2. GHANA

Ghanaian entrepreneurs preparing for

international trade fairs

Ghanaian businesses are preparing to attend two international timber trade

fairs scheduled for later in the year.

One fair is the Timber Expo to be held at the Birmingham, UK, National

Exhibition Centre on 24 ¨C 25 September. The Expo will showcase the latest

products, innovations and developments from the UK and international timber

sectors.

The organisers expect around 150 exhibitors at the Timber Expo which is

considered one of the best in Europe for the building and timber industries.

Ghanaian exporters will also participate in an international forest products

exhibition, the Yiwu Exhibition, which will be held in China. This trade

fair will provide the opportunity for Ghana¡¯s timber exporters to promote

their products in a market with enormous potential.

The Ghana Investment Promotion Centre (GIPC), the Forestry Commission of

Ghana (FCG), Ghana Free Zones Board (GFZB) and the Minerals Commission will

attend the Yiwu Exhibition.

Decisive action on forest degradation

The government has taken decisive action that should drastically reduce

degradation of the country¡¯s forests. The Forestry Commission (FC) is in

talks with the Attorney General¡¯s department to ensure speedy prosecution of

those caught breaking the law.

This was made known by the deputy Minister of Lands and Natural Resources,

Ms. Barbara Serwaah Asamoah, during a 2-day visit to the Ashanti Region

where she inspected the Fomanso Forest Reserve in the Asante-Akim South

District.

She expressed the government¡¯s determination to get denuded reserves

replanted under the National Forest Plantation Development Programme (NFPDP).

The Government of Ghana has been implementing an ambitious plantation

programme under the NFPDP since 2001 with a target of establishing 20,000

ha. of tree plantations each year.

Last month, the Forestry Commission and Form Ghana (a forest plantation

management company based in central Ghana) signed a 50-year Public-Private

Partnership (PPP) Lease Agreement to jointly reforest an estimated 14,000 ha

of degraded forest land within the Tain Tributaries II Forest Reserve near

Berekum, in the Brong Ahafo Region.

The Forestry Commission, Form Ghana and the Berekum Traditional Council

signed a benefit sharing agreement to formally document the responsibilities

for project sustainability and control and on benefits to all stakeholders.

According to the CEO of the Forestry Commission, this kind of partnership

fits well within the Government¡¯s policy framework for plantation

development.

The CEO indicated that "the future of plantation development in Ghana can be

a great success if the private sector is enabled to play a key role".

GDP dragged down by poor performance of industrial sector

Ghana¡¯s unadjusted Gross Domestic Product (GDP) growth stood at 6.7%

year-on-year in the first quarter of 2013 compared with 10.3% a year ago.

The services and agriculture sectors recorded 12% and 1.1% growth

respectively while industry recorded negative growth of 0.8% as the power

crisis in the country has affected factory output.

In related news, the Statistical Service has

announced that the May 2013 consumer price index inflation, calculated on a

rebased index with fresh items to reflect the current consumer priorities,

stood at 11.1% year-on-year. The May inflation figure was 10.9% under the

previous model.

3. MALAYSIA

Fire management the answer to limiting

annual smoke pollution

Many parts of Malaysia are covered by smoke haze, an unhealthy situation

made worse by the current dry weather conditions. The Air Pollutant Index

(API) reached ¡°very unhealthy¡± levels in some populated areas in late June.

The Malaysian government's index for air pollution reached a measurement of

746 on the worst days in the southern district of Muar, far above the

threshold of 300 for hazardous air quality. This pollution has heightened

public awareness of environmental issues.

The smoke, the result of the annual burning by farmers and plantation owners

in Indonesia, is drifting across the Straits of Malacca and seriously

affecting southern Malaysia.

After the serious forest fires in Indonesia in 1996/7 ITTO implemented

several projects on various aspects of forest fire management in Indonesia

and Malaysia with good effect.

Farmers and plantation companies are now more aware of the dangers of fires

spreading to the forest and apply fire management principles but clearly

more needs to be done.

Indonesian authorities say they have fire fighters in the affected areas and

are investigating whether legal action should be taken against those

responsible.

Forestry ¡®peace deal¡¯ delivers payout to Sarawak plymill in Tasmania

In the midst of the political leadership tussle in Australia came news that

the Australian government has agreed to pay compensation to a Sarawak timber

company operating in Tasmania.

The Malaysian news agency Bernama reported that the Australian Government

has agreed to pay Sarawak-owned timber company Ta Ann A$26 million in

compensation for wood supply the company is giving up as part of the

forestry ¡®peace deal¡¯.

