|

Report

from

North America

Tropical sawn hardwood imports recovered in April

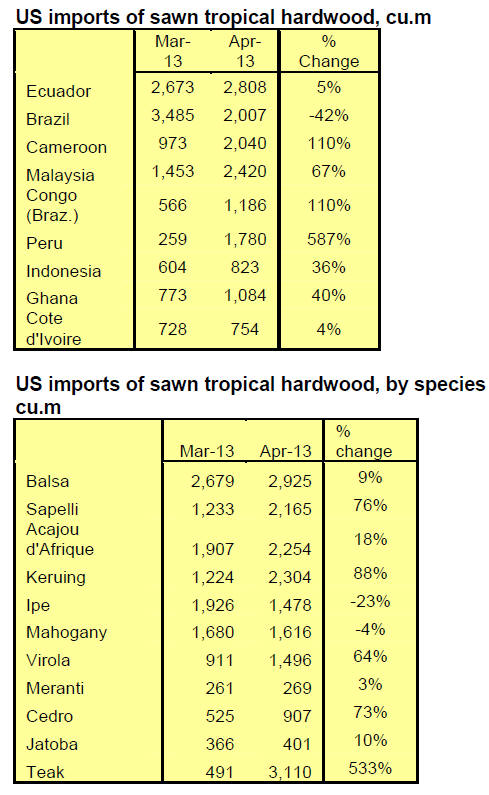

Tropical sawn hardwood imports recovered in April after two months

of low import volumes. Temperate sawn hardwood imports, on the other

hand, fell.

As a result total sawn hardwood imports declined by 34% from March, but

tropical hardwood shipments went up by 43% to 20,937 cu.m. Year-to-date

imports of tropical sawnwood are still slightly lower (-2%) than in

April 2012.

Imports from Brazil fell to just 2,007 cu.m. in April, but total imports

year-to-date are 15% higher than at the same time last year.

Imports of almost all main species from Brazil declined. Ipe imports

were 1,379 cu.m., while Jatoba imports were stable at 349 cu.m.

Imports from Cameroon recovered in April due to higher shipments of

sapeli (1,234 cu.m.) and acajou d¡¯Afrique (508 cu.m.). Total shipments

from Cameroon to the US were 2,040 cu.m. in (-14% year-to-date).

Imports from Peru went back up, to 1,780 cu.m., and year-to-date imports

are 72% higher than in 2012. Virola shipments grew from zero in March to

1,393 cu.m. in April.

Malaysian shipments to the US also increased substantially to 2,420 cu.m.

in April (+4% year-to-date), despite a decline in keruing shipments to

910 cu.m. Imports of Malaysian keruing more than doubled from March to

1,995 cu.m.

There was little change in Balsa imports from Ecuador (2,808 cu.m.) from

March. Balsa imports are almost one third below 2012 levels.

Canadian economy and housing market by region

Canada¡¯s two largest provinces at its centre, Ontario and Quebec,

have long dominated the country¡¯s economy.

Central Canada¡¯s economic output is centered on manufacturing, and

products are mainly shipped to nearby markets in the US.

The manufacturing sector in Ontario and Quebec has declined for a

variety of reasons, including weak US demand, a strong Canadian dollar

and increased competition from Asia, but the two provinces remain the

largest economies and the most populous region in Canada.

The boom in global resource demand and prices has favoured economic

growth in Western Canada and in the small province of Newfoundland &

Labrador on the east coast.

Oil and gas production, and mining contribute to high GDP growth rates

in Alberta, Saskatchewan, Manitoba and in the territories in Northern

Canada. Newfoundland & Labrador¡¯s GDP fell in 2012, but it is expected

to grow by over 6% this year due to higher oil production rates.

As the country¡¯s main oil producer the province of Alberta has the

highest GDP per capita in Canada and strong GDP growth rates. However,

its economic expansion could slow if two proposed oil pipelines are not

approved, which would connect Alberta with US and Asian markets.

Immigration a driver of the economy and housing demand in Canada

Immigration is an important driver of the economic growth in Canada.

Annual net migration is around 250,000 people, according to the Canada

Mortgage and Housing Corporation, which corresponds to approximately

0.7% of Canada¡¯s total population of 34 million.

Immigration also supports demand for housing and related products.

Central Canada has the largest housing market, but in wealthy provinces

like Alberta, the new residential construction sector is significantly

larger than in other provinces of similar size because of a good job

market and high net migration from other parts of Canada and from

abroad.

Canada and EU nearing free trade agreement, US and EU start

negotiations

Canada and the EU are in the final phase of a new free trade

agreement, which has been negotiated since 2009.

The deal covers market access, including public procurement contracts,

technical standards and regulations, investments protection, competition

and intellectual property rights, and sustainable development.

A final deal was expected to be signed at the G8 summit in Northern

Ireland in June, but negotiations are taking longer than expected.

According to Eurostat, the EU is Canada¡¯s second-largest trading partner

after the US, while Canada is the EU¡¯s 12th most important trading

partner. Direct investments in each other¡¯s market are even more

significant than trade in goods.

The US and the EU officially started free trade negotiations this June,

putting pressure on Canada to finalize the trade deal since the US is a

much more significant trade and investment partner for the EU.

According to the German Ifo Institute, free trade between the US and EU

could result in a decrease of exports from countries outside the deal,

especially from Latin America, Asia and Africa.

Even countries like China, Canada, Mexico and Australia could be

negatively affected if EU producers increase their share in the US

market. There may be benefits for raw material exporters, however, who

may gain access to a much larger, combined EU-US market.

|