Japan Wood Products

Prices

Dollar Exchange Rates of

26th May2014

Japan Yen 101.90

Reports From Japan

Machinery orders surge ahead

Japan‟s Cabinet Office has released details of its latest

business survey. This shows that the total value of

machinery orders received by 280 manufacturers operating

in Japan increased by 4.0% in March from the previous

month. In the period January-March machinery orders rose

by 4.3% compared with the previous quarter.

Private-sector machinery orders ( excluding volatile ones

for ships and those from electric power companies)

increased a seasonally adjusted by 19.1% in March, and

showed an increase of 4.2% in the first quarter signalling

that private investment may support the economy as

consumers cut back on spending to adjust to the new

consumption tax rate.

For the full details see:

http://www.esri.cao.go.jp/en/stat/juchu/juchu-e.html

Releasing private sector capital investment is a major

target of the Japanese government as this is seen as

providing a pillar upon which the economy can grow. The

latest data on machinery orders has boosted the confidence

of government analysts who say they foresee good

prospects for economic expansion during the next 2 to 3

months.

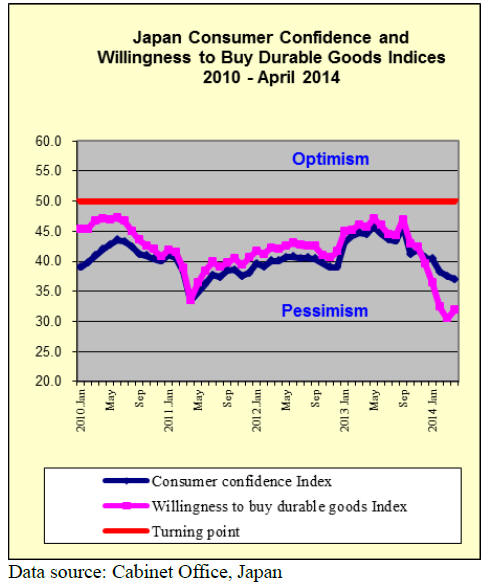

Fifth straight drop in consumer confidence index

Japan‟s Cabinet Office has released the results of the latest

Consumer Confidence Survey conducted 15 April 2014.

The Consumer Confidence Index fell 0.5 points to a

seasonally adjusted 37.0 in April, the fifth straight

monthly decline but the pace of decline in April was the

slowest recorded during the current downtrend.

However, the index remains at its lowest point for the past

two years when the index dropped to a low of 36.9 in

August, 2011.

Most of those surveyed were pessimistic on three of the

four sub-indexes in the survey ( economic well-being,

income growth and job prospects), but the sub-index on

the willingness to purchase durable goods rose after four

months of decline.

See: http://www.esri.cao.go.jp/en/stat/shouhi/shouhie.

html

Retail sales down but by less than expected

Data from Japan‟s Ministry of Economy, Trade and

Industry (METI) shows that retail sales for April were

down 4.4% from the same period last year and down

almost 14% from March this year, a rather modest fall

given the boom in consumer spending prior to the 1 April

increase in sale tax.

The numbers show that the declines were spread across

most products but were steepest for the more expensive

consumer durables such as cars, televisions, refrigerators

and air-conditioners.

For the full details see:

http://www.meti.go.jp/english/statistics/tyo/syoudou/

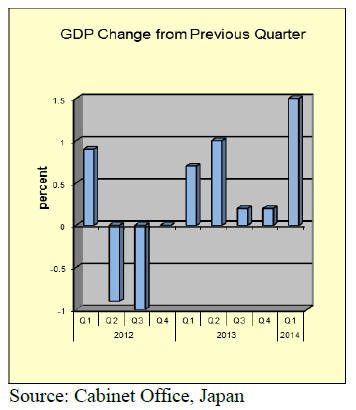

First quarter GDP ‘shock’

Japan‟s first quarter GDP was up 1.5 percent from the last

quarter of 2013. This figure is way beyond analysts‟

expectations and reflects the surge in consumer spending

prior to the increase in consumption tax.