Under the deal, Ta Ann would lose access to forest resources which would

have yielded about 108,000 cubic metres or 40 per cent of its peeler log

supply.

Ta Ann said this means its mills in the Huon and at Smithton in Tasmania

will now have to run below capacity. The company said the compensation

payout will ensure all the 90 plus employees keep their jobs.

The announcement of the settlement has been

welcomed by ¡®peace¡¯ deal signatories, including the Wilderness Society's

Warwick Jordan.

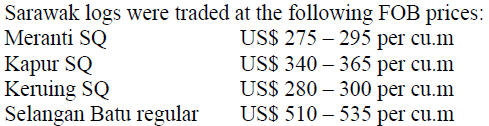

Quiet log market as buyers wait for Indonesian decision on log exports

Sarawak log exporters are saying that market sentiment is uncertain as some

log buyers are waiting to see if the Indonesian authorities decide to allow

the export of plantation logs.

Sabah TLAS being tested

In Sabah, the timber industry and State Authorities are working together on

the Sabah Timber Legality Assurance Scheme (TLAS) as part of the VPA which

Sabah hopes to sign with EU.

Sabah mills are now undergoing compliance audits as they test the Sabah TLAS

criterion on ¡°Issuance, renewal and upgrading of mill license and conditions

for operation¡±, as well as ¡°Worker safety and health¡±.

All wood processing mills are required to be licensed with the Sabah

Forestry Department and must comply with mill license conditions including

submission of monthly mill production returns and maintenance of log

delivery records.

The industry is also testing its TLAS principle on ¡°Trade and Customs¡±,

especially on meeting export regulations.

Exporting companies must have a valid export license from the Forestry

Department and must comply with state and national regulations pertaining to

the export of wood products.

¡¡

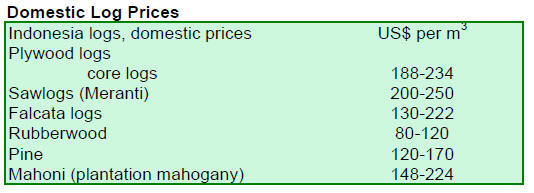

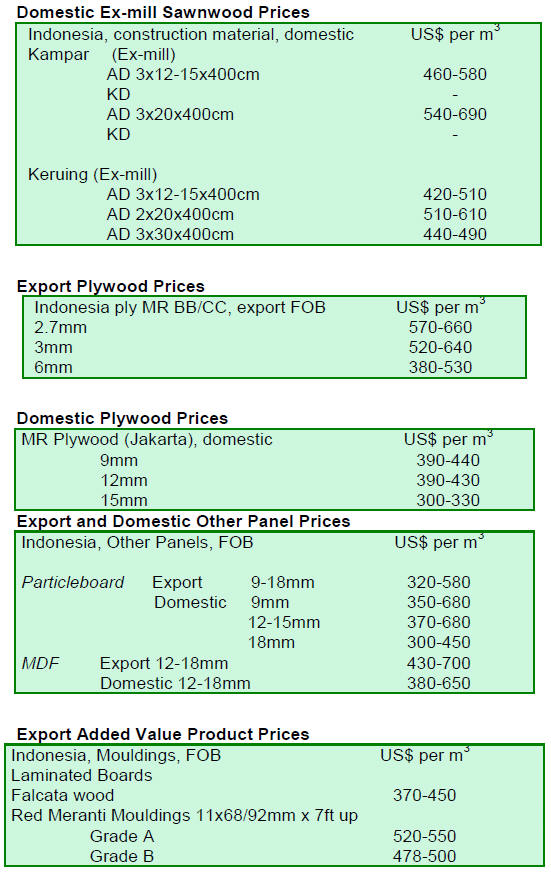

4. INDONESIA

Exports doing well despite delays in

ratification of VPA

With or without the Voluntary Partnership Agreement (VPA) on timber with the

European Union (EU), Indonesia¡¯s timber exports have increased significantly

because the country has an effective timber legality assurance system which

EU importers find satisfies their need to meet the due diligence

requirements of the EUTR.

Colin Crooks, deputy head of the EU delegation to Indonesia, said the volume

of Indonesian timber entering Europe in the first quarter of this year had

more than doubled compared to last year.

Indonesia¡¯s Ministry of Trade has data showing wood product exports, mostly

furniture, more than doubled to US$416 million in the first quarter of this

year, compared to US$194 million in the same period last year.

