Japan Wood Products

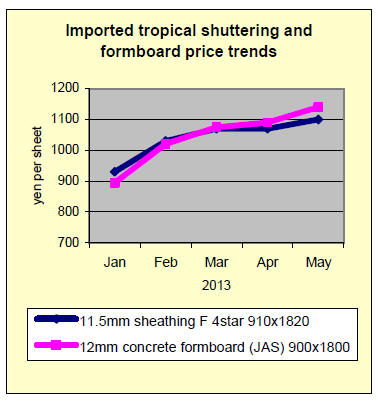

Prices

Dollar Exchange Rates of

27th June 2013

Japan Yen 99.15

Reports From Japan

JCER Outlook signals caution on inflation prospects

Analysts at Japan Center for Economic Research (JCER) are more cautious in

their forecasts for the Japanese economy than the Bank of Japan (BoJ), as is

evident in the latest JCER Outlook Report.

www.jcer.or.jp/eng/pdf/sa154-eng2.pdf

This report recommends caution regarding the likely effectiveness of the

“virtuous circle of production, income, and spending” and inflation

expectations.

The JCER report says “virtuous circle was one of the key terms used during

the previous economic recovery in the early 2000s.

However at that time terms of trade losses meant that the mechanism did not

function effectively and although GDP moved from negative to positive, this

was not enough to lift the economy out of its deflationary spiral”.

The similarity is drawn with conditions in early 2000 and today in Japan

where import bills are rising sharply because of the weaker yen and the

deficit is widening.

The JCER has doubts about inflation expectations also asking, do

expectations cause inflation, or does actual inflation uplift expectations?

Compounding the difficulty in making projections is the planned increase in

consumption tax.

The JCER says the looming increase in tax will result in ‘last minute

demand’ growth which could exceed expected levels such that afterwards there

is a sharp decline in consumer and business spending, perhaps even enough to

cause a slump in 2014.

Exports to US and China increased in May

Industrial output in Japan strengthened in May moving to a level not

recorded since 2011. The Cabinet Office report also shows retail sales grew

and the consumer price index remained flat bringing to an end the continuous

decline over the past six months.

Japan's exports also improved in May growing by around 10 percent, aided by

a weak yen and the better stability and modest improvement in overseas

demand. Exports to the US rose 16 percent from a year earlier while

shipments to China rose 8 percent.

This performance is seen as evidence that the efforts of the government to

break the deflationary spiral may be working.

But the weaker yen added to Japan’s already massive energy import costs,

leaving the country with a US$10 bil. trade deficit. However, analysts

consider the net effect of the weaker yen as offering promise for future

industrial expansion so remain positive on prospects for the economy.

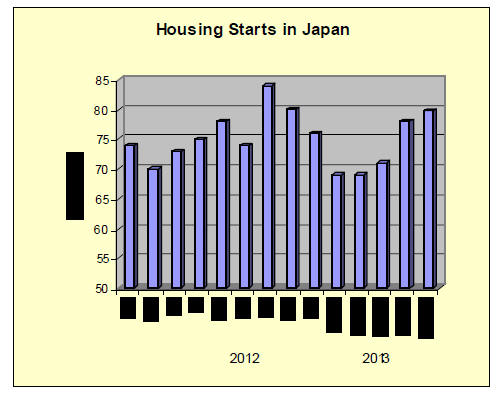

Housing starts surge as buyers act to beat consumption tax hike

May housing starts in Japan totaled 79,751 a nearly 15% rise from April

bringing annualized starts to 1,027,000 starts, well above the forecast

950,000 units. May orders received by the 50 top construction companies in

Japan rose 26% year on year

The full details of housing starts in Japan can be found at:

http://www.e-stat.go.jp/SG1/estat/NewListE.do?tid=000001016966

Analysts attribute the steep rise as a reaction of buyers to the anticipated

increase in consumption tax due next year and to the desire of buyers to

secure mortgages at the cheapest rate possible.

Banks providing home loans in Japan are already imposing increased interest

rates for fix rate mortgages.

