|

Report from

North America

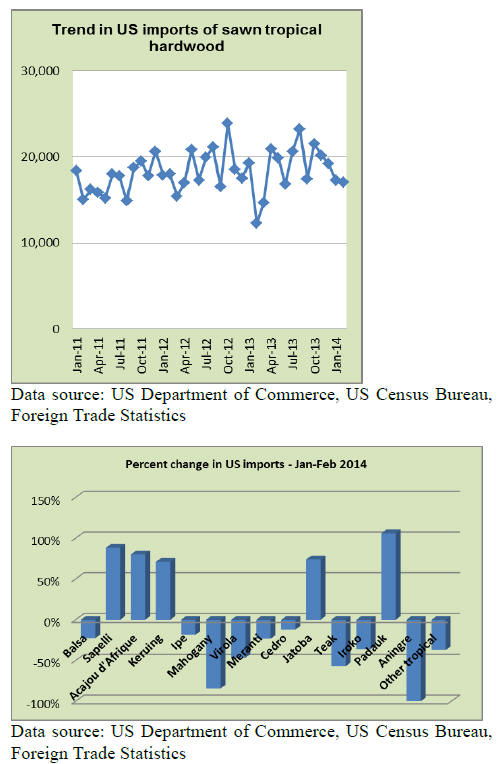

Further declines in tropical sawnwood imports

US sawn hardwood imports in February expanded to

89,414 cu.m , up 43% from the previous month but the

increase was entirely in temperate sawnwood. Tropical

sawnwood imports declined by 2% to 17,030 cu.m in

February. Year-to-date tropical imports are 9% higher than

in February 2013.

Several countries increased tropical sawnwood shipments

to the US market in February, including Malaysia,

Congo/Brazzaville, Ghana and Cote d‟Ivoire.

In terms of species, imports of sapelli, acajou d‟Afrique,

keruing, jatoba and padauk grew, whileimports of all other

major tropical hardwood species declined.

Malaysian shipments of keruing and red meranti grew in

February to 1,794 cu.m and 381 cu.m, respectively.

Congo/Brazzaville increased its exports of sapelli (2,336

cu.m) to the US. Imports of mahogany (Khaya ivorensis)

from Ghana almost tripled in February to 934 cu.m.

Tropical sawnwood imports from Brazil in February were

2,421 cu.m, down 24% from January. Ipe shipments

declined by 21% to 1,930 cu.m, and US imports of virola

and other tropical species also decreased in February.

Canadian imports of Brazilian sawnwood drop

Canadian imports of tropical sawn hardwood were

US$1.86 million in February, a drop of 11% from the

previous month.

However, to-date 2014 imports are much higher (+40%)

compared to the same time last year.

The main decline was in imports from Brazil. February

imports from Brazil were only worth US$66,583, a drop of

84% from January.

Tropical sawnwood imports from Ecuador rose to

US$416,600, up 57% from January. Cameroon, Congo

(Zaire), Ghana and Bolivia also increased their sawnwood

exports to the US market.

Imports of mahogany expanded to US$ 141,215 and for

virola, imbuia and balsa the combined value of imports to

Canada totalled US$456,381. Canadian sapelli sawnwood

imports declined in February.

Thermally treated US hardwoods marketed as tropical

hardwood substitute

The American Hardwood Export Council (AHEC) aims to

expand the market and application of American hardwood

species through thermal treatment.

Thermal treatment improves dimensional stability and

improves resistance to decay. Applications for thermally

treated US hardwoods include decking, patios, siding

(cladding), outdoor furniture and interior uses in moist

areas such as bathrooms.

AHEC‟s promotional campaign specifically targets

tropical hardwood markets and emphasises sustainability

of supply and good forest management in the US. AHEC

also offers data for most commercial hardwood species for

companies to prepare Environmental Product Declarations

(EPDs).

The lower cost of many US species such as ash, red oak,

tulipwood and soft maple, is an additional selling feature.

AHEC promoted thermally modified hardwoods at the

Dubai WoodShow in April, predicting growing demand in

the Middle East in residential and hospitality projects.

Green initiatives and legislation have increased the use of

wood in construction, according to the Dubai WoodShow

organizers. Supplies of thermally modified American

hardwoods are currently limited, but AHEC hopes that

with growing demand more producers will adopt the

technology.

Middle East markets attract US hardwood shippers

US exports of hardwood sawnwood and veneer to the

Middle East and North Africa were worth US$90.5 million

in 2013, up 5% from 2012. The value of sawn hardwood

increased by 3% and the volume grew by 1% from the

previous year.

US sawn hardwood export volumes to the region are 80%

more than five years ago, mainly due to growing demand

from Pakistan and Turkey. Saudi Arabia, the UAE and

Egypt are also important markets for US hardwoods.

Chemically modified wood products advance in US

market

The market for both thermally and chemically modified

wood products is largest in Europe, but manufacturers are

becoming more active in the US market. Kebony, a

Norwegian producer of wood products modified with

furfuryl alcohol, has recently announced a new distributor

for New York City.

Kebony treats softwood (pine from the US, New Zealand

or Europe) with furfuryl alcohol and markets the product

for enduses where tropical hardwoods are typically used,

such as boardwalks, decking, patios and exterior siding as

well as doors and window frames.

According to the promotional material from Accsys

Technologies, which licenses Accoya production, demand

for acetylated wood is growing‟ because supplies of

tropical timber are limited or even declining, while global

timber demand is growing‟.

|