2. GHANA

Progress on timber tracking

The EU/FLEGT Newsletter of Nov/Dec 2013 says Ghana

and the EU reviewed progress made by Ghana in

developing its legality assurance system, especially its

verification protocols and wood tracking system.

During a joint meeting it was agreed that effective tracking

is a considerable challenge within the VPA

implementation process. The two parties agreed to develop

a detailed work plan to guide implementation as Ghana

works towards licensing.

New policy to tackle depletion of forest resources

To halt the depletion of the country‟s forest and natural

resources the Ministry of Lands and Natural Resources has

introduced a Forest and Wildlife Policy. The new policy is

an improvement on the 1994 policy and addresses the

many challenges facing the forestry sector.

The policy will focus on the commitment to degraded

landscape restoration through forest plantation

development schemes, the promotion of small and

medium forest and wildlife enterprises to create

employment.

The policy also addresses biodiversity conservation,

sustainable management of Savannah wood land and

ecotourism development.

The policy aims to consolidate good governance through

accountability and transparency, enhance active

participation of communities and land owners in resource

management and address issues on tree tenure and benefit

sharing.

The Minister of Lands and Natural Resources, Alhaji

Inusah Fuseini, who launched the policy, noted that the

cost of degradation of the nation's forest and wildlife was

about 10% of gross domestic product.

The minister also announced that, a Forestry Development

Master Plan would be developed to ensure effective

implementation of the new Forest and Wildlife policy.

Inflation soars

Inflation rate in Ghana is now 17.5%, up by 2.5%

following last month‟s delivery of the 2014 budget

statement by the Minister of Finance Mr. Seth Terker.

A significant aspect of the budget was the change in scope

of the value added tax (VAT) to widen the tax net. The

new VAT structure received presidential assent on

December 30, 2013 and was subsequently gazetted the

following day.

¡¡

3. MALAYSIA

Heated discussions in Sabah on royalty

rates

The year has started quietly for the timber industry.

Industry watchers anticipate that this quiet mood will last

till after the Chinese New Year which falls on 31 January.

Meanwhile, the most closely watched issue is in Sabah

where the industry is in discussions with the state

government on proposed changes to timber royalty rates.

Any increase in rates will have a big impact on the

industry.

Market prospects in Japan favourable says research

firm

Analysts from Affin Research, a firm affiliated with Affin

Investment Bank Ltd, are optimistic that 2014 will be a

good year for the timber industry. They foresee stronger

demand with moderate improvements in timber prices

underpinned by diminishing resources, recent stabilisation

of the Indian rupee, Myanmar‟s log export ban and

improved economic outlook in Japan, notably for

plywood.

Affin Research projected that log prices would average to

about US$250 to US$260 per cu.m in 2014 (up by around

US$20 to US$30per cu.m from an average of US$230 to

US$240 per cu.m in 2013).

Affin Research noted that the Japanese housing market

recovered in 2013 but whether this can be maintained after

the consumption tax is raised in April is uncertain. Any

improvement in housing starts is very positive for

Malaysian plywood exporters.

Reconstruction in the earthquake and tsunami devastated

areas in north-eastern Japan and construction of venues

for the Olympic Games in 2020 will surely boost demand

for more timber.

