However, the danger with programmes of this nature is that the

responsible, certified, legal and sustainable firms operating in tropical

areas to strict business standards also get tarred with the same brush.

It highlights the need for all consumers to be aware of the origin

of the products they are buying, and for active, engaging due diligence to

be conducted, never accepting any products simply on good faith. This is

exactly what the EU timber regulation (EUTR) is intended to achieve.

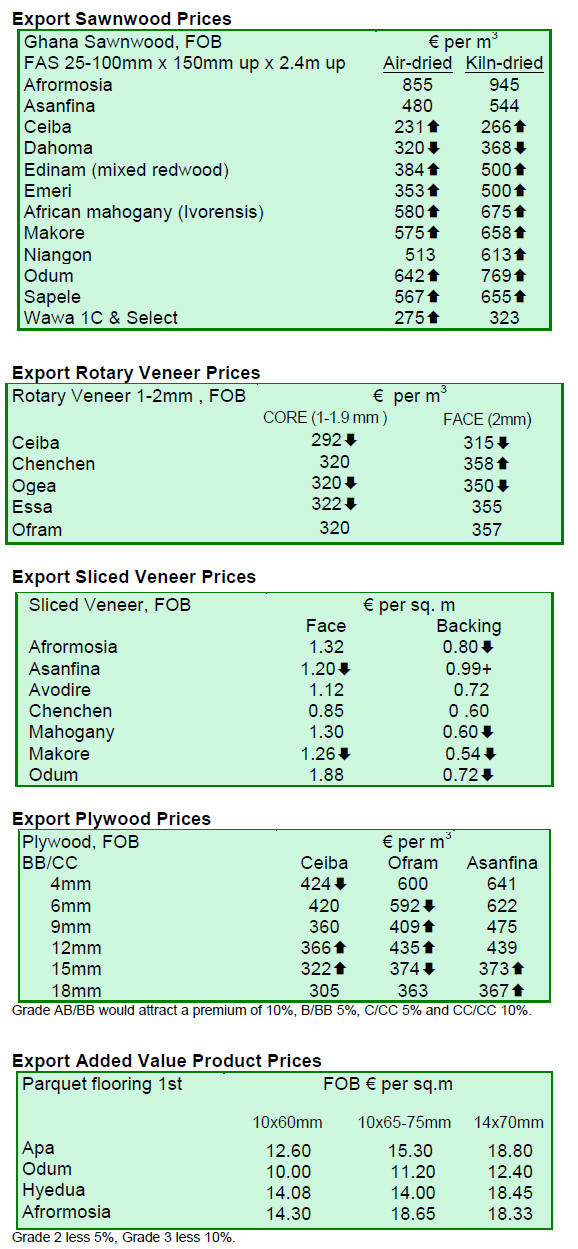

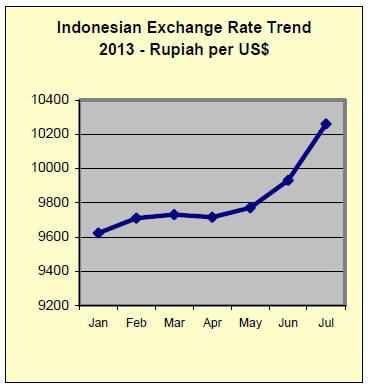

2. GHANA

Upgrading the Abidjan-Lagos corridor road

On the 15th July the inaugural meeting of the five-nation ECOWAS Steering

Committee on the upgrading of the 1,030 km Abidjan-Lagos corridor road

project met to begin work on the legal and institutional framework, the

terms of reference for various studies and on finance and resource

mobilisation.

For the ECOWAS press release see:

http://news.ecowas.int/presseshow.php?nb=223&lang=en&annee=2013

The committee, comprised Ministers of Road Infrastructure, Transport, Public

Works, Finance and Justice of Benin, Cote d¡¯Ivoire, Ghana, Nigeria and Togo.

The road, which carries around 75 per cent of regional trade and impacts

some 30 million people, links major cities such as Lagos, Cotonou, Accra,

Lom¨¦ and Abidjan as well as the region¡¯s dynamic sea ports. The road also

serves landlocked countries such as Burkina Faso, Mali and Niger.

The committee recommended that a feasibility study be conducted prior to

securing financing support from the African Development Bank, the World Bank

and the African Finance Corporation.

The ministers further recommended that the BRIC countries (Brazil, India,

China and South Africa) should be approached with a view to securing the

required financing.

Independent power producers to solve power shortages

Ghana¡¯s ministry of energy has released details of an agreement with General

Electric (GE) for the building of additional power generation capacity in

the country to alleviate the problem of power outages.

In a press release the ministry says,¡°GE will be facilitating the

development, financing and technical partnership required for the

implementation of an incremental 1000MW of power in collaboration with the

Government of Ghana over the next 5 years.

(see:

http://www.energymin.gov.gh/?p=1539)

The agreement comes on the heels of the Government¡¯s proposed target to

generate a total of 5000 Megawatts by 2016.

The Minister for Energy and Petroleum, Honorable Emmanuel Armah-Kofi Buah,

commended GE on its efforts and stated that the Government of Ghana is

committed to achieving increased power outputs through strategic

collaboration with private sector investors.

He noted that the government is putting in place the necessary structures

and creating the enabling environment to attract the needed Independent

Power Producers (IPPs) to ensure that the country had a constant supply of

power for economic growth.

The ¡°Ghana 1000MW Project¡± will introduce the Power Park Concept to enable

lower cost of power and faster implementation.

GE plans to develop the Power Park in collaboration with partners and

investors as well as develop local capabilities and service providers in

plant operation and maintenance¡±.

Bamboo bio-energy technologies from INBAR

According to a Ghana News Agency report the International Network for Bamboo

and Rattan (INBAR), is promoting bamboo charcoal technologies in Ghana which

have the potential to contribute to growth in the bio-energy sector.

In a statement issued in Accra, the Country Director of INBAR, Michael Kwaku,

said the China-Africa collaboration focuses mainly on bamboo to provide

clean, safe and ¡®green¡¯ energy.

