Japan Wood Products

Prices

Dollar Exchange Rates of

24th July 2013

Japan Yen 100.26

Reports From Japan

Timing of consumption tax increase critical if another recession

to be avoided

The Liberal Democratic Party (LDP) now has a majority in both the lower

and upper houses of Japan’s parliament, having secured the biggest

parliamentary majority in six years in the July 21 election.

But the prime minister is facing political dissent within the party over

plans to increase the consumption tax. Many in the LDP are saying such a

move will undermine the fledgling recovery in the Japanese economy, possibly

tipping it back into recession.

But if the government does not act to reduce the massive debt burden and

continues with its stimulus package focused on civil works the market could

begin to doubt whether the government is serious about realigning the

Japanese economy.

Furthermore, the talk of structural reforms including participation in the

Trans Pacific Partnership trade negotiations which if concluded would mean

farmers in Japan have to face severe competition from imports is another

area undermining unity in the LDP.

The prime minister has supported monetary and fiscal stimulus along with

deregulation as two of his ‘three-arrow’ economic strategy to end deflation

but must move cautiously in developing policies for the third arrow.

Mis-timing the introduction of the consumption tax increase could seriously

affect consumer spending and pull down economic growth prospects.

Japan joins TTP talks

Talks on the Trans Pacific Partnership (TPP), took a step further when

negotiators met in Kota Kinabalu, Malaysia in July.

For the first time government and private sector representatives from Japan

were at the talks. The TTP now involves 12 Pacific countries, Brunei, Chile,

New Zealand, Singapore, United States, Australia, Peru, Vietnam, Malaysia,

Mexico, Canada and Japan.

The TPP aims to eventually remove tariffs and other trade barriers in areas

such as government procurement and set standards for workers’ rights,

environmental protection and intellectual property rights. Forestry and wood

products will feature in the negotiations.

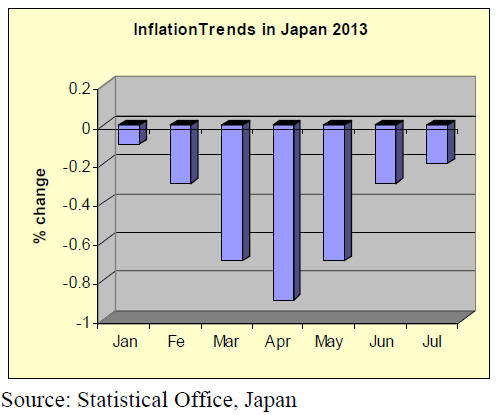

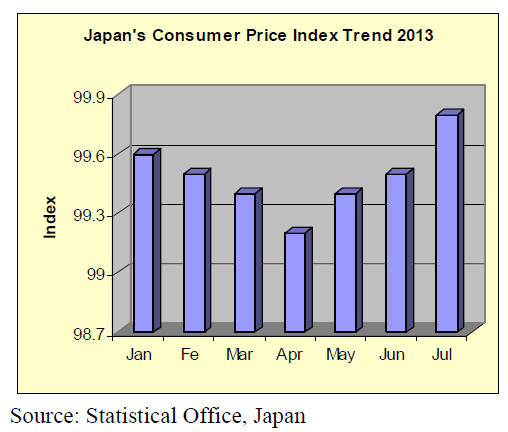

Is Japanese economy shedding deflation?

Japan’s consumer price index (CPI) rose by 0.2 percent in June the

biggest gain since 2008. If fresh food is excluded from the index then it

rose by 0.4 percent from a year ago.

Many analysts are hailing this movement in the CPI as evidence that the

aggressive monetary policies of the Japanese government have created a

measure of inflation, seen as crucial to reverse the downward trend in

growth in Japan.

However, if energy prices are discounted from the index then the picture is

not so encouraging since the CPI excluding food and energy actually fell.

Japan’s energy imports have skyrocketed since the closure of almost all of

the nuclear power plants in the country.

In Japan, the most important categories in the consumer price index are

food (25% loading); housing (20%); transportation and communications (14%);

fuel, electricity and water charges (7%) and medical costs (4%).

The energy import bill will continue to climb and, as the government works

to weaken the yen, the cost of all imports will rise which will drive the

CPI higher. See:

http://www.stat.go.jp/english/data/cpi/1581.htm

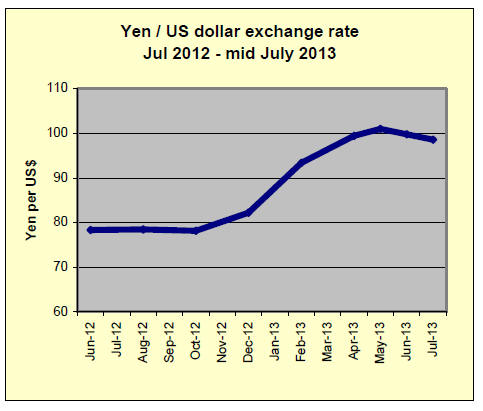

LDP victory spurs rise in yen

The yen rose against the dollar for the first time in four sessions in July

after the Liberal Democratic Party won a widely expected majority in

elections for the upper house of parliament.

The election victory will strengthen the government’s mandate for

reflationary policies however some analysts said that there is not much more

the government can do to stimulate the economy.

