US Dollar Exchange Rates of

27th

August 2013

China Yuan 6.1206

Report from China

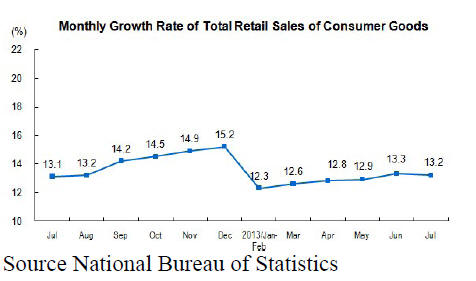

Retail sales deliver good performance

In July total consumer goods retail sales reached yuan 1,851 billion up

13 percent year-on-year according to a press release from the National

Bureau of Statistics of China.

See:

http://www.stats.gov.cn/english/pressrelease/t20130809_402918316.htm

Of the total, retail sales of consumer goods by industrial enterprises

surveyed was yuan 916 billion, an increase of 11 percent. From January

to July, retail sales of consumer goods were up by 12.8 percent

year-on-year.

Retail sales of furniture in July totalled yuan 15 billion up 17 percent

year on year and between January and July this year furniture sales

increased 20.7 percent.

Real estate investment increases but land purchases slip

The National Bureau of Statistics of China recently released details of

real estate investment between January and July 2013.

See:

http://www.stats.gov.cn/english/pressrelease/t20130809_402918312.htm

Investment in real estate in the first seven months of this year grew by

20.5 percent year-on-year but the pace of growth eased slightly in July.

Investment in residential buildings was yuan 3,031.8 billion, up by 20.2

percent, 0.6 percent lower than that in the first six months and

accounted for 68.4 percent of real estate development investment.

Real estate investment from January to July in the eastern region was up

18.6 percent year-on-year, growth in the central region was up by 21.0

percent and growth in the western region improved by 25.0 percent.

In the same period the floor space under construction by the real estate

developers rose 16.2 percent year-on-year while the land area purchased

by real estate developers fell 1.4 percent year on year.

Plywood anti dumping investigations by Colombia, Argentina and S. Korea

In mid July this year the Colombian Ministry of Trade and Industry

decided to investigate the pricing of Chinese plywood entering the

country. This anti-dumping investigation focused on imports of plywood

defined under the HS codes 4412 3100.00 and No. 4412 3200.00.

This followed a similar decision made by the Argentine Foreign Trade

National Affairs Secretariat, in the Ministry of Economy and Public

Finance.

In related news, South Korea¡¯s trade commission in the Ministry of

Trade, Industry and Energy, has proposed anti-dumping duties on imports

of Chinese made plywood for the next three years.

The duties proposed will range from 2.4 percent to 27 percent but the

South Korean Ministry of Strategy and Finance is yet to make a decision

on this.

The plywood market in South Korea is estimated to be worth around US$800

million and Chinese made plywood accounted for roughly 40 percent market

share in 2012.

No more Customs inspection for many forest products

Measures to simplify export clearance procedures and thereby reduce

operational costs and hopefully encourage competitive exports have been

introduced.

As of 15 August the State General Administration of China Quality

Supervision, Inspection and Quarantine, and the State General

Administration of China Customs will no longer be inspecting a wide

range of wood product exports.

However, 26 wood-based panel products such as bamboo-based plywood where

each layer is less than 6mm thick and multi-layer plywood panels with at

least one surface made from non-coniferous wood will still require

inspection.

Many analysts are questioning why exporters of non-coniferous surfaced

panels will still have to submit to costly inspections. But the

authorities in China appear to trying to effect a change in the

structure of the wood product manufacturing sector.

Further support for manufacturers, especially small companies, in the

form of suspension of the value-added tax and turnover tax for small

businesses with monthly sales of less than yuan 20,000 has been

welcomed.

The government has said this would benefit around six million small

companies in all sectors and will boost employment.

Wooden handicraft subject to tighter inspections

The State General Administration for Quality Supervision, Inspection and

Quarantine has issued a new regulation on inspection of wooden

handicraft products destined for the US market. Beginning 24 July only

wooden handicraft satisfying the new regulation can be exported to the

US.

The new regulations identifies the products involved as primarily

processed wooden handcrafts made from natural materials such as bamboo,

wood, rattan and willows and also includes carvings, baskets, boxes,

outdoor items, dried flowers, artificial trees, lattice towers, garden

fences and other primary processed wood products.

The regulation requires that wooden handicraft producers must register

at local entry-exit inspection and quarantine agencies providing

information on production facilities, quarantine processes, quality

control and raw material tracking controls.

The entry-exit inspection and quarantine agencies have the power to

suspend exports by businesses not complying with the regulations.

To ensure the effective implementation of tracking and operational

procedures the State Administration for Quality Supervision, Inspection

and Quarantine regularly reviews implementation of the regulations.

Wooden frame buildings have bright future in China

Experts are urging development of standards for wooden structures

claiming the technologies being applied at present need to be updated.

It has been noted that traditional wooden frame Chinese buildings offer

advantages over other forms of buildings in terms of the time taken to

complete a structure, better heat insulation and better quake

resistance. Wooden buildings are said to have a bright future in China.

Currently, China has 21 national wood-frame building related standards

and 17 sector standards as well as technical standards for lumber and

laminated providing a good foundation for the further development of

standards. It is recognized that the wood frame building sector would

benefit from expanded standards.

Weak flooring market dampens demand for imported timber

In the first half this year the volume of raw materials used in the

solid wood flooring sector in China fell sharply. The main reasons for

the decline were weak domestic and international market demand and

increased costs for raw materials used in the industry.

Analysts report that it is likely that imports of raw materials for

solid wood floors will fall further.

¡¡

|