|

Report

from

Europe

Changes in European flooring sector

The European flooring sector is going through a major

period of change, and is also a good indicator of what is

happening in the wider European timber industry.

It's a valuable source of information on the latest economic

and fashion trends, and one of the few sectors where it is

possible to analyse directly the competitive position of

wood in relation to non-wood materials.

On this last issue, the flooring sector clearly demonstrates

how technological innovation in other material sectors

continues to put enormous pressure on wood's market

position. It shows how the European wood sector is

fighting back with initiatives focusing heavily on high

product quality and strong environmental performance.

It also shows how the European wood sector is responding

to weak and negative growth in domestic markets by

targeting export markets in other parts of the world,

notably China. In doing so, it is seeking to exploit its

particular strengths in the fields of design, technical

innovation, product quality, and environmental

performance.

More positive news for wood flooring in Europe

The Board of Directors of FEP, the European wood

flooring association, met recently to discuss the market

situation and recent economic indicators. There was some

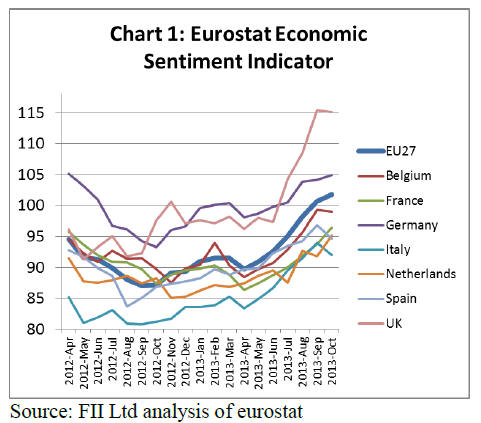

positive news: the latest Economic Sentiment Indicator of

the EC continued its upward trend, increasing sharply both

in the euro area and in the EU.

In October 2013, the indicator rose for the sixth successive

month in both regions, marking a two-year high in the EU

(Chart 1).

Information provided by individual country

representatives at the meeting indicated wide variations in

market conditions at country level. However, overall they

suggested that production fell further in the first half of

2013. Market conditions have also remained difficult in

the second half of the year. Only slow recovery is

expected in 2014.

The situation in individual European markets is as follows:

• Austria - harsh weather conditions in Austria led

to a 2% decline in wood flooring consumption in

the first half of 2013 compared to the same period

in 2012.

• Belgium: wood flooring consumption contracted

by more than 5% year-on-year in the first six

months of 2013. However there are some early

signs of economic improvement.

• Denmark: after a stable first quarter, wood

flooring sales have been declining in recent

months. Sales in the first six months of 2013

were 4% behind the same period in 2012.

• Finland: wood flooring consumption decreased

by 3% in the first half of 2013 compared to the

same period in 2012.

• France: wood flooring sales in the first half of

2013 were 10% less than the same period in

2012. French manufacturers blame weak

consumer confidence and lack of political action

to solve underlying economic issues such as

declining competitiveness and high debt.

• Germany: wood flooring sales in the first half of

2013 were similar to the same period the previous

year. Prospects are improving as the construction

sector is now performing well. The number of

building permits issued has been rising this year.

• Italy: after a poor year in 2012, wood flooring

sales fell a further 11% in the first six months of

2013 compared to the same period in 2012. The

Italian woodworking industries as a whole are

going through an extremely difficult time, losing

up to 25% of sales this year. Italian

manufacturers are losing competitiveness, partly

due to high taxes and labour costs. Imported

products have also benefited from a more

favourable EUR/USD exchange rate.

• The Netherlands: having fallen heavily in

previous years, the wood flooring market has

stabilised at a low level. Sales in the first half of

2013 were similar to the same period in 2012.

The renovation market is now performing well

but this has not yet led to a significant rebound in

wood flooring demand.

• Norway: although construction of new buildings

has weakened slightly this year, demand for

wood flooring has been growing slowly this year.

Sales in the first half of 2013 are estimated to

21 ITTO TTM Report 17:22 16- 30 November 2013

have been 2% higher than the same period in

2012.

• Spain: there‟s still no sign of any improvement

in the Spanish market for wood flooring. Sales

were down a further 10% in the first half of 2013

compared to the same period in 2012.

• Sweden: wood flooring sales were 3% down in

the first six months of 2013 compared to the same

period in 2012.

• Switzerland: wood flooring sales were slow in

the first quarter of 2013, but recovered well in the

spring. Sales for the first half of 2013 were 2%

higher than the same period the previous year.

However manufacturers claim the market is

increasingly flooded by products ¡°of dubious

quality¡± which is undermining the image of real

wood flooring.