Positive outlook for demand from India

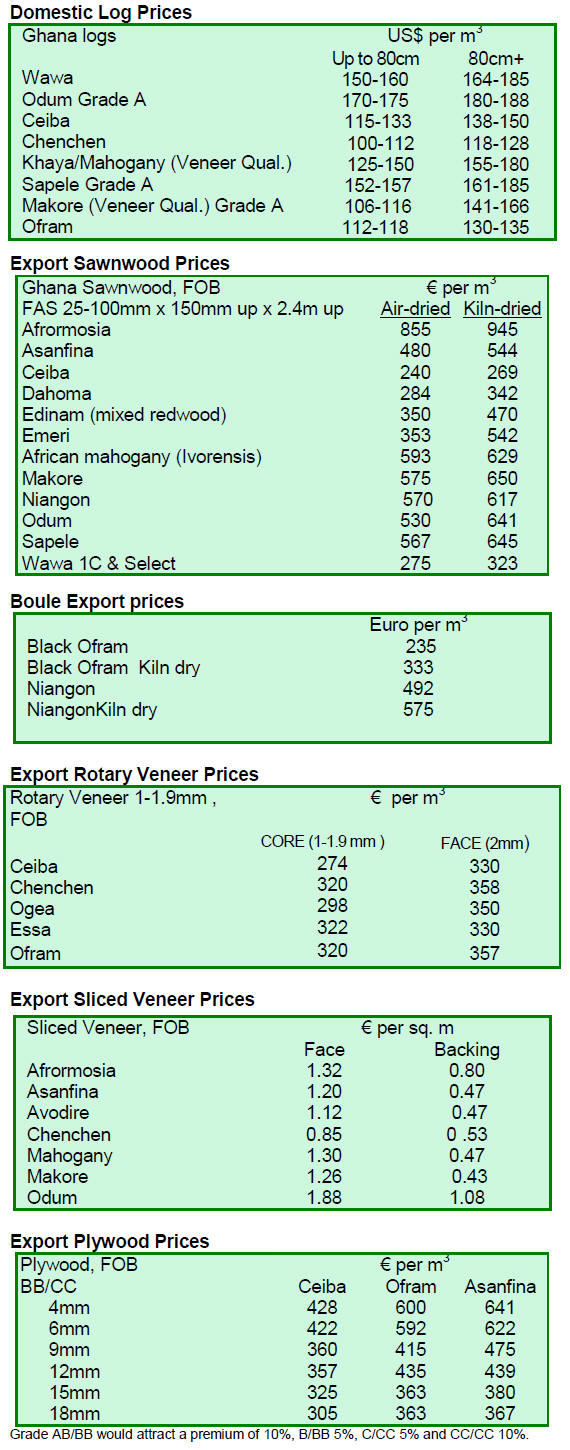

Log exports to India accounted for 61% of Sarawak‟s total

log exports in 2013. India‟s imports from Sarawak slowed

in mid-2013 due to the sharp depreciation of the Indian

rupee against the US dollar but prices picked up towards

the end of 2013 because of firm demand prior to the rain

season and because the rupee exchange rate stabilised.

Demand for logs in India could be strong this year if the

housing market picks up.

Malaysian log exporters are expected to benefit from the

log export ban in Myanmar. The reduced availability of

non-teak hardwoods should result in upwards pressure on

prices in all markets.

VPA negotiations continue

Malaysia continues to negotiate with the EU on the

Voluntary Partnership Agreement (VPA) and analysts

anticipate that representatives from Peninsular Malaysia

will be concluding their negotiations soon so as to sign a

VPA.

The state authorities in Sabah have stepped up activities to

speed negotiations with EU but in Sarawak the state

authorities have made it clear they would adopt a phased

approach towards the VPA.

Sarawak Timber Association explains its position VPA

Sarawak‟s position on the VPA negotiations has attracted

much international attention. The Sarawak Timber

Association (STA) recently released a statement on the

FLEGT VPA to explain its position.

The main elements of the STA statement are reproduced

below:

Malaysia has been negotiating with the EU over the EUMalaysia

FLEGT VPA. The State Government of Sarawak

has taken the cautious stance by adopting a phased

approach to the signing of the EU-Malaysia FLEGT VPA

which is on a voluntary basis.

Sarawak Timber Association (STA) fully supports this

decision made by the State Government as STA strongly

believes that the real benefits to the industry must first be

forthcoming.

STA would like to emphasize that even though Sarawak¡¯s

licensing authority will be unable to issue FLEGT

Licenses having taken the phased approach if Malaysia

signs VPA, but this does not mean that timber and timber

products from Sarawak are illegal.

Sarawak has already in place a legality verification

system to ensure its timber and timber products are legally

sourced and exported to a final destination which is in

compliance with the requirements of the existing forestry

laws and regulations. This has been accepted by our

international markets.

Since the VPA is a voluntary bilateral trade agreement,

there must be reciprocal benefits for the timber-producing

country.

STA sees the advantage of the VPA is to provide a green

lane for expeditious import into the EU BUT notes that

being included in the VPA does not confer any

commitment to a guaranteed market share which is very

important for the continuous survival of our timber

industry.

STA wishes to highlight that there is no common

agreement globally on what elements constitute the

definition of legal timber.

It is very subjective on how one interprets what legal

timber is and this has caused timber-producing countries

to incur higher transaction costs without any market

premium to meet the demand of the markets with its

different criteria and objectives due to the different

definitions of what is legal timber.

STA therefore supports any initiatives by timberproducing

countries to explore mechanisms and

arrangements, such as mutual recognition that can

eventually lead to the harmonization of the categories of

laws to be used to define what legal timber is for the

benefit of the timber industry internationally as a whole.

4. INDONESIA

Further debate on plantation log export

The suggestion that limited log exports could be resumed

has generated considerable debate. The idea was first

made by the Association of Indonesian Forest

Concessionaires (APHI) who said such a change in the ban

on log exports would generate better prices and offer

opportunities for market diversification.

It was suggested by the Ministry of Forestry that logs from

either community plantation forests (HTR) or industrial

forest plantation concessions could be exported provided

they come from areas covered by SVLK certificates.

Hadi Daryanto, the Forestry Ministry‟s secretary-general

said ¡°exports would be limited to companies fulfilling the

SVLK certification requirements so exports would not be

on a massive scale and so quota would be imposed and the

log trading would be mainly driven by market demand¡±.