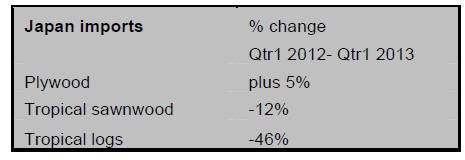

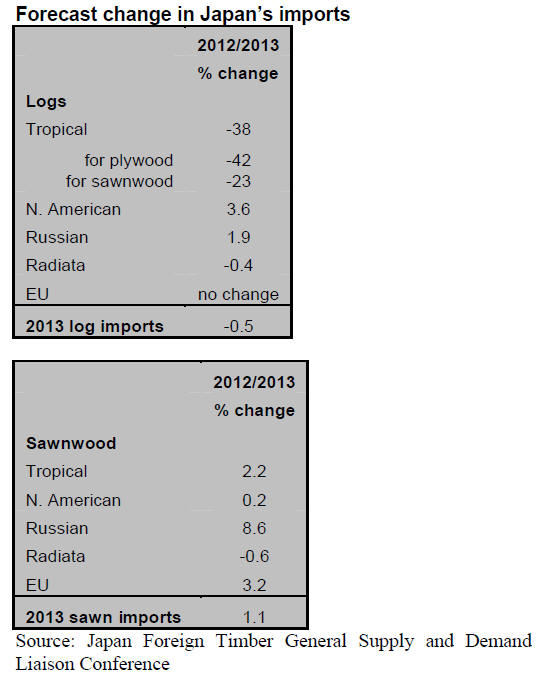

Japan’s tropical log imports forecast to fall sharply in 2013

The Japan Foreign Timber General Supply and Demand Liaison Conference has

released forecasts for timber imports in 2013.

While total demand for logs in 2013 is forecast to be as much as it was in

2012, demand for tropical logs is expected to fall by around 40% largely

because of the closure of one Japan’s major tropical plywood mill.

Statistics for first quarter imports shown below bear out the forecasts by

the Conference.

North American logs are utilised in Japan for sawnwood production and

2013 imports are expected to rise around 3%. Demand for Russian logs and

radiate pine logs is estimated to be about the same level as in 2012.

Japan imports significant volumes of tropical plywood and demand in 2013 is

forecast to be higher than in 2012 driven by increased activity in the

construction and house building sectors.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published

every two weeks in English, is generously allowing the ITTO Tropical Timber

Market Report to extract and reproduce news on the Japanese market.

The JLR requires that ITTO reproduces newsworthy text exactly as it appears

in their publication.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Canadian minister protests Wood Use Point System

The minister of the Canadian embassy in Tokyo in charge of commerce made

some speech at the reception of the Wood Truss Association and mentioned

that the Wood Use Point System is unfair system in favor of domestic wood.

The system narrows selection of lumber and method for house builders and may

force higher cost wood. Japanese house buyers should have right to select

method and

materials they like in house building but the System excludes imported wood,

which narrows options for the buyers.

This may conflict with WTO rules and may be against the Prime Minister’s

policy to promote free trade with foreign countries. To protect consumers’

interest, the system should include imported wood.

Canadian wood is highly evaluated in quality for the prices and has been

widely used in Japan for many years.

Downward projection on tropical hardwood logs

The Japan South Sea Lumber Conference held the regular meeting on June

10th to discuss demand of South Sea and African hardwood logs for 2013.

Total log demand for 2013 is down to 270 M cbms, 28.2% less than 2012

because of shrinking demand in Japan and gaining power of large log

consuming countries like India.

The peak of tropical hardwood logs is 1973 when total imports were 27,314 M

cbms so the imports dropped down to one hundredth in 40 years.

South Sea logs were used for plywood and lumber with smooth surface and

dimensional stability so they were the main materials for construction after

the war and during growing economy days in Japan but the demand started

dropping during 1970s because of log export restriction by producing

countries and violent price fluctuations then Indonesia shifted to

industrialization so import of finished products like plywood increased.

In 1980s, environmental issues became important so log import further

dropped. At the same time, plywood industry in Japan shifted to use softwood

logs so total log import in 1993 decreased down to less than 10,000 M cbms

then down to less than 4,000 M cbms in 1998. In 2012, the total volume was

mere 336 M cbms.

Unlike other imported logs, South Sea log market prices continue soaring in

Malaysia because of exhausting resources and aggressive purchase by India.

Japanese plywood mills are not able to pay competitive prices so that number

of mills using hardwood logs continues declining.

By application, logs for plywood are 215 M cbms, 28.3% less than 2012 and

for lumber are 55 M cbms, 27.6% less so shrinking trend continues.

