Japan

Wood Products Prices

Dollar Exchange Rates

of

26th September 2013

Japan Yen 98.44

Reports From Japan

Be prepared for zero growth in 2014

The Chief Economist at the Japan Center for Economic

Research (JCER), Nobuyasu Atago is warning of a likely

slow down in Japan‟s growth in 2014. For his presentation

see:

http://www.JCER.or.jp/eng/pdf/sa155-eng2.pdf

The JCER economist says in a press release that GDP

grew by an annualized rate of 2.6% during the April–June

period, continuing positive growth from the previous

quarter.

This suggests that the Japanese economy is recovering

well, but these figures do not fully reflect the effects of the

supplementary budget for fiscal 2012 (April 2012 to

March 2013) or the last-minute demand in housing

construction prompted by the impending consumption tax

hike in April next year.

Although these factors will continue to push up growth in

the July–September quarter and beyond, what happens

after the consumption tax rate increases in fiscal 2014

remains to be seen.

JCER is forecasting that the Japanese economy will

continue to expand at an annual rate of over 3% in the

immediate term, and will achieve 2.7% growth in fiscal

2013, owing to recovering external demand, the boost

received from the fiscal 2012 supplementary budget and

last-minute demand before the consumption tax increase

scheduled for April next year.

However, JCER says “it expects growth to slow to around

0.2% in fiscal 2014 as the rebound from factors the

supplementary budget and last minute purchases by

consumers slows resulting in almost zero growth.

The international economy, so crucial for Japanese

exports, is expected to continue its steady recovery. This

recovery will be led by the United States and there are also

indications that the slump in Europe has bottomed out.

In China, on the other hand, there is an increasing risk of

an economic downturn. The Chinese government is

concerned about the risk of a bubble caused by the shadow

banking system and their priority is now to bring an

inflated money supply down.

But it is Japanese domestic demand that will play the most

important role in determining national economic

developments from now on.

The JCER expects an increase and recovery in capital

spending and corporate earnings should improve thanks to

a weaker yen. This will lift profits for listed companies.

There should also be a considerable increase in

consumption and investment in housing as a result of lastminute

demand before the consumption tax rate goes up.

This surge in demand will lift consumption‟s contributions

to real GDP growth for fiscal 2013 by 0.5% and housing

investments by 0.2%. The fiscal 2012 supplementary

budget will also contribute a boost of around 0.6%.

However, a rebound in fiscal 2014 will shrink real growth

by around 1% for consumption and housing investment;

the rebound from the effects of the supplementary budget

will shrink growth by a further 0.3%.

Temporary employment now makes up a large proportion

of the job market, and wage increases are harder to

achieve. These fact ors mean that household budgets are

tight and there is little cash to spare. If real disposable

income or actual net assets shrink as a result of the

consumption tax rate increase or higher prices, there is a

possibility that the negative impact on consumption will

be more severe than anticipated.

In the currency markets, JCER expects the tendency

toward a slightly cheaper yen to continue. Japan will

continue its program of qualitative and quantitative easing,

while in the United States the third round of quantitative

easing (QE3) will be reduced in size in the near future,

perhaps as early as this year. The gap between US and

Japanese interest rates is likely to widen. Based on this,

exports should continue their modest increase.”

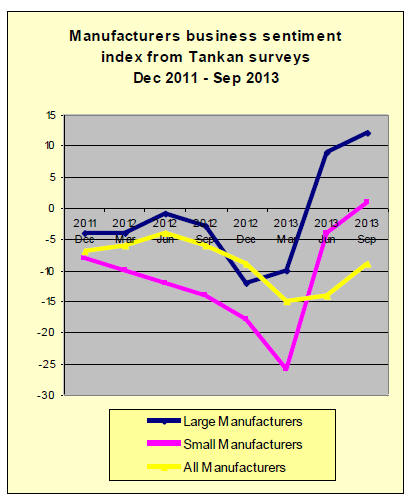

Business sentiment in large manufacturers provides

support for consumption tax increase

The Bank of Japan quarterly survey of business sentiment

(Tankan) was released on 1 October and has provided the

government with the confidence to proceed with plans to

raise the consumption tax in Japan.

The key index which is closely watched the that of

sentiment amongst major manufacturers. In the latest

survey this index rose to +12 from plus 4 in the June

survey. This result was much better than economists had

expected and was the third consecutive quarter of

improvement.

The survey showed that large manufacturers were scaling

back investment plans to the surprise of analysts who

attribute the caution on the part of manufacturers to rising

energy costs.

All nuclear reactors in Japan are now shut down meaning

Japan has to import all fuel for power generation at a time

when the yen has weakened thus pushing up the import

bill.

Sentiment amongst small manufacturers remains firmly

pessimistic but some are reading the change in index from

-14 to -9 as a sign of moderating skepticism.

Growing trade deficit with China

The Japan External Trade Organization (JETRO) has

reported that, in US dollar terms, Japan.s trade with China

dropped 10.8% to US$147.3 billion in the first half of

2013, marking the first drop in four years on a first halfyear

basis since 2009.

In the same period imports from China fell by 6.1% to

US$85.8 billion, marking the first drop since 2009.

Japan.s balance of trade was in deficit by over US$24.4

billion, an increase of 1.4 times over the same period last

year setting a new record on a first half-year basis.

Also, Japan.s global first half exports fell 12.6% in US

dollar terms to US$358.1 billion year on year. The decline

in exports to China was the major reason for the overall

drop in exports.

Outlook for the second half 2013

The Chinese government is now emphasising its structural

reform over economic growth and Jetro considers the

Chinese government is unlikely to implement large-scale

stimulus measures to boost domestic demand. Further,

Jetro says China.s slowing industrial production and

consumption are forecast to continue so Japan.s exports to

China are likely to decline.