Leading by example ¨C government agencies to use

only SVLK certified products

The government has said it would require government

institutions to use only timber and timber products that

have been certified through the timber legality verification

system (SVLK).

Forestry Minister Zulkifli Hasan said that his ministry,

along with the Government Procurement Regulatory Body

(LKPP), the National Development Planning Board

(Bappenas), the Public Works Ministry and the

Environment Ministry were drafting a regulation on the

use of wood products by government agencies.

Forestry Ministry director general for forestry business

development, Bambang Hendroyono, said the new

regulation would help to boost the domestic use of SVLKcertified

products. The number of companies that had

secured SVLK certification stood at 632 at the end of

December.

Imported wood should comply with RI certification

The Indonesian government intends to limit wood product

imports to products which comply with domestic

certification standards so that manufacturers using

imported raw materials will no longer need pre-export

inspection.

Bachrul Chairi, the Trade Ministry Director General

said

where the export country had a certification system

comparable to that in Indonesia the mutual recognition

agreements would be concluded.

Through such agreements Indonesia would be

acknowledging the legality system in its trading partners

and vice versa. Arrangements for this scheme are expected

to be in place this year according to Bachrul Chairi.

VPA implementation advances

The EU and Indonesia recently agreed a draft action plan

for the ongoing implementation of the VPA according to

the EU FLEGT Facility Newsletter of Nov/Dec 2013.

The action plan is based on findings from the first phase of

an independent evaluation of Indonesia‟s timber legality

assurance system conducted in 2013.

The action plan describes planned improvements to SVLK

regulations, amendments to VPA annexes, development of

new legislation and capacity building.

Preparations to ratify the Indonesian¨CEU VPA are

ongoing.

The International Trade Committee of the EU Parliament

is reviewing the treaty while the Indonesian President‟s

office is preparing for its ratification by the national

legislature.

5. MYANMAR

Unlikely all accumulated teak and

hardwood logs can

be shipped before log export ban

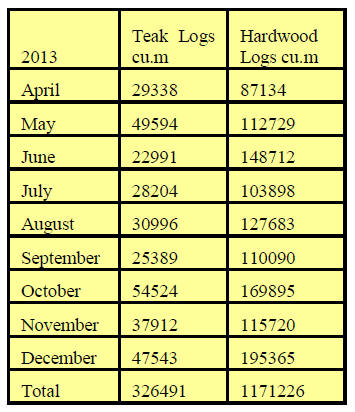

Export shipment volume increased in December however,

it is estimated that around 270,000 cu.m of teak logs and

810,000 cu.m of other harwood logs remain unshipped at

various log depots in Myanmar.

Analysts say that it is unlikely that this quantity of logs

could be shipped in the three months until the log export

ban takes effect.

Shipments to date during the 2013-14 financial year are

shown below.

MTE informs on transactions after the log export ban

The log export ban (LEB) is set to begin immediately the

2014-15 financial year begins which will be midnight on

the 31 March 2014. It is understood that at this time all

loading of logs bound for export will be halted.

On 24 December the Myanma Timber Enterprise (MTE)

issued a statement on pre and post log export ban

procedures and a summary is provided below:

Before the log export ban

(1). Payment for log shipments must be made by 28

February 2014 and loading of vessels must be concluded

before 31 March 2014.

(2). Buyers having outstanding balances on purchase

contracts may conclude purchases at contracted FOB

prices provided the logs are processed inside the country.

In this case payments are to be made (in full) before 30

June 2014. From 1 July 2014, all remaining

unshipped/unpaid logs under existing contracts will

become the property of the MTE and sold by open tender.

After the log export ban

After 31 March 2014 grading and sales of logs will be

undertaken as follows:

(1) Industrial raw logs will be sold by open tender to

sawmills and factories operating under Myanmar

Investment Commission approval and to mills and

factories from the private sector.

(2) Teak log Grades 6 and Grade 7 will be grouped

together and re-designated as Grade 6. Logs that do not

fall in the category of Grade 6 will be sold as Grade 7.

(3) Grades for Padauk logs (Pterocarpus macrocarpus) will

remain as currently used, except that the Export Reject

Grade (ER) will be called Domestic Quality.

(4) For other hardwood logs what is currently termed

Export Quality will become First Quality and Export

Reject Grade will become Second Quality.

(5) Logs that are to be sold by open tender will be parceled

in Yangon and in other suitable locations outside Yangon.

(6) Auction deposits will be US$3000 for companies

owned by Myanmar nationals; and US$5000 for

companies owned by foreigners.

(7) If (full) payment for the successful lots are not paid

within (60) days, the respective lots will revert to MTE for

resale by open tender.

