2. GHANA

Forest Investment Programme fully funded

Ghana has received approval for a US$9.75 million

contribution from the Climate Investment Fund through

the African Development Bank to implement a Forest

Investment Programme.

The funding is intended to help reduce deforestation and

forest degradation, increase carbon stocks and reduce

poverty. This programme will engage communities in land

management to generate financial and environmental

benefits.

About 12,000 people, half of them being women, would

receive support in capacity building and equipment. They

will also benefit from financial incentives through benefitsharing

agreements to develop forestry, agro-forestry and

alternative livelihood activities. The initial stage of the

programme will be piloted in the forest areas in the

Western and Brong-Ahafo regions.

According to the Task Manager for the programme, Mr.

Albert Mwangi, ※Approval of this funding means that

Ghana can ramp up sustainability of its forest sector and

ensure that forest-related communities are both recipients

and creators of effective and climate-smart economic

solutions.§

The CIF was established in 2008, and is one of the largest

fast-tracked climate financing instruments in the world,

which provides developing countries with grants,

concessional loans, risk mitigation instruments and equity

through engaging local communities in REDD+ and

Enhancement of Carbon Stocks (ELCIR+)§ projects.

Inflation leaps by 5.4%

The Ghana Statistical Service (GSS) has announced that,

the producer price inflation year-on-year between

September 2012 and September 2013, increased by 5.4

percent, which represented an increase in producer

inflation by 0.7 percent relative to the rate recorded in

August 2013 (4.7 percent).

The month-on-month change in producer prices between

August 2013 and September 2013 was 1.9 percent.

According to the GSS statement, output in the mining and

quarrying sub-sector declined by 2.8 percent compared to

levels in August.

The GSS further said manufacturing output, which

constitutes more than two-thirds of the total industry,

increased by 1.82 percent to 12.6 percent for the year to

date while the rate of the utilities sub-sector remained

unchanged.

﹛

3. MALAYSIA

VPA talks put on hold

Malaysia‟s Ministry of International Trade has announced

a postponement of talks on the free trade agreement

between European Union and Malaysia.

It seems that this postponement was decided upon to allow

the Malaysian negotiators to focus on the Trans Pacific

Partnership Agreement (TPPA) talks. Analysts are

speculating that the priority previously placed on the VPA

negotiations with the EU may have shifted.

Deputy Minister Hamim Samuri was reported as saying

his ministry would now focus on the completion of the

TPPA talks and then resume the EU-Malaysia free trade

talks.

The EU Ambassador to Malaysia, Luc Vandebon,

reiterated that, upon completion of a free trade agreement

between Malaysia and the EU, both sides would have duty

free access to each other‟s markets which will benefit

exporters.

Malaysia graduated out of GSP

In other news the Trade Ministry announced that from

next year Malaysia will no longer enjoy benefits provided

through the Generalised System of Preference (GSP)

scheme offered by the EU and Turkey.

Malaysia has been graduated out of the scheme because

the country has attained the status of an upper middle

income country according to the World Bank. This change

will not affect exports to Norway, Switzerland, Russia,

Belarus and Japan.

Sabah to secure „Green capital for the future‟

Sabah has just hosted an international conference ※Heart

of Borneo‟s Natural Capital: Unleashing their potential for

sustainable grown in Sabah§.

In his welcoming address, the Sabah Forestry Department

Director Sam Mannan said Sabah commented on the

record low collection of revenues from forest activities

this year, the lowest since 1973.

Revenue from the forestry sector is expected to fall to

about RM 50 million a year for the next 20 years before

rising again as plantation resources begin to be utilised by

the timber industries.

The lower forest revenue collected in Sabah is attributed to

lower harvest levels considered sustainable to ensure, in

the words of the Minister, ※green capital for the future§.

He said the Sabah State government and the timber

industries have made huge sacrifices in the interest of long

term conservation and an endowment for future

generations.

„Heart of Borneo‟ is an initiative between Malaysia,

Brunei and Indonesia, This initiative was signed in 2005 to

protect the biological, ecological and cultural richness of

the rainforests of Borneo. The initiative focuses on the

remaining intact band of forests in the centre of the island

of Borneo.

A Minister in the Sarawak Chief Minister‟s Office

recently announced plans to gazette 20 more parks and

nature reserves in the state to protect the state‟s diverse

biological resources.

This would bring the state closer to reaching its target of

setting aside a million hectares of forests, out of total land

area of 12.4 million hectares, as totally protected areas.

The increase in protected areas will be welcomed as the

state battles wildlife poachers. The Forestry Department

intends to mount a campaign to increase awareness among

the various authorities and public on the seriousness of the

crime of poaching.

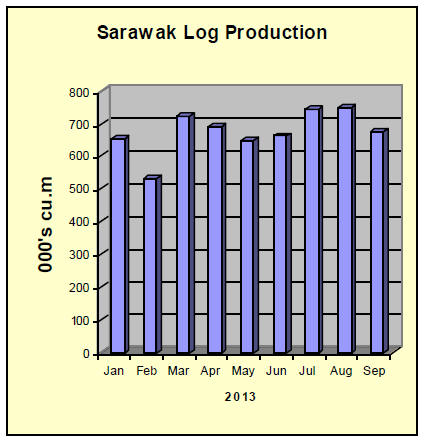

Sarawak log export trends

The Sarawak Forestry department released 2013 log

production statistics.

January 654,930 cu.m, February 530,441 cu.m, March

719,518 cu.m, April 692,012 cu.m, May 645,460 cu.m,

June 660,836 cu.m, July 744,505 cu.m, August 749,163

cu.m and September 674,502 cu.m.

