2. GHANA

Civil Society calls for enforceable laws

A Civil Society Organisation, Civil Response, has said

Ghana would need to formulate laws which are

enforceable at the community level if forest conservation

programmes are to succeed .

The view is that there are significant challenges with

enforcement of laws to prohibit and control unauthorised

chainsaw milling operations in forest reserves. This, say

analysts, is driven by unsatisfied domestic demand for

timber. Reports of unauthorised harvesting are particularly

high where communities living close to forest areas need

wood products for their daily livelihood, an issue which

requires a long term solution.

Some NGOs such as Civil Response and Tropenbos (TBI)

Ghana are involved in negotiations between Ghana and the

European Union on the Voluntary Partnership Agreement

(VPA) and efforts are being directed to ensure community

issues and perspectives are considered and provided for in

the agreement.

The Programme Director at TBI, Samuel Nketiah, has said

he is confident community engagement in VPA

negotiations will help ensure the integrity of the forest.

Fuel price increases to hit timber sector

The National Petroleum Authority (NPA) increased prices

of petroleum products for the second time this year which

is having a direct impact on the logging and wood

processing industries. Petrol prices have increased 3% and

diesel prices are up 3.3%.

Prices of petroleum products are reviewed by NPA

fortnightly to reflect the prices of crude oil on the world

market and current exchange rate. According to the Ghana

Statistical Services, hikes in petroleum products prices

contribute to Ghana.s inflation which in December 2013

stood at 13.5%, up from the 13.2% in Nov.2013

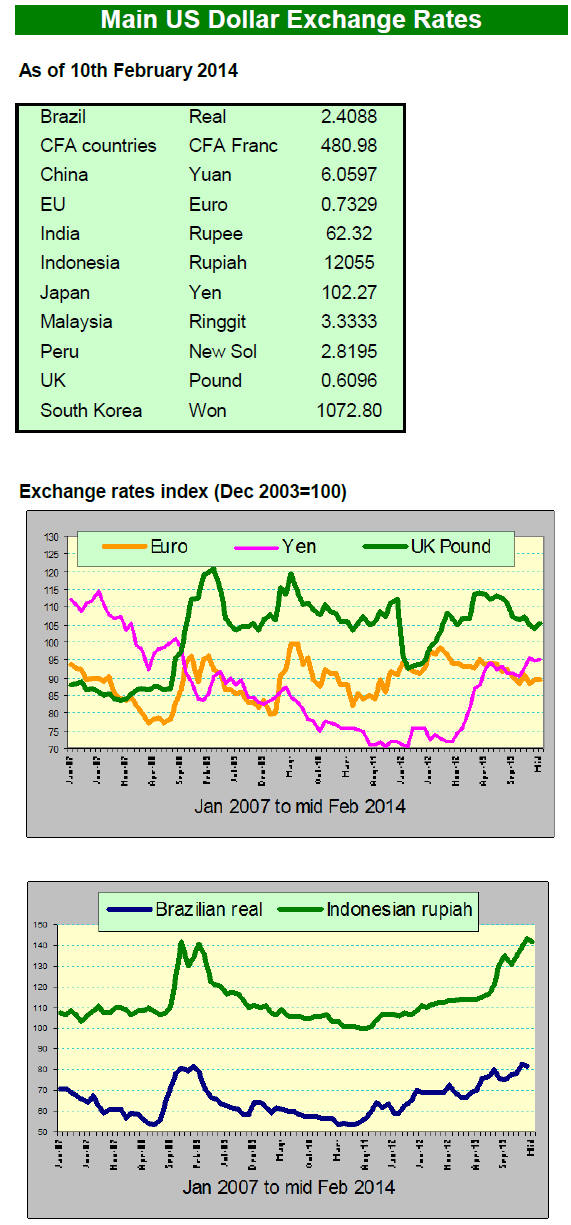

Central Bank acts to stem ¡®dollarisation¡¯ of economy

To stabilise the local currency, the Bank of Ghana.s has

issued a new directive on the operation of Foreign

Exchange and Foreign Currency Accounts to stop the

.dollarisation. of the domestic economy.

The measures introduced by authorities in Ghana are

intended to streamline the operations of Foreign Exchange

Accounts (FEA) and Foreign Currency Accounts (FCA)

and to bring about clarity and transparency in their

operations on the pricing, receipts and payments for goods

and services in foreign currency.

The purpose is to ensure all transactions in the country are

conducted in Ghana cedis, which is the sole legal tender.

Failure to comply with the new legal provisions will result

in severe penalties.

However, according to the rating agency, FITCH, the

decision by Ghana's Central Bank to increase interest rates

and introduce new foreign-exchange controls is unlikely to

ease pressure on the cedi if domestic macroeconomic

imbalances are not addressed.

Interest rates climb higher

At the recent Monetary Policy Committee (MPC) meeting

the interest rate was increased to 18.0% as the bank

anticipated an uncertain short term outlook and weakening

domestic fundamentals.

These factors drove the MPC to decide for continued tight

fiscal and monetary policies and measures that would

reduce the country.s vulnerability to external shocks.

3. MALAYSIA

Top SE Asian furniture fair to open in

March

The Malaysian International Furniture Fair (MIFF) will be

held in Kuala Lumpur 4 to 8 March 2014. Since its

inception in 1995 MIFF has grown to become one of

Southeast Asia.s top furniture fairs and a global .top ten.

event.

