US Dollar Exchange Rates of 10th

March 2014

China Yuan 6.1389

Report from China

Prices for new homes continue to rise

In February this year in the 70 medium and large-sized

cities surveyed prices of newly built homes declined in 6

cities, remained the same in 2 cities and increased in the

balance. The maximum month-on-month increase was 1.2

percent.

Compared with prices in the same month of last year,

prices of newly constructed residential buildings increased

in 69 cities. In January this year the highest year-on-year

change was an increase of almost 21 percent.

See:

http://www.stats.gov.cn/english/PressRelease/201402/t201

40225_515933.html

Prices of second-hand homes were also surveyed and

found to have fallen in 13 cities, remained stable in 9 cities

and increased in 48 cities.

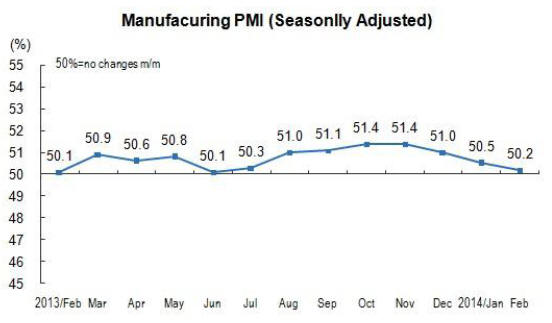

China's PMI at 50.2 in February

China‟s National Bureau of Statistics of China has issued a

press release on the manufacturing PMI.

See:

http://www.stats.gov.cn/english/PressRelease/201403/t201

40303_518369.html

In February, China's manufacturing purchasing managers

index (PMI) was 50.2, down by 0.3 points month-onmonth

but still above the negative threshold, indicating a

healthy manufacturing sector but one where February

production declined because of the "Spring Festival"

holidays.

In terms of size of enterprises, the PMI of large-sized

enterprises was 50.7, down 0.7 points month-on-month but

still in positive territory.

The PMI for medium-sized enterprises was 49.4, down by

0.1 point month-on-month, it has been below the negative

threshold for 3 consecutive months.

The PMI for small-sized enterprises was 48.9, up by 1.8

points month-on-month but still positioned below the

threshold.

In February, amongst the five sub-indices comprising the

PMI, one sub-index increased, while the other four

declined. The production index was 52.6, down 0.4 points

month-on-month. The New Orders index was 50.5, down

by 0.4 points month-on-month.

The February survey results showed that the new export

orders index and import index, reflecting foreign trade of

manufactured goods were 48.2 and 46.5 respectively down

1.1 and 1.7 points month-on-month. Both indexes have

been below the 50 threshold for 3 consecutive months.