Personal consumption was so high in the first quarter that

any impact from the slowing of the US was overwhelmed.

Private consumption in the first quarter was up an

annualised 8.5%!

The boost to GDP growth defies the overall sluggish

economic performance and is a one-off surge unlikely to

be repeated in the quarters to come. Second quarter figures

due in July are expected to be very sobering.

Analysts are forecasting a correction in monthly GDP

growth which hit a record high of 5.9% on an annualized

basis in March.

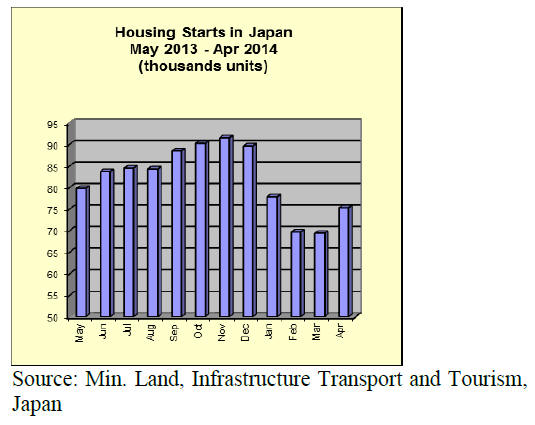

April housing starts better than expected

April housing starts were up on levels in March, a

particularly poor month but, at 75,300, were some 4%

down on April 2013.

However, the April figures were much better than

expected as analysts had forecast starts to fall as much as

8% year on year.

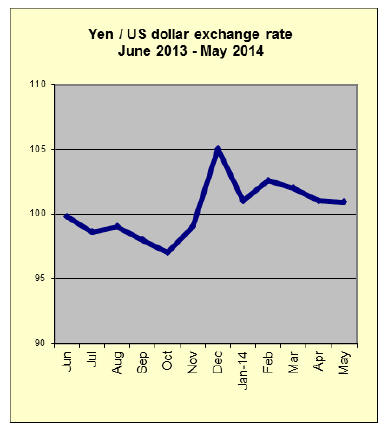

BoJ sticks to weak yen policy

The Japanese yen strengthened against the dollar in the

latter half of May with the US dollar trading at only 101.5

at its lowest point.

The yen may have derived some of its strength as money

moved out of dollars after the US stocks have tended

towards weakness. Even at yen 101.5 to the dollar the yen

is down about 16 percent against the dollar year-on-year.

The Bank of Japan (BoJ) governor has warned that that a

sustained rise in the value of the yen would undermine the

targets set by the Bank clearly signalling that it will act to

stem any major rise in the yen.

The BoJ has is sticking firmly to its 2% inflation goal and

appears determined to provide substantial monetary

stimulus to achieve its goal.

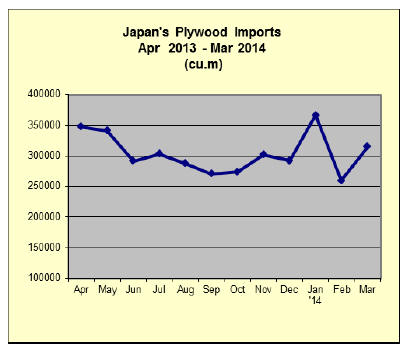

Plywood mills easing back on production

Shipment of softwood plywood from domestic mills for

large house builders and pre-cutting plants continue firm

even after consumption tax increase since April but the

orders in wholesale channel are declining.

March softwood production was 226,800 cbms, 5.4%

more than February and the shipment was 222,300 cbms,

0.7% more and the inventory was 92,000 cbms.

Movement in wholesale channel remains stagnant in April

and the prices are weakly holding at 1,010 yen per sheet

on 12 mm 3x6 delivered (special type/F☆☆☆☆). Thick

24 mm panel prices are unchanged at 2,050 yen. 9mm

3x10 long panel prices are 1,450 yen.

Plywood mills say that movement of plywood had been

120-130% of production capacity before the tax increase

then things go back to normal and drop of demand is

within initially forecasted. With very limited inventory,

mills are not worried about so much about future market.