For more information contact MTE:

http://www.myanmatimber.com.mm/index.php/contact-us

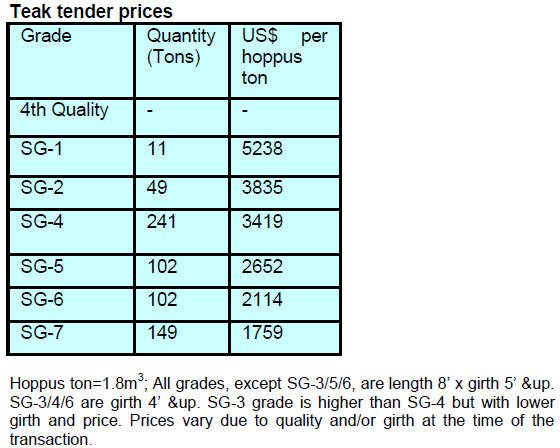

December teak log tender results

The following grades and volumes were sold by Myanma

Timber Enterprise (MTE) through competitive bidding on

13 and 16 December 2013.

¡¡

6.

INDIA

Housing market growth forecast for early

2014

Developments in the economy and legislative changes

impact prospects for growth in the housing sector and this

directly affects demand for wood products.

Since the beginning 2003 India‟s GDP growth was around

8% per annum and inflation was a modest 5% but during

2013 there was a reversal as India‟s GDP growth stalled at

around 5% and inflation almost reached 10%. Against this

economic backdrop, growth in the housing market has

weakened.

During the last quarter of 2013 the Indian media talked of

an over-supply of housing and a slowing of demand for

urban housing. This led some struggling developers to

offer discounts and free extras not part of the normal deals.

Despite the current weakness in the housing market

analysts expect that in first few months of 2014 demand

will resume and prices will respond accordingly.

On the other hand, developers are raising concerns over

the possible impact of the recently introduced Land

Acquisition Act which came into effect on 1 January 2014.

The larger real estate companies are afraid that the act will

result in cost increases for infrastructure and residential

developments and could add between 15 per cent and 45

per cent to development costs.

However the Minister for Rural Development has said the

act will not affect private purchases of private land as it

applies only to land acquired by Central and State

authorities for any public purpose. The fear on the part of

developers is that the rehabilitation and resettlement

clauses of the act could drive up land prices as land

owners will see higher prices being paid by the state.

Paper industry concerned on import duty change

The domestic paper industry, which is struggling with a

chronic shortage of pulpwood is facing a new challenge in

the form of cheaper duty free imports from ASEAN

member countries.

Up until the 1 January 2013 the import duty on paper was

2.5% but this has now been eliminated and became zero

with effect from the beginning of this year under the terms

of the trade agreement between ASEAN countries.

The domestic supply of pulpwood is limited and prices

have increased by as much as 70-80 per cent over the past

two years to about Rs.10,000 per tonne but even at this

price there is no adequate supply and domestic mills have

to import the shortfall.

The paper industries raised paper prices by 10-15 per cent

during 2013 which brought domestic paper price to

Rs.52,000 per tonne. The landed cost of similar paper

from South Korea is around Rs.48,000 so imports have

been growing.

With the change in duties as a result of the ASEAN

deal

imports of coated paper, copier paper and specialized

products are expected to increase. Currently India imports

around 8~900,000 tonnes of these types of products

annually with China being the major supplier.

With the change in duties producers, such as Indonesia,

will have an opportunity to expand exports to India.

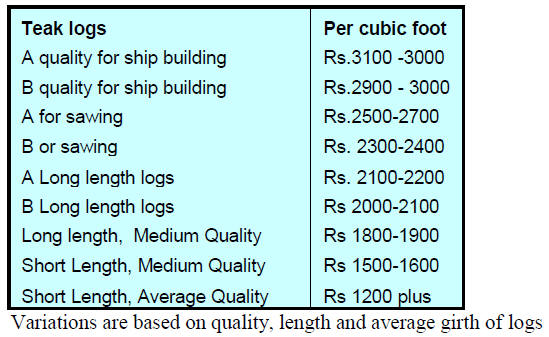

Auction prices of domestic teak at Western India

Forest Depots

During the last auctions of 2013 at various log depots in

the Dangs division approximately 12,000 cubic metres of

logs were sold. The majority of these were freshly felled

good quality logs.

Average prices recorded at the most recent auction are as

follows:

¡¡

The lack of demand from building companies

depressed

overall prices but the available logs were sold as sawmills

needed to restock the logs used up during the monsoon

period when auctions do not take place.

Good quality non-teak hardwood logs of Haldu (Adina

cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium, 3 to 4

m in length having girths 91cms and up were sold at prices

in the range of Rs.600~850 per cu.ft while medium quality

logs were priced at 400 ~550 per cu.ft.

Now that the holiday season is over demand is expected to

rise and substantial quantities of logs are expected to be

put up for sales in coming months.