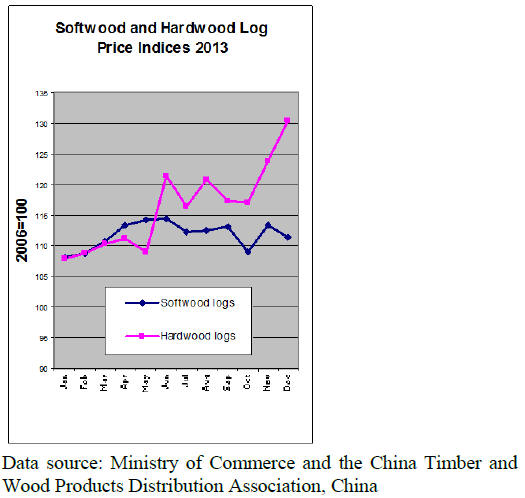

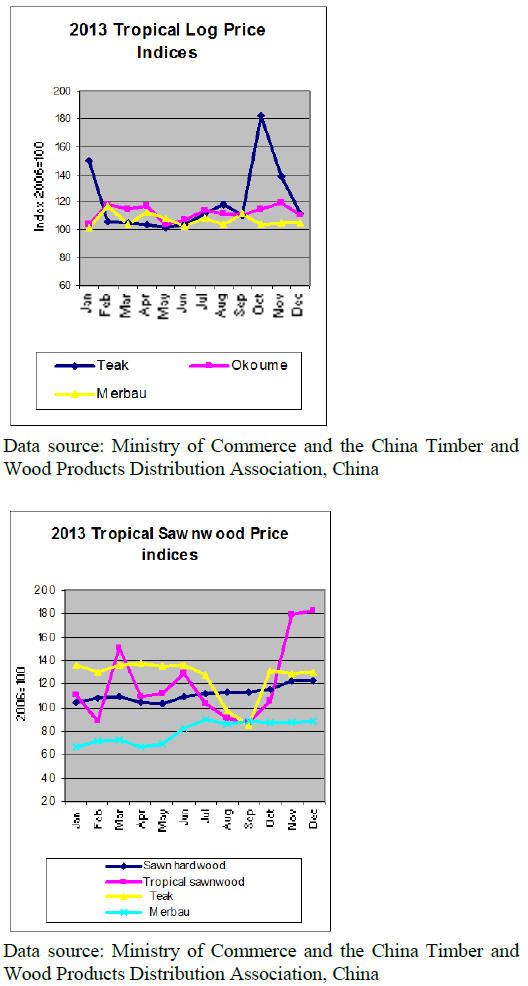

Timber price indices

The following illustration of price trends are based on data

released by the Ministry of Commerce and the China

Timber and Wood Products Distribution Association and

published in the Chinese journal "China Timber and Wood

Products".

For full details see:

http://www.cnwood.org/default.htm and

http://ltfzs.mofcom.gov.cn/article/buwg/redht/201305/201

30500128380.shtml.

The price indices provided are based on the CIF price so

caution is advised when assessing the trends.

Eighth forest inventory published

China's State Forestry Administration (SFA) has briefed

the media on the latest resource inventory and forest

protection efforts by the SFA. Director, Zhao Shucong,

pointed out that a National Forest Resource Inventory

Report is produced every five years and that latest report

covers the period 2009 through to 2013.

The report states that China‟s forested area extends to 208

million hectares up from the 195 million hectares in 2008.

Forest stocking volumes are estimated at 15,137 million

cubic metres (13 721 million cubic metres in 2008). The

forest coverage increased to 21.63 percent of the country‟s

total land area from 20.36 percent in 2008.

Both forested area and stocking volume continued to

increase. China‟s forested area increased 13 million ha.

and stocking volume increased 1416 million cubic metres

from 2008.

The area of forest plantations has increased by 7.64

million ha. from 61.69 million ha in 2008 to 69.33 million

ha in 2013. The stocking volume increased 522 million

cubic metres from 1.961 cubic metres in 2008 to 2,483

million cubic metres in 2013.

China‟s national annual timber consumption was reported

as about 500 million cubic metres with around half being

imported. National timber consumption is forecast to rise

to 800 million cubic metres by 2020.

How to increase the domestic wood supply and reduce the

dependence on timber imports is one of the major

challenges in China. The SFA has a target of keeping

timber imports at no more than 60% of national

consumption.

To achieve this goal it is planned that 4 mil. ha. of

domestic plantations will be established annually to create

a strategic reserve. In addition overseas investment in

forestry will be expanded. At the moment China has more

than US$15 billion invested in foreign forestry projects

and has rented or purchased about 40 million ha. of

forested land in other countries.