3. MALAYSIA

ITTO initiates work on EPD for tropical

timber

Experts from Indonesia and Malaysia met in Bogor, Indonesia to prepare the

workplan for development of environmental product declarations (EPDs) for

three tropical wood products, meranti plywood, ipe decking and khaya lumber.

In 2003, ITTO published a review of available information on Life Cycle

Analysis (LCA) for tropical timber products but did no further work until

initiating the current EPD project.

The ITTO Trade Advisory Group (TAG) has, over the last few years, vigorously

encouraged work on EPDs as international markets are demanding this

information on tropical timber products especially as EPDs are already

available for wood products from temperate and boreal countries and for

alternatives to wood.

The current work will fill a critical gap in the environmental data for

three tropical wood products and will hopefully stimulate more work tropical

wood products.

The expected outcomes from the current work include a Life Cycle database,

LCA reports for the three products conducted in line with ISO standards,

assessment of the carbon footprint for the three products in line with the

PAS2050 methodology and an overall EPD for each product examined.

What is PAS 2050?

PAS 2050 is a publicly available specification for assessing product life

cycle GHG emissions, prepared by BSI British Standards and co-sponsored by

the Carbon Trust and the Department for Environment, Food and Rural Affairs

(Defra).

PAS 2050 is an independent standard, developed with significant input from

international stakeholders and experts across academia, business, government

and non-governmental organisations (NGOs) through two formal consultations

and multiple technical working groups.

The assessment method has been tested with companies across a diverse set of

product types, covering a wide range of sectors.

Across-the-board increases in 2012 exports from Sarawak

The Sarawak Timber Industry Development Corporation (STIDC) reported that

the timber sector in Sarawak increased its contribution to state exports

from RM 7.1 billion in 2011, to RM 7.5 billion in 2012.

Plywood was the main export revenue earner. The volume of plywood exported

increased by 17% to 2.6 million cubic metres and the value of exports

increased 6% to RM 4 billion (approx. US$ 1.23 billion).

STIDC reported that Japan is still the biggest market for plywood from

Sarawak accounting for of 1.4 million cubic metres (RM2.3 billion) followed

by the Middle East 334,000 cubic meters (RM411 million) and Korea 331,000

cubic metres (RM427 million).

Exports to Japan, the Middle East and Korea constituted 79% of the total

volume of all sawnwood exports in 2012.

The STIDC reported that, although the volume of log

exports increased by 7% 3.3 million cubic metres compared to the 3.1 million

in 2011, the value of log exports fell 2% to RM1.8 billion.

The Sarawak Timber Association reported a total harvest of 3.48 million

cubic cubic metres of meranti logs last year which made up almost a third of

the 9.13 cubic metres of logs harvested last year.

India was the top buyer of logs with purchases of 2.1 million cubic metres

(RM1.2 billion), followed by Taiwan P.o.C 387,000 cubic metres (RM213

million) and China 345,000 cubic metres (RM176 million).

2012 exports of sawnwood increased by 12% to 822,000 cubic metres from

731,000 cubic metres in 2011. The corresponding increase in export earnings

grew by 13% to RM785 million.

Thailand remained the number one market for Sarawak sawnwood accounting for

240,000 cubic metres (RM235 million).

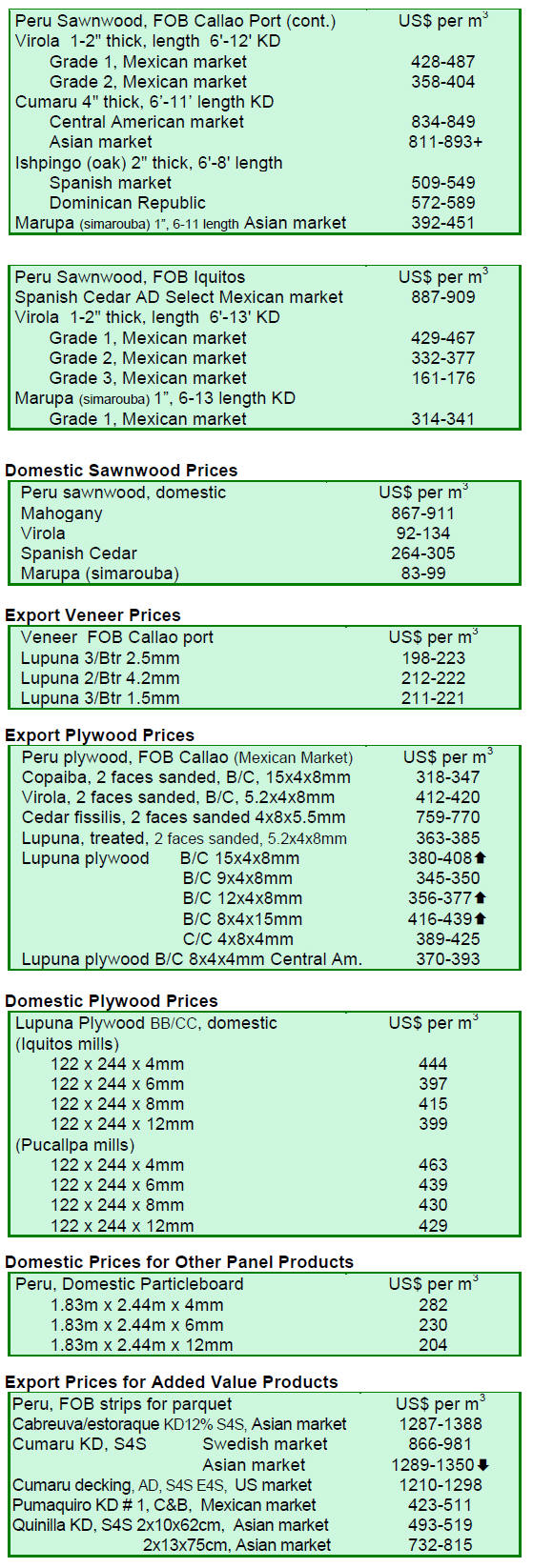

Indicative plywood prices for various markets

The Sarawak plywood manufacturers reported the following plywood FOB prices

for MR BB/CC quality boards; Taiwan P.o.C, 8.5-17.5mm, US$440; South Korea,

8.5-17.5mm, US$460; China/Hong Kong 9-18mm, US$450 and Middle East, 9-18mm,

US$430 ¨C 435.

