US Dollar Exchange Rates of 27thJune 2013

China Yuan 6.1910

Report from China

Slowing growth alarms exporters to China

Disappointing data on factory output provided another sign that an

economic slowdown in China is well underway. In addition adding to the

concern of analysts are growing signs of a credit squeeze in the

country.

For many years money has been pouring into infrastructure projects which

have helped sustain growth. However, this impressive growth has been

fuelled by debt taken by provincial governments who are now struggling

to find the funds service these loans.

Countries which have a close trading relationship with China are

tracking events carefully as a continuing decline in growth in China¡¯s

economy could undermine the recent recovery by exporters.

Importers to feel impact of weaker yuan

After appreciating against the US dollar for most of this year the

yuan has started to weaken as foreign funds flow out, largely because of

evidence that the Chinese economy is slowing.

However, the yuan is still almost 1.5% higher against the dollar for the

year to-date even though there has been a major movement of cash out

other Asian countries.

However, the recent decline in the yuan/dollar rate is read as signaling

there are real concerns about the pace of slowdown in the Chinese

economy.

Until the middle of last year it seemed certain that the yuan, widely

considered as under valued, would continue to appreciate but markets

have been surprised by the trends in growth and by the decision by the

Chinese Central Bank to intervene.

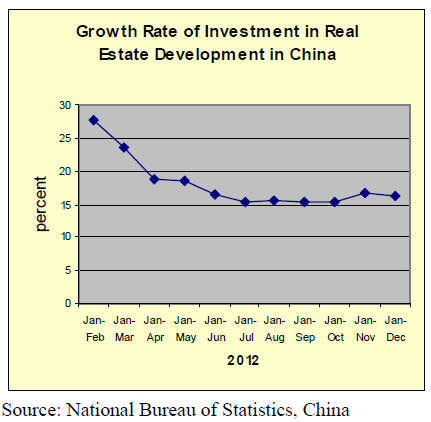

China achieves solid 2012 real estate sales

Chinese residential real estate sales in 2012 grew 14.9 percent

according to the National Bureau of Statistics of China. Continued

growth in demand for homes is good news for the domestic wood product

manufacturing sector and for exporters supplying timber to the Chinese

market.

Sales of commercial buildings in China, a major driver of demand for

joinery products and office furniture, increased in 2012. The total

floor area of office building sold in 2012 increased 12.4 percent.

Preoccupation with the strength of Chinese wood products in the

international markets distracts attention from the rapidly developing

domestic market for wooden building materials and added value wood

products.

The expansion of domestic demand in China serves to balance declines in

exports such that demand for timber raw materials will continue to grow.

Price trends for new homes

Data from National Bureau of Statistics show that ,compared to

levels in March 2013, prices for newly constructed residential buildings

declined in 3 cities, remained flat in 2 cities but rose in the

remaining other 65 cities included in the survey. For the complete data

see:

http://www.stats.gov.cn/english/pressrelease/t20130618_402904575.htm

Compared to levels in March this year, prices for existing homes in

April fell in only 3 of the major cities included in the recent survey.

For the most part, house prices increased across the country.

Compared to levels in April last year prices in April 2013 fell in only

3 cities. For 67 cities the year-on-year price increase was in the order

of 13 percent.

Rising prices add to fears of unmanageable inflation in the housing

sector which puts policymakers in a quandary as they try to curb growth

house prices while, at the same time, trying to achieve an economic

recovery.

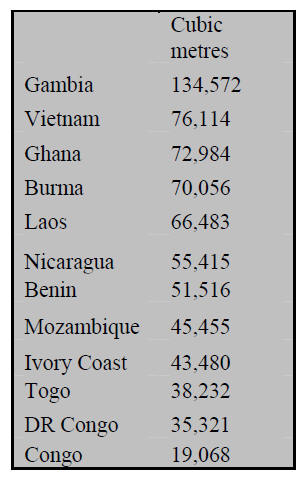

Strong domestic demand for ¡®redwood¡¯ furniture drives up imports

In recent years the manufacturing of ¡®redwood¡¯ furniture by Chinese

companies has increased and ¡®¡®redwood¡¯¡¯ imports have grown rapidly.

The term ¡®redwood¡¯ includes 5 genera, 8 classes and 33 species. The main

imports are of padauk, mahogany, rosewood, sanders, wenge and ebony.

China Customs data show that in 2012, ¡®redwood¡¯ log imports were 760,000

cubic metres, up by 25% from 2011. The value of imports of ¡®redwood¡¯ in

2012 was US$787 million, an increase of 9% year on year.