The signing and ratification of the VPA has been delayed in the EU because

documents have to be translated into all 22 of the EU languages.

Indonesia¡¯s timber legality scheme is being assessed, a process that is

required before it can be formally accepted as meeting the VPA requirements.

5. MYANMAR

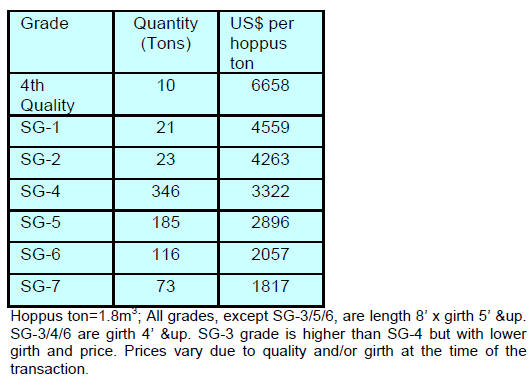

Teak log sales

The following prices were recorded for teak log sales during competitive

bidding on 21st and 24th June 2013 during the Myanma Timber Enterprise

tender.

In addition to the grades mentioned in the table

above teak logs of other specifications are available. Some 8 tons of short

logs measuring length 6 feet to 7 feet girth were sold at an average price

of US$1900 per ton hoppus measure.

Log-ends with lengths less than 5 feet are also sold and during the recent

tender the average price for this specification was US$1225 per ton hoppus

measure.

Short logs and log ends are usually by-products accumulated from

cross-cutting high quality veneer logs.

Short logs and log-ends are usually purchased by domestic or Thai buyers.

Apart from Teak, other hardwoods are not attracting much demand despite the

likelihood of a log export ban being introduced in April 2014.

Demand for teak logs is subdued at present as buyers are not expanding

stocks any further. Buyers from China and India are not very active which

has led to weakening demand.

Resource contracts could be renegotiated

Mizzima news ran a story recently saying a leading US think tank mentioned

that the Myanmar government plans to renegotiate billions of dollars of

natural resource deals to impose tougher environmental standards.

It added that Myanmar is a candidate to join the Extractive Industries

Transparency Initiative, which seeks to set international standards in

countries with major resource revenues.

South Korean firms bidding for business

The Irrawaddy News reported in its Business Roundup that a South Korean

trade delegation, led by Finance Minister Hyun Oh-seok, visited Myanmar amid

reports that the Korean government intended to triple its development aid

and loans to US$100 million.

Korean firms are bidding for contracts to help develop the planned new

Yangon airport at Hanthawaddy (near Bago).

¡¡

6.

INDIA

Timber imports through Kandla port

During the period April 2012 to March 2013 Kandla port handled imports of

4,354,300 cubic metres of timber. Out of the total imports coniferous

timbers totalled 1,703,265 cu.m and hardwoods 2,651,035 cu.m. Of the

hardwoods imported teak accounted for 470,535 cu.m.

The main hardwoods imported were identified in the report for the early part

of June 2013.

Overall timber shipments via Kandla port were 5%

higher in 2012-13 compared to 2011-12 and the indications are that shipments

are still increasing but, with the Indian rupee depreciating and prices

rising, the pace of growth in imports may slow in the coming months.

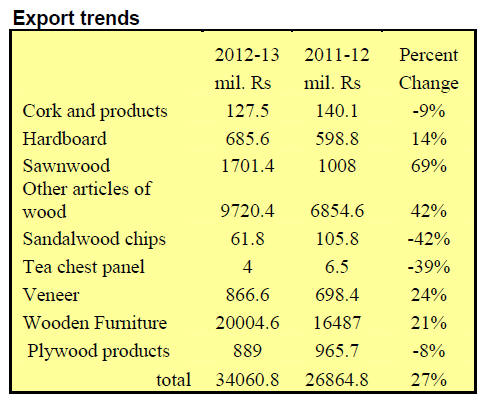

Surprising recovery in 2012 wood product exports

The 2012 export figures have been published, showing an improvement year on

year.

Exports of wood products (incl. cork and cork

items) grew by 27% in 2012-13 compared to a year earlier. A steep rise in

export values was recorded for most products except cork and cork products,

sandalwood chips, tea chest panels and other plywood products.

Correction

In Volume 17 Number 11, 1st ¨C 15th June 2013 the table, Imports of teak and

other hardwoods April 2012 to March 2013, refers to shipments through Kandla

port only.