Advancing Sustainable Trade in Asia

Because Asia can play an important role in unlocking the production and

trade of sustainable forest products PEFC will, in cooperation with the

Malaysian Timber Certification Council, hold its first Forest Certification

Week from 11-15 November 2013.

For more information see:

http://www.pefc.org/news-a-media/general-sfm-news/1231-pefc-forest-certification-week-2013-advancing-sustainable-trade-in-asia

¡°There are tremendous opportunities for stakeholders in Asia to contribute

to sustainable forest management in Asia, for both forest managers as well

as companies along the timber value chain,¡± said Ben Gunneberg, PEFC

Secretary General.

¡°As forest certification has yet to fully penetrate the Asian market and new

approaches are required to strengthen market demand, build capacity and

connect supply chains to deliver sustainable products.

PEFC will bring together diverse stakeholders across the forest sector

landscape for this year¡¯s Stakeholder Dialogue during the PEFC Forest

Certification Week, to take stock and identify opportunities to catalyze

action on and uptake of sustainable practices with respect to the forest

based sector within the Asian region¡±.

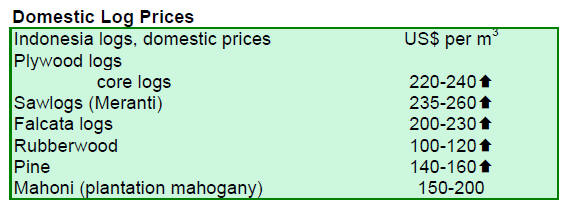

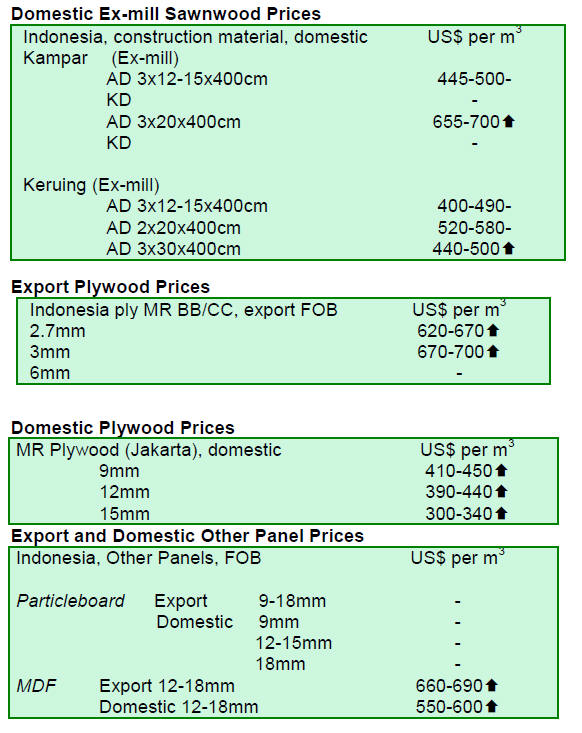

4. INDONESIA

Despite government subsidies SVLK

certification slow in Bali

The Bali Industry and Trade Agency reported that of the more than 250

exporters specialising in wooden handicrafts in Bali only 18 have been SVLK

certified.

Head of the forest product development division at Bali¡¯s Forestry Agency, I

Ketut Subawa has said that the Agency is finding it difficult to get

community forest owners and wood craft exporters to submit to SVLK

certification despite the subsidies provided by the Ministry of Forestry.

Forest owners and exporters are still not convinced of the benefits of SVLK

certification.

Community forests in Bali are small at just over 9,700 ha but currently only

around 60 ha. in Singaraja, Buleleng regency have been SVLK certified.

The Jakarta Post has reported Subawa as saying ¡°Honestly, we are unable to

provide the calculations when people ask what kind of price increase they

can obtain after having their timber certified.

However, we can only guarantee that having their timber certified prevents

them from having their products rejected in the export market.,¡±

In related news the Indonesian government has demanded an explanation from

EU officials on the delay in ratification of the VPA and a specific time

frame for completion of all the formalities in Europe.

SVLK clinics provide free support to industry

To support the timber industries secure the mandatory SVLK certification

consultation clinics have been established in Yogyakarta, Jepara, Surakarta,

Pasuruan, and Jombang.

The establishment of these clinics was initiated by a non-governmental

organization, Java Learning Center (Javlec), in collaboration with the

provincial trade and industry offices in the various cities. This effort by

Javlac is being supported by the Multi-Stakeholder Forestry Programme (MFP)-KEHATI.

The clinics provide advice to various stakeholders such as local government

officials, timber enterprises, associations and field facilitators. The aim

of this initiative is to address forest governance, licensing and

synchronisation of activities of the associations.

Domestic consumption will be future driver of economic growth

Indonesia¡¯s domestic demand continues to be robust, offsetting the slow

growth in exports.

According to research by McKinsey Indonesia, 90 million Indonesians will by

2030 be considered the ¡°consumer class¡±, a group with annual incomes

surpassing $3,600. This, says the McKinsey report, opens up business

opportunities which could be as high as US$1.8 trillion.

In a press release the Bank of Indonesia (BoI) has said that it expected the

economy to expand by 6.1 percent in 2013 and by around 6.4 to 6.8 in 2014.

On the other hand, the World Bank is now forecasting the Indonesian economy

to grow 5.9 percent in 2013, down from its previous forecast of 6.2 percent

in March.

However, the Bank report notes that expectations are for a moderate slowdown

in 2013 but the risk of a more pronounced slowdown is high as recovery in

exports is expected to be slow and domestic investment is likely to weaken.

In related news the BoI released CPI inflation data. See:

See:http://www.bi.go.id/web/en/Ruang+Media/Siaran+Pers/sp_151113_dkom.htm

Inflation in June 2013 increased 1.03% compared to one month earlier,

equivalent to 5.90% year on year which is consistent with the BoI

projections.

The escalation of inflationary pressures was anticipated because of the

recent lowering of fuel subsidies. The BoI expects the impact of higher fuel

prices to be temporary lasting approximately three months followed by a

subsequent easing.

