|

Report

from

North America

Hardwood plywood imports from China, Indonesia up

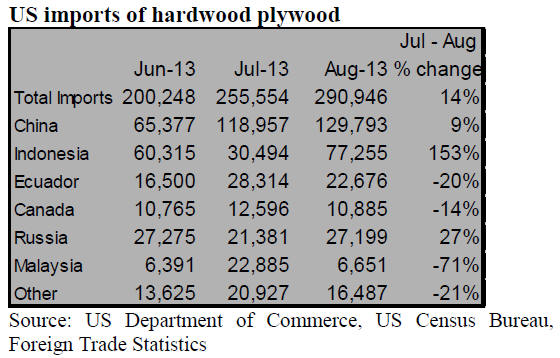

US imports of hardwood plywood grew by 14% to

290,946 m³ in August. Higher shipments from China and

Indonesia accounted for much of the growth. Year-to-date

imports were 11% higher than in August 2012.

Imports from China were 129,793 m³ in August, up 9%

from July. Imports from Indonesia recovered after

dropping steeply in July. August shipments were 77,255

m3, and year-to-date imports were 125% higher than at the

same time last year.

Ecuador‟s shipments fell from last month to 22,676 m3,

but on a year-to-date basis US imports from Ecuador were

more than four times higher than in August 2012.

More hardwood moulding from Brazil

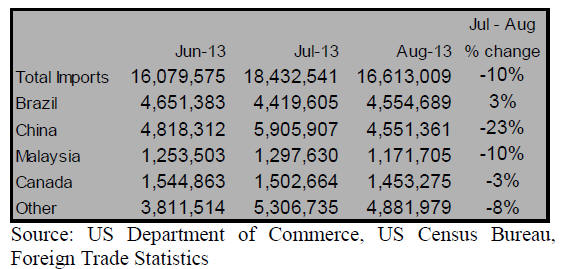

Hardwood moulding imports fell to $16.6 million in

August, after they surpassed $18 million in July. Despite

the decline in total imports, Brazilian manufacturers

increased shipments to $4.6 million, up 3% from the

previous month.

All other major suppliers shipped less than in July.

Imports from China fell by 23% to $4.6 million in August.

Malaysian shipments declined by 10% to $1.2 million.

Indonesia remains largest hardwood flooring supplier

despite drop in August shipments

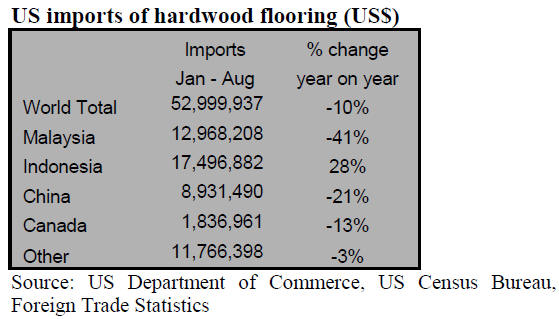

Imports of assembled flooring panels remained almost

unchanged from the previous month at $14.9 million, but

hardwood flooring imports grew by 14% to $3.1 million.

Hardwood flooring imports from Indonesia fell to

$861,000, down 34% from July. Malaysia shipped

$919,000, up 133% from the previous month. On a yearto-

date basis Indonesia remains the largest hardwood

flooring supplier, followed by Malaysia and China.

Wooden furniture imports from Mexico and Indonesia

up

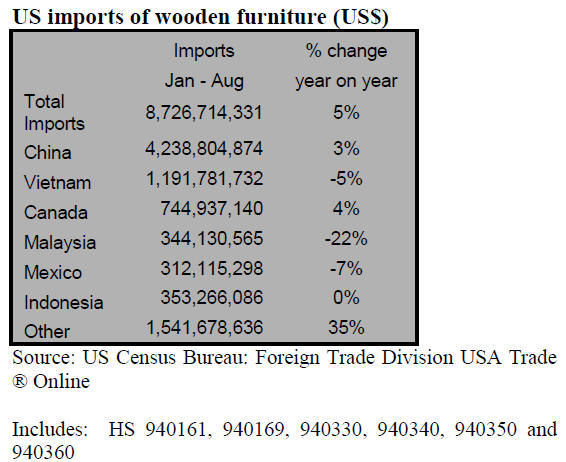

US imports of wooden furniture remained around the $1.2

billion mark in August. Year-to-date imports were 5%

higher than in August 2012. Imports from China and

Vietnam declined in August, while imports from Mexico

and Indonesia were up.

China‟s furniture shipments to the US were $585.8 million

in August, down 7% from July. China‟s market share in

total US furniture imports in 2013 remained unchanged

from the previous year at 49%.

Imports from Mexico‟s were worth $49.7 million (+11%).

Imports from Indonesia grew to $51.6 million (+3%) and

Malaysian shipments were worth $47.9 million (+1%).

Furniture, wood products manufacturing expanding

Economic activity in the manufacturing sector expanded in

September for the fourth consecutive month, according to

the Institute of Supply Management. Furniture

manufacturing increased, while the wood products sector

reported no change from August.

Raw material prices increased, and wood product

companies reported the highest increase in purchasing

prices of all manufacturing sectors.

The overall economy also expanded in September. Based

on the Institute‟s survey data and past experience, GDP

growth is estimated at 3.3% on an annualized basis.