India and Malaysia competing for Mid-East demand for sawn meranti

Indian mills are reportedly doing well sawing imported Sarawak meranti logs

and marketing sawn meranti in Middle East markets in competition with

sawnwood from Peninsula Malaysian mills. Analysts presume this is possible

because labour costs are lower in India compared to rates in Malaysia.

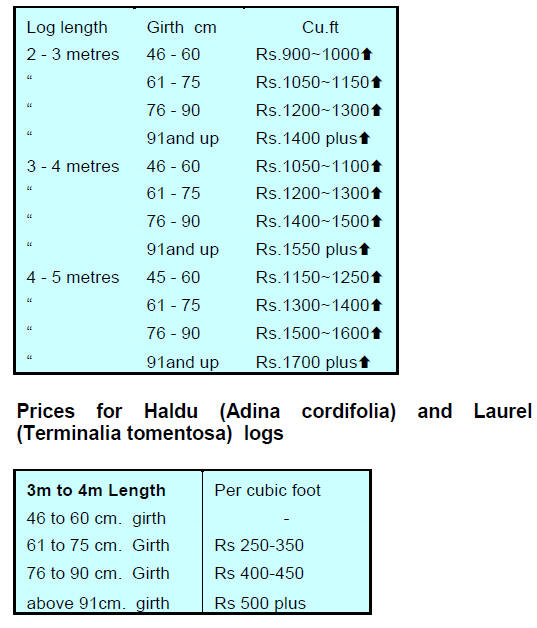

Hardwood auction prices in central India

In recent auctions at government forest depots in Khiria, Timarni and

Ashapur in Central India approximately 5,000 cubic metres of mainly teak and

some of Haldu and Laurel were sold.

Due to the rising costs of imported logs and because the domestic logs at

these auctions were of good quality prices were higher than in previous

auctions. Average prices per cubic foot ex-depots are shown below.

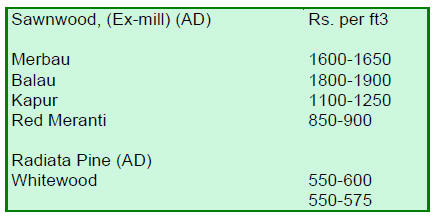

Domestic prices for sawnwood

Domestic ex-sawmill prices for air dried sawnwood per cubic foot are

unchanged but are likely to rise in the short term.

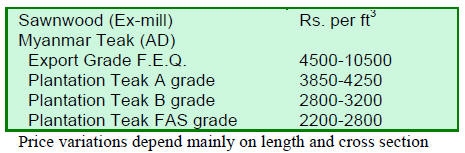

Myanmar teak sawnwood processed in India

Competition from plantation teak and durable non-teak hardwoods is a barrier

to price increases for locally sawn imported teak such that prices remain

unchanged.

Plantation teak imports affected by rupee dollar

exchange

Arrivals of plantation teak shipments have been affected by the strong

dollar and resultant higher landed costs in rupees.

Some minor adjustments in prices has beeen observed but generally prices

have remained steady as exchange rates in supply countries have also

adjusted to the stronger dollar. Current prices, C & F Indian ports per

cubic metre are shown below.

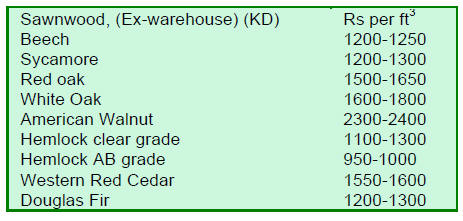

Prices for imported sawnwood

Ex-wharehouse prices for imported kiln dry (12% mc.) sawnwood per cu.ft are

shown below

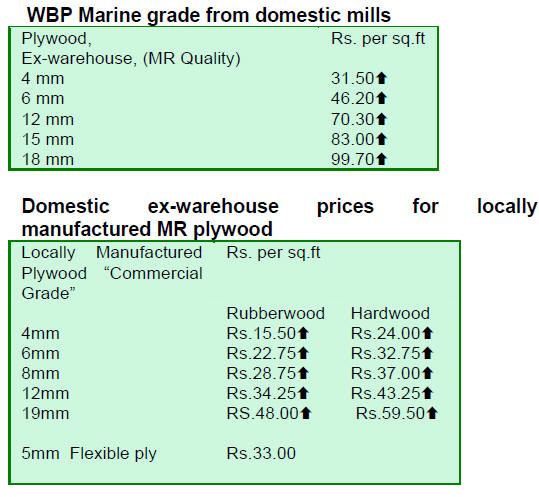

Plywood producers raise prices

Inflationary pressure and weak Rupee has forced the manufacturers to

increase the rates. Revised prices are shown below.