The BoI press release also notes that increased exports reduced the trade

deficit in May. According to a Press Release issued today by BPS-Statistics

Indonesia, the trade deficit in May was amounted to US$ 0.6 billion, which

is smaller than that posted in April at US$ 1.7 billion. This was made

possible by an increase in exports.

Encouragingly, the pace of export growth is most pronounced for manufactured

goods, followed by primary goods.

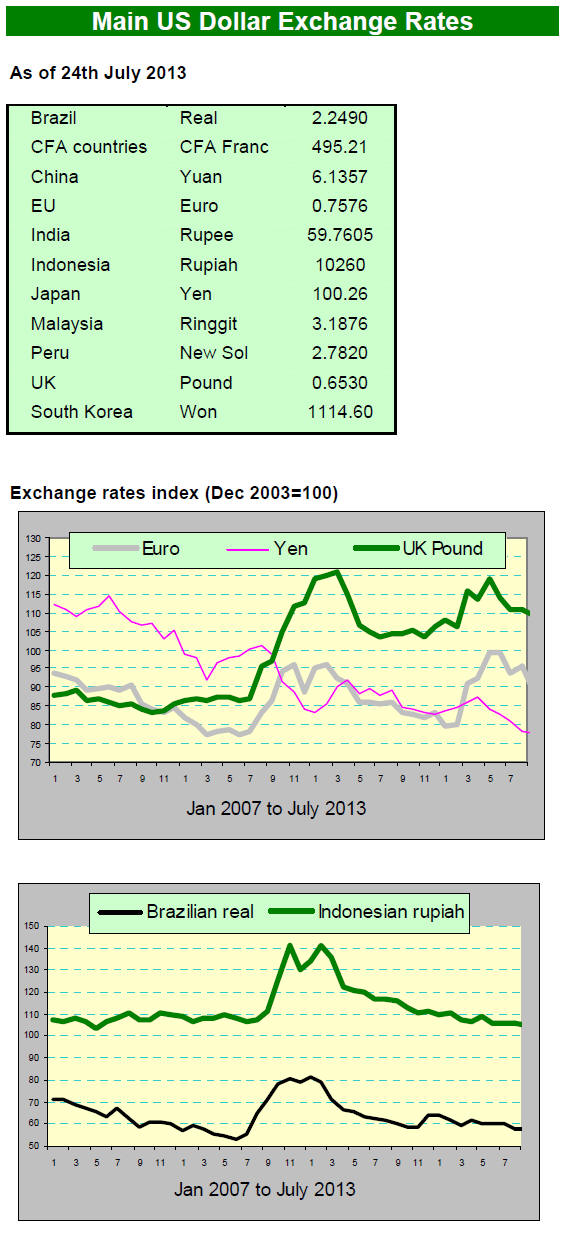

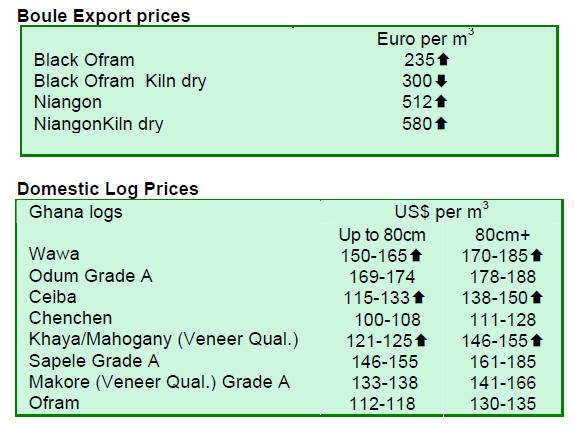

Rupiah weakens sharply

On July 23 the rupiah was traded in the range of Rp10,120 ¨C Rp10,265 to the

dollar, a sharp drop from a month ago.The US dollar has strengthened

recently.

Adding to the downward pressure on the rupiah has been large foreign

exchange transactions by companies as well exchange transactions for

repatriation of dividend and investment returns.

¡¡

For the BoI press release see:

http://www.bi.go.id/web/en/Ruang+Media/Siaran+Pers/SP_151713_DKom.htm

Compared to the exchange rate at the beginning of 2013 the rupiah has

depreciated almost 6%. Bank Indonesia Governor, Agus D.W. Martowardojo has

said, ¡°In the last few days, the rupiah has been converging to a new

equilibrium level which reflects the Indonesian economic fundamentals¡±.

He urged everyone to remain calm saying the BoI will continue to conduct

thorough surveillance and protect the stability of the currency in relation

to economic fundamentals.

Indonesia to host market dialogue in August

The Indonesian Exporters Association (GPEI), in collaboration with PT Mutu

Hijau Indonesia, will host the third High Level Market Dialogue - 2013 on

¡°The New Era of Indonesian Legal Timber Products to meet Global Markets¡±.

For information contact: Robianto Koestomo at

robiantokoestomo@mutuhijau.com

Up for discussion will be the Indonesian SVLK (Timber Legality Assurance

System), the Australian Illegal Logging Prohibition Bill, the EUTR (European

Union Timber Regulation) and developments in other markets for verified

legal timber products from Indonesia as well as how consumers are taking

action to eliminate illegal timber from their markets.

With the introduction of Australia¡¯s Illegal Logging Prohibition Act and the

coming into effect of the EU Timber Regulation, along with further

developments in the United States related to the U.S Lacey Act, as well as

developments in China and Japan, GPEI together with PT. Mutu Hijau Indonesia

see the value in once again convening a market dialogue, bringing together

Indonesian and international trading partners from the forestry and timber

sector.

The High Level Market Dialogue will be addressed by HE the Minister of

Forestry, HE the Minister of Trade, HE the Minister of Industry and Minister

of Cooperatives and Small and Medium Enterprises along with representation

from Australia¡¯s Department for Agriculture, Fisheries and Forestry, the UK

Permanent Under Secretary of State for International Development and the EC

Trade Commissioner.