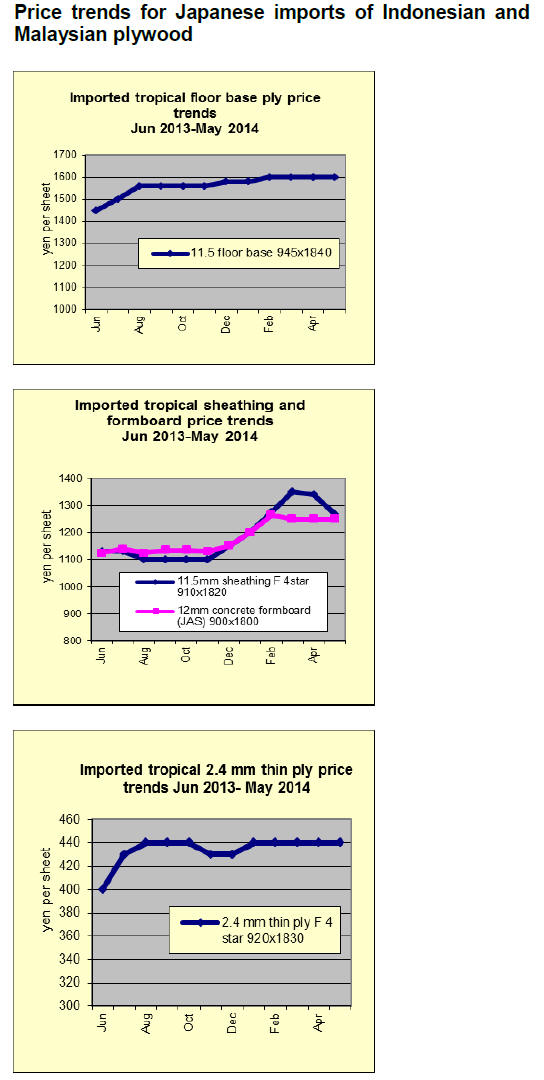

Log production in Sarawak, Malaysia continues low with

continuous dry weather so that log market prices stay up

high and plywood mills struggle to procure logs even with

high prices.

Plywood mills have to ask high export prices because of

high log cost. In Indonesia, argument on timberharvest tax

increase continues and log suppliers and plywood mills

have already asked higher prices.

In Japan, supply and demand are balancing on 3x6 coated

concrete forming panel with the supply beingtight because

of delayed shipment. JAS concrete forming 3x6 panel

prices are 1,250 yen per sheet delivered.

JAS coated concrete forming panel prices are 1,350 yen.

Both are unchanged from April. 12 mm structural panel is

about 1,300 yen, which is the only weak item.

Indonesian timber harvest tax to impact prices

Indonesia changed ordinance on timber harvest tax in

February, which is in force since March 14. However,

there has been continuous argument on this issue between

the government and the industry and this has not been

actually applied yet.

Once this is applied, it will be sizable increase of tax,

Ordinance is effective next to law in Indonesia and the

ordinance was signed by the President and the Minister.

Focus of this is higher tax on logs produced by clear

cutting for the purposes of replanting, mining and

agricultural development. Tax on meranti will be about

600,000 rupiah (about $60) per cbm and about 360,000

rupiah (about $36) on MLH.

So far tax of 60,000 rupiah is imposed on all the species of

IPK logs (wood utilization permit logs) then non tax on

HTI logs (industrial plantation logs). Generally IPK is

timber harvest for purpose of changing property to oil

palm or mining and HTI is logs from clear cut with the

purpose of replantation.

In any case, prices of MLH logs with less than 30 cm in

diameter, which had been traded with $70-80 per cbm,

would go up to $110-140 so they would be as high as

MLH logs in Sarawak, Malaysia ($120-130).

Now the tax is collected by each provincial government

and each province has different tax system and the

provincial governments are busy coordinating with the

local industry so it is not actually in effect yet.

Announcement of the change came all of a sudden so there

are various conjectures as to why this came up now but

tendency in Indonesia is that the government has been

trying to increase tax for every sector of industry.