The average price for imported ¡®redwood¡¯ logs in 2012 was US$1,039 per

cubic metre. The main sources of ¡®redwood¡¯ imports to China can be seen

in the table below.

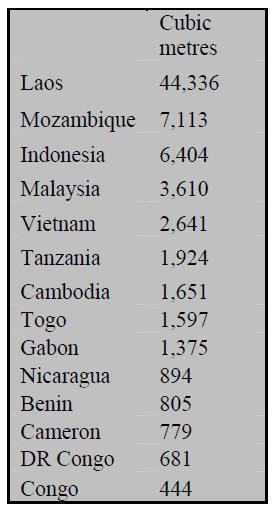

Imports of ¡®redwood¡¯ sawnwood have also increased and in 2012 China

imported 74.538 thousand cubic metres of sawnwood ¡®redwood¡¯.

The sources of ¡®redwood¡¯ sawnwood imports in 2012 are shown in the table

below.

The main sources of ¡®redwood¡¯ are Africa, Southeast Asia and Latin

America. Countries in Southeast Asia remain the traditional suppliers of

¡®redwood¡¯ to China but in recent years some African and Latin American

countries have become regular suppliers.

In the first quarter of 2013, China imported 250,000 cubic metres of

¡®redwood¡¯ logs at a value of US$239.20 million in value. The average

landed price was US$956 per cubic metre, up by around 25% year on year.

Imports of ¡®redwood¡¯ sawnwood in the first quarter of 2013 were 16,800

cubic metres, down by 29% year on year and the average landed price was

US$1,556 per cubic metre.

New-for-old furniture policy extended

The Beijing Municipal Commission of Commerce recently re-issued

regulations for the New-for Old furniture policy detailing the products

included and the scope of subsidy.

Items included in the policy are cabinets, sofas, beds, tables and

chairs which must be free standing. There are no restrictions on size or

material but the policy states the exchange must be only one old item

for one new item of the same type.

The subsidy is a maximum of 10% of the actual price of the new furniture

with 5% of this amount provided by government and 5% provided by the

furniture seller. The amount of the subsidy for a single piece of

furniture must not exceed 1000 Yuan.

The number of companies involved in the programme has increased this

year from 5 to 10 and the number of companies involved in recycling of

old furniture has increased to 7. The new programme will begin in July

and last for 6 months.

New technology institute to promote S. American species

A new institute called the South American Timber Application

Technology Institute has been created to provide Chinese manufacturers

with technological information on South American timbers.

The new institute, located in Beijing, is supported by the China Timber

and Wood Product Distribution Association (CTWPDA), the Timber Saving

and Development Center, the China Forestry Group and the Timber and Wood

Products Quality Supervising and Testing Center of China Logistics and

Procurement Association.

The institute will establish a data bank of South American timbers,

compile data on wood properties and be ready to provide advice on

appropriate processing techniques and enduses. The four agencies

involved will establish a consultative group of experienced local

specialists who can provide technical advice to industry.

The institute aims to provide support for promotion of South American

timber in China and to expand the range of species traded to China.

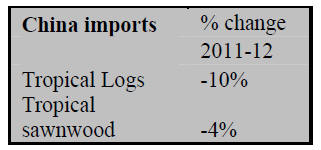

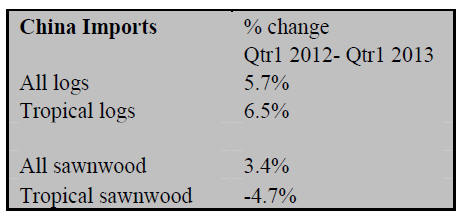

First quarter imports reverse downtrend of 2012

2012 imports of logs and sawnwood fell short of the levels in 2011

but first quarter 2013 data shows that this down trend has been

reversed. Imports of tropical logs and tropical sawnwood expanded in the

first quarter as can be seen in the following table.

Yuan 10 billion root carving business attracts official support

The business of wood and root carving has, until recently, not

attracted the attention of the public or government agencies but this is

a huge business in China.

The number of companies in China known to be involved in wood and root

carving exceeds 10,000 and these companies employ thousands of workers

as production is labour intensive. It has been estimated that the output

of this industry is around Yuan 10 billion annually.

In May this year a Wood and Root Carving Special Commission was launched

by the China Timber and Wood Product Distribution Association to try

raising the awareness of the public and policy makers of the growing

contribution the industry is to the economy.

¡¡

|