Japan Wood Products

Prices

Dollar Exchange Rates of

10th August 2013

Japan Yen 96.23

Reports From Japan

IMF sees positive signs in the economy but urges further bold

action

An International Monetary Fund (IMF) team recently met with officials from

the government, the Bank of Japan (BoJ), and private sector representatives,

to discuss recent economic developments. At the conclusion of the visit, the

mission issued a press release: See:

http://www.imf.org/external/np/sec/pr/2013/pr13194.htm

The IMF press release said the economic recovery in Japan is gaining

momentum mainly as a result of the new monetary easing policy.

The long term success of these policies (“the so called three arrows of

Abenomics”) depends on the determined implementation of fiscal and growth

reforms, details of which are yet to be revealed.

The IMF teams said the rewards from an ambitious package of reforms are

potentially large and will not only benefit Japan but also strengthen growth

and stability of the global economy.

The reaction to the new policies has been positive and growth in the first

quarter of 2013 rebounded strongly led by consumption and exports.

The IMF expects growth to reach 1.6 percent for the year as a whole.

However, growth in 2014 is likely to slow moderately as a result of the

planned consumption tax increase and the unwinding of reconstruction

spending.

The policies implemented so far, says the IMF, are providing the foundation

for the complementary growth strategies and fiscal reforms that will be

essential to raise inflation.

But there are risks, says the IMF:

“Fiscal risks have risen as additional stimulus and social security spending

have added to the public debt. A concrete and credible medium-term fiscal

plan should be adopted as quickly as possible.

The IMF estimates that over the next decade, structural fiscal consolidation

of 11 percent of GDP is needed to put the debt-to-GDP ratio firmly on a

declining path.

“Raising the consumption tax rate as scheduled to 10 percent by 2015 is an

essential first step and together with waning stimulus and reconstruction

spending could contribute to about half of the needed adjustment.

“To raise growth over the medium-term, structural reforms are critical.

Further measures required include deregulation in agriculture and domestic

services, encouraging the provision of risk capital for start-ups while

phasing out costly government support for unviable SMEs.

Reducing Japan’s excessive labor market duality will increase flexibility.

Also, further relaxing entry requirements for high-skilled foreign workers

could strengthen labor supply in areas where there are shortages.

Bank of Japan reports moderate economic recover track

At the Monetary Policy Meeting held on the 7 August the Bank of Japan (BoJ)

decided to conduct money market operations such that the monetary base will

increase at an annual pace of about 60-70 trillion yen.

See press release at: http://www.boj.or.jp/en/announcements/release_2013/k130808a.pdf

The Bank says it will continue with quantitative and qualitative monetary

easing, aiming to achieve the price stability target of 2 percent, as long

as it is necessary for maintaining that target in a stable manner.

With regard to asset purchases the Bank will purchase Japanese government

bonds so that their amount outstanding will increase at an annual pace of

about 50 trillion yen.

The Bank will also purchase exchange-traded funds and Japan real estate

investment trusts to increase the annual pace of purchases by about 1

trillion yen and about 30 billion yen respectively.

In this situation, exports from Japan have been picking up and business

investment has stopped weakening.

The up-turn in housing investment continues and private consumption in Japan

remains resilient assisted by the improvement in consumer sentiment.

Reflecting on these developments in domestic and international demand,

industrial production is expected to increase moderately.

The BoJ says “Japan's economy is expected to recover moderately on the back

of the resilience in domestic demand and the pick-up in overseas economies”.

All eyes on GDP revision due in September

Japan’s cabinet Office released provisional GDP figures on 12 August. See:

http://www.esri.cao.go.jp/en/sna/sokuhou/sokuhou_top.html

In the second quarter, GDP is estimated to have grown 0.6 percent, the third

quarterly expansion of GDP and analysts are seeing this as an endorsement of

the government’s monetary policies.

However, the increase in the second quarter was lower than expected but

revised figures due out in September will provide a more accurate picture

and will guide the government on its decision whether or not to begin

raising the consumption tax from April next year.