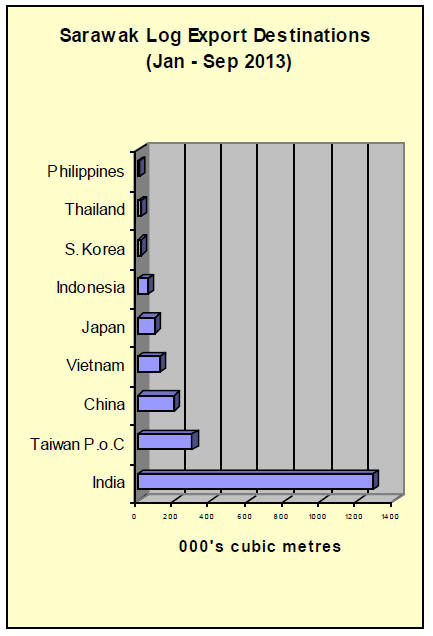

The department also release log export market data for the

period January to September 2013.

China 197,676 cu.m, India 1,282,804 cu.m, Indonesia

53,774 cu.m, Japan 93,600 cu.m, South Korea 19,330

cu.m, Taiwan 294,785 cu.m, Vietnam 123,041 cu.m,

Thailand 15,030 cu.m and Philippines 7,250 cu.m.

The total value of log exports from January to September

was RM 1,253,194,801 (approximately US$ 387.3

million).

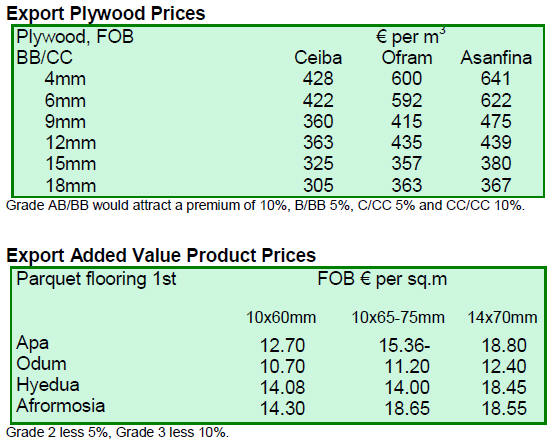

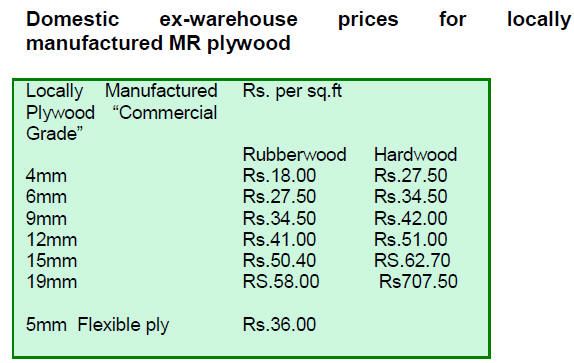

Plywood price indications for late November

Traders in Sarawak provided the following price

indications for export plywood: from Sarawak: FB

(11.5mm) US$680 每 685 FOB, CP (3‟ x 6‟ UCP) US$530

FOB, to Middle East (9 每 18 mm) US$465 FOB, to South

Korea (8.5 每 17.5 mm) US$480 C&F, to Taiwan P.o.C

(8.5 每 17.5 mm) US$450 FOB, and to China/Hong Kong

US$460 每 480 FOB.

﹛

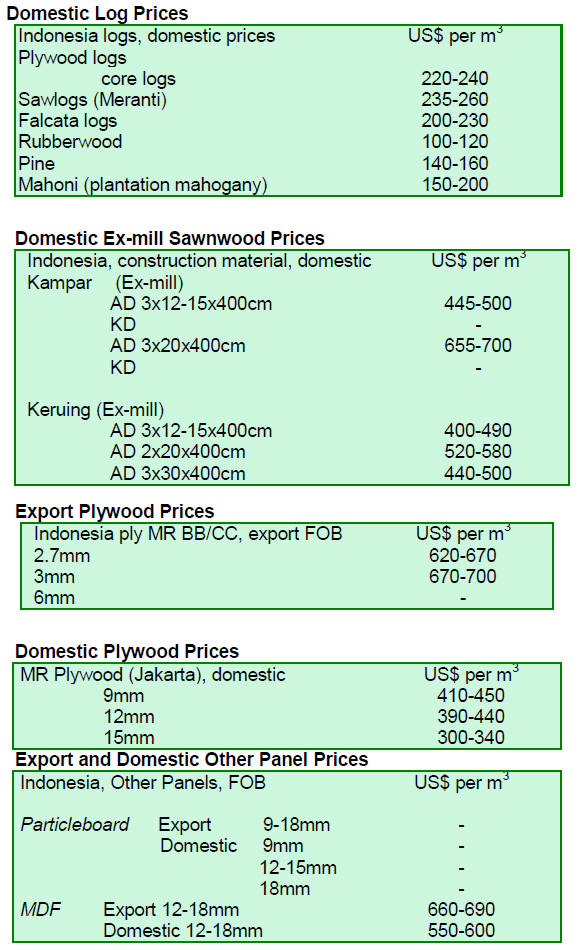

4. INDONESIA

Plans for massive investment in

infrastructure

Indonesia‟s Central Bank issued a press release on the

performance of the economy in the third quarter say, as

anticipated, the economy grew 5.6% in the July-to-

September period from a year earlier, down from 5.8% in

the previous quarter.

For the press release see:

www.bi.go.id/web/en/Ruang+Media/Siaran+Pers/SP_154

313_DKom.htm

The press release says ※The economic slowdown primarily

results from weak investment due to declining growth of

investment in construction as well as weak investment in

non-construction§.

The Bank considers the economic slowdown a result of the

stabilisation policy implemented by the Government and

Bank Indonesia to bring economic growth towards a more

sustainable level. Further, the Bank estimates that

economic growth for 2013 is still within the range of the

previous 5.5% to 5.9% forecast.