Every March, furniture manufacturers, buyers,

international chain stores, hoteliers, architects and interior

decorators visit MIFF to conclude business take in the

latest trends and network.

Last year, business concluded as a result of MIFF totalled

US$854 million. This year the organisers expect over 500

furniture manufacturers and exporters to participate and

estimate that about 70% of participants will be Malaysian

companies, the balance coming from China, Taiwan P.o.C,

Hong Kong, Indonesia, Singapore, South Korea, USA,

UK, India, Spain and Vietnam.

On everyone.s mind at the moment is what will be the

impact of the increasing production costs being faced by

Chinese companies and asking if this will undermine the

competitiveness of Chinese made furniture.

Government urged to let newsprint anti-dumping duty

expire

The Malaysian Star newspaper has reported that the

Malaysian Newsprint Publishers Association (MNPA) is

appealing to the government not to extend the antidumping

duties on imports of newsprint paper.

A statement from MNPA urged the government to allow

the anti-dumping duties to expire as scheduled saying

¡°The anti-dumping duties have been imposed for the last

10 years on imports of newsprint in rolls from Canada,

Indonesia, South Korea, the Philippines and the United

States. Newsprint is a major cost component for the

newspaper business.¡±

The Association said that the necessary mechanisms to

ensure survival of Malaysian newsprint manufacturers are

already in place so there is no need to extend the antidumping

duties. Currently, the Government provides an

incentive in the form of an import duty waiver on

newsprint if MNPA members procure 50% of their

newsprint locally.

MNPA said the livelihood of the Malaysian newspaper

sector as a whole depends on the survival of the

newspaper industry and its ability to control cost.

¡°The newspaper industry employs about 12,000 workers,

about 10,000 newspaper vendors and agents, as well as

5,000 suppliers and transporters,¡± said the MNPA.

For the full story see

www.thestar.com.my/Business/Business-

News/2014/01/29/MNPA-says-antidumping-duties-erodemargin-

increase-cost/

Sarawak Chief Minister signals desire to step down

In Sarawak, the Chief Minister, Abdul Taib Mahmud, has

announced his desire to step down after 33 years leading

the state government. Taib said he would need to follow

protocol with his plan to step down by seeking an

audience with the governor to convey his intention.

Taib played an instrumental role in developing the timber

industry in Sarawak. While serving as the Federal minister

of primary industries, he invited FAO to undertake

resource assessment and research in the forests of Sarawak

and this laid the foundation for development of the

industry.

He also made the historic decision in May 1989 to invite

an independent mission from ITTO ¡°to undertake a study

of sustainable forest management in Sarawak¡±.

Slow start for Sarawak industry after Chinese New

Year

The timber industry in Sarawak is slowly ramping up

production after the New Year holiday and reports say

plywood trading is very active.

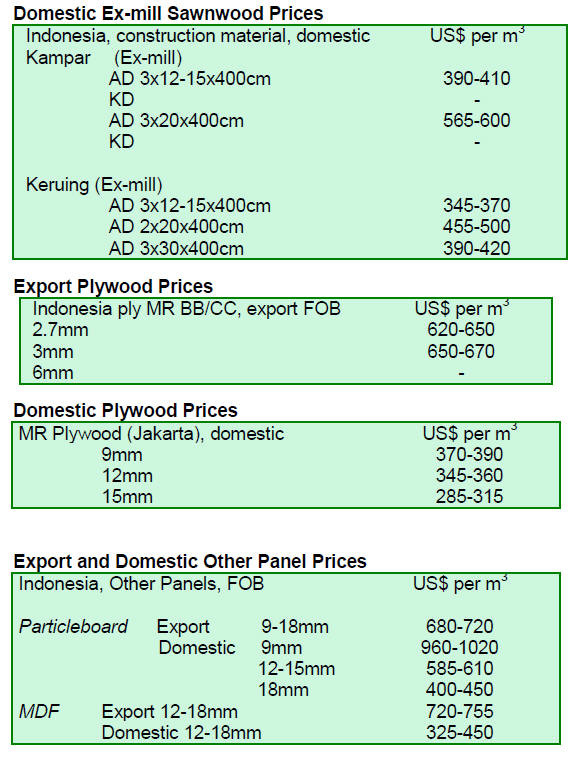

The current plywood export prices per cubic metre have

been reported as follows:

Floor-base (11.5 mm) US$690 FOB;

Concrete formboard (3. x 6.) US$555 FOB;

For Middle East markets (9 . 18 mm) US$460 FOB;

For South Korea (8.5 . 17.5mm) US$480 . 500 C&F;

For Taiwan P.o.C (8.5 . 17.5 mm) US$455 . 460 FOB;

and for Hong Kong US$460 . 480 FOB.

2013 Plywood exports from Sarawak

Statistics published by the Sarawak Timber Association

show that for the entire year of 2013, Sarawak exported

2,576, 288 cubic meters of plywood, worth RM

4,003,850,463 (approximately US$ 1.19 billion).

Major importers were: Japan (1,429,052 cu.m; South

Korea 266,141 cu.m; Taiwan P.o.C 256,419 cu.m and

Yemen 119,084 cu.m.