In spite of the stable demand for smart phones and signs of

recovery in the Japanese economy, imports from China

will likely see only a small improvement because of

weakened price competitiveness in raw materials and

intermediate goods due to the weak yen. Overall, says

Jetro, the Japan-China trade for 2013 is likely to fall for

the second consecutive year.

For the full Jetro report see:

https://www.jetro.go.jp/en/news/releases/20130820558-

news

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade

journal published every two weeks in English, is

generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese

market.

The JLR requires that ITTO reproduces newsworthy text

exactly as it appears in their publication.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Plywood supply for the first half of this year

Total supply of plywood of both domestic and import for

the first six months of this year was 3,271,500 cbms, 9.6%

more than the same period of last year. Domestic supply

was 9.6% more and imports were 9.6% more. Monthly

average was 317,900 cbms, 27,900 cbms more than the

average in 2012.

In Malaysia, log supply shortage was serious from the

beginning of the year and the export FOB prices soared

then at the same time, the yen got weaker, which pushed

sales prices in Japan considerably. An anticipation of

future high prices stimulated active speculative purchases.

Monthly average of Malaysian plywood was 147,900

cbms, about 20,000 cbms more than 2012. However, since

last spring, the anticipated demand pickup did not

materialise.

The arrivals for March and April were more than 340 M

cbms, which resulted in more than two weeks waiting for

unloading of cargoes in Japan. This led to reduction of

future purchase. Port inventories are expected to drop in

coming months so that the supply and demand should

balance out.

In domestic supply, softwood plywood production was

1,266,300 cbms, 11.6% more. The monthly average was

211,000 cbms, about 22,000 cbms more than 2012. Also

the shipment was 1,296,500 cbms, 22.2% more than 2012.

Average monthly inventory was 128,200 cbms, which is

about 80 M cbms less than monthly average of 208,400

cbms in 2012.

South Sea (Tropical) logs

In Malaysia, log prices are seesawing between suppliers

and buyers. Log production is recovering after recovery of

weather and vacation season but the demand is active by

purchase of local plywood mills and India so that supply

and demand is balancing.

Some log suppliers are bullish and others are bearish.

Sarawak meranti regular prices are $280-290 per cbm

FOB, unchanged from August. Small meranti prices are

$250 and super small are $220.

They are all flat from August. Sabah kapur regular prices

are firm at $370 due to tight supply of quality logs.

Considering coming rainy season since November,

Japanese buyers wish to have reduced log prices now

while logging season lasts but compared to India, purchase

volume by Japan is too small to take initiative in price

negotiations.

India continues buying necessary volume although they

are reluctant to buy high price logs because of weakening

of their currency rupee. If India strengthens log purchase,

FOB prices would surely go up.

Meanwhile, Japanese plywood mills strongly resist paying

higher log prices.

South Sea hardwood plywood demand in Japan has been

slightly recovering since last month. Log prices in Japan in

late August were about 10,000 yen per koku CIF on

Sarawak meranti regular, 400-500 yen up from early July.

Due to weak yen, future prices would be much higher.

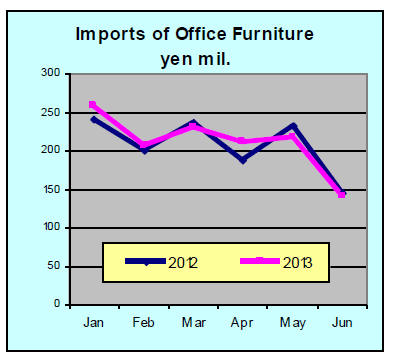

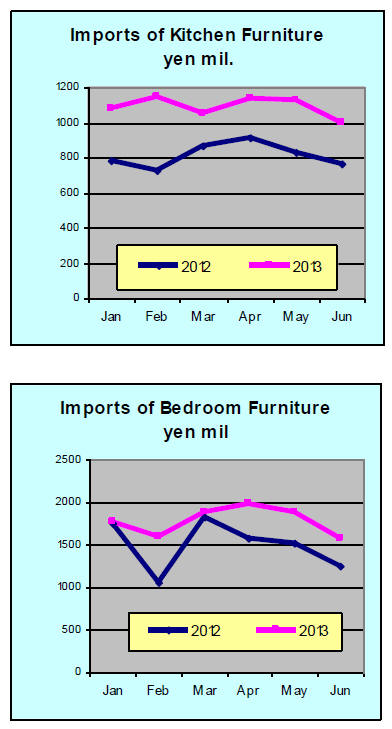

Marked differences in furniture import trends

The following three graphics illustrate the trends in

Japan‟s imports of office, kitchen and bedroom furniture

in the first half of 2012 and 2013.

Overall furniture imports in the first half of 2013 were

higher than in the same period in 2012 but there are

marked differences in the trend for various categories of

furniture.

While 2013 imports of kitchen and bedroom furniture are

significantly higher than in the same period in 2012 the

level of imports of office furniture has not increased.

The low level of office furniture is a reflection of business

activity and investment especially for the small and

medium sized companies. In 2012 many small business

folded and confidence has not returned to this sub sector.

Small companies are not benefiting from the mere

„sentiment‟ that the Japanese economy is improving, they

are finding that sentiment is not translating into significant

new business and as a result are not investing in

manufacturing plant or office furniture

In contrast imports of kitchen and bedroom furniture in the

first half of 2013 are well above that in the same period in

2012.

The driving force behind the growth in kitchen and

bedroom furniture has been the expansion in housing

starts, pre-consumption tax hike purchases and purchases

that were put on hold particularly after the devastating

earthquake and tsunami.

|