To boost growth the government has announced plans for

massive new infrastructure projects which will include

port improvements, new dams and roads as well as

additional power generation capacity. The poor

infrastructure in Indonesia has always been seen as a

handicap to growth.

Forestry Ministry to address rights abuses in the

sector

The Indonesian Ministry of Forestry has indicated it would

review the legal framework for forestry in an effort to

eliminate human rights abuses linked to illegal practices in

forestry.

Forestry Ministry secretary general Hadi Daryanto said

※We are open to suggestions to improve the framework

regarding timber standards, which has so far not included

terms to protect the rights of indigenous peoples. We will

review the standard for legal timber.§

The recent emphasis on rights abuses comes after Human

Rights Watch (HRW) released the Indonesian version of

its recent report, ※The Dark Side of Green Growth: Human

Rights Impacts of Weak Governance in Indonesia‟s

Forestry Sector§, regarding mismanagement in Indonesia‟s

forestry sector.

See the HRW press release at

www.hrw.org/reports/2013/07/15/dark-side-green-growth

HRW urged the government to improve the timber legality

standard, saying that the Forest Law Enforcement,

Governance and Trade Voluntary Partnership Agreement

(FLEGT-VPA) signed with the EU in Brussels, Belgium,

in September was not enough to curb rights abuses.

Demands to scrutinise forestry crimes

Indonesian law enforcement institutions have been urged

to strengthen their fight against forest crimes after the

Indonesia Corruption Watch (ICW) released a report

estimating that state losses from such crimes could have

been as much as Rp691 trillion (US$62 billion) between

2011 and 2012.

Lalola Estele, a researcher with ICW, said the total losses

had been calculated from 124 cases of forest crimes

recorded by the watchdog from 2011 to 2012.

﹛

5. MYANMAR

Massive jump in log shipments as Indian

buyers return

In October 54,500 cu.m of teak logs and 170,000 cu.m of

other hardwoods were shipped. The total volume of logs

shipped between April to the end of October was 241,000

cu.m of teak and 860,000 cu.m of hardwoods. The October

shipment volume is impressive and is the highest for the

past six months.

As India purchases the largest volume of teak (around

70%) analysts assume that that the stabilised US dollar-

Indian rupee exchange rate has encouraged Indian buyers

to ship logs.

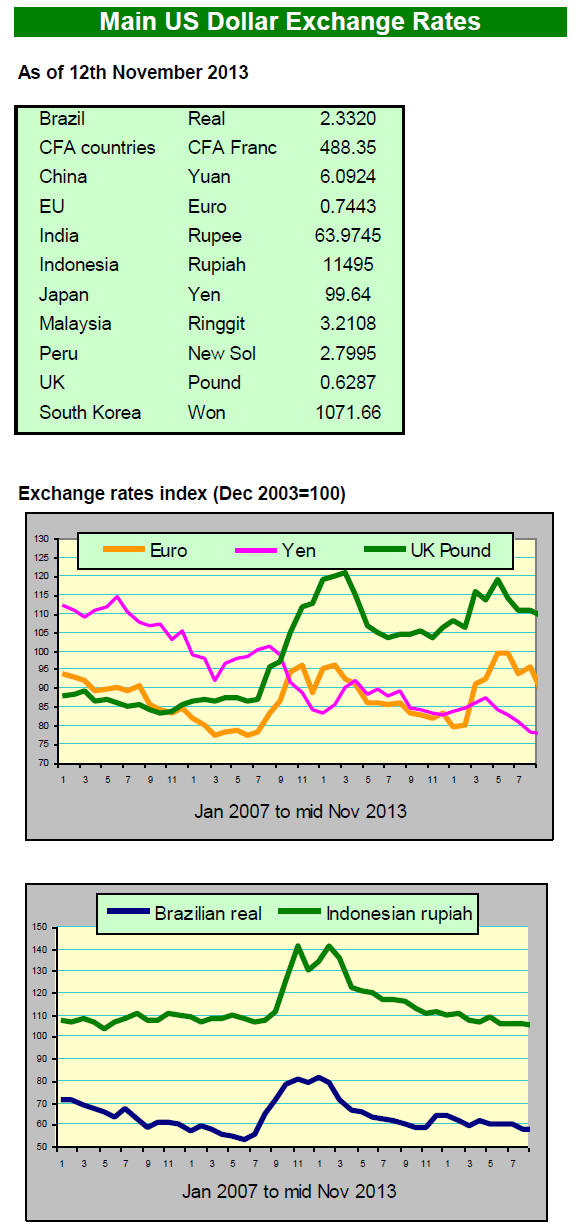

The US$/rupee exchange rate was 54.2491 on 9 May but

fell to 68.7947 on 28August but recovered slightly to

62.4593 on 1 October. Some analysts expect log

shipments to increase with the continued easing of the

pressure on the Indian rupee.

Discrepancies in border trade statistics

The Weekly Eleven newspaper, quoting Ministry of

Commerce sources, reported that, according to China‟s

trade data, forest products valued at US$17 mil. had been

transported overland to Yunnan Province within a single

month. In contrast, figures from Myanmar‟s border

checkpoints show a much lower figure. Analysts say this

sort of discrepancy in the trade data is not a new thing but

requires investigation.

Similar disparities in export/import data appear in the

Myanmar-Thailand border areas. Unrecorded exports

along the Myawaddy and Tachileik trade routes have also

been reported.

Deforestation, an obstacle to alleviating rural poverty

At a recent meeting of the Forest Products Joint Venture

Corporation (FJV), Myanmar‟s Union Minister, Win Tun,

stressed the importance of the country‟s forest resources in

the fight against poverty. He also mentioned that

deforestation was the biggest obstacle to long term

sustainability of the environment.