Despite the brief rally of the yen the US dollar is now up around 16%

against the Japanese currency for the year.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

The JLR requires that ITTO reproduces newsworthy text exactly as it appears

in their publication.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

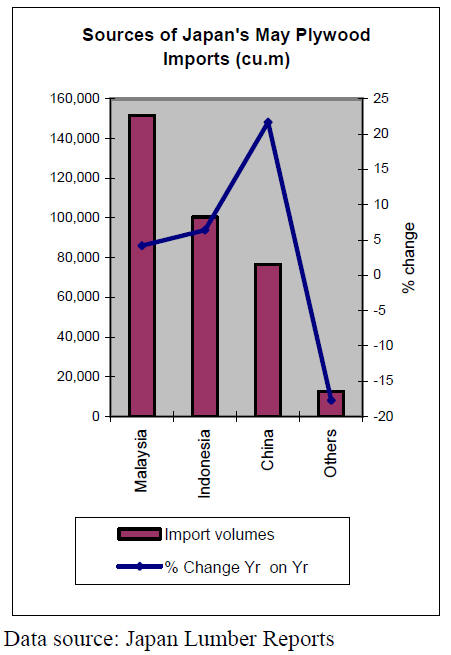

May plywood supply

Total supply of plywood in May was 571,000 cbms, 7.7% more than May last

year and 2.1% less than April.

This is high level supply followed April. Imported plywood exceeded 340,000

cbms for two straight months and domestic production was also over 210,000

cbms.

Imported volume in May was 341,200 cbms, 7.3% more and 1.9% less. Average

monthly arrival for last five months was 323,100 cbms. Malaysian volume

dropped by

13,000 cbms from April while Indonesian volume increased by 8,300 cbms ,

which is the first time that Indonesian volume surpassed 100,000 cbms since

August 2011.

Purchases of floor base increased with expanding housing starts so June

arrivals are expected higher again. Average monthly arrival of imported

plywood for last 12 months is 305,000 cbms.

Import from Malaysia will decline as June shipment by the largest supplier

was 40% less than May and July would be the same.

Domestic plywood production in May was 229,700 cbms, 8.4% more than May last

year and 2.3% less than April, out of which softwood was 213,800 cbms, 9.3%

more and 2.8% less.

Shipment of softwood plywood was 210,800 cbms, 15.0%more and 4.7% less. The

shipment exceeded 200,000 cbms for eight consecutive months. The inventory

increased by 3,000 cbms with 127,100 cbms, only about a half month volume

for the monthly shipment.

South sea (tropical) logs

The rain season in log producing regions is over and log production is

recovering. Main reason of log supply tightness and high log prices was

brought on by aggressive purchases by India but since late June and July,

India’s purchases slowed down so that log prices have been calming down.

The highest price of Sarawak low grade meranti logs for India in May was

$290 per cbm FOB, which dropped down to $240 by early July. Then India

started buying actively in mid July again after log prices dropped so the

supply situation is getting tight again.

Meranti log prices for Japan are about $290 per cbm FOB but the importers

think this is time to reduce FOB prices more considering cornered Japanese

plywood mills. Small meranti prices are about $250 and super small are about

$220.

In PNG and Solomon Islands, FOB prices shot up in April and May. There are

variety of log prices, depending on quality and available volume. FOB prices

of calophylum logs for plywood are about $300per cbm, $5 higher than last

month.

Log prices in Japan are 9,800-9,900 yen per koku CIF on meranti regular,

300-400 yen higher than in June.

With high FOB prices and weak yen, current log prices in Japan are the

highest so the importers worry that unless log prices are reduced, Japanese

plywood mills would die out despite effort of price hike of plywood.

Mitsubishi estate home copes with wood use point system

Mitsubishi Estate Home Co., Ltd. is preparing to deal with the Woos Use

Point System by using domestic materials for structural members and interior

materials.

Also, the second floor timbers are switched to domestic product of softwood

24 mm panel so that all the models are now object of the Wood Use Point

System. It also prepares to offer trading items like furniture.

In their 2x4 houses, it replaced south sea (tropical) hardwood plywood to

domestic softwood plywood more than ten years ago then sill and girder are

replaced to domestic cypress.

Also I joist and LVL made out of domestic larch are used for second floor

joist. Except for main structural item of SPF lumber, it has been replacing

domestic materials gradually thus percentage of domestic wood is high thus

it can deal with the Wood Use Point System. Now after second floor is

switched to 24 mm domestic softwood plywood, whole unit is qualified to the

system.

Pan Pacific developed thermal modified timber

Pan Pacific Forest Product (Napier, New Zealand), a subsidiary of Oji Paper

group, newly developed ‘Thermal Modified Timber’ (TMT).

TMT is highly dried lumber recovered from pruned butt logs of radiate

pine. Pan Pac installed high temperature processing kiln as experimental

facility in February 2012 and has made test development. Then by March next

year, it will install German made high temperature kiln with capacity of 80

cbms and will start commercial production.

Radiata pine lumber, which is dried by normal kiln to bring moisture content

down to about 10%, is retreated by high temperature kiln, which brings

temperature to 220-230 Celsius gradually in 36 hours then leave it for three

hours. Then the temperature is gradually reduced in 30 hours. Final moisture

content will be 6-7%.

TMT is said to be durable with high dimensional stability and preservative

treatment is not necessary so it is ideal for exterior use like decking,

window frame and siding board. It will be on the market next year with

annual production of 9,000 cbms.

|