|

Report

from

North America

Furniture manufacturing remains fastest growing

industry

Economic activity in the US manufacturing sector

expanded for the second consecutive month in July,

according to the Institute of Supply Management.

The overall economy expanded for the 50th consecutive

month. The fastest growing industry sector was again

furniture and related products. Wood product

manufacturers also reported growth.

US unemployment was 7.4% in July, down from 7.6% in

June, according to the US Bureau of Labor Statistics.

Consumers expect interest rate rise

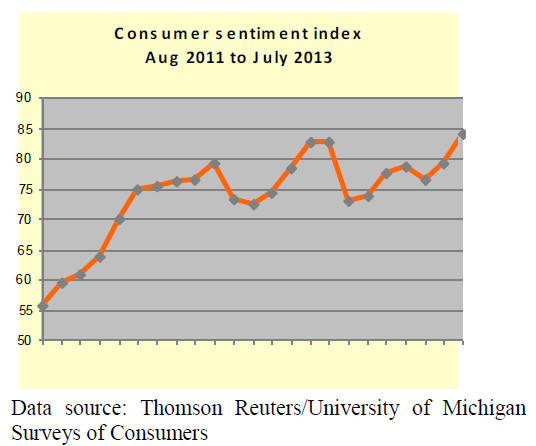

Consumer confidence in the US economy remained strong

in July, according to the Thomson Reuters/University of

Michigan consumer sentiment index. More consumers

(68%) expect interest rates to rise.

A rise in interest rates dampens the longer term economic

outlook, but more consumers plan big purchases ahead of

higher interest rates.

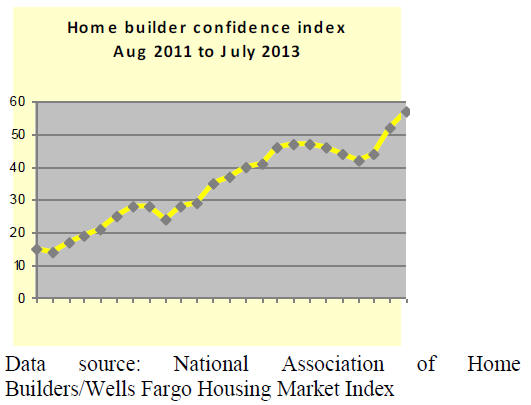

Home builders¡¯ confidence highest in Midwest and

West

Builder confidence in the market for newly built singlefamily

homes was at its highest since January 2006. The

National Association of Home Builders reports a 6 point

increase in July in the Home Builders/Wells Fargo

Housing Market Index, following an 8 point increase in

June. This is despite a relatively slow recovery in housing

starts.

Builders. confidence was highest in the US Midwest,

followed by the West and South. Home builders in the

Northeast were the least confident in the market.

Multi-family construction down, single-family

unchanged

US housing starts declined by 9.9% in June to 836,000 at a

seasonally adjusted annual rate. The decline was primarily

in multi-family construction, which is more volatile in the

US market than single-family home building. Singlefamily

starts remained stable from the previous month.

Housing starts declined in all four regions: US West (-

5.4%), Midwest (-7.4%), South (-12%) and Northeast (-

12.1%).

The number of building permits issued declined by 7.5%

to 911,000 in June at a seasonally adjusted annual rate.

Permits for multi-family housing fell by 21.4%. Singlefamily

permits grew only slightly (+0.6%). The number of

permits issued is usually an indicator of future building

activity.

Existing home sales down, prices up

Sales of existing homes also declined from May to June.

Sales fell by 1.2% in June at a seasonally adjusted annual

rate, according to the National Association of Realtors.

The national median price for existing homes sold was

$214,200, 13.5% higher than in June 2012.

Mortgage rates rose to over 4% in June. Further mortgage

rate increases are expected to moderate the housing market

in expensive areas such as California, Hawaii and New

York City.

Canadian housing starts decline

Canada‟s housing starts declined by 2.5% in June,

according to the Canada Housing and Mortgage

Corporation. Construction started on 200,000 units at a

seasonally adjusted annual rate. Both multi-family and

single-family starts declined. Sales of existing homes grew

by 3.3% in June, at a seasonally adjusted rate. The average

home price was C$386,585 in June, up 4.8% from June

2012.

Canada‟s central bank announced in July that the target

interest rate would remain unchanged at 1%. Mortgage

rates have been steady at around 5% since June 2012.