¡¡

5. MYANMAR

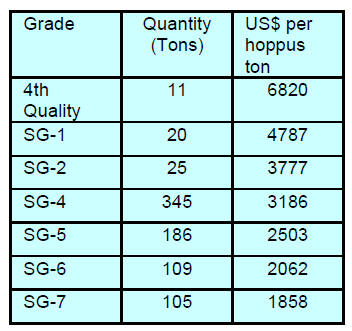

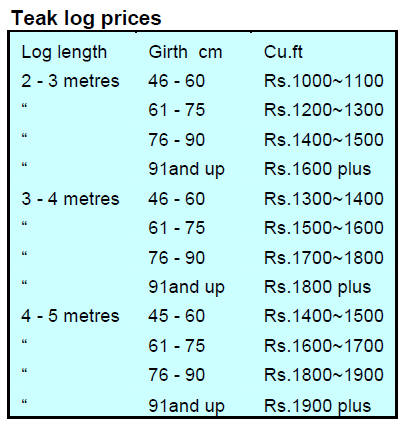

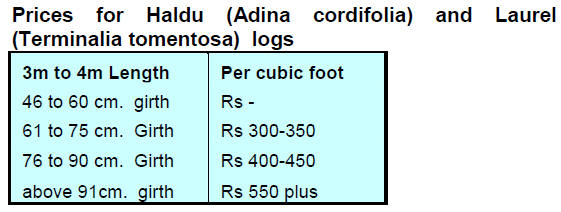

Teak tender prices

The following prices were recorded for teak log sales during competitive

bidding on 26th and 29th July during the Myanma Timber Enterprise tender.

Vessels waiting for cargo as log deliveries are

slow

Natural teak is still reported to be trading below expectations and demand

for non-teak hardwoods remains very weak. Analysts say that delivery of logs

to the port has been slow such that vessels have to wait for cargoes.

Durable species like pyinkadoe and thitya, ingyin are currently poor in

demand. Some analysts say the weak Indian rupee has had a negative effect on

sales as India is the major buyer of Myanmar teak.

Myanmar timber certification committee replaced

The Ministry of Environmental Conservation and Forestry (MOECAF) has

established a Myanmar forest certification committee (MFCC) which replaces

the old Myanmar timber certification committee.

The new committee is more broad-based as it includes members from various

ministries such as Health, Labour; National Planning, Science and

Technology; Attorney General¡¯s Office; Myanmar NGO¡¯s and the Myanmar Timber

Merchants¡¯ Association.

Some say this new committee lends more credibility to the process as it

includes representatives outside of MOECAF.

Raising awareness on the EU FLEGT Action Plan

An EU-MOEFCAF workshop on FLEGT was held at the capital city, Naypyitaw in

mid July and the MOECAF Minister, Win Tun, provided an opening address.

The workshop was attended by the Director-Generals of MOECAF and officials

from the EU. One of the aims of the workshop was to increase awareness of

the EU FLEGT Action Plan and the changes in the international timber

markets.

Myanmar has not yet entered into negotiations with the EU on a VPA. Analysts

say that it is definitely in the interest of the country to adopt a credible

domestic system of legality verification.

Analysts expect Myanmar may follow the steps taken by other ASEAN member

countries.

The consensus is that until an internationally acceptable scheme for

legality verification is implemented in the country exporters may find it

very difficult to expand trade with EU member states.

¡¡

6.

INDIA

Exports fall but revival expected in

second quarter

Exports declined in the first quarter of fiscal 2013 dropping by almost 1.5%

year on year to US$72.4 billion.

At the same time imports of gold and silver also were down which helped

narrow the trade deficit to a three month low of US$12.2 billion in June

2013, a healthy figure when compared to the high of $20.1 billion in May.

Declining exports are a global phenomena for those countries pursuing export

led growth. China, for example, recorded a contraction in exports in June.

Indian exporters are asking the government to arrange an export credit

facility as they are now severely hit by high interest rates from commercial

banks.

The Indian Industrial Production Index also fell in May which, say analysts

surprised many. Weak output numbers were anticipated but no-one expected

negative growth.

However, despite the gloomy first half data

analysts are optimistic that the export performance will have picked up in

the second quarter. All eyes will be on the second quarter trade numbers

when they are released.

Industry fears re-introduction of import duties on wood products

India¡¯s trade deficit in the April-June period was a hefty US$50 billion

compared with US$42.2 billion in the corresponding period last year. The

numbers show that while exports fell imports rose. It has been reported that

the government is considering raising import duties on high cost items and

on gold.

Unfortunately wood and wood products are also included in the list of items

for which import duties may be raised. The timber industry has been quick to

point out that wood products are a basic raw material required for house

building and for domestic manufacturing industries.

Import duties on wood products were removed some time ago when the current

prime minister was finance minister. The removal of import duties was

applauded by the forestry sector for the positive impact it had on reducing

illegal logging and over cutting of domestic forests.

The industry and forestry sector feel that the re-imposition of import

duties on wood products would be unfortunate as the benefits of duty free

wood product imports for the economy and forest security would be lost.

Domestic teak prices climb at local auctions

The effects of higher landed costs of imported logs and wood products are

now being felt in the domestic trade and on sale prices for domestic timber.

Recent auctions prices paid by millers have increased and average prices per

cubic foot ex-depot were as follows:

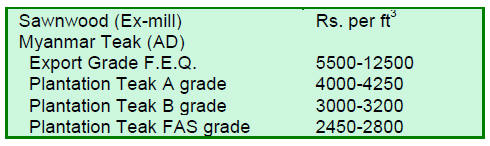

Imported plantation teak prices

The demand for teak in India seems insatiable but the continued depreciation

of the rupee is pushing up the cost of teak imports. Current prices, C & F

Indian ports per cubic metre are shown below.

¡¡

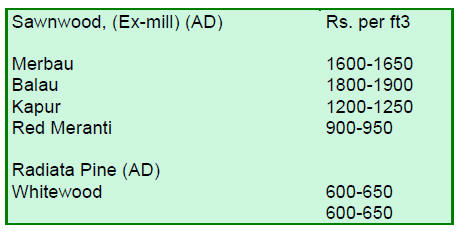

Ex-mill prices for sawnwood

Domestic ex-sawmill prices for air dried sawnwood cut from imported logs.

Price per cubic foot is shown below.

Domestic prices for Myanmar teak processed in

India

Slowing demand has resulted in relatively stable price structures.