Slow recovery forecast in the UK wood flooring sector

In the absence of a large domestic wood floor

manufacturing sector, the UK is not represented at the FEP

meetings.

However it is a large consuming market for imported

wood flooring. Insights into recent trends and future

prospects in the market are provided in a new report by

AMA Research entitled ¡°Wood and Laminate

Floorcoverings Market Report ¨C UK 2013-2017 Analysis¡±.

According to the report, in 2012 the wood flooring sector

(solid wood, engineered wood and laminates) accounted

for 16% value share of the total UK floor coverings sector,

estimated to be worth some £1.7 billion. At around £284

million in 2012, market value has risen marginally since

the low of £281 million in 2011. However, market value

last year was still 26% lower than the peak of £385 million

achieved in 2007.

The report suggests that sales of wood laminates fell by

30% in value terms 2007-2011. However sales of

laminates were still worth around £166 million in 2012

and accounted for 58% of the total UK wood flooring

market. Wood laminates remain one of the most popular

products in the DIY flooring sector.

In recent years, there has been a shift in focus from cutprice,

bargain-basement laminated wood flooring products

to higher-quality products. Sales of higher-margin and

more desirable products have helped to offset some of the

decline in DIY flooring sales in recent years.

There are indications that the UK laminate market has now

„stabilised‟, with suppliers reporting a rise in sales during

2013 for the first time in many years.

In 2012, sales of solid and engineered wood floors in the

UK were worth £104 million. Although still holding a

smaller share of the overall UK market, these products

have outperformed laminates in the UK in recent years.

Solid and engineered wood flooring is more focused on

the middle to upper sectors of the market which has been

less volatile than the low end of the market. Sales of solid

and engineered wood flooring declined 16% in the 2007 to

2011 period and the market returned to growth in 2012.

The report notes that imports dominate the UK wood floor

coverings market, with the value of imports reaching a

seven-year peak in 2010 before falling again 2011-12.

China remains the key source country, accounting for over

half (53%) of imports, in value terms, in 2012.

The contract sector accounts for around 44% of the market

for wood floors in the UK. This sector has been less

volatile than the domestic sector since the start of the

recession.

The contract sector recovered well in 2012 when it was

estimated to be worth around £124 million. The domestic

sector accounts for an estimated 56% value share of the

total UK wood floors market and was worth £160 million

in 2012.

Looking ahead, the total value of the UK wood flooring

market is expected to rise by 1% in 2013 to reach £286

million. The market is forecast to experience 1-2% annual

sales growth between 2013 and 2016 when value is

expected to reach around £305 million. That is still 21%

below the pre-recession peak of £385 million in 2007.

Growth in the domestic sector continues to be constrained

by the slow pace of recovery in the housing sector.

However demand should be positively influenced by

government incentives aimed at stimulating home buying

and housing output.

Recovery for key commercial sectors is likely to be

moderate, at best, in the short to medium term. Rising

demand from commercial buyers will be offset, to some

extent, by lower demand in the public sector.

European laminate producers report on new-season

fashion trends

According to the Association of European Producers of

Laminate Flooring (EPLF), manufacturers are preparing

for the 2014 laminate flooring season with a range of

creative decoration ideas. The wood look is still very

dominant and there continues to be a strong fashion for

longer and wider plank sizes.

Oak continues to dominate wood decors with its almost

inexhaustible decorative potential. Yet floors with the

appearance of delicately-grained ash or elm, or rich

softwoods such as spruce and larch, are also rapidly

gaining in popularity. In general, demand for decor that

resembles elegant wood varieties is on the rise.

Dark colours have seen a slight decline, with the

collections of European manufacturers instead presenting

a varied spectrum of natural grey and beige tones ¨C a trend

that originated in the field of interior decor and which is

now being adopted by the laminate flooring sector. A

considerable amount of wood decor in the laminate sector

no longer appears in its "natural" version, but rather with a

discreet white or grey haze.

Laminate producers have also invested heavily in so-called

¡°synchronisation technology¡± which matches surface

structures with the relevant decor image. This allows

production of rustic boards which not only look authentic

but also feel like the real thing.

Modern synchro-pore printing enables the authentic

transfer of a wide variety of surface structures, from fine

veins and pores to deep, distinctive knots.

Building on this technology, the rustic "used look"

remains the key theme in European laminate flooring

ranges. This appears in several varieties of commercial

products, from construction timber styles with imitation

cement traces, to laminate flooring that feels brushed,

planed or freshly sanded.

This rustic nature particularly comes into its own in the

new rural-style wooden floorboard collections, which are

increasingly being offered in longer and wider floorboard

sizes.