The Minister explained to the gathering the need to

minimise the depletion of forests and natural resources;

preserve biological diversity; administer proper land use to

combat climate change and to successfully implement

international agreements.

FJV is a joint venture corporation with 45% of the shares

owned by MTE; 10 % by the Forest Department; and 45 %

by the public.

Thilawa special economic zone

Work on Myanmar‟s first special economic zone, the

Thilawa Special Economic Zone (SEZ) is set to begin. The

SEZ is a sprawling complex about 25 kilometres south of

Yangon.

The SEZ is 51 percent Myanmar owned and will have a

deep water port, factories and large housing projects. Last

week Japan‟s Thilawa SEZ Company Ltd. (JTSC) signed a

joint-partnership agreement in Tokyo with Myanmar

Thilawa SEZ Holdings Public Ltd. (MTSH).

The Japanese companies Mitsubishi, Sumitomo and

Marubeni have formed a joint venture to develop the

Thilawa Special Economic Zone. This planned investment

represents Japan‟s largest in Myanmar to date. For more

see:www.marubeni.com/news/2013/release/00056.html

The first challenge facing the government is to reach

agreement with land owners on compensation. The second

major challenge will be to arrange power, water and

transport facilities to service the SEZ.

Of the 51 percent ownership by Myanmar, 41 percent is

private belonging to MTSH. The first stage includes work

on 400 hectares of the 2,400-hectare Thilawa SEZ. In

2015, factories will be finished and infrastructure in the

zone will also be complete.

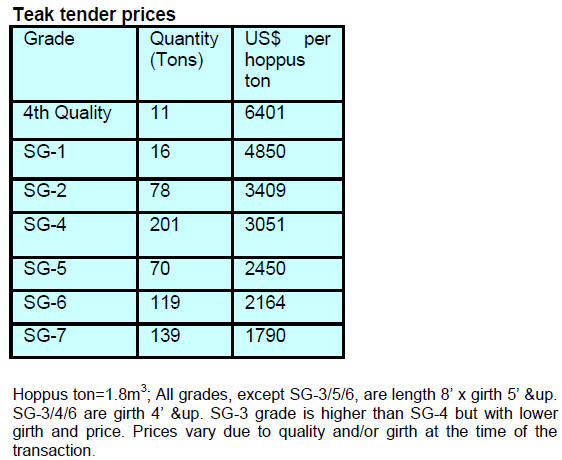

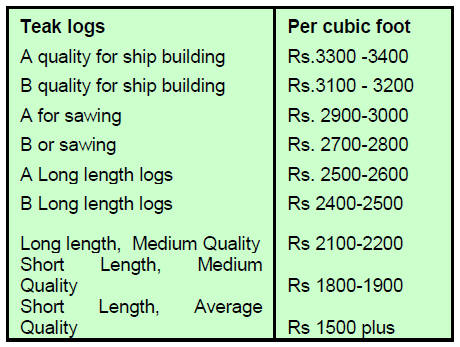

October teak log tender results

The following shows the grade, quantity and prices for

teak logs during the 25 and 28 October tender conducted

by the MTE. The next tender sale will be at the end of

November.

6.

INDIA

Housing market hit by inflation and high

interest rates

Positive economic news continues to drive private sector

sentiment higher. The fact that the rupee/US dollar

exchange rate remains stable is good news for importers.

Quarterly results for industrial production have improved

and companies are looking forward to good financial

results.

The only weak spot is the real estate sector where, despite

attractive offers and discounts made during the Diwali

festive season, unsold homes have reached new highs. At

the end of September figures for unsold housing stock

stood at 711 million square feet as against 670 million

sq.ft at the end of June.

The bad news is that consumer price inflation is eating up

the personal savings and the high interest rates introduced

to curb inflation are also weighing on consumers and

affecting decisions on taking loans for new homes.

This scenario hurts sales of wood and wood products and

the industry hopes the government will introduce measures

to assist those wanting to buy a home.

Farm contract planting to feed plywood mills a reality

TNAU,(Tamilnadu Agricultural University) is the largest

Agricultural University in India and its campus spreads

over 125 ha.. The university does excellent work not only

to help Agriculture but also the Forestry sector through

research and application on tree improvement to increase

opportunities for manufacturing.

In 2011 TNAU developed a hybrid of Casuarina

equisetifolia called MTP CA-1 and 2 which, besides

growing faster and having better form, has a higher

cellulose content. Similar work is underway on eucalyptus,

teak and silver oak.

Recently, the university has been promoting the idea of

contracting farmers to help the plywood industry in

Tamilnadu through the planting of a fast growing new

hybrid Melia dubia, called MTP-1 and 2 which has been

found very suitable for plywood manufacture.

The proposed farm/plantation model involves guaranteed

buy-back and assured prices as well as supportive

mechanism for the growers.

On the environmental front, the cultivation of Melia

dubia trees, it is said, will help reduce atmospheric carbondioxide

through carbon sequestration. This tree

accumulates a biomass of 300 tonnes/hectares in six years

and removes 150 tonnes of atmospheric carbon-dioxide

through sequestration.

Melia grows in a wide range of soils and the logs attract a

price of around Rs 7,500/tonne once at a girth of 20 inches

(approx 50cm.). This could mean a farmer will earn Rs 6-8

lakh per acre (Rs. 1.5-2.0 mil. per ha) within six years.

Contract „farming‟ of tree species is common for the

production of raw material for the pulp and match

industries and more than 30,000 hectares planted in the

State but the idea for „farming‟ for raw materials for the

solid wood product sector is new. As resources from

natural forests come under pressure from growing demand

there is a need for alternate sources to be created.