Availability of alternatives creates competition for teak

exporters

The stabilised rupee exchange rate has provided some

relief for importers. As it is the dry season in many

plantation teak supply countries the volumes offered have

increased.

Some suppliers of plantation teak are asking for higher

prices but, with the present economic situation and the

weak housing market in India, is not surprising that

importers do to accept price increases, on the contrary,

Indian buyers are pressing for reduced prices.

Also, the availability of other tropical hardwoods

at

competitive prices is creating tougher competition for teak

suppliers and holding down prices.

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

Recently plantation teak was imported from Cameroon

at

prices in the range of US$350 to 510 per cu.m

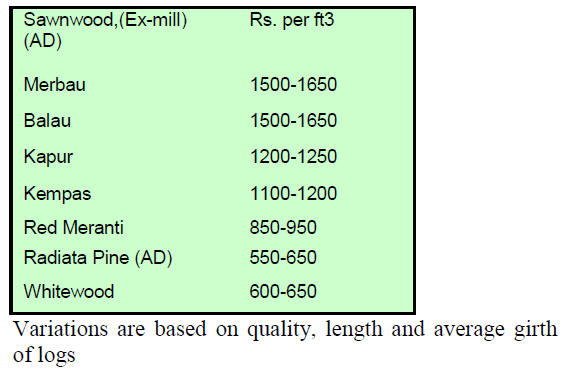

Domestic ex-sawmill prices for air dried

sawnwood cut

from imported logs

As demand and supplies remain balanced and the rupee

exchange rate is stable landed costs for imported logs have

not changed so sawnwood prices remain unchanged.

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

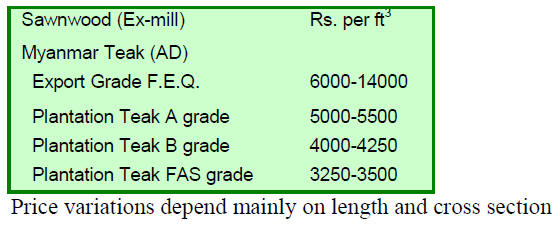

Domestic prices for Myanmar teak processed in

India

Export demand for teak products manufactured in India

continues to be good but domestic demand for Myanmar

teak products is only from selective high net worth clients.

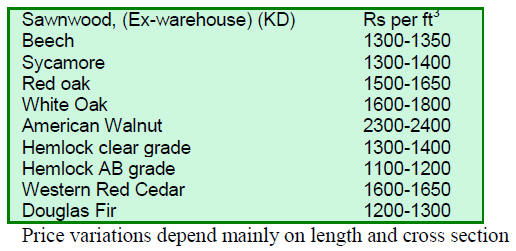

Prices for imported sawnwood

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

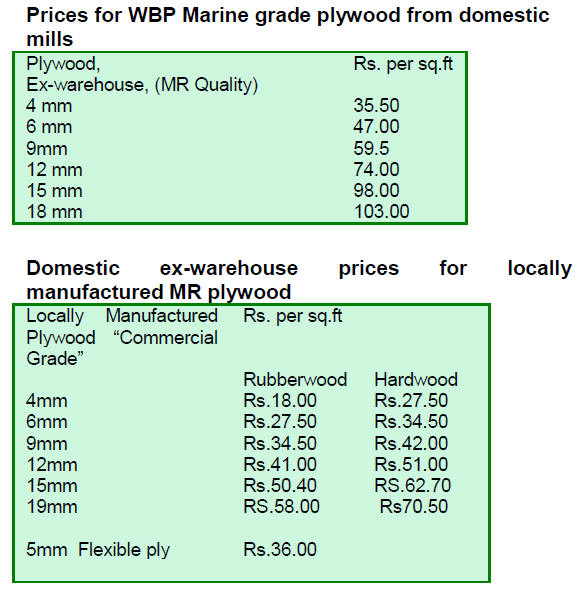

Plywood Market

The housing sector continues to be very depressed and

plywood manufacturers are suffering from rising

production costs and want to increase prices immediately

but the current demand is not supportive of this.

Plywood prices on the domestic market remain

unchanged.

7.

