US Dollar Exchange Rates of 10th

August 2013

China Yuan 6.1225

Report from China

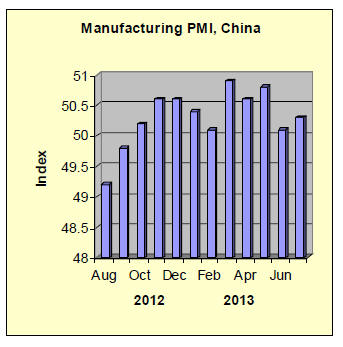

PMI indicates optimism on part of manufacturers

In July, China's manufacturing purchasing managers index (PMI) was 50.3

percent, up by 0.2 percentage point month-on-month.

The PMI for large-sized enterprises was 50.8 percent, up by 0.4 percent

month-on-month; that of medium-sized enterprises was 49.6 percent, down

by 0.2 percent month-on-month; that of small-sized enterprises was 49.4

percent, up by 0.5 percents month-on-month. In July, of the five

sub-indices constituting PMI, four increased while one declined.

The Production Index was 52.4 percent, up 0.4% month-on-month. The New

Orders Index was 50.6 percent, up 0.2% month-on-month staying above the

negative threshold.

The most recent survey shows that the Export and Import Order Index was

49.0 and 48.4 percent respectively an improvement of 1.3% and 0.5% but

still in negative territory.

The Production and Business Activity Expectation Index was 56.4 percent,

up 2.3 percent over last month, ending a three-month downward trend.

This indicates that the proportion of manufacturing companies that are

optimistic on business activities in the next three months has

increased.

Raw material prices down for seven consecutive weeks

According to the Ministry of Commerce as of the end of June prices of

raw materials used in manufacturing including timber have fallen for the

past seven weeks.

Prices for steel were down 0.4% prices for agricultural materials

dropped 0.1% prices for building materials declined 0.9% of which glass,

timber and cement fell 1.7%, 1.1% and 0.6% respectively.

Too many furniture stores

According to recent estimates, since August 2011 twelve mega home

furnishing stores have closed in China and over the past six months a

further eight large stores have closed.

In addition, another five mega stores are about to relocate. The

closures and relocations are in response to the cooling of the property

development boom which began in 2010.

The China Furniture Association has calculated that for every 10,000

sq.m of furniture store floor area annual sales are in the region of

yuan 100 mil.

Thus, to service domestic furniture demand for yuan 20 bil. (2012

figure) the ideal floor space in the retail sector should be around 20

mil. sq.m. but the total area of current domestic home furnishing stores

exceeds 40 million sq.m.

If the furniture retail sector does not change then 50% of the retail

floor area is likely to be unprofitable.

Obstacle slow development of wood/plastic composite market

Wood plastics composite products are now used more often in China in

construction, interior decoration, outdoor furniture, the automotive and

transportation sectors, logistics and packaging, etc.

However, the biggest problem for further development of the market for

wood/plastic products is inadequate standards and highly variable

product quality which have undermined consumer confidence.

According to the China Institute for Sustainable Development, Wood

Plastic Composite Materials Professional Committee it was not until 2008

that the first national standards were developed.

Following this in early 2009 the national standards ¡°GB/T 24137 wood

plastic decorative panels" and "GB/T 24508 wood plastic flooring" were

prepared and eventually adopted in 2010.

At present another 6 standards for wood plastic composite materials are

either being drafted or awaiting ministerial approval.

First half 2013 good for China's furniture manufacturers

According to the latest data released by National Bureau of Statistics

in the first half of 2013 revenue for furniture manufacturers grew 13%

year on year.

The total accumulated profit in the industry reached yuan15.31 billion,

a year-on-year increase of 16%.

From January to May 2013 the wooden and metal furniture manufacturing

industries contributed most to cumulative profits in the furniture

sector.

Cumulative profits for wooden furniture manufacturers accounted for 60

percent of the total, metal furniture manufacturing industry 26 percent,

other furniture manufacturing industry 10 percent, bamboo, rattan

furniture manufacturing industry 2 percent and plastic furniture

manufacturing 1.8 percent.

Amongst the five sub-sectors growth of profits in the bamboo and rattan

furniture manufacturing industry exceeded 100 percent, plastic furniture

manufacturing 74 percent and wooden furniture 2 percent.

Wood-based panel sales surge

According to the State Forestry Administration (SFA) sales of wood-based

panels have grown by an average of 20% annually since 2007 to reach to

272 million cubic metres in 2012.

However, new policies in the domestic real estate sector and weak

international demand have slowed the expansion of wood based panel

sales.

The SFA estimated that production and sales of China¡¯s wood-based panel

in 2012 were 286 million cubic metres and 272 million cubic metres, up

21 percent and 17 percent respectively.

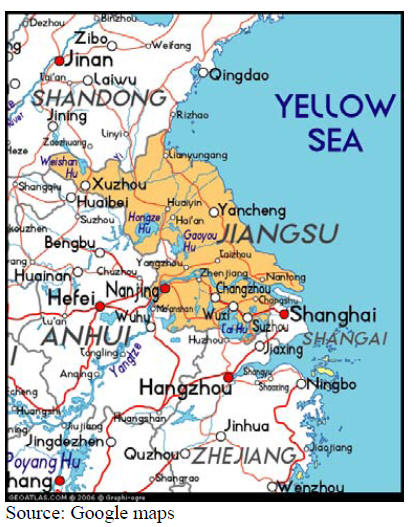

Jiangsu Province timber imports up twelve percent

The 26 ports in Jiangsu Province handle the highest volume of timber

imports in China. In the first half of 2013 timber imports through ports

in Jiangsu Province achieved a new record of 8.09 million cubic metres

valued at US$1.6 billion, a year on year increase of 12 percent in

volume and value.

Timber imports from North America continue to grow and reached 2.45

million cubic metres in the first half of 2013 making up 30 percent of

the total. Timber imports from Africa fell again and were only 790,500

cubic metres, down 7 percent.

Hardwood log imports from Oceania were stable but softwood imports

increased. Timber imports from New Zealand rose 53 percent to 1.21

million cubic metres. Sawnwood imports through Jiangsu ports declined 17

percent to 853,500 cubic metres in the first half.

ASEAN suppliers drive up imports through Nanhai ports

Statistics from the Nanhai Entry-Exit Inspection and Quarantine

Bureau for January to April show that log imports through Nanhai ports

were worth US$106 million, a year on year increase of 52 percent. It was

reported that as much as 90% of the timber imports were from ASEAN

countries.

The Nanhai international container terminals are in the Sanshan economic

development zone in Foshan city in the mid-northern area of the Pearl

River Delta in the Guangdong Province.

The port is 84 nautical miles from Hong Kong and 70 nautical miles from

Shenzhen. Nanhai port operates seven berths capable of handling both

container and general cargo.

The main reasons for the increase in imports are; first, Nanhai is home

to major furniture and wood product manufacturing enterprises; second,

domestic timber supplies in the area are not adequate to satisfy demand

and finally, timber imports from ASEAN countries duty free.

¡¡

|