Western India Forest Depot auctions

Auctions at the Tapti depots of Raj Pipla, Vyara etc. held

from 20th to 25th October 2013 were successful and prices

were firm. Approximately 6000 cu.m of logs were offered

for sale at the recent auction.

Teak logs sales

Average prices recorded at the most recent auction are as

follows:

Bidding at the auction was brisk for fresh teak

logs of

desirable specifications. Unfortunately, for some medium

quality lots bids failed to achieve the reserved price and

went unsold.

Good quality non-teak hardwood logs, such as Haldu

(Adina cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Indian Kino (Pterocarpus

marsupium) having lengths of 3 to 4 metres and girths of

91cms and up fetched prices in the range of Rs.800-900

per c.ft while medium quality logs traded at around

Rs600-700 per c.ft.

Now that the Diwali and Indian New year holidays

are

over, auctions will continue.

Imported plantation teak prices reflect wide variations

in quality

Plantation teak shipments continue to arrive irrespective of

exchange rate fluctuations as India needs to import all

types of wood including teak. Because of changed

specifications and the willingness of importers to accept

logs with smaller girths, prices have declined. On the other

hand some exporters have been shipping higher quality

logs so, for these shipments, prices have improved.

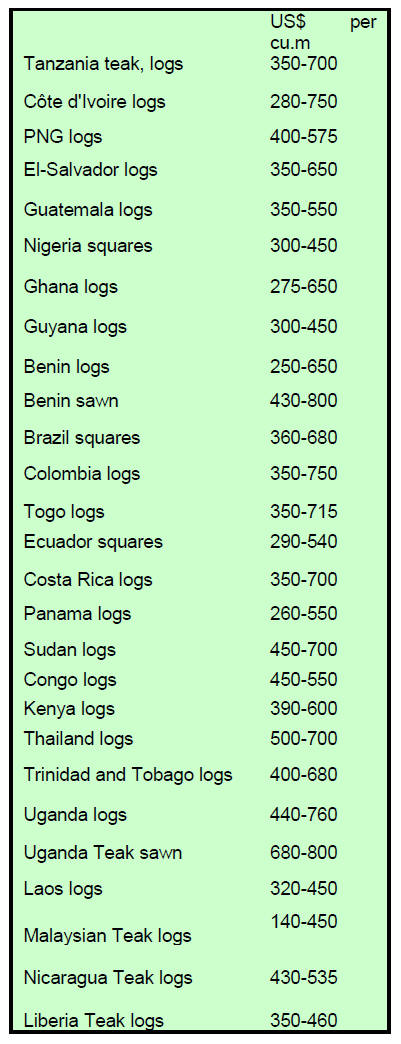

Current C & F prices for imported plantation teak, Indian

ports per cubic metre are shown below.

In the period reviewed Brazilian plantation teak logs

arrived in India at prices ranging from US$ 350-750 per

cubic metre.

Variations are based on quality, length and average girth of logs

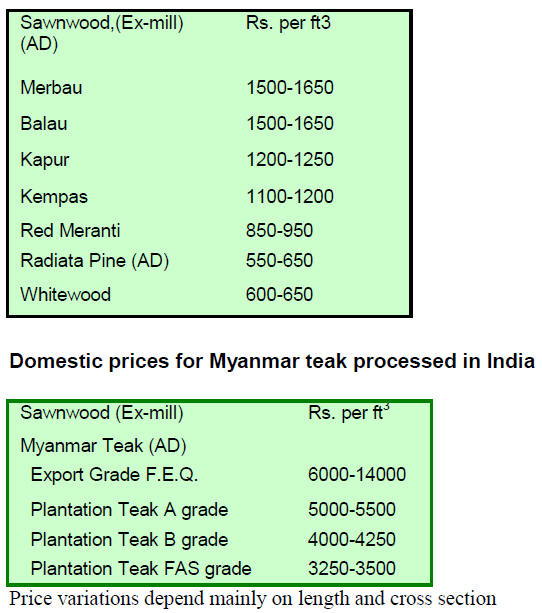

Domestic ex-sawmill prices for air dried

sawnwood cut

from imported logs

Prices for air dry sawnwood per cubic Foot, ex-sawmill

are shown below.

Prices for imported sawnwood

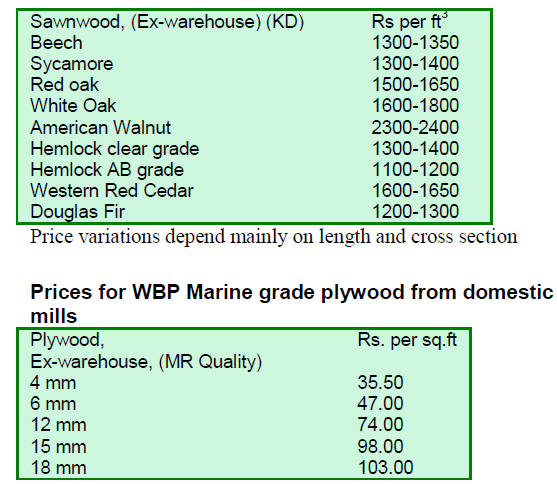

The recent slowing in the Indian economy and the weak

housing market is holding down imported sawnwood.

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

7.

BRAZIL

ABIMCI launches timber sector report

The Brazilian Association for the Mechanically Processed

Timber Industry (ABIMCI), in partnership with the

National Forum of Forest-Based Activities (FNABF), has

published a sectoral study of Brazil‟s timber industry. This

study provides the main socio-economic data and an

overview of the timber industry in Brazil.

The new study presents information such as the trade

balance in the forest-based sector which in 2012 was a

positive US$6.9 billion or 35.4% of Brazil‟s trade surplus

in that year.

The study also shows that the wood processing industries

are responsible for 72% of the output from the forestry

sector with 58,200 active companies.