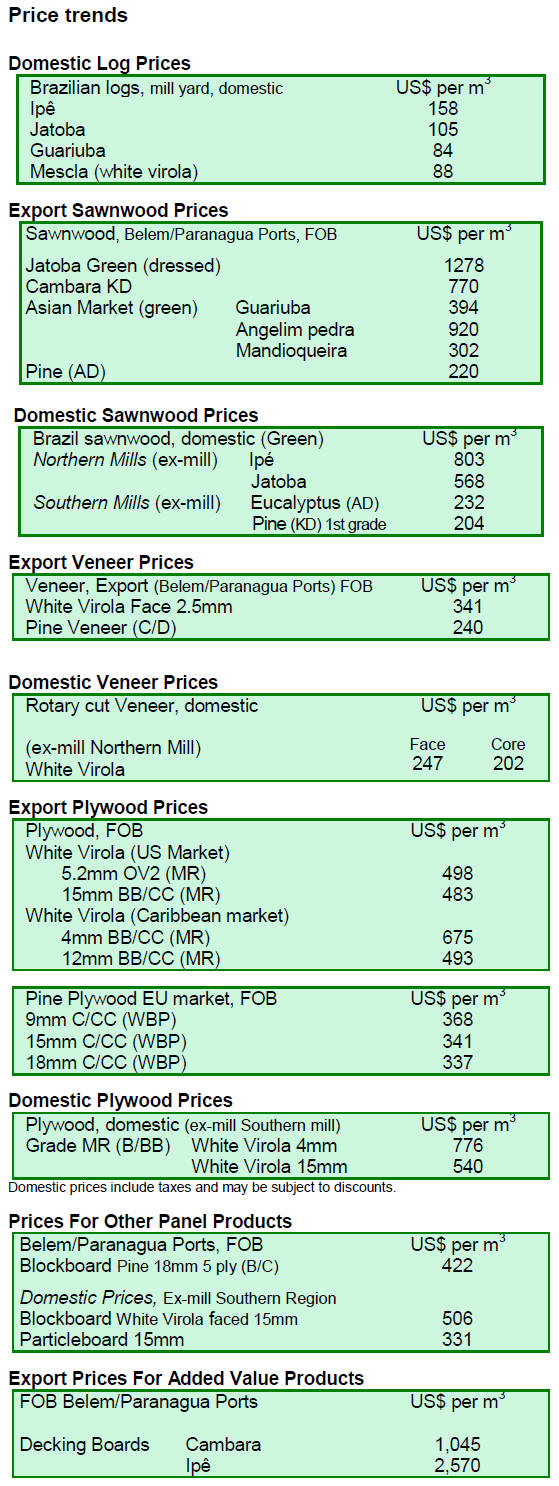

BRAZIL

Rio 2016 driving demand for

certified wood

An agreement between FSC Brazil and the Olympic

organising committee for Rio 2016 provides for all wood

products used for event venues to be certified.

Certified, in this case is defined as complying with the

FSC principles and criteria that go beyond the compliance

with existing law and is said to include workers rights,

indigenous people issues and local community‟s rights.

This initiative has precedent in the 2012 London Games in

which more than two-thirds of the wood products in the

Olympic Park and over 90% of the wood products used in

the Olympic Village were FSC certified.

The aim of the Brazilian Olympic Committee is to

demonstrate leadership with new standards of

sustainability management.

Improvements in the timber sector in Mato Grosso

State

Mato Grosso is one of the major tropical timber producing

states in northern Brazil. Over the past few years the

forestry sector in the State has encountered difficulties in

raising industry awareness on issues of sustainable

development so as to demonstrate to international markets

that the industry is acting responsibly, is vibrant and in its

economic activities is respecting the environment.

To create greater sector transparency the Center for

Timber Producers and Exporters Industries of Mato

Grosso (Cipem), with support from the Fund for Wood

Sector Support (Fundo de Apoio ¨¤ Madeira - Famad),

launched a publication that features timber industry

developments between 2009 and 2013.

The report is entitled ¡°On the right track in

defense of

forest-based industry (No caminho certo em defesa da

Base Florestal)¡± and describes how forestry is promoted in

the state.

The report also presents details on issues such as the

participation of forest industries in international events,

sustainability issues, timber industry worker skills and

qualifications, management, fiscal and tax policies that

affect the sector as well as data on timber production,

exports, tax levels and employment.

One of the highlights of the publication is reference to the

„Program for Sustainable Forestry Development of Mato

Grosso‟ (PDFS/MT) due to be released in February 2014.

This programme will further support achieving a

sustainable forest-based industry in the state.

Mato Grosso timber sector performance in 2013

The forest industries of Mato Grosso State exported

97,900 tons of wood products, from January to November

2013, earning some US$93.7 million.

According to the Ministry of Agriculture, Livestock and

Supply (MAPA) and the Bureau of Foreign Trade,

Ministry of Development, Industry and Foreign Trade

(Secex / MDIC), export volumes in 2013 (Jan-Nov) were

up 4.1% year on year and export earnings were up 1.5%.

Sawnwood accounted for the bulk of 2013 exports at

51,960 tons. Exports of sawnwood earned US$42.2

million, 5.9% more than in the same period in 2012.

The second ranked export product was solid wood profiles

at 23,722 tons (Jan - Nov 2013) up 4.5% compared to the

22,694 tons recorded in 2012. 2013 revenue from exports

of solid wood profiles totaled US$42.4 million, compared

to US$ 42.8 million of the previous year.

In the first half of 2013 export revenues declined despite

an almost 7% increase in export volumes however, during

the second half of the year prices recovered.