One view is there are increasing number of changing of

plantation to oil palm plantation without any permit so that

palm oil market prices are declining by oversupply and the

government is trying to control and manage such transfer

business.

Log demand statistics for 2013

The Ministry of Agriculture, Forestry and Fisheries

disclosed the statistics of log demand in 2013. Total log

demand was 26,029,000 cbms, 5.6% more than 2012.

With active housing starts, log demand for lumber and

plywood increased by 6.3% and 9.0% respectively.

Demand for domestic logs increased by 6.3% while that

for imports increased by 3.3% so share of domestic logs

increased to 75.9% (74.9% in 2012). Log demand had

increased for four consecutive years. Compared to the

recent low of 2009, 2013 was 14.1% more, out of which

domestic log demand increased by 18.2%.

Logs for lumber were 17,271 M cbms, out of which

domestic logs were 12,058,000 cbms, 6.5% more than

2012 and imported logs were 5,213,000cbms, 5.8% more.

Share of domestic logs was 69.8%, almost the same as

2012. In imports, South Sea and New Zealand logs

decreased by 7.8% and 17.2% but North American and

Russian logs increased by 11.8% and 4.0%. Logs for

plywood were 4,181,000 cbms.

In this, domestic logs were 3,016,000 cbms, 15.9% more

and this was the first time that the volume exceeded three

million cubic metres.

Imported logs for plywood dropped down to 1,16,000

cbms, 5.7% less than 2012 so that the share of domestic

logs was 72.1% from 67.1% in 2012.North American logs

for plywood increased by 1.9% but South Sea (tropical)

logs decreased by 18.7%.

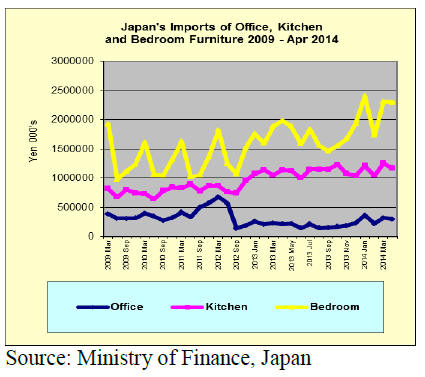

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office, kitchen and bedroom furniture imports

from 2009 to the end of April 2014 are shown below.

Japanese imports of furniture exhibited a cyclical trend

between 2009 and 2012. However, from 2012 bedroom

furniture imports began to increase while imports of office

and kitchen furniture have remained within a narrow

range.

April imports of office, kitchen and bedroom furniture fell

as stocks were readjusted to account for the anticipated fall

in demand in the wake of the consumption tax increase on

1 April.

Consumer purchases of furniture are expected to be slow

in the coming months as consumers adapt household

spending to absorb the impact of the higher consumption

tax.

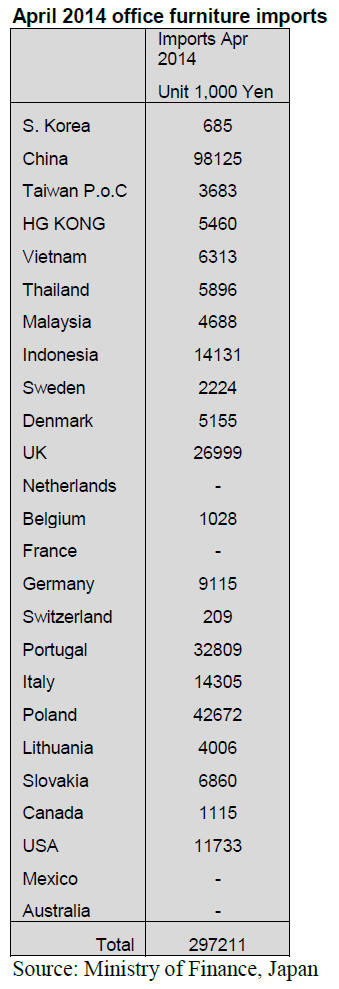

Office furniture imports (HS 9403.30)

April imports of office furniture into Japan fell 6.5%

compared to March. In April, while China was the major

supplier, it saw sales to Japan fall by around 29%.