Furthermore, the forestry sector added direct jobs in 2012

and the total now stands at 735,000. Other information

includes consolidated trade and market data which are

relevant for the development of strategies for the forest

sector in Brazil.

The official launch of the Sectoral Study will take place in

Brasilia in mid-November. ABIMCI also plans to promote

the study. The first phase of this promotion will be in

Europe where the results of the study will be presented to

timber and trade organizations such as the Timber Trade

Federation (TTF), the European Timber Trade Federation

(ETTF), the Global Timber Forum (GTF), the European

Plywood Federation (FEIC) and major importers.

Tax revenues from timber sector fall

The state of Mato Grosso is one of the major timber

producing states in the Amazon region. In the first half of

2013 the Tax on Goods and Services (ICMS) collected

from the forest-based sector in the state amounted to real

33 million.

Despite an increase of real 12 million in taxes collected in

the last two months the semiannual report from the State

confirmed a 10.8% decline in state tax revenue from

forestry compared with that collected in the first half of

2012.

The ICMS tax revenue from the forest-based sector has

fallen 11.6% over the past ten years. Currently, the Center

for Timber Producers and Exporters Industries of Mato

Grosso (Cipem) is working on a proposal for a new

taxation model for the timber industry. The proposal was

discussed recently during a meeting with the State Finance

Secretariat.

Furniture exports fall in January - September period

Bento Gonçalves is the main municipality in Southern

Brazil for the production of furniture. The value of

furniture exports from furniture clusters in Bento

Gonçalves from January to September amounted to

US$42.9 million.

This represents a decline of around 8% when compared to

levels in the same period last year. This performance is

worse than the fall in exports from companies in the state

of Rio Grande do Sul.

Amongst the twenty major markets serviced by exporters

in Bento Gonçalves demand from twelve weakened and

this was most noticeable for neighbouring countries in

Latin America and some countries in Africa. Colombia

remains the main market for furniture from Bento

Gonçalves, accounting for 15% of total state exports.