Furniture exports slipped in 2013

The indications are that Brazil‟s furniture exports in 2013

will be some 15% down on levels in 2012. Despite the

weaker than expected 2013 export performance the

furniture sector expanded output by over 6%.

It is expected that 2014 wooden furniture exports will be

higher than in 2013 which will support further expansion

of domestic production.

According to a study by the Institute for Industrial and

Market Studies (IEMI), while exports slipped in 2013,

furniture imports increased by over 6% to 13.5 million

pieces.

The IEMI study shows that exports accounted for 3% of

furniture production in 2013. An expansion of furniture

imports has been observed since 2010 and in all

subsequent years.

Furniture manufacturers are concerned that the withdrawal

of the tax relief provided through a reduction in the IPI tax

(tax on industrialized products) will undermine

competitiveness especially as they also face rising interest

rates.

¡¡

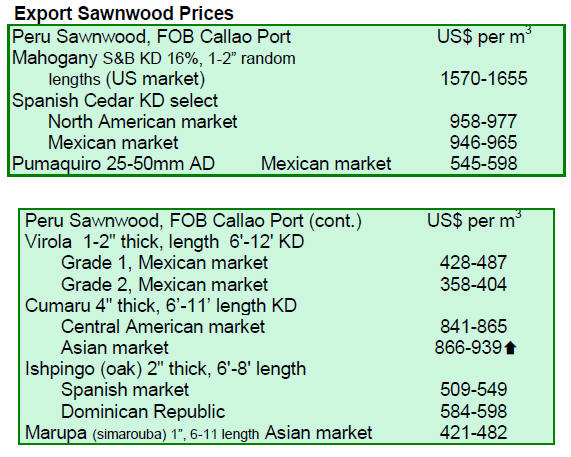

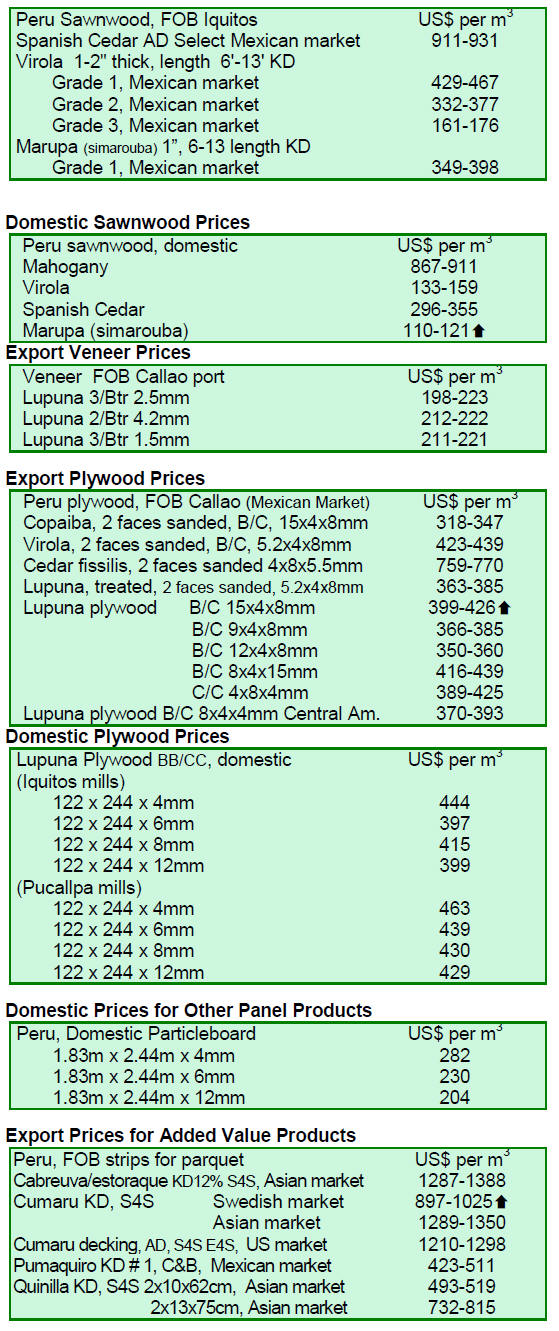

8. PERU

Ambitious forest concession plan launched

The Agriculture Minister Milton Von Hesse, said his

ministry has an ambitious forest concession plan for this

year and is aiming to attract large scale investments and

entrepreneurship to support sustainable forest

management.

In support of this the Director General of Forestry and

Wildlife explained that the agency was working with

regional governments to determine production forest

stocks.

In this regard the minister said that by the middle of this

year inventories will be concluded in Ucayali and San

Martin. The forest inventory in the Loreto region has been

completed and work is now underway to delimit

concession areas. By late 2014 the first series of forest

concessions will be offered and it is hoped these will

attract international companies.