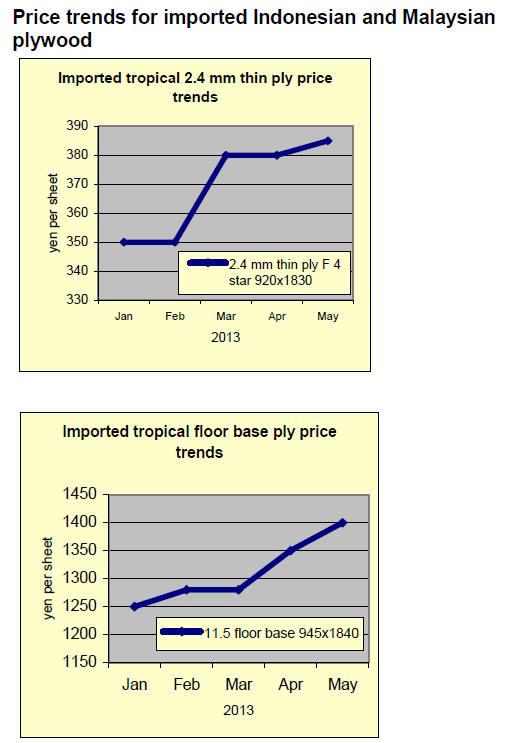

South Sea (tropical) logs

While log production in Malaysia remains slow and dull, the demand

continues very active by local plywood mills and India so that log

inventories in ports and log yard stay very low.

Log exporters intend to push the export log prices for Japan since log

prices for India are high but the Japanese buyers strongly resist higher

prices because of weakening yen so the negotiations take much longer now.

Some plywood mills in Japan think that log production should improve in late

July so that they buy minimal volume now.

Log prices in Japan are firm. Sabah kapur prices are 13,500 yen per koku CIF

and Sarawak meranti regular are 9,500 yen. Both are 300-400 yen higher than

May.

PNG’s calophyllum logs for plywood are 11,000 yen per koku CIF for June

arrivals.

Plywood mills and lumber mills in Japan are facing inflated cost of not only

logs but other materials like electricity, trucking and adhesive for plywood

so they need to increase the sales prices soon.

Meantime, plywood mills in Malaysia are aggressively procuring logs,

supported by busy plywood orders but log supply is chronically short so that

they even use logs for

export.

Log suppliers, which run plywood mills, send logs to plywood mills if it is

more profitable than exporting logs. This makes supply of small logs tight.

Sarawak meranti regular FOB prices are $305-310 per cbm and meranti small

are $260-270.

Log harvest in Sarawak during January and March this year was 1,904,800 cbms,

about 16% less than the same period of last year.

Nankai Plywood builds second plant in Indonesia

Nankai Plywood (Kagawa prefecture), building materials manufacturer, has two

plants in Indonesia. To expand production, it has started building second

plant at Lumadjang to produce laminated lumber of falcate, which will be

completed by the year end.

The Lumadjang plant has started running since October last year. It produces

lumber and laminated lumber from falcate logs and the products are sent to

Gresik plant, which is final assembly plant in Indonesia, where materials

for shelves and cabinets are made.

Nankai Plywood thinks that the demand will expand so that it decided to have

the second plant at Lumadjang.

The first Lumadjang plant has two band saws, planer gang saw and finger

jointer with laminating machines.

The second plant will have the same machines so that laminated lumber

production will be expanded from current 400 cu.m to 800 cu.m.

Gresik plant has capacity of 2,500 cu.m a month to process falcate laminated

lumber for shelf and cabinet board and also ceiling strips and closet bars

made out of meranti and mixed species , which are shipped for the plant in

Japan for final assembly.

Falcata logs are purchased in local open market for Lumadjang plant but the

company has its own plantation in Eastern Java and in two years’ time, it

will start supplying from its own plantation.

Japan’s furniture imports

May 2013 furniture imports

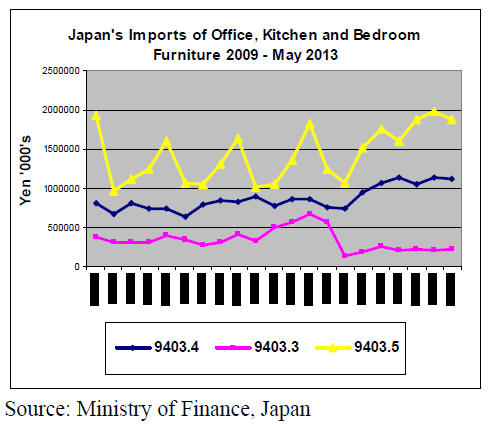

The source and value of Japan’s office, kitchen and bedroom furniture

imports for May 2013 are shown below. Also illustrated is the trend in

imports of office furniture (HS 9403.30), kitchen furniture (HS 9403.40) and

bedroom furniture (HS 9403.50) between 2009 and May 2013.