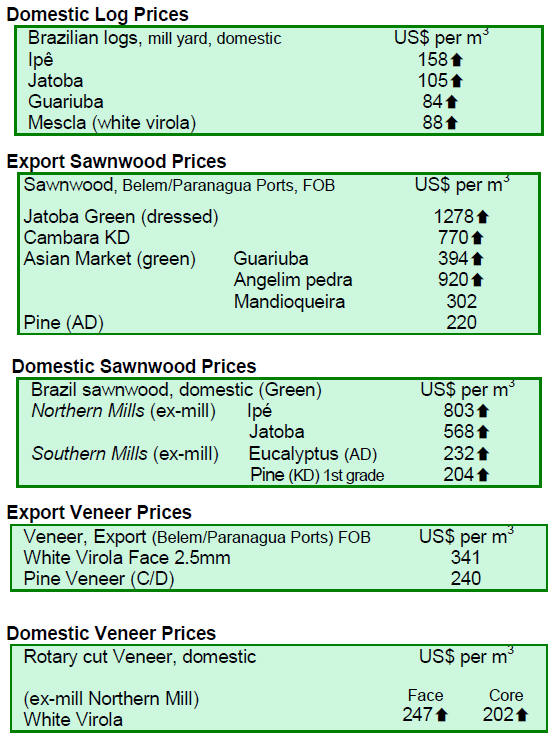

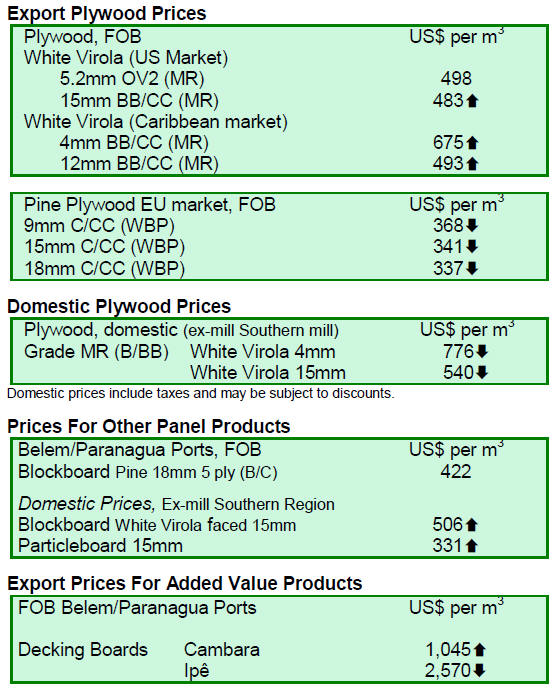

Price trends

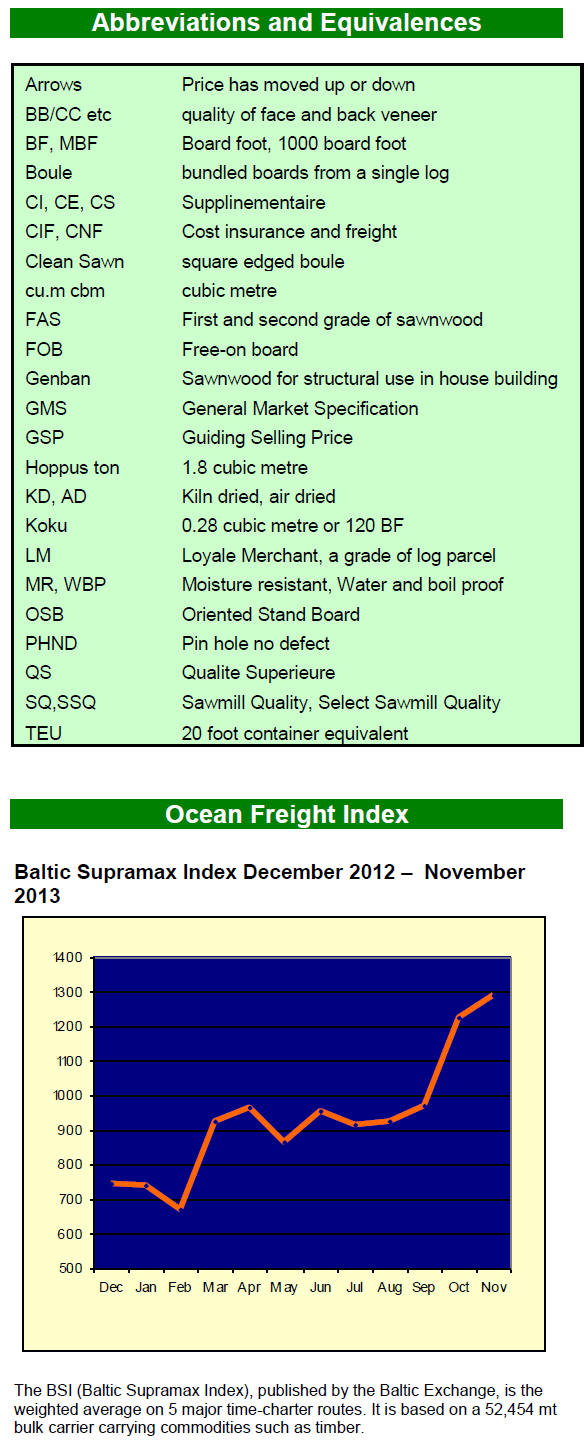

Wood products prices in real increased by an average

0.7% over the past two weeks. Prices in US$, as shown in

the tables, increase by an average of 2.1%.

﹛

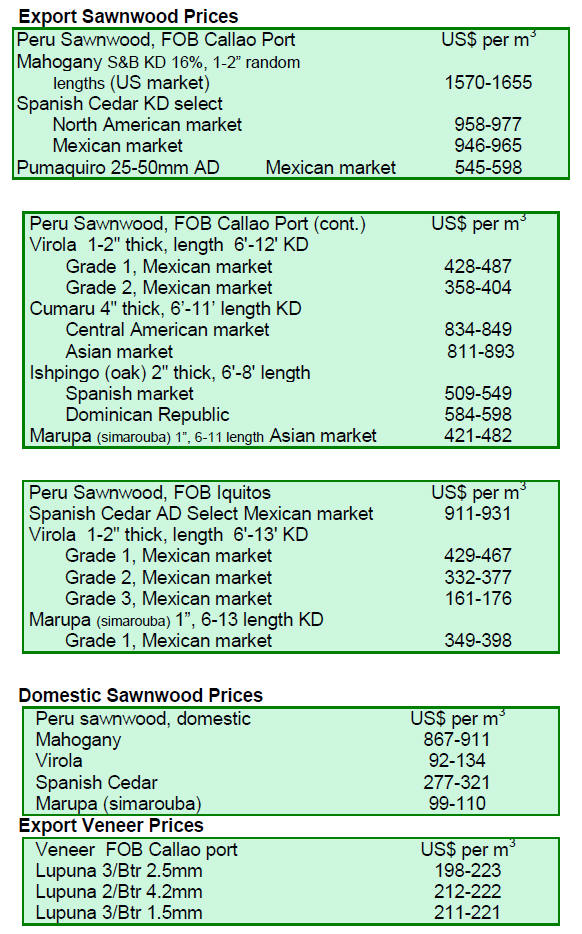

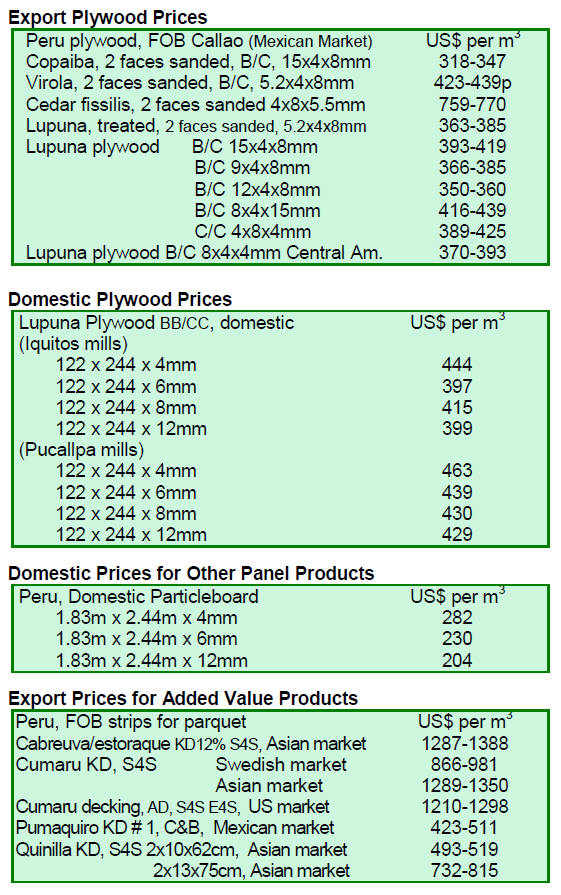

8. PERU

Wood based panel imports reach US$ 78

million

In first eight months of 2013 imports of particleboards

were valued at US$56.2 mil. while imports of MDF

totalled US$22.1 million.

The main supplier of panels was Ecuador, with shipments

valued at US$ 24.4 million and a market share of 43.5%

for imported particleboard. The second largest supplier

was Chile at US$23 million (40.9% market share)

followed by Spain US$4.6 million (8.2% share) and

Portugal US$3 million (5.4% share).