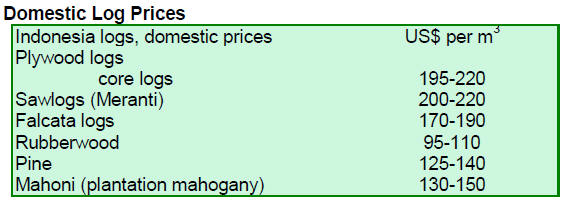

4. INDONESIA

Burden of timber regulations on SMEs

highlighted

once more

A forum involving the International Centre for Trade and

Sustainable Development (ICTSD) and the Centre for

International Forestry Research (CIFOR) has highlighted

the consequences of requiring Indonesian businesses to

comply with the domestic timber legality verification

system. Now only businesses certified under Indonesia‟s

Timber Legality Assurance System (TLAS) are allowed to

export wood products.

Agus P. Djailani, a small and medium enterprises (SME)

technical assistant for the Multi Stakeholder Forestry

Programme (MSFP), said that small businesses may miss

out on the opportunity to export timber to the EU as they

lack the working capital and administrative competencies

to comply with the requirements of the scheme.

Biomass power plant for Siak

South Korean company Global Logix Co. Ltd. is set to

invest US$20 million in the construction of a wood pellet

factory and a 10,000 megawatt (MW) biomass power plant

in Siak, Riau Province.

The company has signed a memorandum of understanding

with the Siak administration for processing oil-palm fruit

bunches and kernel shells which have no commercial use.

Global Logix chairman, Myong-Ho Cho said the wood

pellet factory will produce 10,000 tons of pellets from

60,000 bunches and 20,000 tons of shells, which is the

waste generated from nearby palm plantations every

month.

The 10,000 MW biomass-fired power plant would need 3

tons of oil-palm bunches per hour. Construction of the

plant will begin in April and production is scheduled to

begin in January 2016.

South Korea has seen an increase in pellet consumption,

with 2013 figures estimated at 500,000 tons, compared to

174,000 tons in 2012.

New policy direction for major pulp and paper

corporation welcomed

WWF Indonesia has welcomed the recent forest

management policy issued by Asia Pacific Resources

International Ltd (APRIL).

The policy sets out the company‟s commitment to

supporting conservation activities and WWF-Indonesia

CEO, Efransjah, said this was a new standard for the pulp

and paper industry in Indonesia and it will contribute to

forest conservation and biodiversity, the reduction of

carbon emissions and in securing the well being of

Indonesian people.

The new policy will require a moratorium being placed on

utilising land where conservation values have not yet been

independently assessed.

¡¡

5. MYANMAR

Pace of log shipments increases

The pace of log export shipments has recently increased

but this is not because of improved demand but rather the

urgency with which buyers want to ship the logs that they

have in yards in Myanmar before the log export ban comes

into effect.

Despite the pick-up in shipments analysts still anticipate a

substantial quantity of logs will remain at log yards in

Myanmar when the log export ban comes into effect on 1

April.

Export shipments from April to the end of January 2014

are estimated to have been just over 398,000 cu.m for teak

logs and around 1,307,100 cu.m for other hardwood logs.

Debate rages over exports of teak baulks

While there is doubt in some quarters that the log ban will

really be implemented, up to now the government seems

determined to go through with its decision to ban log

exports after 1 April.

After the ban only processed wood will be allowed but

what constitutes „processed‟ in now being discussed.

Some observers say continued exports of baulk squares

(roughly hewn logs but not further manufactured) would

be an option to sustain the India market, the biggest

importer of Myanmar teak logs.

Another debate is centred on whether domestic companies

will be able to compete with mills set up by foreign

investors as they benefit from tax holidays for a certain

period. This, say local millers, will give foreign companies

a huge advantage.

Most analysts are of the view that it is unlikely that export

of baulk squares will be allowed but an announcement

from the Ministry of Environmental Conservation and

Forestry (MOECAF) is expected to clarify this.

2014 harvest plan announced

MOECAF Deputy Minister, Aye Myint Maung, has

announced that the harvest plan for the 2014-15 fiscal year

would be 108,000 cu.m of teak and 670,000 cu.m of nonteak

hardwoods.

He reiterated that no private companies would be

permitted to harvest logs and that all timber extraction will

be undertaken by the Myanma Timber Enterprise. He

further reported that after 1 April all logs would be sold by

competitive bidding for local processing only.

The deputy minister also said that, at present, there are

only around 13,560 ha. of plantations and that his

ministry is negotiating with both local and foreign

companies to increase investment in plantations.

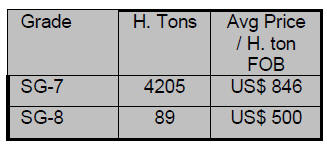

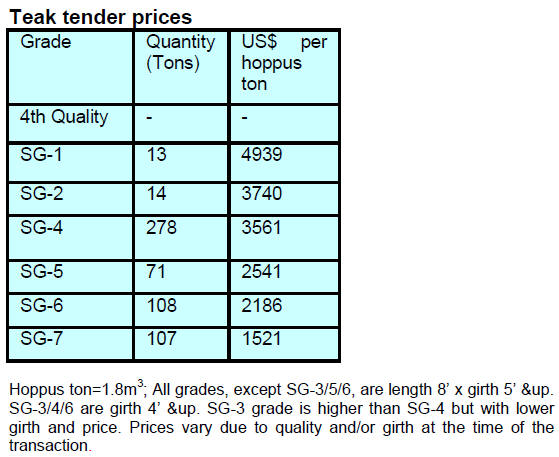

Result of teak logs sales by open tender, Yangon 7

February 2014. These logs can be exported in log form.