Price variations depend mainly on length and cross

section.

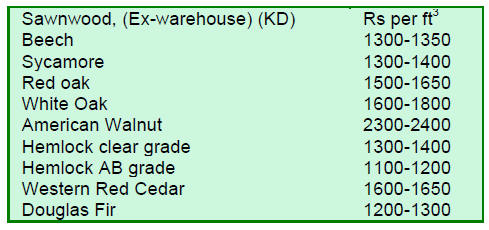

Prices for imported sawnwood

Ex-wharehouse prices for imported kiln dry (12% mc.) sawnwood per cu.ft are

shown below.

Price variations depend mainly on length and cross

section.

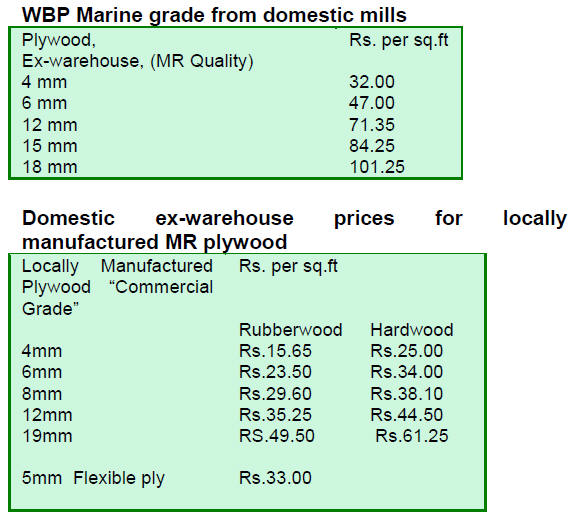

Plywood prices advance once more

Strong demand and the rising costs of resins and logs due to exchange rate

fluctuations have resulted in plywood manufacturers raising prices once

more.

Imperial tobacco reports on plantation

initiatives

Social and Farm Forestry initiatives by Imperial Tobacco Company (ITC) have

added more than 17,000 hectares of plantations during 2012-13 and this

brought the cumulative area of plantations to around 142,000 hectares.

Planting activities have increased the ¡®green cover¡¯ improved raw-material

supplies and have generated over 64 million man-days of employment for rural

households including poor farmers.

The combined planting of trees and agricultural

crops during the early years of the plantation provides for agricultural

increased agricultural production.

7.

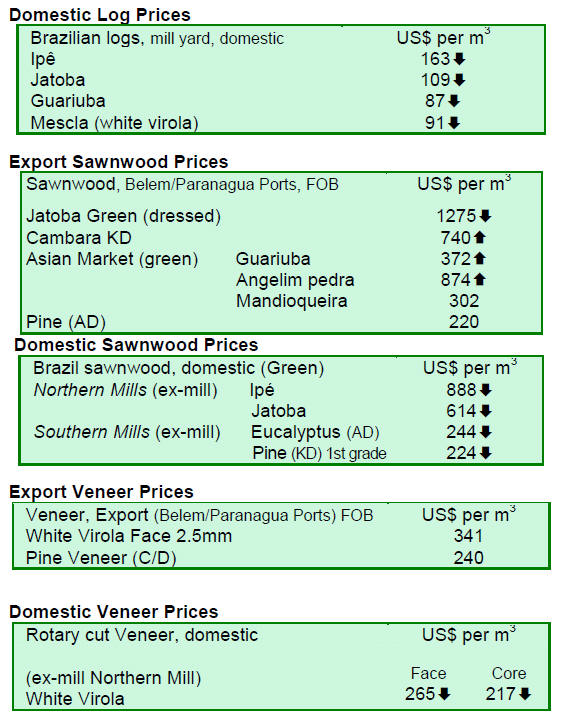

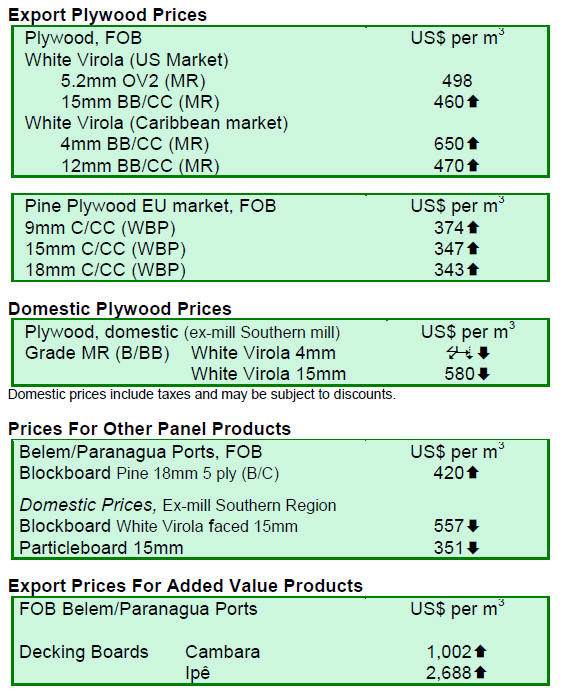

BRAZIL

Unfavourable outlook for inflation

Brazil¡¯s balance of payments posted a deficit of US$1.3 billion in June and

the current account turned in a deficit of US$4 billion, accumulating a

deficit of US$72.5 billion in the 12-month period up to June, equivalent to

3.17% of GDP.

Brazil¡¯s Consumer Price Index (IPCA) eased 0.26% in June falling below the

0.37% registered in May 2013 resulting in the lowest IPCA since June 2012.

In June the average exchange rate was BRL 2.17 to the U$ dollar compared to

BRL 2.05 a year ago.

For the third consecutive time the Central Bank adjusted the interest rates

as it moved to tame increasing inflation. The Monetary Policy Committee (Copom)

increased the Selic rate by 0.5 percentage point to 8.5% per year and

analysts say it could go to 9% in the next few months after starting 2013 at

just 7.25%, a historic low.

A note on the Central Bank website says ¡°The committee considers that this

decision will contribute to put inflation on the decline and assure that

this trend will persist next year.¡±

Greater than anticipated inflationary pressures have caused domestic prices

to rise sharply prompting street protests. The higher than forecast

inflation has undermined the effects of government stimulus measures and

affected consumer confidence, industrial output and retail sales. Policy

makers have reiterated warnings that the outlook for inflation remains

unfavorable.