In the first eight months the main importer was Novopan

Peru with purchases worth US$22.1 million and a share of

39.3 % of all imported particleboard followed by Arauco

Peru (21.5%), Masisa Peru (19.4%) and Representative

Martin (9.4%).

For MDF, the main supplier was Chile (US$14.7 mil., 66

% share of total imports) followed by Turkey, (US$2.6

mil. 11.8% share), Uruguay, (US$1.8 mil. 8.2% share) and

Ecuador which supplied US$1.1 mil. for a 4.9%share of

total imports of MDF.

Regulations in support of Forestry and Wildlife law

discussed

The Minister of Agriculture and Irrigation (Minagri)

Milton Von Hesse, presented the details of the Forest and

Wildlife Act No. 29763 to civil society groups which have

until February next year to lodge recommendations and

observations.

After the February 2014 deadline consultations will be

held with indigenous communities as part of the

participatory process.

Already, national participatory thematic working groups

(16) have been formed to facilitate dialogue at the regional

level and to solicit contributions from other ministries

such as the Ministry of Agriculture and Irrigation,

Ministry of Environment, Ministry of Foreign Trade and

Tourism, Ministry of Culture, Ministry of Production, the

Agency for Supervision of Forest Resources and Wildlife

and regional governments.

The Ministry of Agriculture has indicated that this

regulation is complementary to other management tools

that it has developed to strengthen the sector, such as the

approval of the National Forestry and Wildlife law, the

approval of the Rules of Organization and Functions of the

National forestry and Wildlife service which will be the

new authority responsible for the stewardship of forestry

and wildlife.

In addition, there will be the National Forest Inventory

with advice from the United Nations Organization for

Food and Agriculture (FAO) and financial support from

the Government of Finland.

9.

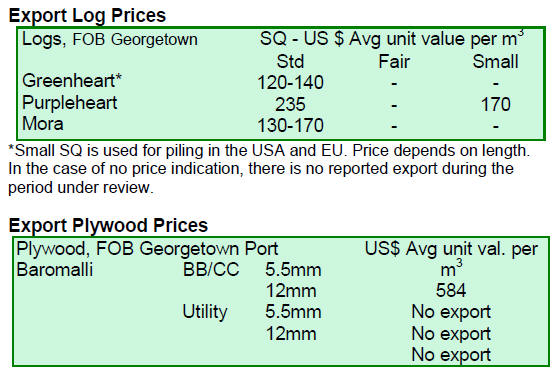

GUYANA

Log exports of prime species resume

For the first time in some weeks log exports of all the

prime species resumed.

Greenheart logs were exported at prices in the region of

US$120 to US$140 FOB per cubic metre.

Prices for purpleheart logs in both the standard sawmill

quality were very favourable at US$235 per cubic metre

FOB for standard while sawmill quality logs achieved

prices of US$170 per cubic metre FOB.

Mora logs remain popular and attracted export prices

ranging from US$130 to US$160 per cubic metre FOB in

Asian and Caribbean markets.

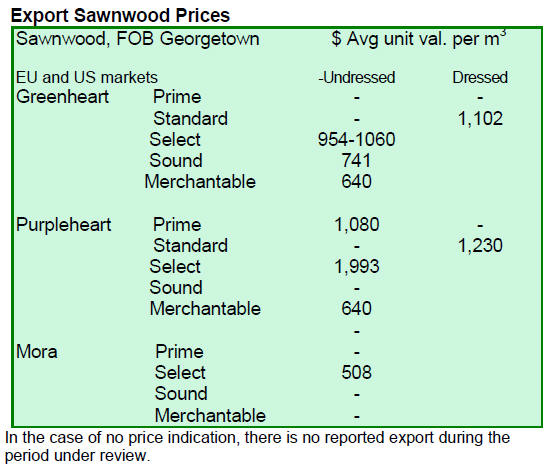

Variable prices recorded for Undressed sawnwood

exports

FOB prices for Undressed sawn greenheart select were

between US$1,060 to US$954 per cubic metre.

In contrast, sound category Undressed sawn greenheart

FOB prices were as high as US$741 per cubic metre.

However, prices for merchantable quality experienced a

decline in top end price from US$679 to US$594 per cubic

metre FOB. The main market for Undressed Greenheart

was the Caribbean, Europe and North America.

Undressed purpleheart sawnwood saw significant price

increases during the period reviewed with Prime category

sawnwood trading at US$1,080 per cubic metre FOB.

This was matched by very attractive price offers for Select

category purpleheart sawn of US$1,993 per cubic metre

FOB sharply up from the previous FOB price of US$1,279

per cubic metre.

For Merchantable quality sawn purpleheart FOB prices

were only fair at US$ 640per cubic metre. The main

markets for Undressed purpleheart sawnwood was the

Caribbean, Oceania (New Zealand) and North America.

Undressed Mora FOB prices held firm in the export

market and only Select category mora sawnwood saw any

price movement where top end FOB prices were US$508

per cubic metre in the Caribbean and European markets.

Caribbean market sustains exports of dressed

sawnwood

Dressed sawnwood from Guyana continues to attract

favourable FOB prices on the export market; the

Caribbean was the only active market during the period

reported.

Dressed greenheart prices declined during the period

reviewed from US$1,272 to US$1,102 per cubic metre

FOB and prices for Dressed purpleheart sawnwood also

dipped slightly from US$1,290 to US$1,230 per cubic

metre.

Plywood was shipped in the period reviewed at top end

prices of US$ 584 per cubic metre FOB for markets in

Central and South America.

Prices for greenheart piles were favourable at as much as

US$613 per cubic metre FOB in markets across Europe

and North America. Wallaba poles exports also made a

notable contribution to export earning as did Splitwood

(shingles).

﹛