European laminates industry emphasise premium

quality in product promotion

Members of the EPLF are to being encouraged to use an

assertive new slogan - 'Quality and Innovation made in

Europe' - as a common foundation for their marketing

efforts. The new slogan highlights the various core values

that EPLF believes are inherent to European laminate

flooring products.

According to EPLF, these values are ¡°certified quality,

mature technology, excellent usage characteristics, ecofriendliness,

and products that are pleasing to the eye and

the touch ¨C combined with ever new and creative

designs¡±.

According to Volkmar Halbe, Chairman of the EPLF's

Market and Image Committee, "among wholesalers, the

EPLF registered trademark has already established itself

as a mark of quality in laminate flooring. The new slogan

now conveys a clear statement of quality to the customer.

The same quality implied by the label is what you'll find

inside the product. We are the world's quality and

technology leaders. That's our USP. The new slogan

enables EPLF members to communicate this pithily and

effectively."

The slogan is intended to identify the quality of EPLF

members, especially in the growing export markets outside

Europe.

Volkmar Halbe says ¡°in some foreign markets, especially

China, more and more products are appearing that

purport to satisfy load classes specified by the EN-13329

standard ¨C but testing proves that this is not the case.

Cheap imitations put the reputation of the whole laminate

flooring industry at risk. We simply will not tolerate this.

The EPLF is actively working to counter fake labelling.

We hope that the new logo will help to support legal

action taken by our members in cases of fake labelling by

third parties.¡±

European laminate flooring producers target Chinese

domestic market

Much of the dialogue in the European wood flooring

sector in recent years has focused on the rising tide of

competition from Chinese manufacturers in their domestic

markets. However, judging by recent reports from the

EPLF, there is a growing focus by European

manufacturers seeking to capture a larger share of the

Chinese market.

Europe‟s flooring manufacturers have recognised that their

domestic markets are unlikely ever to recover the ground

lost during the recession. Future opportunities for market

development are now seen as heavily concentrated in other

regions.

China is seen as a particularly attractive target. US market

research organisation Catalina Research estimate that total

flooring sales throughout China amounted to 3.9 billion

m2 in 2011 and forecast that demand for new floors will

increase by 149 to 177 million m2 per year at least until

2025.

In addition to the growth of China‟s overall market,

European manufacturers reckon that there is significant

potential for high-end laminated products to capture more

market share. According to Catalina Research, in 2011

laminate flooring made up just 4% of China‟s market (156

million m2), with solid wood and bamboo floors

accounting for 4% (156 million m2).

This compares to tiles, which represented a massive 75%

(2.93 billion m2) of all flooring products sold in China in

2011, carpets with 9% (351 million m2), and elastic floors

with 5% (195 million m2).

Several years ago laminate flooring began to be

manufactured in China, causing the import market for

European manufacturers to collapse. In 2012 China

produced 28% of the world's laminate flooring, moving

into the top spot for the first time (with Germany

accounting for 27%).

However, European manufacturers report that sales of

their branded products in China also began to recover in

2012. Imports into China and Hong Kong of high-quality,

specialist brand-name goods manufactured by European

companies once again exceeded 3 million m², after having

fallen to 2.3 million m2 in 2011.

Several European manufacturers, such as Pergo, Skema

and Unilin, are already active on the Chinese market, and

they could soon be joined by other names.

European manufacturers believe the high-end segment of

the Chinese market offers particular potential for

European-made quality laminate flooring. European

manufacturers are seeking to position themselves

unambiguously in the premium segment, for example

through widespread of their new slogan (see above).

EPLF believes there is a growing demand in China for

genuine European-made flooring which is subject to strict

EU norms, meeting very high standards of product quality,

sustainability and eco-friendliness. According to Volkmar

Halbe, Chairman of the EPLF's Market and Image

Committee, ¡°because Chinese customers are increasingly

demanding these qualities, Chinese manufacturers will

quickly attempt to catch up. But the EPLF is convinced

that European manufacturers, with their production

expertise, are well positioned to maintain the lead over

Chinese competitors¡±.

Particular efforts are being made to influence interior

designers for commercial premises and affluent private

clients in China. For example, according to Raffaele

Ferrara of Italian manufacturer Skema, "interior designers

are focusing on Western style and importing European

tastes into the Chinese market. Grey and beige decors, in

vogue in Europe for the past couple of years, are also

doing very well in Chinese cities. In general, light and mid

tones are very popular, while walnut and smoked oak are

the dark decors of choice. Recently we have also seen a

rise in demand for high-quality synchro-pore finishes.

Formats are changing too: in addition to standard boards

the Chinese market is slowly but steadily acquiring a taste

for long board and tile formats."

¡¡

|