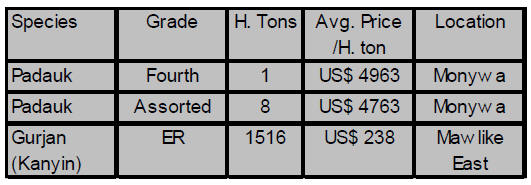

Result of hardwood logs sales by open tender 7

February

2014.

Result of handsawn timber sales by open tender on 7

February 2014.

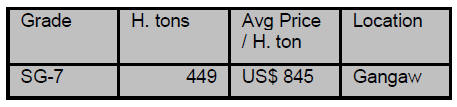

Sales of teak logs for local processing, open

tender 7

February 2014.

January teak log tender results

The following grades and volumes were sold by Myanma

Timber Enterprise (MTE) through competitive bidding on

24 and 27 January 2014.

6.

INDIA

Economic prospects brighten

The outlook for the Indian economy is now looking

brighter. The shrinking of the current account deficit from

4.8 of GDP in the last fiscal year to just a little over 2% of

GDP for this year is giving hope that better days are

ahead. At the same time the rupee: US dollar exchange

rate has been stable for some time now at 61-63 to the

dollar.

Manufacturing activity recovered to a 10 month high in

January this year on account of rising domestic orders and

improving exports. India‟s manufacturing PMI rose to

51.4, the highest since March 2013, and the third straight

month of expansion.

Look East policy to stimulate economy

The government‟s „Look East‟ policy is expected to result

in increased trade with ASEAN countries and generate

private sector investment and infrastructure improvements,

all of which will strengthen the economy.

Media reports say the North East region of India is likely

to benefit from the ongoing construction of new roads and

rail links, investments partly driven by the keen interest of

British firms looking to invest in that region.

Arunachal Pradesh to industrialise its bamboo

resource

India has rich bamboo resources and more than sixty

percent is concentrated in North East India. Arunachal

Pradesh is known to harbour very diverse bamboo species.

However, this resource rich state has a long way to go to

adopt the latest bamboo processing technologies to

maximise economic benefits.

India has a strong bamboo and cane craft tradition but

does not take full advantage of the resources available.

With technical, financial and policy support from the

government through the National Bamboo Mission (NBM)

and the National Mission on Bamboo Applications

(NMBA) as well as the Arunachal Pradesh state

government, efforts are underway to industrialise the

bamboo sector.

The development of industries based on non-timber forest

products including bamboo is one focus of the industrial

policy of Arunachal Pradesh.

Bamboo development including plantation establishment,

management, harvesting and value added processing has

the potential to generate employment especially for rural

unemployed youths.

Moreover, advancing the industrial bamboo sector in the

State would produce an alternative for timber and would

expand local skills and generate income for rural

communities and the state.

The production of plywood and veneers using bamboo as

the raw material by mills within approved industrial

estates has been authorised. Further, under section 4.1 of

the Arunachal Pradesh (Control of felling and removal of

trees from non forest land) Rules, 2001; authorisation

from the Forest Department to harvest bamboo is not

required for bamboo in non reserve forest areas or

plantations.

Prices for small plantation teak logs dip

Imports of plantation teak continue to increase and there is

firm demand for good sized logs. Analysts report that

currently there is glut of small diameter logs (below 60

cms girth) as endusers are avoiding these smaller logs.

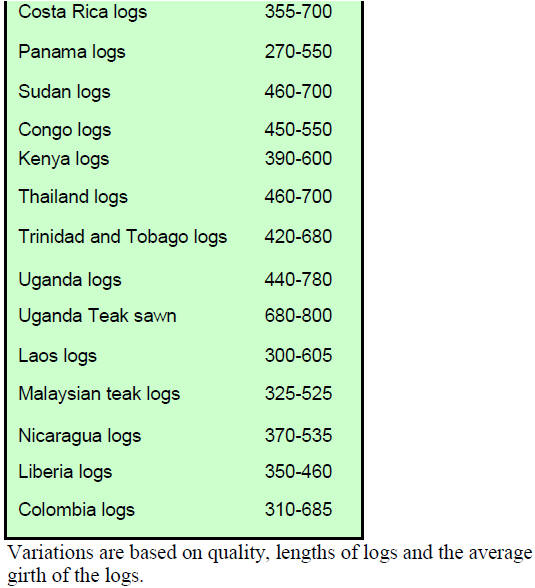

Current C & F prices for imported plantation teak at

Indian ports are shown below.

Prices for domestically sawn imported logs

Demand and supply of domestically milled imported logs

is balanced so landed costs and wholesale prices have not

changed.

