|

Report from

North America

Dark colours and strong texture the choice of US

buyers of flooring

The World Flooring Association has released a summary

of trends in flooring design in 2014 and beyond. The

North American market for hardwood flooring has been

dominated by darker colours for many years now, but light

colours are making a comeback.

The main wood species with natural light colours sold are

white oak, maple and (slightly darker) walnut. Sunbleached

and light greyish tones are popular.

The texture of wood flooring is becoming almost as

important as the colour. Distressed, weathered, wirebrushed

and hand-scraped are the most common textures,

with hand-scraped being the most costly.

Reclaimed wood from industrial or commercial buildings

often shows unusual texture. Reclaimed wood is marketed

as environmentally friendly because of the reuse of

material. Prices are high and luxury homes are the main

market.

Strand-woven bamboo flooring of growing popular

Bamboo has enjoyed widespread popularity for some time

now. Low cost, hardness and attractive looks have

contributed to the success of bamboo flooring.

The range of colours and textures has increased in recent

years. Strand-woven bamboo is becoming popular because

it is even harder than traditional bamboo flooring and it

has a different texture.

Bamboo flooring is still widely regarded as a „green‟

material choice among North American consumers,

although recent reports published in the US show

environmental problems in bamboo growing areas. Thirdparty

certification of bamboo has been recommended by

environmental groups.

Wide board bamboo flooring is becoming more widely

available, following the trend in hardwood flooring

towards wider and longer widths.

Wide, matt finished flooring dominating the market

Wide plank wood flooring has become common and this

trend is expected to continue. Wider widths (up to 25 cm)

look more modern and manufacturers offer solid wood

flooring boards up to 3 metres long now.

Buyers are becoming more interested in matte finishes,

which provide a more natural look and show imperfections

less than a glossy finish.

Hard wax and oiled finish floor are becoming more

popular, although they still account for a much smaller

market share than in Europe. The ability to repair and

refinish small areas of the floor is a key advantage of

waxed and oiled wood flooring.

EPA considering easing testing and certification

requirements for laminated products

Wood product manufacturers who make or use composite

wood products had again opportunity to comment on the

proposed rules for formaldehyde emissions from

composite wood products. The input ended May 8, 2014.

The Environmental Protection Agency (EPA) also held a

public meeting for stakeholders who wish to modify the

proposed rules. The most contentious rule affects

laminated products, which includes the lamination of

wood veneer on composite panels.

This would require furniture manufacturers who laminate

purchased panels in-house to test and certify, even though

the panels purchased for lamination had already been

tested.

Wood industry associations support California‟s approach

to regulate formaldehyde emissions from laminated

products. Based the industry‟s feedback received in the

comment period last year, the EPA is now looking at

reducing testing and certification requirements for

laminated products, especially for small manufacturers.

The new emission rules apply to hardwood plywood,

particleboard, MDF and finished products containing these

materials. Both imported and domestically produced

products must meet the standards.

For more information about the rules:

http://www.epa.gov/oppt/chemtest/formaldehyde/index.ht

ml

China requests Dispute Settlement Panel for US

antidumping proceedings

China has requested that a Dispute Settlement Panel is

convened under World Trade Organization (WTO) rules to

examine several antidumping investigations by the US

Department of Commerce.

China alleges that the Department of Commerce did not

follow WTO obligations in its rulings on several products

imported from China.

Multilayer wood flooring and wooden bedroom furniture

are among the products that the US investigated for

antidumping.

China challenges the Department of Commerce‟s

methodology in three aspects with respect to imported

wood flooring and bedroom furniture imported from

China:

1. The use of "single rate presumption for non-market

economies"

2. "NME-wide methodology" which includes according to

China‟s challenge, the failure to request information, the

failure to provide rights of defense, and recourse to facts

available

3. The use of "adverse facts available."

Comments regarding the issues raised by China can be

submitted to the US government at www.regulations.gov

(docket number USTR-2014-0001).

Hardwood plywood imports from Indonesia up in

February

US imports of hardwood plywood increased by 4% to

240,723 cu.m in February. However, hardwood plywood

imports were 10% lower year-to-date than in February

2013.

Hardwood plywood imports from China fell by 11% from

January to 121,960 cu.m. Imports from Ecuador and

Russia also declined in February, while shipments from

Indonesia and Canada increased. Imports from Indonesia

more than doubled from January to 48,964 m3.

Moulding imports down except from Malaysia

Hardwood moulding imports were worth US$13.7 million

in February, down 6% from the previous month. China

was the largest supplier at US$4.3 million, down 1% from

January.

Imports from Brazil decreased by 19% from the previous

month to US$2.8 million. Malaysian shipments of

hardwood moulding grew by 31% to US$1.2 million in

February.

Hardwood flooring imports still below 2013 values

Hardwood flooring imports were up by 18% in February,

but year-to-date imports remain lower than in 2013. The

value of total hardwood flooring imports was US$2.8

million in February.

China was the largest hardwood flooring suppliers in

February at US$838,961 (+32%), followed by Indonesia at

US$732,067 (+55%). Imports from Malaysia were worth

US$620,579 (+5%).

Year-to-date, Malaysia is the only major supplier that has

shipped more hardwood flooring to the US in 2014

compared to the previous year.

Assembled flooring imports declined by 22% to US$7.8

million in February. Much of the decline was in lower

imports from China, which fell by 44% to US$3.5 million.