If converted to an annualised rate then GDP growth for 2013 would be 2.6

percent, somewhat lower than the forecast 3.6 percent increase.

In the second quarter private consumption increased and exports improved but

business investment continued to decline. However, the pace of decline in

investment is clearly slowing.

It is worth noting that provisional economic data released by the Cabinet

Office is notoriously unreliable and is invariably changed. The final second

quarter GDP will be released in September and is expected to show a more

robust growth in GDP.

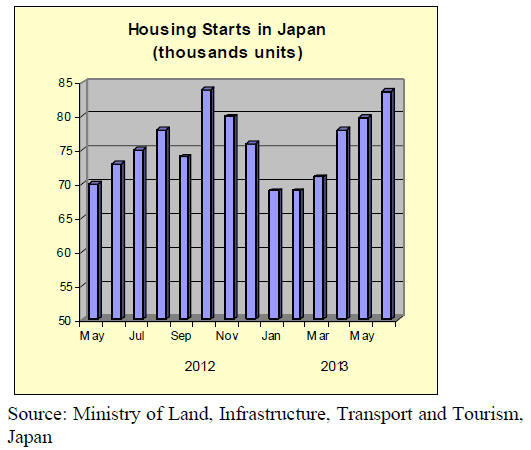

Housing starts continue to climb

June housing starts in Japan totalled 83,704 up by around 4% on levels in

May but were up over 15% compared to June 2012.

Analysts attribute the continued increase in demand for new homes as the

response of home buyers to the threat of a consumption tax increase

scheduled for 2014.

It is likely that August housing starts will move even higher as the major

construction companies are reporting that orders are up over 20%.

For the complete housing data see the Construction Research and

Statistics Office Policy Bureau, Ministry of Land, Infrastructure, Transport

and Tourism website at:

http://www.mlit.go.jp/toukeijouhou/chojou/stat-e.htm

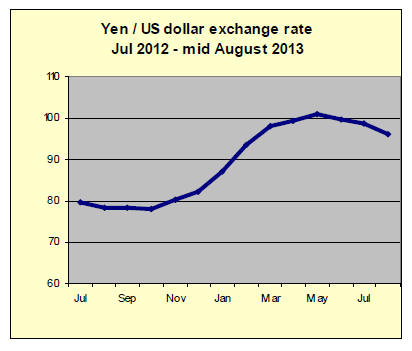

Investors move money into yen

In early August the yen strengthened against the dollar largely because of

purchases of the currency as investors moved out of equities and currencies

in countries where the risks were perceived higher.

The weaker than expected GDP figures for the second quarter caused a flow of

funds from Japanese stocks and back into yen which also further strengthened

the yen against major currencies.

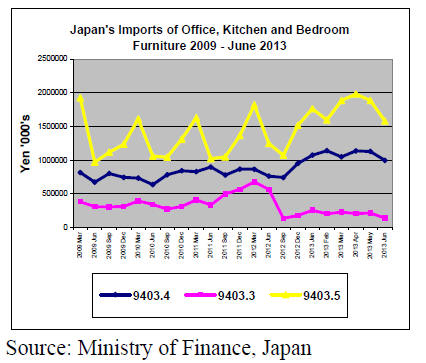

Japan’s furniture imports

June 2013 furniture imports

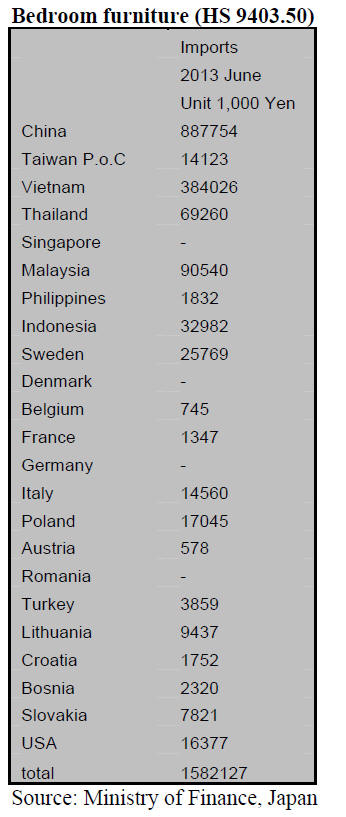

The source and value of Japan’s office, kitchen and bedroom furniture

imports for June 2013 are shown below. Also illustrated is the trend in

imports of office furniture (HS 9403.30), kitchen furniture (HS 9403.40) and

bedroom furniture (HS 9403.50) between 2009 and June 2013.