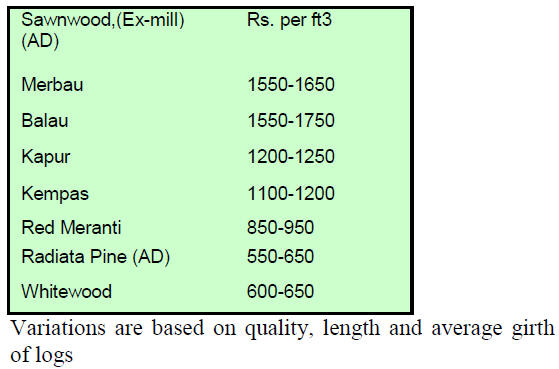

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

¡¡

Firm international demand for teak products

International demand for teak products manufactured in

India from imported Myanmar teak continues to be good

and domestic demand has improved slightly. With the

coming log export ban being introduced in Myanmar

Indian buyers have increased the pace of log shipments out

of Yangon and Indian mills are flush with stocks of logs.

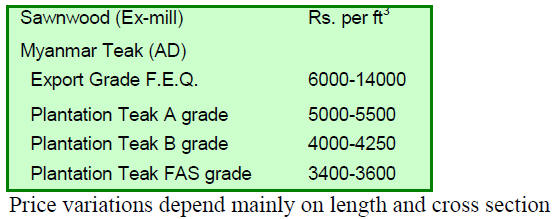

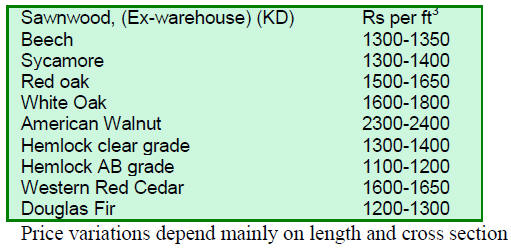

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

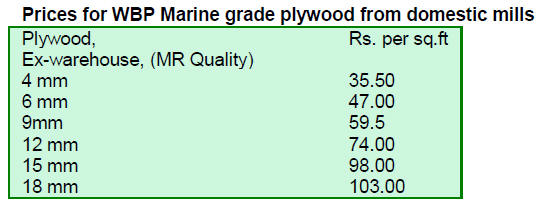

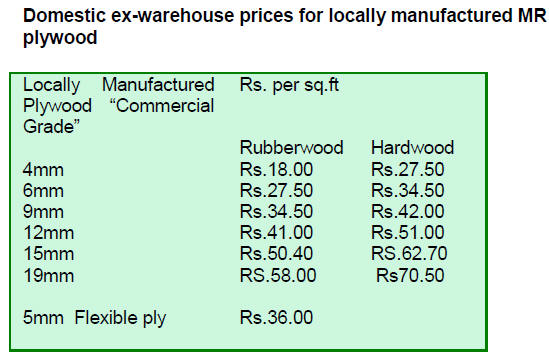

Plywood market depressed by slack housing sector

The domestic plywood market is still suffering from weak

demand as the housing market has not yet reacted to the

overall improvement in economic prospects.

Plywood manufacturers are trying to improve sales by

concentrating more on rural markets where demand is

better. Plywood prices remain unchanged.

7.

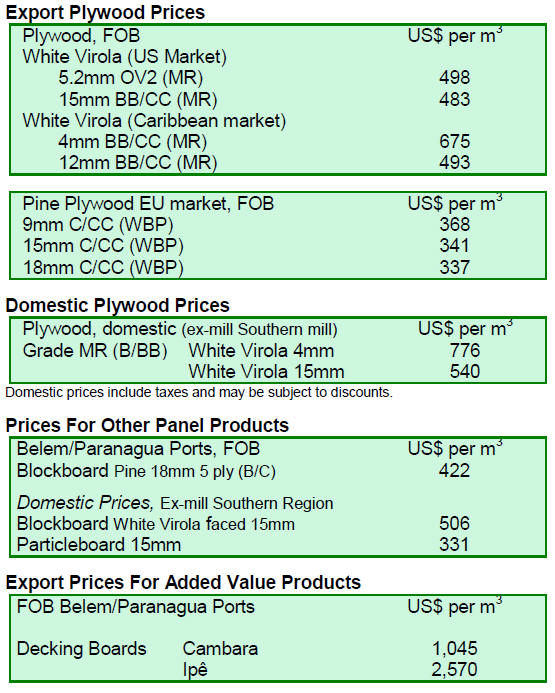

BRAZIL

Forestry output could double

contribution to Mato

Grosso state growth

According to a recent report from the Program for

Sustainable Forestry Development of Mato Grosso State

(PDFS-MT) the forestry sector in the state of Mato Grosso

could significantly increase its contribution to GDP.

The report suggests it would be possible to increase the

value of output from the sector from the current R$3.3

million to over R$7 million per year. If this was achieved

then the contribution of the forestry sector to state GDP

would rise from the current 5.4% to 6.5%.

The report further says with expansion of the area of

managed natural forest, by 2030 timber production could

rise by as much as 7% for fuelwood and by over 70% for

sawnwood.

The National Forum of Forest-Based Activities (FNBF)

indicates that there are currently 214 billion ha of forest

assets in the Amazon and 28% of which it is located in the

state of Mato Grosso.

It is estimated that it may be possible to harvest up to 9

million cubic metres of wood compared to the only 3

million cubic meters harvested at the moment.