7.

BRAZIL

Central Bank raises interest rates to

tame inflation

Brazil¡¯s Consumer Price Index (IPCA) increased by 0.37% in May, which was

0.18 percentage point below the rate of 0.55% recorded in April. This is the

lowest monthly IPCA rate since June 2012 (0.08%). The accumulated IPCA rate

for the year to May was 2.88% which is lower than the 2.24% rate in the same

period in 2012.

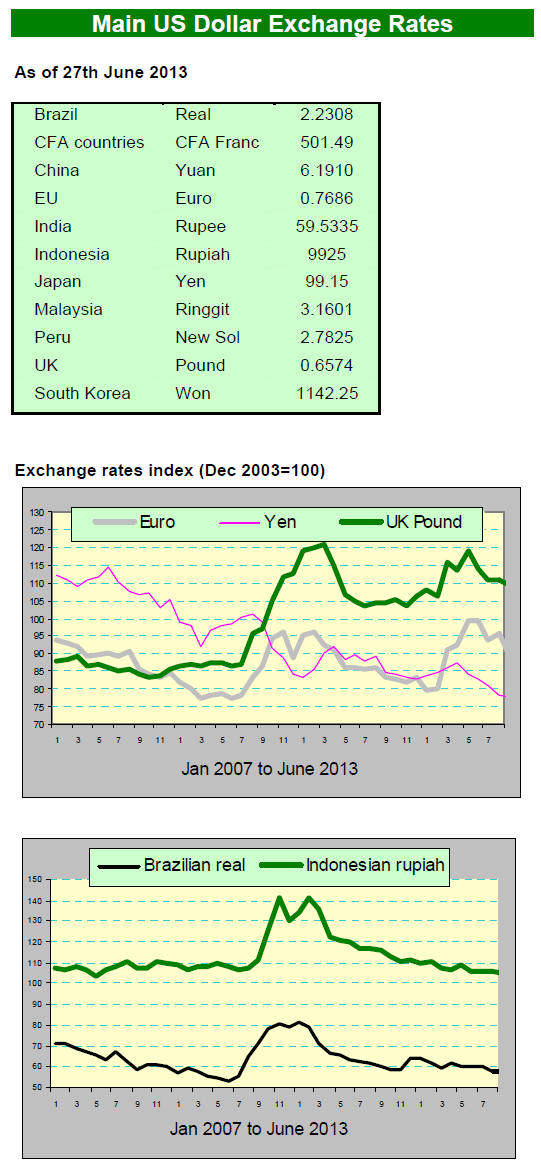

In May 2013 the average exchange rate was BRL 2.03/USD while in May last

year the rate was BRL 1.99/BRL indicating a slight depreciation of the real

against the dollar.

The Monetary Policy Committee (Copom) of the Brazilian Central Bank (BC)

raised the Selic rate by 0.50 percentage point at the end of May to an

annualized rate of 8%. The Committee considers this will contribute to

capping inflation.

Potential of Parica timber examined

Plantations of native species are not common in Brazil but some have been

established for commercial use and for recovery of degraded forests.

Among the species planted is Parica (Schyzolobium parahybum var. amazonicum)

a fast growing tree which yields timber with good characteristics.

The favourable characteristics have caught the attention of veneer and

plywood manufacturers however there is a lack of information on the

technical and working properties of the wood. Most past research on Parica

has been related to its silviculture.

Researchers at the Federal University of Lavras (UFLA), have carried out

work to document the characteristics of this timber.

The research involved describing and quantifying the structure of Parica

from different regions of the Amazon, determining the physical and chemical

properties of the wood both in commercial plantations and natural forests

and conducting dendrochronological studies.