On the other hand, Portugal and the UK saw exports of

office furniture to Japan rise. Japan‟s imports of office

furniture from Portugal accounted for 11% of all imports

of office furniture; double that in March, while imports

from the UK rose from zero in March to account for 9% of

April imports.

The top three SE Asian suppliers in April were Indonesia,

Vietnam and Thailand (approx. 9% of April office

furniture imports).

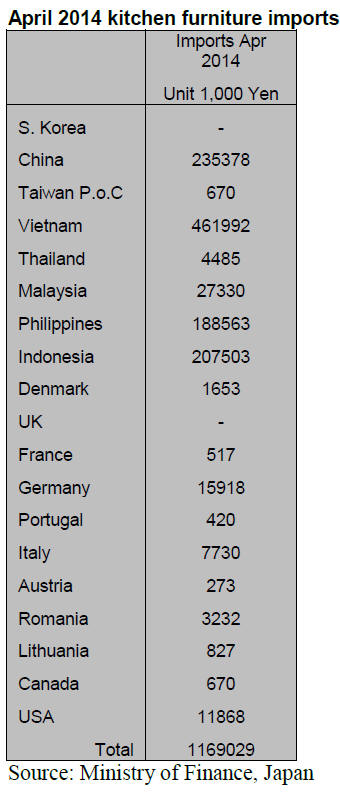

Kitchen furniture imports (HS 9403.40)

The top three suppliers of kitchen furniture to Japan in

April remained Vietnam, 39.5%, China, 20.1% and

Indonesia 17.8%. Overall, Japan‟s imports of kitchen

furniture fell almost 7% from levels in March. The top

three suppliers accounted for over 75% of April imports of

kitchen furniture.

EU furniture exporters do not have a significant share of

the Japanese kitchen furniture market and in April only

Germany and Italy featured as important suppliers but

together they only accounted for around 2% of all April

kitchen furniture imports by Japan.

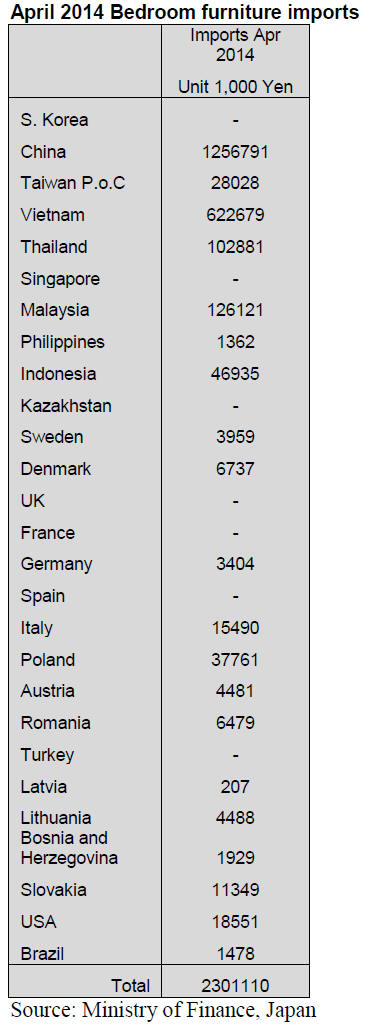

Bedroom furniture imports (HS 9403.50)

After the steep rise in bedroom furniture imports in March

a correction in April would have come as no surprise

however, April imports were largely unchanged and so

avoided the downswing seen with office and kitchen

furniture imports.

The top supplier of bedroom furniture to Japan is China

which accounted for more than half of all bedroom

furniture imports in April. Surprisingly, China‟s April

bedroom furniture exports to Japan rose by around yen 63

million.

The second ranked supplier in April was Vietnam (27%)

followed by Malaysia, a distant 5.6%. Other suppliers in

Asia, the EU and the Americas struggle to secure a market

share with China and Vietnam holding over 80% of the

market for imported bedroom furniture.

|