According to the Center for Timber Producers and

Exporters Industries of the State of Mato Grosso (Cipem),

the forest sector is satisfied with the outcome of PDFS-MT

study which will guide timber industry development in the

state. The PDFS-MT report is expected to promote

discussion and further evaluation of the opportunities for

increasing output from well managed forests.

Forest production increases in Mato Grosso

In 2014, the Gross Value of Production (GVP) of wood

products and fuelwood in Mato Grosso State could grow

to R$526.4 million, equivalent to 1.8% of the GVP of the

state.

Initial estimates of 2013 GVP from the Institute of

Agricultural Economics of Mato Grosso (IMEA), suggest

the GVP of the forestry sector in the state will come in at

R$501.5 million up by 5% over 2012 levels.

In determining the potential growth for 2014 it is assumed

there would be an approximate 5% increase in production

and a similar appreciation in the price of products

originating from natural forests.

In 2013, there was an 18% decline in production of logs

from natural forests but there was a slight increase in price

compared to 2012.

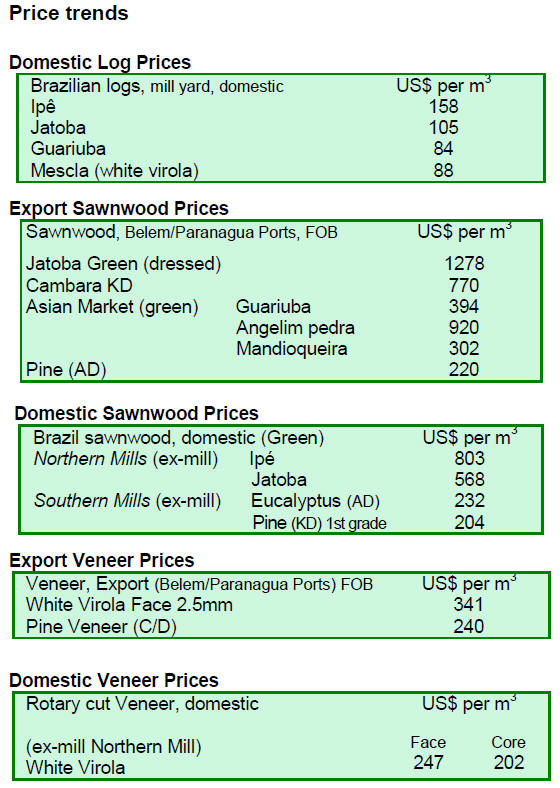

Sales of wood products to the international markets in

2013 earned some US$100.6 million, a 3.1% increase over

the US$ 97.5 million recorded in 2012.

Furniture exports from Bento Goncalves down in 2013

2013 furniture exports by the Bento Goncalves furniture

cluster in the state of Rio Grande do Sul dropped 7.5% to

just US$58.3 million. Despite a favorable exchange rate

for part of the year this was not enough to offset

competition for market share. In addition to the loss of

competitiveness of the Brazilian industry in general,

increases in production costs, taxes, logistics and labour

were the major causes of the fall in exports.

International markets in South America and Africa, which

account for around 80% of all exports, weakened in 2013.

In South American markets demand dropped most

significantly in Argentina, Uruguay and Venezuela.

In Africa, demand weakened in South Africa, Angola and

Mozambique but grew in Namibia. Other countries where

market demand improved in 2013 were Peru, Cuba, the

United Kingdom, Puerto Rico and Qatar.

While exporters in Bento Goncalves did not do so well in

2013, furniture exports from the State of Rio Grande do

Sul grew 2.6% in the year and this, say analysts, was due

to increased exports to Chile, Uruguay and Paraguay. In

these markets exports from Bento Goncalves fell in 2013.

Brazil's overall 2013 furniture exports fended the year

down 2.8% compared to 2012.

China the top importer of Brazilian sawnwood

Brazil.s sawnwood exports in 2013 fell 5% in value and

11% in volume year on year. In 2012, the main markets

were the Netherlands, China, France, the United States and

Vietnam, representing 13.2%, 12.5 %, 12.3 %, 11.4% and

9.2% respectively.

In 2013, the main markets remained the same as in 2012

but China became the top buyer taking 15% of all Brazil.s

sawnwood exports. Demand in the US accounted for 13%,

France 11%, the Netherlands 9% and Vietnam 7.6%.

In terms of volume, 2013 exports fell to 338,324 cubic

metres from the 379,547 cubic metres in 2012. Exporters

in Para state accounted for 35% of all sawnwood exports

followed by Mato Grosso (26%), Rondonia (14%) and

Parana (10%).