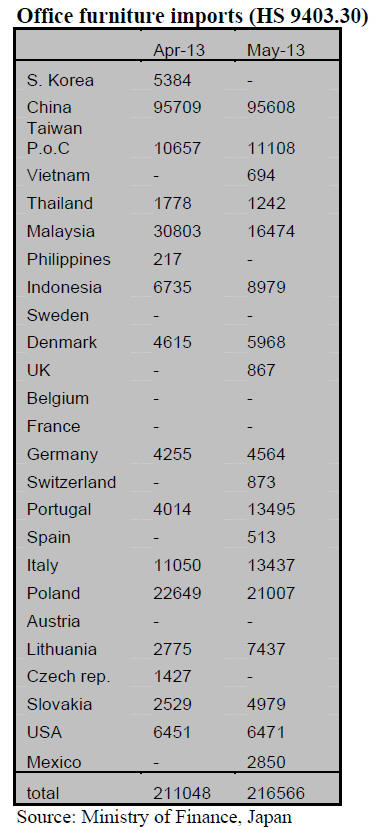

Office furniture imports (HS 9403.30)

In May 2013 Japan’s imports of office furniture from China, Poland and

Malaysia accounted for around 62% of total imports of this category of

furniture.

May imports from China were at around the same level as in April but imports

from Malaysia slumped from yen 30.8mil. to yen 16.5 mil. Imports from EU

member states and Switzerland accounted for 34% of Japan’s office furniture

imports in May.

The main EU suppliers were Poland at yen 21 mil. followed by Portugal,

from which imports more than doubled, and Italy at yen 13mil. Office

furniture imports from the EU increased by approx. 34% in May. In May,

Japan’s office furniture imports totaled yen 216 mil. an increase of over

20% from April.

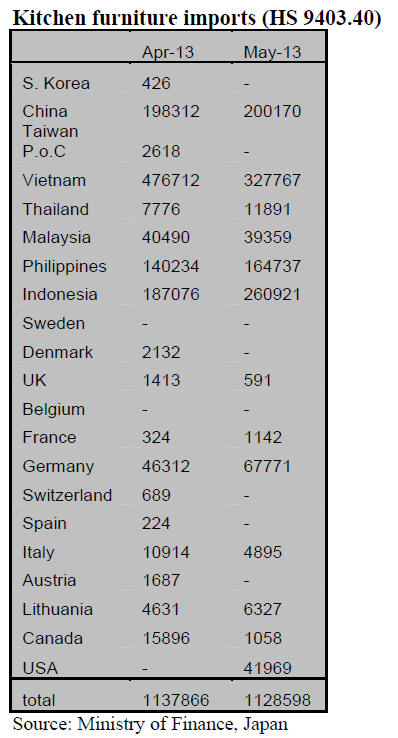

Kitchen furniture imports (HS 9403.40)

Kitchen furniture imports remain the second largest segment of all wooden

furniture imports into Japan after bedroom furniture.

Vietnam continues to be the number one supplier of kitchen furniture to

Japan but in May the value of imports from Vietnam, at yen 327 mil., was

down almost 30% from April.

Three suppliers, Vietnam, Indonesia and China in order of magnitude,

accounted for 76% of total kitchen furniture imports by Japan in May and if

shipments from the Philippines is included, then four suppliers provided 85%

of the total.

May shipments of kitchen furniture from Europe were dominated, once more, by

those from Germany and at yen 68 mil. were almost 50% higher than in April.

Imports during May from Italy fell by around half that in April while, in

contrast, imports of kitchen furniture from the US were the sixth highest of

all the main suppliers.

Bedroom furniture (HS 9403.50)

Japan’s imports of bedroom furniture are close to yen 2 bil. every month.

Imports in May fell slightly to yen 1.88 bil. from the yen 1.98 bil. in

April this year.

As in April the top suppliers in May were China and Vietnam which, together

with imports from Malaysia, accounted for around 88% of all wooden bedroom

furniture imports to Japan. Shipments of bedroom furniture to Japan from

China in May were at the same level as in April but shipments from Vietnam

and Malaysia fell 23% and 15% respectively. Imports by Japan from Taiwan

P.o.C and Poland fell significantly and imports from the US were down almost

50%.

Overall, imports of Bedroom Furniture in May were down 5% from levels in

April.

|