Financing for production forestry

Agrobanco will continue its financial support for

responsible forestry enterprises. The business manager of

Agrobanco, Hector Liendo, said that Agrobanco is the

only Peruvian financial entity offering credit to promote

the production forest sector.

Agrobanco supports investment in commercial logging,

reforestation with native species, conservation of forests

and wildlife and as such helps create employment

opportunities in the sector.

Liendo also said Agrobanco is in a position to provide the

same level of finance as in 2013 and can support

requirements for working capital and fixed asset purchases

allowing entrepreneurs and small timber producers to

purchase machinery enabling them to work efficiently

within the requirements of the Forestry and Wildlife Act.

¡¡

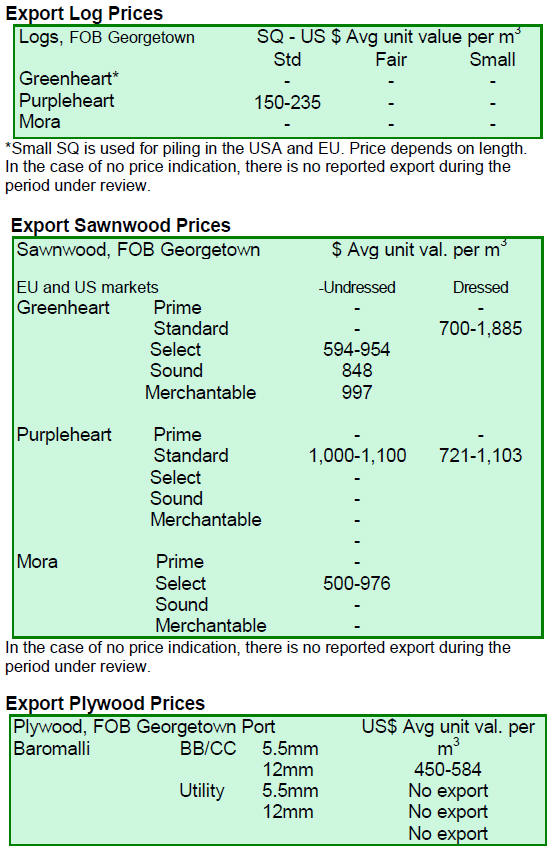

9.

GUYANA

Log market quiet over holiday period

Over the holiday period the market was understandably

slow. There was no export of greenheart and mora logs

and it was only for purpleheart that there was some trade

with Standard sawmill quality logs securing a fairly good

FOB price of US$235 per cubic metre. The primary

market for the export of purpleheart logs was Asia.

But, shipments of sawnwood continue unabated

Despite the holiday season, sawnwood maintained a

healthy presence in the export market. Undressed

greenheart managed to secure favourable prices on the

export market.

For Undressed Select quality greenheart the top end FOB

prices fell from US$1,145 to US$954 per cubic metre,

while for Undressed Sound category greenheart sawnwood

the market price was only fair at US$848 per cubic metre.

For Undressed Merchantable quality greenheart, top end

price were more positive, increasing from US$721 to

US$997 per cubic metre, FOB. The major market for

Undressed greenheart was the Caribbean, Europe and

North America.

FOB prices for Undressed purpleheart changed with Select

category earning as much as US$1,100 per cubic metre.

The main market for this Undressed purpleheart was New

Zealand.

Undressed mora prices held firm in contrast to the

previous period and for Select category sawnwood price

were around US$976 per cubic metre FOB. For

Merchantable qualities the FOB price was US$500 per

cubic metre with Europe and North America being the

main market.

Dressed sawn greenheart export prices were favourable

and top end prices were as high as US$1,885 per cubic

metre FOB in markets ranging from the Middle East and

the Caribbean.

Dressed purpleheart sawnwood prices remained relatively

stable during this period compared to the previous period

and top end FOB prices slipped from US$1,187 to

US$1,103 per cubic metre with the Caribbean being the

major market.

Plywood prices unchanged

Prices for Baromalli (Castostemma commune) plywood

remained steady at US$584 per cubic metre FOB, a level

that has been unchanged for months. Guyana plywood

attracts buyers in Central America and the Caribbean.

Roundwood products such as piling, poles and posts made

a positive contribution to export earning. Greenheart piling

top end prices reached US$712 per cubic metre FOB in

the US market.

Wallaba transmission poles were in demand in the

Caribbean earning as much as US$834 per cubic metre

FOB, while wallaba posts secured a fairly good price of

US$649 per cubic metre also in Caribbean markets.

Wallaba shingles (Splitwood) exports were fair securing

prices in the region of US$977 per cubic metre FOB.

Guyana‟s added value products were in demand over the

holiday season .Guyana‟s beautiful crafted and exotic

timber species were utilised to create items which found

their way to the Caribbean markets.

¡¡