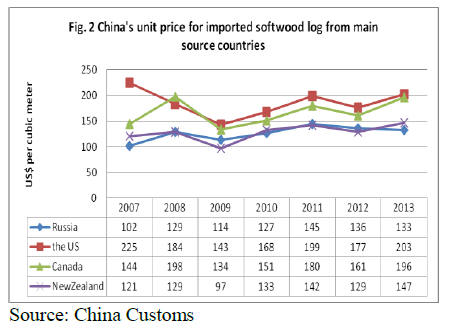

In terms of unit log price from the main source countries,

in 2013 prices for US logs fell to an average US$203 per

cubic metre.

However, imports from Canada, Russia and New Zealand

were all more expensive at US$196, US$133 and US $147

per cubic metre respectively.

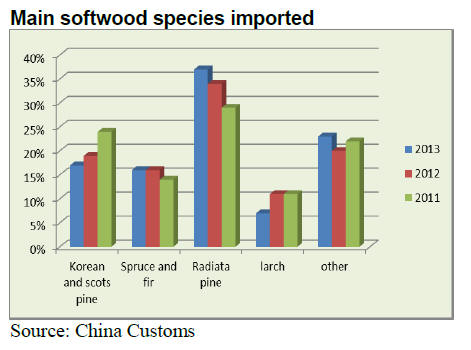

The main species of imported softwood logs were scots

pine, spruce and fir, radiata pine and larch and imports of

these species account for 77% of the total softwood log

imports.

Before 2007, scots pine was the main species imported but

between 2007 to 2013 imports of radiata pine rose sharply

and now account for about 37% of all softwood log

imports.

The figure below illustrates the changes in species

imported over time.

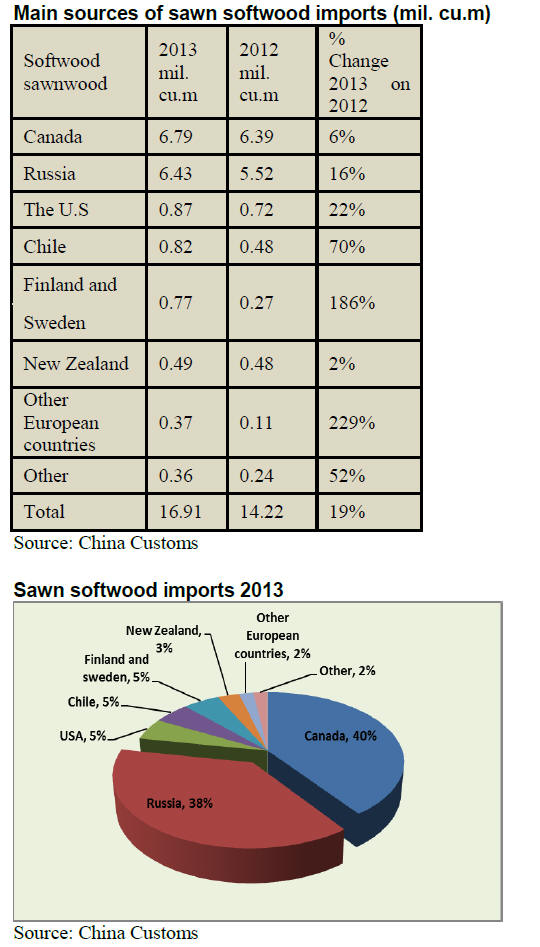

Sawn softwood imports

China‟s sawnwood imports were 23.95 million cubic

metres in 2013. Of this total, sawn softwood imports

accounted for about made up 70%.

Canada and Russia were the main suppliers of imported

sawn softwood in 2013 at 6.79 million cubic metres and

6.43 million cubic metres respectively.

The faster growth in sawn softwood imports was recorded

for Finland and Sweden (up 186% in 2013).

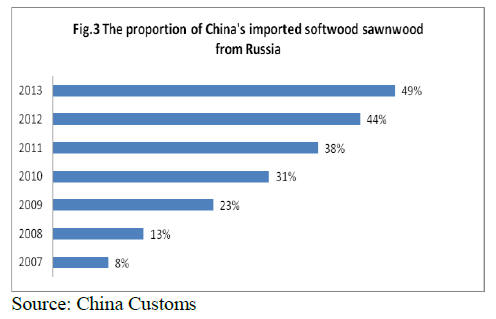

The proportion of China's imported sawn softwood from

Russia has been increasing since 2007. China‟s sawn

softwood imports from Russia in 2013 rose 16% over

2012.

Analysts forecast that China‟s sawn softwood imports

from Russia will exceed those from Canada this year and

it may be that Russia will become the largest supplier of

China‟s sawn softwood imports.

China‟s sawn spruce and fir imports have increased

rapidly in recent years. In 2013 some 92% of China‟s

spruce and fir imports were from Canada and amounted to

6.8 million cubic metres.

Imports of sawn spruce and fir from European countries

have been increasing and and last year totaled 1.91 million

cubic metres.

The pattern of China‟s sawn softwoodmarket has changed.

In 2013, 80% of Chin‟a sawn softwoodwas imported by

traders in Inner Mongolia, Jiangsu, Shanghai, Guangdong,

Tianjin, Shandong and Heilongjiang provinces.

Some 76% of China‟s scots pine sawnwood was imported

through Inner Mongolia while 56% of the spruce and fir

imports came through ports in Jiangsu, Shanghai and

Tianjin.

|