Appreciation of US dollar pushes up domestic furniture prices

The Association of Furniture Industries of the State of Rio Grande do Sul (MOVERGS)

has said that the recent appreciation of the US dollar was one of the main

reasons for last months¡¯ increase in furniture prices.

The stronger dollar raises the cost of imported inputs and raw materials and

companies find hard to absorb the higher production costs so must pass the

rise onto consumers. High production costs are an obstacle to the furniture

industry of Rio Grande do Sul state.

Despite government incentives such as the home development programme ¡°My

Better Home¡± (Minha Casa Melhor) which offers access to competitive credit

for low-income families for the purchase of furniture and appliances

furniture, manufacturers have not been able to recover their competitiveness

in either the domestic or international market.

The extension, until only September this year, of

the reduction in the tax on industrialized products (IPI) for furniture also

influenced furniture prices say furniture producers.

While the extension of the tax reduction could boost sales in the

short-term, manufacturers are looking long term and preparing for the

tougher trading conditions to come.

New furniture centre and industrial park in Acre

Manufacturers in the municipality of Xapur¨ª, state of Acre, are benefiting

from a new furniture cluster and restructuring of the old Industrial Park.

This investment by the state government is aimed at stimulating the timber

sector economy and at bringing workers in the sector into the formal,

registered workforce.

Until now workers in the sector operated informally and could not secure

state production and environmental licenses. This made it difficult for them

to purchase raw materials in the regular market forcing them to turn to

alternative, often illegal, suppliers.

The creation of furniture clusters was made possible through support from

the Brazilian Development Bank (BNDES) which allocated some BRL 17 million

for this and other activities. The plan is to construct and refurbish 10

industrial parks for the sector.

The Acre state government recognises the value of the wood product

manufacturing sector and wants to provide stable and decent working

conditions for workers in the sector so they can contribute to the economic

development of the State.

June export trends encouraging

In June 2013, wood products exports (except pulp and paper) increased 7.7%

compared to values in June 2012, from US$190.9 million to US$205.6 million.

Pine sawnwood exports increased 3.1% in value in June 2013 compared to June

2012, from US$12.9 million to US$13.3 million. In terms of volume, exports

fell 2.4%, from 59,500 cu.m to 58,100 cu.m over the same period.

Tropical sawnwood exports declined 5.4% in volume, from 31,600 cu.m in June

2012 to 29,900 cu.m in June 2013 (from US$15.6 million to US$15.5 million).

Pine plywood exports declined 3.2% in value in June 2013 compared to June

2012, from US$34.2 million to US$ 33.1 million (from 87,600 cu.m to 85,700

cu.m.).

In a reverse of recent trends, tropical plywood exports increased 4.9% in

volume, from 4,100 cu.m in June 2012 to 4,300 cu.m in June 2013. But the

value of exports fell 7.7%, from US$2.6 million in June 2012 to US$2.4

million in June 2013.

A slight decline in furniture exports was recorded in June 2013. Furniture

export values fell from US$38.2 million in June 2012 to US$ 37.9 million in

May 2013.

Potential in Colombian furniture market assessed

The ¡®Brazilian Furniture Project¡¯ supported by the Brazilian Agency for

Export Promotion and Investments (Apex-Brazil) will provide information to

furniture manufacturers on opportunities in the Colombian furniture market.

The ¡®Brazilian Furniture Project¡¯ currently brings together 64 companies

offering them benefits such as access to business intelligence, information

and participation in national and international events.

The main target markets are the United States, Mexico, Peru, Chile, the

United Arab Emirates, Colombia, South Africa, Russia and Angola.

Apex-Brazil says Brazil¡¯s furniture exports to Colombia can be increased.

Colombia imported furniture valued at US$ 185.3 million last year but Brazil

accounts for just 6% of this total. Imports from the United States accounted

for 8% while imports from China were a massive 50%.

Brazilian exporters hope to capitalise on their design, aesthetic style

furniture, functionality and quality to secure a larger slice of the

Colombian market.

8. PERU

New ¡®Atlas¡¯ a tool to prevent misuse

of the natural forest

The much awaited forest concession Atlas which identifies forest cover loss

due to various practices has been launched by the National Forest

Supervisory and Wildlife Resources Service (OSINFOR). This Atlas provides a

tool to assess and therefore plan prevention of misuse of the natural

forest.

OSINFOR is the national body responsible for supervising and monitoring the

sustainable use and conservation of forest resources and wildlife.

The Atlas will eventually identify areas prone to erosion and loss of

biodiversity and will help identify forest loss from shifting cultivation,

the biggest risk to tropical forests in the country.

The Atlas contains recommendations on the design and implementation of a

geographic information system for the management and presentation of

information gathered. It also illustrates a conceptual model and the

application of the proposed Geographic Information System using GIS analysis

software ArcGIS 10.0.

Value the forests to encourage domestic growth says ADEX

Erick Fischer, chairman of Wood and Wood Industry Exporters Association (Adex)

said last week that exports of wood products for the first half of this year

fell almost 6% because of weak international and domestic demand.

He further indicated that the timber sector has the potential to contribute

more to the national economy as there is an area of around 17 million

hectares of permanent production forests that can be harvested sustainably.

"The current system of forest management and concession allocation fails to

(adequately) value the forests as a means to encourage domestic growth¡±, he

said.

In this regard, there is a need to promote policies in which the central

government empowers regional governments for implementation of effective

management to achieve sustainable timber flows to the domestic industry.

Programme for recovery and conservation of Amazonian forests

The Inter-American Development Bank has provided funds for a sustainable

forest development programme, some of which will be used for development

activities in the Peruvian Amazon."

According to the Ministry of Economy and Finance (MEF), this programme is

aimed at the recovery and conservation of Amazonian forests by strengthening

public forestry institutions and the competitiveness of the forest sector.

Its implementation will be the responsibility of the Ministry of

Agriculture, through the National Forest Service and Wildlife (SERFOR).

