|

Report

from

North America

Hardwood plywood imports up again

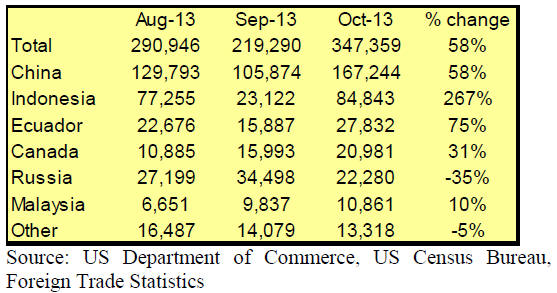

US imports of hardwood plywood grew to 347,359 cu.m

in October, up 58% from the previous month. Almost all

supplier countries gained from the higher import volume,

with the exception of Russia.

The largest increases were imports from from Indonesia

(84,843 cu.m, +267% from September) and China

(167,244 cu.m, +58% from September).

While imports from China were higher than at any other

time in the last six months, total imports in 2013 to

October were still 15% lower than at the same time in

2012.

More hardwood moulding from China

Hardwood moulding imports fell to US$13.9 million in

October, down 7% from the previous month. However,

hardwood moulding imports from China grew by 12% to

US$4.5 million.

Brazilian shipments of mouldings declined by 19% to

US$3.2 million and imports from Malaysia were down

43% from September.

Higher flooring imports from Indonesia and Malaysia

Hardwood flooring imports were US$3.0 million in

October, up from September, but imports remain lower

than at the same time in 2012. Indonesia and Malaysia

were the largest hardwood flooring suppliers in October.

Imports from Canada and China declined.

October imports of assembled flooring panels are also

lower than last year, but flooring panel imports from

Europe increased significantly in October. Total October

imports were worth US$8.8 million. Imports from China

fell by 11% to US$4.8 million.

Furniture imports remain strong

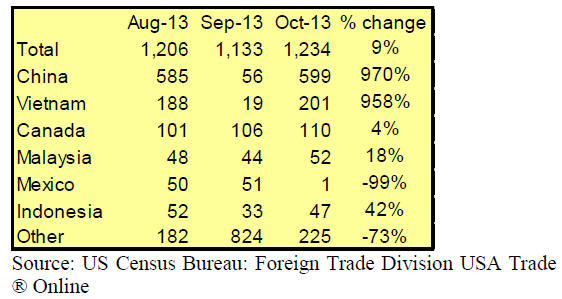

US imports of wooden furniture remained strong at

US$1.23 billion in October. Year-to-date imports were 6%

higher than in October 2012. China‟s shipments accounted

for 49% of total US imports in October. Vietnam‟s import

share recovered to 16%.

China‟s furniture shipments to the US were US$598.7

million in October. Imports from Vietnam increased to

US$201.2 million, but year-to-date imports were 11%

lower than in October 2012.

Furniture imports from Malaysia and Indonesia increased

by 18% and 43%, respectively, from the previous month.

Furniture market update

The furniture market continued to slowly improve

according to the latest data by Smith Leonhard (Smith

Leonhard Furniture Insights November 2013). However,

relatively low consumer confidence is holding back

demand.

New furniture orders increased in the third quarter of 2013

and most companies (80%) reported higher orders

compared to 2012.

Total furniture orders in 2013 until September were 6%

higher than at the same time last year.

Furniture and home furnishing retail sales slightly up

Retail sales at furniture and home furnishing stores grew

in October after a brief decline in September according to

the US Census Bureau.

October sales were US$8.4 billion, up 1% from

September. Retail sales were 8% higher than in October

2012. Sales figures include both furniture and other home

furnishing items, with furniture typically accounting for

50-60% of sales.