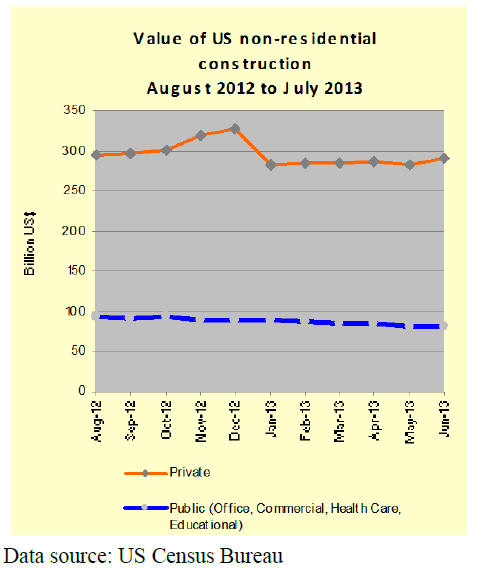

Non-residential construction unchanged

Spending in non-residential construction in June was

virtually unchanged from the previous month, at a

seasonally adjusted rate. However, April and May

spending have been revised upwards.

Architectural firms also reported only a modest

improvement in business conditions in June. According to

the Architecture Billings Index, firms in the US Northeast

and the South perform better than in the Midwest and

West.

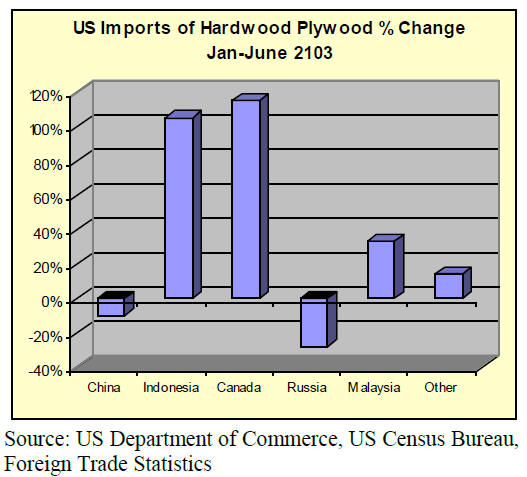

Hardwood plywood imports

US hardwood plywood imports remained at low levels in

June. The drop in imports from China due to the US antidumping

and countervailing investigation has not been

offset by other suppliers, although Indonesia has

significantly increased plywood shipments to the US.

US imports of hardwood plywood declined by 7% from

May to June. Total imports were 200,248 m³ in June with

one third (65,377 m³) imported from China. By

comparison, two thirds of total 2012 US hardwood

plywood imports came from China.

Other major suppliers to the US market have markedly

increased hardwood plywood shipments in 2013, with the

exception of Russia. Indonesia shipped 60,315 m³ in June,

up 133% from May. Year-to-date imports from Indonesia

more than doubled.

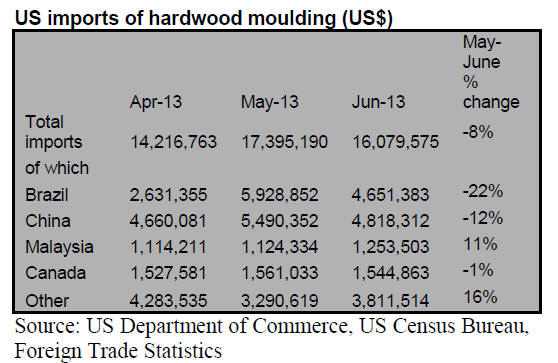

Hardwood moulding imports

Hardwood moulding imports declined by 8% to $16.1

million in June (-6% year-to-date). Hardwood moulding

imports from both China and Brazil declined. Imports

from China were $4.8 million in June (-9% year-to-date),

while $4.7 million worth were imported from Brazil (-17%

year-to-date).

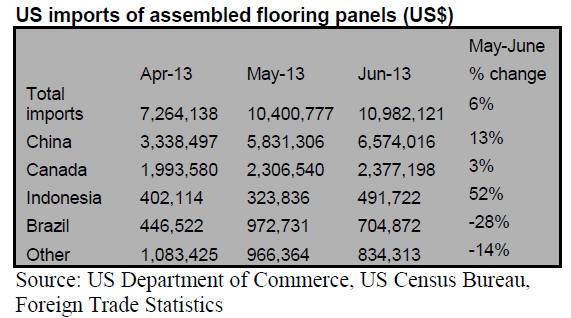

Wood flooring imports

US imports of assembled flooring panels increased to

$11.0 million in June. Year-to-date imports are still 6%

lower than in 2012.

China.s shipments accounted for 60% of total assembled

flooring imports in June. On a year-to-date basis, imports

from China declined by 20%, while imports from

Indonesia increased by 12%.

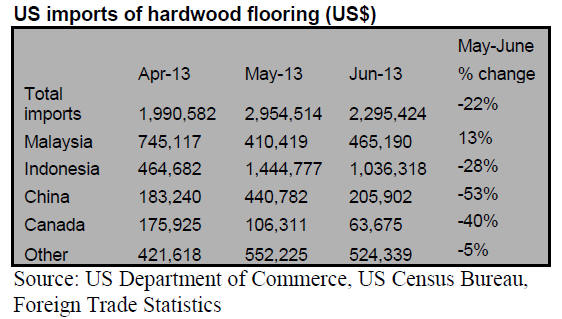

Hardwood flooring imports were $2.3 million in June,

down 22% from May. Indonesia has become the leading

supplier to the US so far in 2013. In June imports from

Indonesia were $1.0 million (+86% year-to-date).