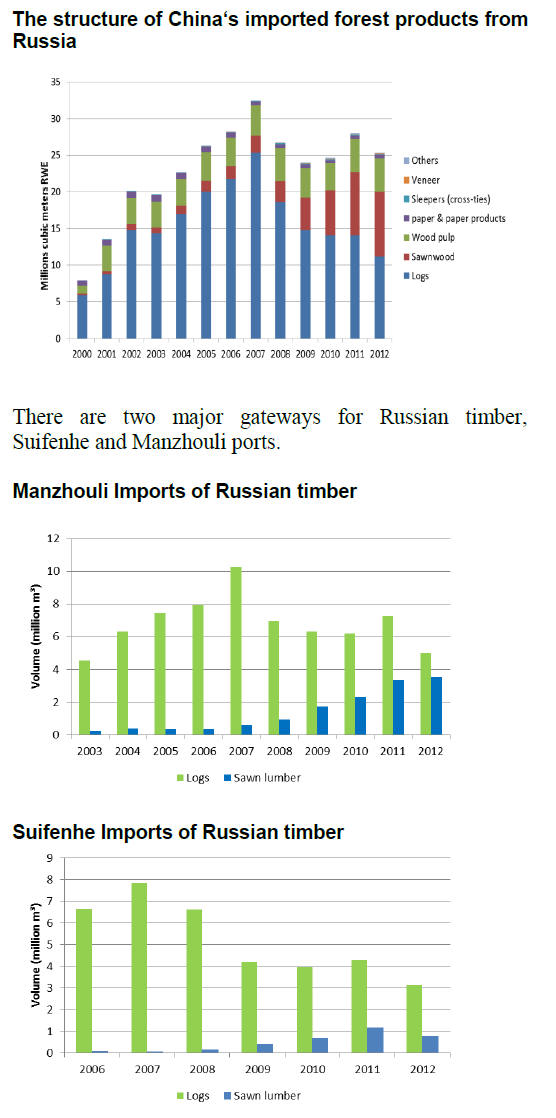

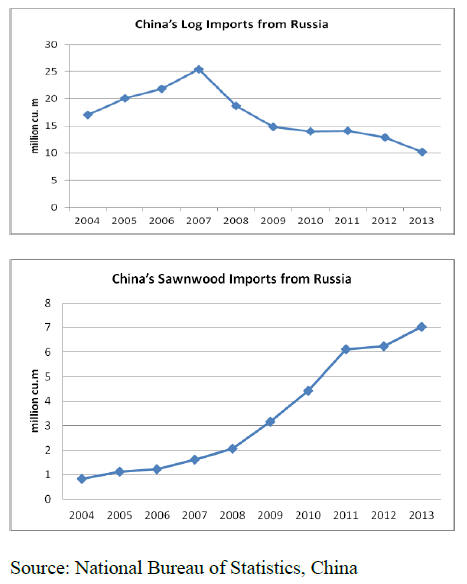

China-Russia cooperation for a legal timber trade

China‟s log imports from Russia have fallen in recent

years because the Russian government imposed high

export tariffs on logs but sawnwood imports from Russia

increased dramatically from 2004 to 2013.

The softwood species imported from Russia are mainly

Mongolian pine, white pine, Korean pine, and larch.

Around 80% of the imports from Russia are consumed in

domestic markets for construction, interior decoration and

furniture.

Most of imported hardwood species are ash, oak, linden

and birch which are used mainly for the manufacture of

flooring, furniture and plywood much of which is

exported.

Despite the thriving timber trade between Russia and

China there are some major challenges that must be

addressed.

Analysts in China have identified the following issues of

concern:

China‟s dependence on Russian imports creates

uncertainty as export rules may change without

notice.

There are no detailed forest resources data in

Russia

Russia‟s foreign labour regulations act to hold

down long-term investment by Chinese

enterprises.

The Russian Far-East is economically overdependent

on timber exports.

The current China-Russian forest industry is

predominantly of small scale enterprises.

Verification of the legality of the Russian timber

is an issue.

In response to the challenges identified above the Chinese

government has signalled its intention to undertake the

following actions:

Establish a government-led cooperation

framework to promote trade between the two

countries.

Facilitate „green‟ growth by improving forest

quality in the border between China and Russia.

Expand timber processing zones/business parks

in the bordering area.

Increase China-Russia cooperation on forestry

law enforcement.

Provide stronger guidance for Chinese enterprises

to regulate their forest management.