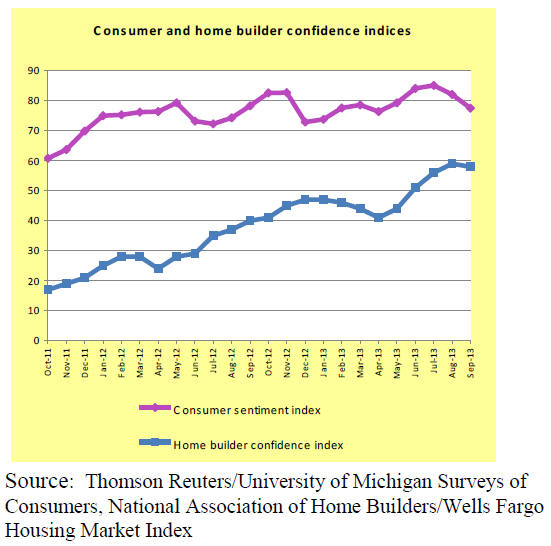

Consumer confidence down

Consumer confidence in the US economy fell in

September, according to the Thomson Reuters/University

of Michigan consumer sentiment index. Consumers are

worried about the government‟s economic policies and

they expect interest rates to rise in 2014.

The consumer survey was carried out before the partial US

government shutdown, and according to other surveys, the

government shutdown led to a steep decline in consumer

confidence in early October.

Builder confidence in the market for newly built singlefamily

homes remained essentially unchanged in

September, according to the Home Builders/Wells Fargo

Housing Market Index.

Factors that deter potential home buyers are rising

mortgage rates and difficulties to obtain credit. Rising

labour costs contribute to higher costs of construction.

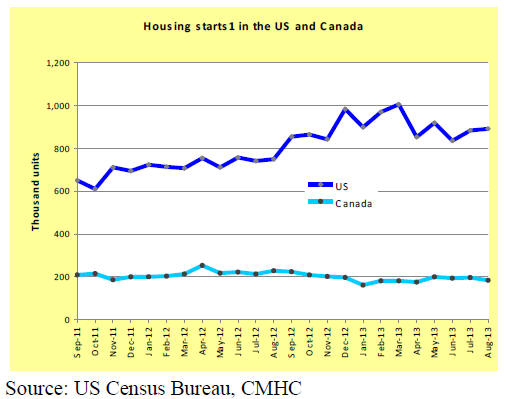

Slow recovery in housing market continues

US housing starts increased slightly in August.

Construction started on 891,000 homes at a seasonally

adjusted annual rate, 0.9% above the revised July estimate

of 883,000. Housing starts are 19% higher than at the

same time last year.

In August, Single-family starts, which account for a larger

share of wood demand than multi-family housing,

increased by 7% to 628,000.

The number of building permits issued declined by 4% to

918,000 in August at a seasonally adjusted annual rate.

The number of permits issued is usually an indicator of

future building activity.

Sales of existing homes increased strongly in July. Sales

rose by 6.5% in July at a seasonally adjusted annual rate,

according to the National Association of Realtors. The

median home price is only 7.3% below its record high in

July 2006, before the financial crisis.

Canadian housing market stable

Canada‟s housing starts declined by 6.4% in August from

the previous month (seasonally adjusted annual rate).

Much of the decline was in multi-family starts in urban

areas.

Demand for existing homes remains strong. Sales of

existing homes grew for the sixth consecutive month in

August. Homes prices increased from the previous month

and compared to August last year.

Growth in non-residential construction projected

Commercial/industrial building construction was the

strongest non-residential sector in August. Construction of

hotels has also grown, but other non-residential building

types have declined, including manufacturing, offices and

education.

Non-residential construction will increase in the last

quarter of 2013 and continue to grow in 2014, according to

surveys by the American Institute of Architects. The

institute projects an overall increase of 2.3% for 2013 and

7.6% for 2014.

No duties on plywood from China

The US International Trade Commission ruled in early

November that there is not enough evidence for injury to

the US wood industry by imported Chinese plywood. The

unanimous ruling overturns the Commission‟s preliminary

determination of injury in 2012. The final countervailing

and antidumping duties that were announced in September

will not be imposed.

The Commission acknowledged that Chinese plywood

was subsidised and sold at less than fair market value. But

this has not harmed the US industry enough to impose

antidumping or other additional duties.

A public report of the investigation will be available after

December 16. The report ¡°Hardwood Plywood from

China¡± can be requested by email from the International

Trade Commission (pubrequest@usitc.gov).

Union calls for stronger enforcement of laws against

illegal logging

The United Steelworkers union supports measures to stop

illegal logging abroad to protect jobs in the US wood

processing industry. The union is the largest in North

America, representing workers in the pulp, paper and

forestry industries, mining, metals and several other

sectors.

The union has called for stronger enforcement of trade and

environmental laws, such as the Lacey Act, in response to

a report on illegal logging published by the Environmental

Investigation Agency. The report describes the illegal

logging and trade from Russia to China and after

processing and manufacturing, to the US market. For

example, illegally logged Russian hardwood is processed

into flooring in China and then exported to the US.

The Environmental Investigation Agency report is

available here: http://eia-global.org/campaigns/forestscampaign/

liquidating-the-forests

|