Peruvian plantation company executives learn from Chilean counterparts

A group of businessmen whose companies are involved in reforestation

recently visited Chile to get first hand experience of the latest

technological advances related to site preparation, mechanised planting,

tree breeding and modern nursery technology.

The group also examined industrial plantation harvesting and utilisation

systems for chip, pulp, paper and solid wood product manufacture.

The visit enabled the privates sector group from Peru to interact directly

with their Chilean counterparts. Analysts suggest this visit has motivated

the Peruvian group to move forward in their plantation development

investments.

¡¡

9.

GUYANA

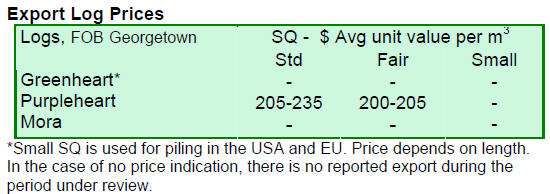

Firm demand in Asia for wide variety

of Guyana logs

Greenheart logs are yet to attract overseas buyers and during the period

reviewed there were no exports of greenheart logs.

On the other hand, exports of purpleheart logs continue and purpleheart

Standard Sawmill Quality logs attracted favourable top end prices of US$235

per cubic metre FOB, while purpleheart Fair Sawmill Quality logs were traded

at top end FOB prices of US$205 per cubic metre. There were no exports of

Mora logs during this period.

Asia continues to be the main market for Guyana¡¯s logs. In addition to

greenheart, purpleheart and mora several other species such as kabukalli (Goupia

glabra), shibadan (Aspidosperma album) and wamara (Swartzia leiocalycina)

were in demand in Asian markets.

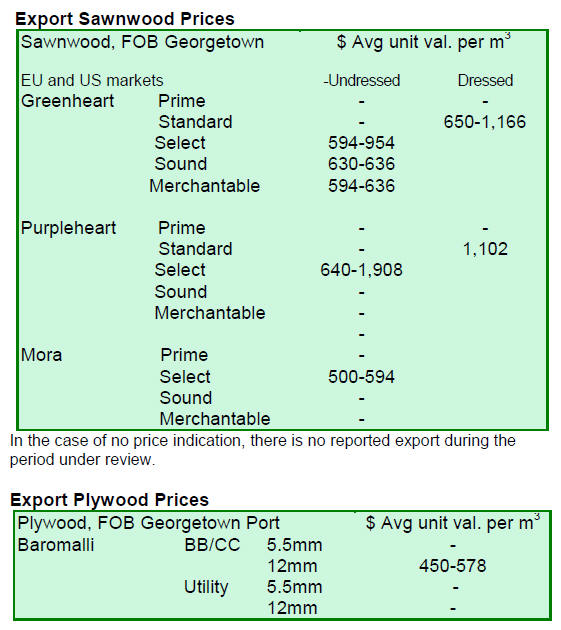

Sawn white silverballi attracts buyers in Qatar

Sawnwood exports continue to make a valuable contribution to total export

earnings.

Undressed greenheart FOB prices eased in the period reviewed. Select Quality

greenheart undressed sawnwood top end FOB prices fell slightly from US$1,230

to US$954 per cubic metre.

Sound Quality greenheart undressed sawnwood earned as much as US$636 per

cubic metre FOB, while Merchantable Quality FOB prices held at US$636 per

cubic metre.

Undressed purpleheart was shipped to the US at a significantly higher top

end price of US$1,908 per cubic metre. Other markets for Undressed

purpleheart included the Caribbean, Qatar and New Zealand.

During the period reviewed Undressed mora Select Quality FOB prices advanced

from US$500 to US$594 per cubic metre.

In addition to the trade in species mentioned above there were sales of

Undressed Sawn white silverballi (Ocotea canaliculata) at a high end price

of US$2,218 per cubic metre FOB in the Middle Eastern market.

Trade in dressed sawnwood improves

Export prices for sawn Dressed greenheart were good and the top end price

increased from US$1,060 to US$1,166 per cubic metre FOB in the Caribbean

market.

In contrast Dressed purpleheart prices remained unchanged at US$1,102 per

cubic metre FOB.

Sawn Dressed kabukalli (Goupia glabra) earned favourable market price

earning as high as US$975 per cubic metre FOB.

Caribbean markets significant consumers

Guyana export plywood FOB prices dropped marginally from US$584 to US$578

per cubic metre. Splitwood (shingles) were traded at US$977 per cubic metre

FOB with the Caribbean being the leading market for this product.

Roundwood (greenheart piles) secured good prices of US$ 599 per cubic metre

FOB in the North American market while exports of wallaba posts fetched fair

prices of US$510 per cubic metre FOB in the Caribbean.

Update EU FLEGT VPA Process

The VPA process has been moving within the timeframe set out in the

¡®roadmap¡¯ agreed between Guyana and the European Union.

The National Technical Working Group (NTWG) held consecutive weekly meetings

in preparation for the second round of negotiation focusing on progress on

the development of the VPA Objectives and Structure, the Scope of Agreement,

the Legality Definition, Compliance Framework, Community Importation

Procedures and the FLEGT License Specification.

In addition, preparations were also being made to present the issues and

concerns arising from the process.

A second round of negotiations was held in Brussels on July 18 and the

National Technical Working Group was comprised of 14 members representing

all of the major stakeholder groups.

Guyana participates in Chatham House meeting

Guyana was given the opportunity to participate at a Chatham House meeting

on the VPA on July 8 and 9 in London.

Representatives from Guyana¡¯s private sector, government and civil society

attended the meeting and each group was given the opportunity to report on

progress made on the FLEGT VPA ¡®roadmap¡¯.

Presentation topics included: Guyana¡¯s engagement with EU FLEGT VPA ¨C

progress to date, good Guyanese timber ¨C A participatory approach, Building

the competence of indigenous communities in relation to Guyana-EU FLEGT VPA

and Forest activities in indigenous communities.

Consultants identified for VPA communication strategy development

The government of Guyana has completed the recruitment process for

consultants to design a communication strategy and the scoping of impacts

for the VPA. Work on both the communication strategy and the Scoping of

Impacts is scheduled to commence shortly as they are integrally a part of

the development of the VPA.

¡¡