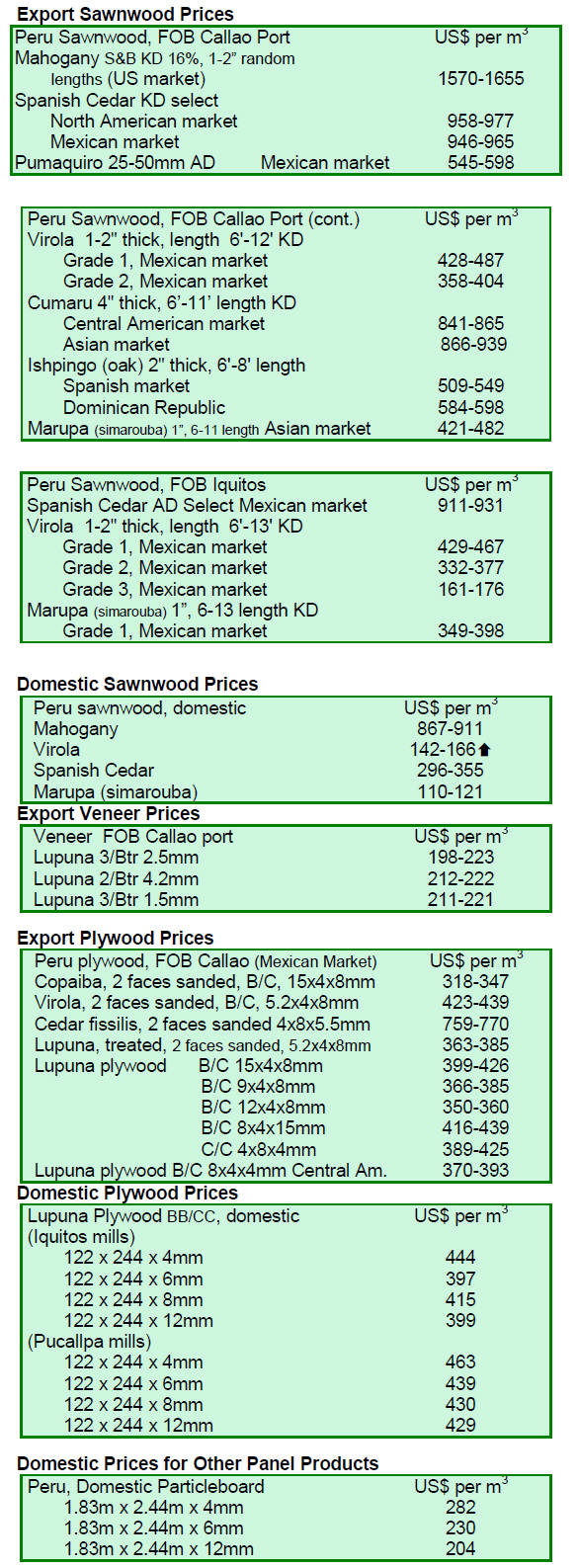

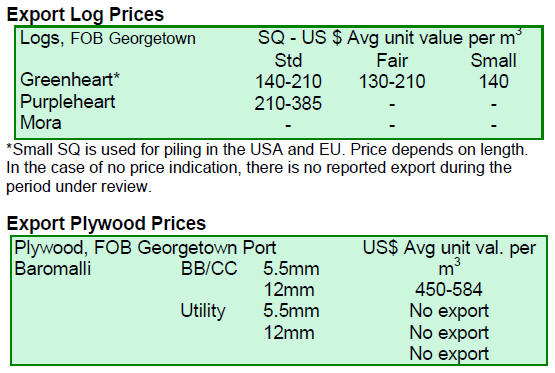

8. PERU

Peru¡¯s 2013 timber exports did well in

weak market

Timber exports for the period January to November 2013

were worth US$ 145.7 million FOB. For the same period

in 2012 exports were almost the same at US$ 145.9

million .

Shipments in November last year, the lastest for which

data is available, were mainly to China, the U.S. and

Mexico which, together, accounted for 76 % of total value

of timber exports. The main products exported to China

were strips and friezes for parquet.

Up to November 2013, year on year demand from China

expanded almost 11%, there was a 18% improvement in

demand from buyers in the US but demand from Mexico

fell 18% year on year.

Indigenous communities propose revisiting draft

forestry regulations

The Inter-ethnic Association for the Development of

Forests (AIDESEP) has expressed concern on regulations

in the Forest Act which provide for the allocation of

concessions to investors from outside of Peru, fearing the

land rights of Amazonian indigenous peoples could be

undermined.

To allay these concerns AIDESEP is calling for the State

to execute comprehensive and independent audits of

forests investment plans submitted by large concessions

holders. The Ministry of Agriculture and Irrigation

(MINAGRI) is expected to have a final text of the relevant

regulations ready by the first half of this year.

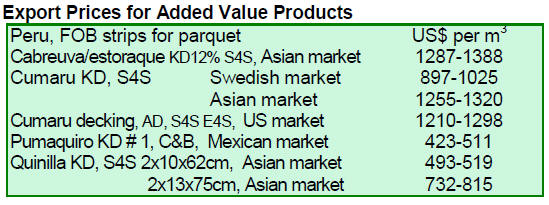

9.

GUYANA

Rising demand for logs back after lull

During the period under review exports of greenheart and

purpleheart logs resumed.

Because there had been a break in log exports, prices

changed as new orders flowed in. Greenheart prices

improved for all three log categories. Standard sawmill

quality logs were traded at FOB prices ranging from

US$140 to US$210 per cubic metre.

Likewise prices for Fair sawmill quality ranged from

US$130 to US$210 per cubic metre FOB while FOB

prices for Small category logs were US$140 per cubic

metre.

Purpleheart logs (Standard Sawmill quality) attracted

favourable prices on the export market from US$210 to

US$385 per cubic metre FOB. Buyers for markets in Asia

and the Caribbean were active and supported the trade in

purpleheart.

Additionally, wamara (Swartzia leiocalycina) logs were

exported and FOB prices held firm ranging from US$125

to US$140 per cubic metre.