Establish a China-Russian Commercial Chamber

on Forestry

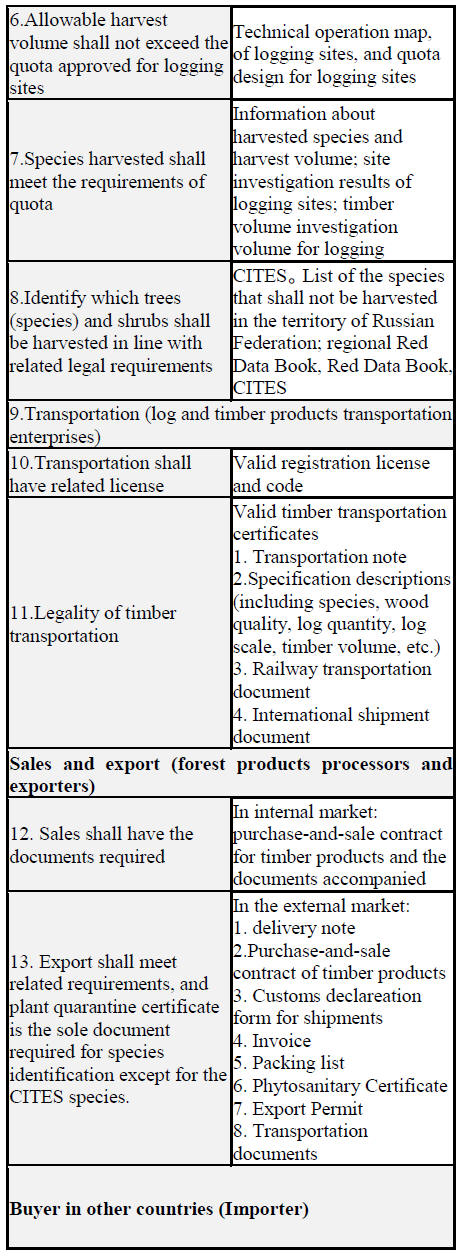

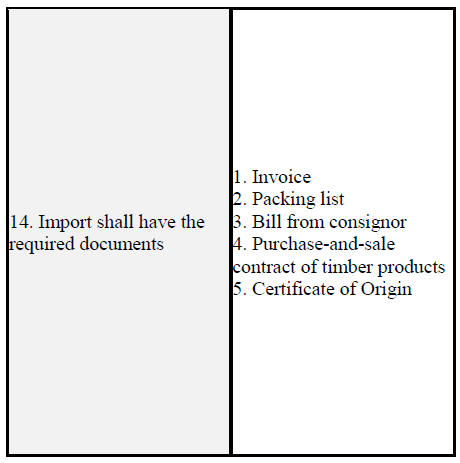

Specific suggestions for Chinese enterprises operating in

Russia and for Chinese timber importers have been drafted

by the Chinese authorities. The main suggestions for

enterprises regarding the legality of the timber are

summarized below:

Promoting a legal and sustainable timber trade

In late February this year an international workshop

„Promoting Legal and Sustainable China-Russia Timber

Trade‟ was jointly hosted by the Institute of Forestry

Policy and Information within the Chinese Academy of

Forestry (CAF), the State Forestry Administration‟s

International Trade Research Center for Forest Products,

Forest Trends, the European Forestry Institute (EFI), the

World Wildlife Fund (WWF) and the Suifenhe municipal

government.

The aims of this workshop were to promote a legal and

sustainable China-Russia timber trade, to share

information, to promote policy dialogue and to identify

feasible solution for enterprises.

According to the conference, China‟s Timber Legality

Verification Standard was issued by China National Forest

Products Industry Association. The Research Institute of

Forestry Policy and Information, under Chinese Academy

of Forestry is developing the guideline on oversea timber

trade and investment.

Russian roundwood Act

It has been reported that an amendment to the Russian

Forestry Code (Federal Law of December 28, 2013N 415-

FZ) has been made.

See:

http://www.rg.ru/2013/12/30/drevesina-dok.html

This amendment changes the requirements for

measurement, marking, registration and the transport of

roundwood. The amendment aims to provide a system to

document and provide tracability for roundwood from the

harvest site, through transport and sale to the point of

processing or export.

If successful this system would be significant for

importers of Russian roundwood who wish to be assured

of the legality of their raw materials.

Chinese manufacturers are large importers of roundwood

and wood products from the Russia Far East where illegal

logging is of considerable concern so the latest

improvements proposed in documentation are very

welcome.

Improving the legality of the Russian forest sector and

increasing the ability to trace roundwood back to the forest

of origin and providing assurance of the legality will be an

important means for Chinese manufacturers to provide

overseas buyers with the required information and

documentation on legality.

|