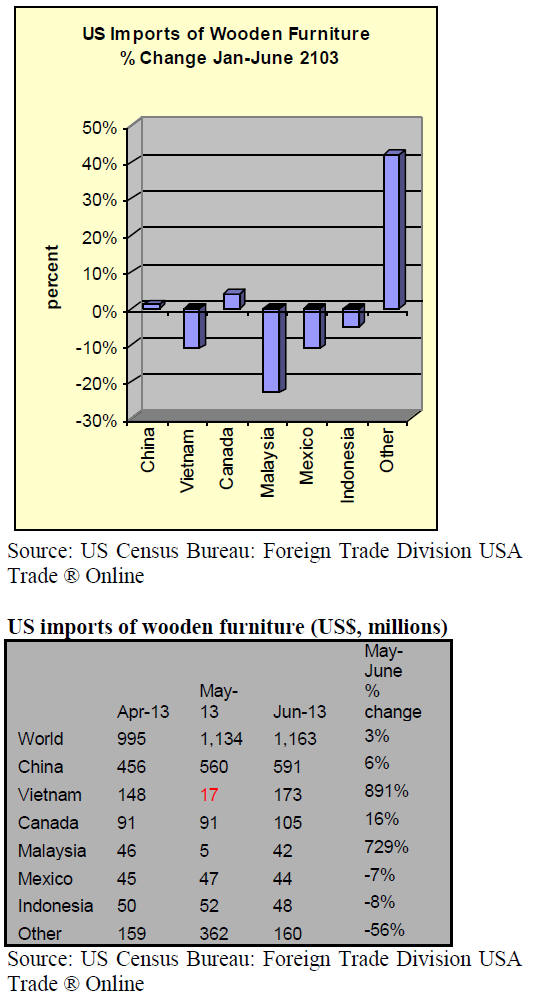

Wooden furniture imports

The US imported $1.2 billion worth of wooden furniture

in June, slightly up from the previous month. Year-to-date

imports were 3% higher than in June 2012.

China‟s furniture shipments to the US were $591.1 million

in June (+1% year-to-date). Imports from Vietnam

recovered to $172.5 million (-11% year-to-date), after

appearing to drop sharply in May. The May data for US

imports from Vietnam is suspiciously and therefore

probably erroneous.

Furniture and flooring retail sales positive

Retail sales at furniture stores in the US increased by 6%

from April to May, according to US Census Bureau

figures. However, furniture sales were 4% lower than in

May 2012.

Retail sales at floor covering stores grew by 10% in May

from the previous month. Flooring sales were higher

(+4%) than in May last year. These sales figures include

both wood and non-wood flooring products.

Home remodelling spending on the rise

With rising home prices and sales, US homeowners spend

more on home improvement projects. New homeowners

are the most likely to carry out major home improvements.

Flooring replacement is the most common remodelling

project, following by replacing kitchen and bathroom

cabinets.

Spending on home remodeling has steadily increased since

the end of 2012, according to US Census Bureau data.

Spending in the first quarter of 2013 reached $127 billion.

Remodelling contractors were confident in the market in

the second quarter of 2013, according to the Remodelling

Market Index survey by the National Association of Home

Builders. For the first time in eight years, contractors

reported a consistently positive outlook.

The Joint Center for Housing Studies at Harvard

University projects a further improvement in the

remodelling market for the second half of 2013.

Strengthening sales of existing homes in particular raise

spending on remodelling. For the last quarter of 2013

spending on remodelling is projected to surpass $150

billion.

Countertop market study released

A new market study released by Freedonia in July

describes the US market for countertops and forecasts

demand through 2017 and 2022 (Freedonia Study #3049).

Countertops are primarily used in residential kitchens and

bathrooms. In 2012, 79% of countertop demand was in the

residential market, mainly in single-family homes.

Therefore, single-family housing starts is the most

important driver of countertop demand.

US countertop demand was 582 million square feet (54

million m2) in 2012. Freedonia forecasts that demand will

increase by 5.1% per year to 750 million square feet (70

million m2) in 2017.

The recovery of new home construction will boost demand

for countertops through 2017. Remodeling of older homes

will also support market growth.

The leading countertop material is laminate, usually on

composite wood. The share of laminates in total demand

has declined from 60% ten years ago to about half in 2012,

and this trend is forecast to continue. Natural stone and

engineered stone have become more affordable, replacing

laminate countertops.

|