Asian markets attracted by some exotic timbers

Some of the other prime species being exported in log

form included kabukalli (Goupia glabra) US$130 to

US$160 per cubic metre FOB; shibadan (Aspidosperma

spp) US$130 to US$150 per cubic metre FOB and

washiba (Tabebuia sp.) US$150 to US$170 per cubic

metre FOB. Markets in Asia were the main destinations

for these exotic timbers from Guyana.

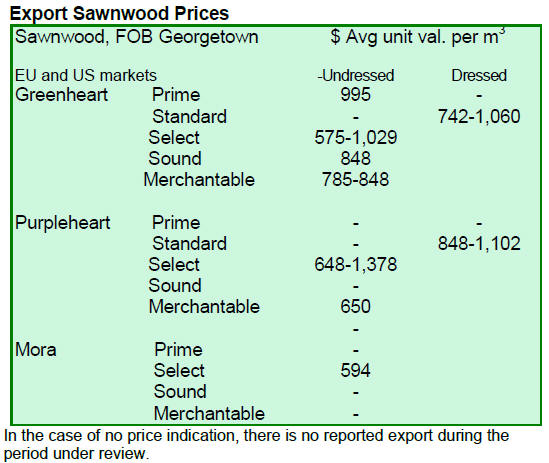

Sawnwood exports steady

During the period under review sawnwood exports made a

positive contribution to total export earnings.

Undressed greenheart (Prime) sawnwood attracted a top

end price of US$955 per cubic metre FOB while Select

Undressed sawn greenheart prices were favourable with a

top end price ranging from US$933 to US$1,209 per cubic

metre FOB. Encouragingly, Merchantable category

Undressed sawn greenheart top end FOB prices went as

high as US$848 per cubic metre.

This durable and sustainable timber attracted diverse

markets in the Caribbean, Europe, French West Indies and

North America.

Undressed purpleheart (Select) sawnwood also

attracted a

good price on the market earning as much as US$1,378

per cubic metre FOB, on the other hand for the period

reviewed, Merchantable quality sawn purpleheart secured

only a fair FOB price of US$650 per cubic metre.

Undressed mora (Select) sawnwood prices held steady at

US$594 per cubic metre FOB for markets in the Caribbean

and New Zealand.

Growing demand for dressed sawnwood

During the period reviewed the overseas demand for

Dressed greenheart sawnwood was encouraging as this

category of sawnwood earned as much as US$1,060 per

cubic metre FOB.

Similarly, FOB prices for Dressed purpleheart held firm at

around US$1,102 per cubic metre. Markets in the

Caribbean dominated the trade in Dressed purpleheart

sawnwood.

Greenheart for marine applications

Greenheart piles attracted positive export market prices as

much as US$355 per cubic metre FOB, with Europe being

the prime market for this durable timber product which is

used for marine and wharf structures.

Guyana‟s wallapa posts earned a favourable market FOB

price of US$685 per cubic metre while wallaba splitwood

(shingles) attracted a price of US$1,091 per cubic metre

FOB in Caribbean markets.

Regional market demand supports added value

production

The Caribbean market in particular supports the

production of added value products such as craft items,

doors, indoor furniture, spindles, window frames, and

wooden utensils as well as non-timber forest products.

Exporters target new markets for washiba (Guyana ipe)

Washiba (Tabebuia sp) is known in the trade as Guyana‟s

ipe. Tabebuia is a high density timber (1,040 kg/ cu.m)

and can be found across Central and tropical South

America.

This species is also known and traded internationally as

hakia and lapacho. The Guyana Forestry Commission

(GFC) says a sustainable supply of this timber species can

be assured. Washiba has long been one of Guyana‟s export

species and can be used for a variety of end-uses where

strength, durability and appearance are important.

Between 2008 and 2013 the export price for Washiba

(Dressed) went from US$636 per cubic metre to as high as

US$2,900 per cubic metre FOB.

The increase in price was due to the significant increase in

demand for this product because of its versatile end use

applications. Washiba is especially popular for outdoor

decking particularly in the United States.

The GFC says there is potential for this timber species to

gain a stronger footing in Caribbean and other markets

where there is a need for a durable timber for use in sea

front accommodation or for decking.

Update on Guyana¡¯s FLEGT VPA process

The Guyana Forestry Commission (GFC) has reported that

Guyana‟s engagement with the EU on a Voluntary

Partnership Agreement (VPA) is progressing and work has

continued on the various components in the agreed

Roadmap.

The National Technical Working Group meets as

scheduled and work has continued on the development of

the two projects for which Guyana has received financial

support from the Food and Agriculture Organization of the

United Nations.

The consultant for the Communication and Consultation

Strategy has met with various stakeholder groups and the

feedback garnered from this process will inform the

Communication and Consultation Strategy.

The Scoping of Impacts Study has commenced and an

initial testing of the draft Legality Definition was

conducted to ascertain the compliance level and identify

initial gaps. Both of these activities are scheduled to be

completed during the first quarter of 2014.

Funding for various aspects of the VPA is still being

explored and must be secured so that work plan for 2014

can be implemented.

Collaboration on chainsaw milling

During a second phase of the Chainsaw Milling Project in

Guyana the National Technical Working Group, NTWG

and the Project have successfully collaborated in an effort

to continue the consultation process on Guyana‟s VPA.

¡¡