Canadian assembled flooring shipments increased to

US$2.0 million.

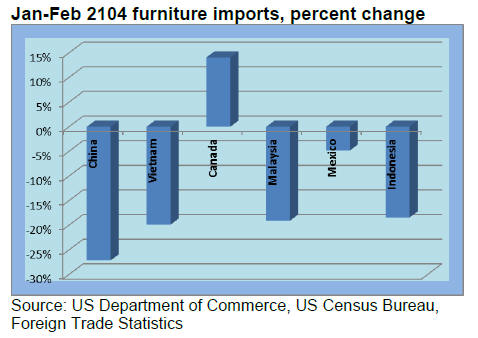

China¡¯s furniture shipments to the US fall

US imports of wooden furniture were down 21% in

February. Total imports were worth US$1.01 billion,

slightly lower than in February 2013. However, year-todate

imports are still 6% higher than in 2013.

The February import data show a reversal of the situation

in January, when most countries exported more furniture

to the US, with the exception of Canada. In February,

Canada‟s furniture shipments to the US recovered, while

other countries shipped less.

China‟s furniture shipments to the US fell by 27% to

US$482.5 million in February. Imports from Vietnam

were US$180.2 (-20%). Malaysian and Indonesian

shipments declined to US$47.3 million and US$40.5

million, respectively.

Stronger domestic furniture manufacturing

Both the manufacturing sector and the overall US

economy grew in March, according to the Institute for

Supply Management.

The rate of growth in furniture production increased from

the previous month. The wood products industry reported

a decline in output in March, although demand appears

good. Insufficient hardwood sawnwood supply appears to

be an issue for some companies.

Stubborn unemployment rate undermines confidence

Employment did not improve from February to March.

The unemployment rate remained at 6.7% in March.

The Federal Reserve dropped the statement that

unemployment needs to fall below 6.5% before interest

rates are raised, stating that the unemployment rate on its

own is a poor indicator of the economic recovery.

Interest rate raises have not been ruled out but they appear

unlikely in the near future. The Federal Reserve‟s target

interest rate was unchanged near zero in March.

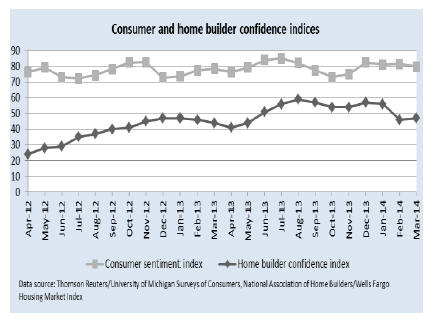

Consumers still unsure about US economy

Consumer confidence in the US economy remained

largely unchanged from January to March, according to

the Thomson Reuters/University of Michigan consumer

sentiment index.

A growing number of Americans expect their personal

financial situation to improve this year. One third of

American expect income gains, more than any other time

since 2009.

However, many consumers worry that there will be

another downturn in the US economy within the next five

years. The slower growth in home prices has also affected

consumer confidence.

Builders concerned about growing labour shortage

Builder confidence in the market for newly built singlefamily

homes rose by one point in March, according to the

National Association of Home Builders.

Usually construction activity increases in spring, but the

index remained below 50 points, which means that more

builders regard the market conditions as poor rather than

good.

Builders remain concerned about the same issues as last

year, primarily the cost and the availability of workers and

building lots.

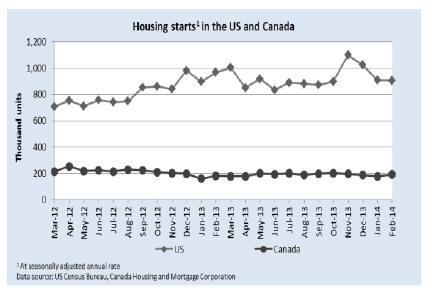

New home construction unchanged from low January

figures

February housing starts were still affected by the cold

winter weather and new construction was unchanged from

January. Construction started on 907,000 new homes at a

seasonally adjusted annual rate.

The share of single and multi-family housing starts also

remained constant. Single-family homes accounted for

64% of total starts, down from 67% in February 2013.

The number of building permits increased by 7.7% to over

1 million units in February (seasonally adjusted annual

rate). The market for new housing is expected to

strengthen in spring, as the number of building permits

issued is an indicator of future building activity.

Tight credit affects homes sales

Sales of existing homes declined further in February,

largely because of weather conditions and higher home

prices. Home prices were 9% higher than in February

2013, but sales were lower than last year.

Tight credit conditions and high personal debt reduce or

delay home buying, especially among young first-time

home buyers.

Canadian multi-family housing starts up in the east

Canadian housing starts increased by 8% in February from

the previous month at a seasonally adjusted annual rate,

according to the Canadian Housing and Mortgage

Corporation. The growth was entirely in multi-family

construction, primarily in Quebec and Atlantic Canada.

Little improvement in non-residential construction

Public spending on construction of offices, commercial,

health care and educational buildings in the US was

unchanged from January to February.

Private spending on non-residential construction increased

slightly (+1.2%) in February, according to US Census

Bureau data.

Architecture firms reported improving conditions in

February, according to the American Institute of

Architects. However, the residential market still

outperforms the construction of commercial, industrial and

institutional buildings.

|