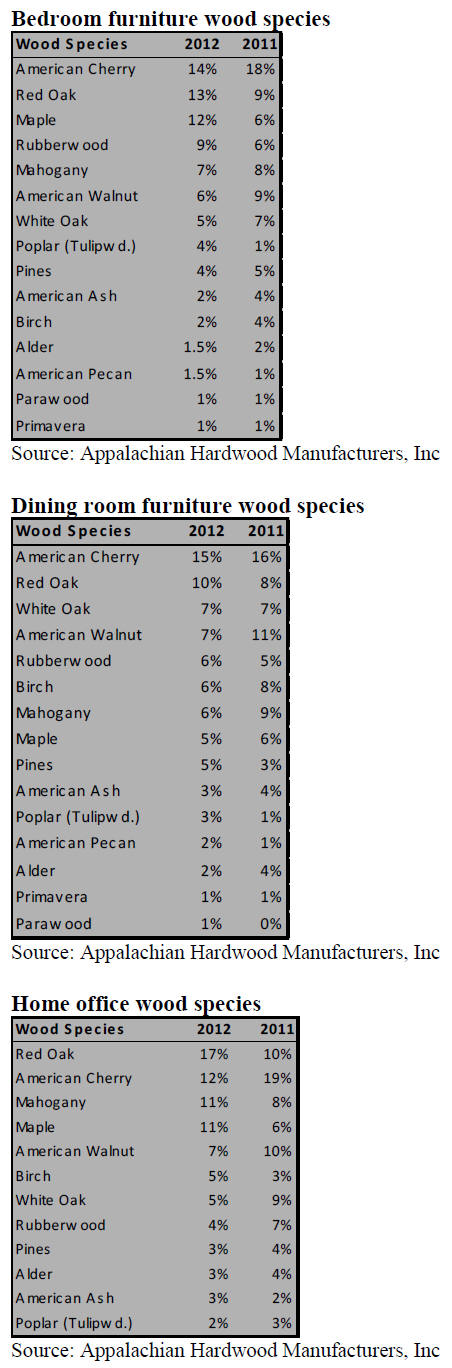

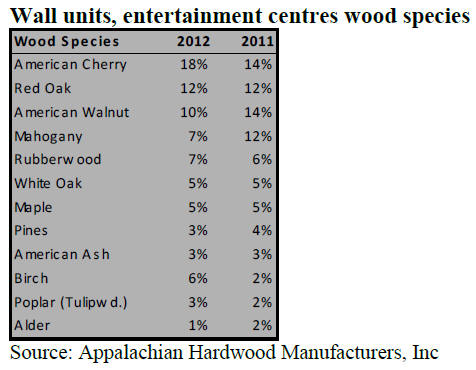

Survey identifies species use in cabinets and furniture

The Woodworking Network has assessed recent trends in

wood species from the High Point Furniture Market and

industry associations.

For kitchen cabinets dark finishes and colours have

become more common than white/light and medium

finishes. Kitchens include different species and finishes on

different cabinets and furnishings.

Cherry, maple and alder remain popular, but their use has

declined. Use of the following species has grown: oak,

walnut, birch and bamboo. Demand for rift sawn white

oak is up. Rift sawing is the most costly type of

production, but the boards are very stable and have a

distinctive tight grain.

American cherry is the most popular species in bedrooms,

dining rooms and entertainment centres. Red oak is the

most used species in home office furniture.

The tables below provides an overview of the most

popular wood species in furniture by room type, based on

the 2012 survey by the Appalachian Hardwood

Manufacturers at the High Point Furniture Market.

Lower unemployment

Unemployment declined to 7.0% in November. This is the

lowest rate since 2008. Employment grew in

transportation and warehousing, health care and

manufacturing, according to the US Department of Labor.

Furniture manufacturing companies reported growth in

November, but wood product manufacturing declined,

according to the Institute for Supply Management.

Despite the overall decline in wood product

manufacturing, many companies are reporting better

market conditions than normally at this time of year.

Consumers expect slow economic growth in 2014

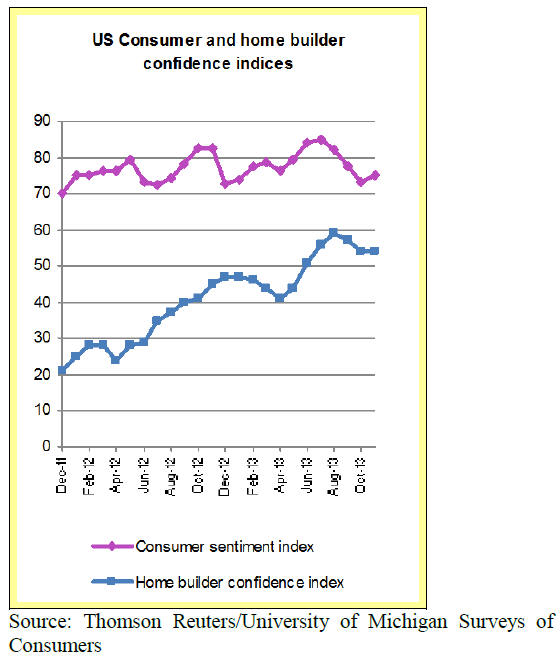

Consumer confidence in the US economy improved in

November, according to the Thomson Reuters/University

of Michigan consumer sentiment index. The improvement

was mainly in higher income households. Lower income

households reported declines in their incomes. Consumers‟

view of government economic policies remained negative.

Consumers expect the economy to grow in 2014, but only

slowly.

Construction cost still affecting home builders¡¯

confidence

Most housing markets across the country are slowly

climbing back to normal levels according to the National

Association of Home Builders. Several markets are

already above normal levels, including smaller cities such

as Oklahoma City, Austin, and Houston in Texas and

Pittsburgh.

Builder confidence in the market for newly built singlefamily

homes remained unchanged from October.

Consumers appear uncertain about the economic outlook,

while builders face rising costs of construction. Home

builders‟ confidence was highest in the West and Midwest

in November.

Home prices outpace income growth

The number of building permits for residential

construction was over 1 million in October, at a seasonally

adjusted annual rate. This is 5.2% higher than in

September and 13.9% higher than in October 2012. The

increase was primarily in permits for multi-family housing

construction.

|