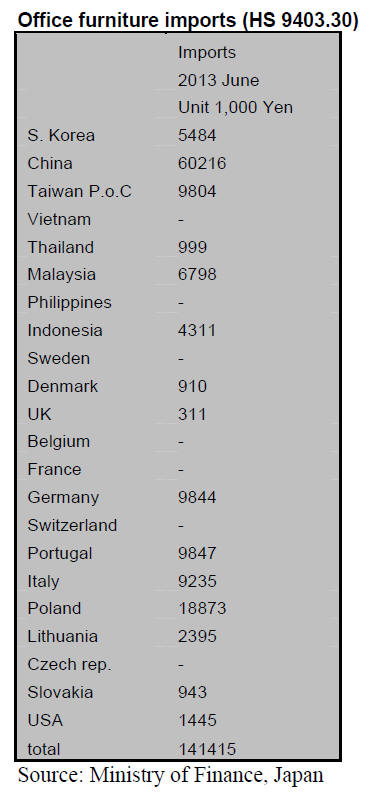

Office furniture imports (HS 9403.30)

June office furniture impost fell sharply dropping to yen 141 mil. a 32%

decline on levels in May. However, the second quarter 2013 imports at yen

9,283 mil. were almost the same as in the first quarter of the year (yen

9,249 mil.)

The top ranked suppliers of office furniture remain China (1st), Poland

(2nd) and Malaysia and these three countries supplied 60% of Japan’s

imported office furniture. June imports from China and Malaysia fell around

30% but imports from Poland, while declining were down just 14%.

Imports from EU member states and Switzerland accounted for 37% of Japan’s

office furniture imports in June almost the same as in May. After Poland,

other main suppliers were Portugal and Germany.

Kitchen furniture imports (HS 9403.40)

Kitchen furniture imports slumped in June falling to yen 9,986 mil. from the

yen 11,285 mi. in May.

Vietnam continues to be the number one supplier of kitchen furniture to

Japan and in June the value of imports from Vietnam, at yen 344 mil were

slightly up on the yen 327 mil. level in May.

This is in sharp contrast to the 37% decline in imports from China and the

29% decline in imports from Indonesia.

Three suppliers Vietnam, Indonesia and Philippines, the three top ranked

suppliers provided almost 70% of Japan’s imports of kitchen furniture in

June. For the first time in 2013 China did not make it to the top ranked

three suppliers.

Shipments of kitchen furniture from Europe in June were dominated once more

by those from Germany and at yen 81mil. were up by about 20% on levels in

May.

Imports during June continued the decline seen in May falling to just yen 34

mil. representing only around 10% of imports from the USA.

Bedroom furniture (HS 9403.50)

Japan’s imports of bedroom furniture have been close to yen 2 bil. every

month but in June imports fell around 16% to yen 1,582.

While this may seem a significant decline analysis of first and second

quarter imports show that, overall, import levels are virtually unchanged.

In the first quarter of 2013 Japan imported bedroom furniture worth yen

5,245 and in the second quarter imports totaled yen 5,449 mil.

As in May, the top suppliers in June were China and Vietnam which, together

with imports from Malaysia, accounted for around 80% of all wooden bedroom

furniture imports to Japan.

Shipments of bedroom furniture to Japan from China in June were however,

significantly down (-26%) compared to May but shipments from Vietnam were up

7%.

Malaysia is the third ranked supplier of bedroom furniture to Japan but June

shipments from Malaysia were down around 9%.

Imports of bedroom furniture from EU suppliers accounted for just 5% of June

imports by Japan. The largest supplier from the EU was Sweden overtaking

Poland for the first time.

|