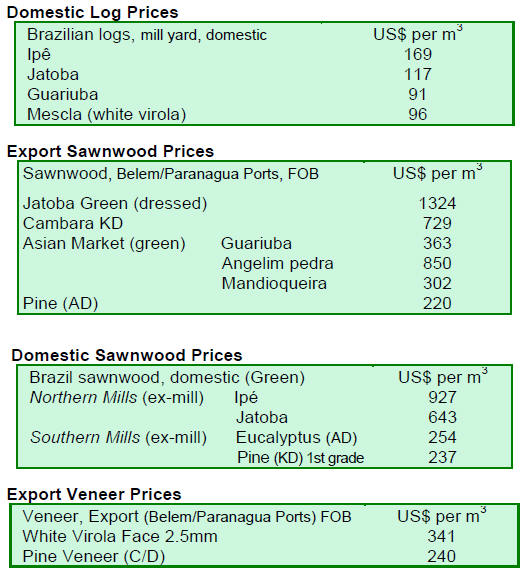

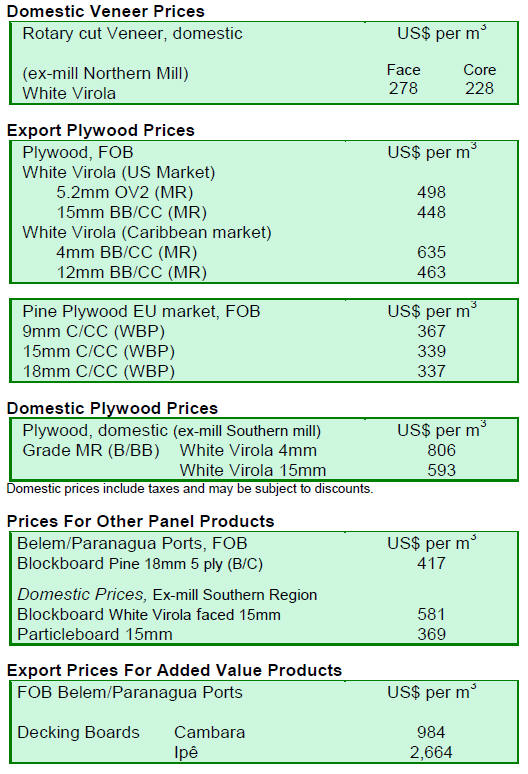

Tropical plywood exports continue to decline

In May 2013 the value of wood products exports (except pulp and paper)

increased 8.8% compared to levels in May 2012, rising from US$204.1 million

to US$ 222.0 million.

The value of pine sawnwood exports fell 14.9% in May 2013 compared to May

2012, from US$14.1 million to US$12.0 million. In terms of volume, exports

declined 17.7%, from 64,500 cu.m to 53,100 cu.m in the same period.

Exports of tropical sawnwood increased 3.0% in May from 33,200 cu.m in May

2012 to 34,200 cu.m in May this year. The value of tropical sawnwood exports

rose 4.3% from US$16.2 million in May 2012 to US$16.9 million this year.

Pine plywood exports increased 13.6% in value in May 2013 compared to May

2012, from US$35.9 million to US$40.8 million. The volume of pine plywood

exports also increased (14.7%) from 91,300 cu.m to 104,700 cu.m. over the

same period.

On the other hand, tropical plywood exports which are now very small, fell

9.4% from 5,300 cu.m in May 2012 to 4,800 cu.m in May 2013.

The value of exports of tropical plywood dropped 19.4%, from US$3.6 million

in May 2012 to US$2.9 million in May 2013.

A 4.4% increase in wooden furniture exports was recorded in May 2013

compared to the same period in 2012. Exports rose from US$41.0 million in

May 2012 to US$42.8 million in May this year.

Brazilian furniture does well in Dubai fair

Eight Brazilian companies participated in the¡¯ Index Dubai 2013¡¯ fair, which

took place on 20 ¨C 23 May.

During the event, orders worth around US$800,000 were attracted and the

value of prospective business for the next 12 months was put at US$2.2

million. ¡®Index Dubai 2013¡¯ attracted more than 800 exhibitors from 47

countries and more than 20,000 visitors.

Participation in trade fairs in Bahrain, Kuwait,

Oman, Qatar, Saudi Arabia and the United Arab Emirates has enabled Brazilian

businesses to generate significant income.

Reports suggest that between January and March this year these countries

invested US$3.3 billion in their residential housing sector which provides a

great opportunity for wood product exporters.

Strengthening sustainable forest management

A conference on Forests for Future Generations was held in mid-June in

Berlin, Germany. The discussions focused on public and private

responsibility for sustainability, initiatives to support forest management

and responsible trade by countries that produce, process and buy tropical

wood or wood products.

The meeting brought together about 100 participants, including government

officials, representatives of industry and civil society and the Brazilian

Forest Service participated.

The main themes discussed included promotion of sustainable forest

management in tropical regions, the expansion of the scope of legal and

sustainable forest products, possible partnerships among the public sector,

civil society and the private sector, the awareness of consumers and

influence of buyers and civil society on actions for government decisions.

Price trends

Average prices of wood products in Brazilian real did not change over the

past two weeks.

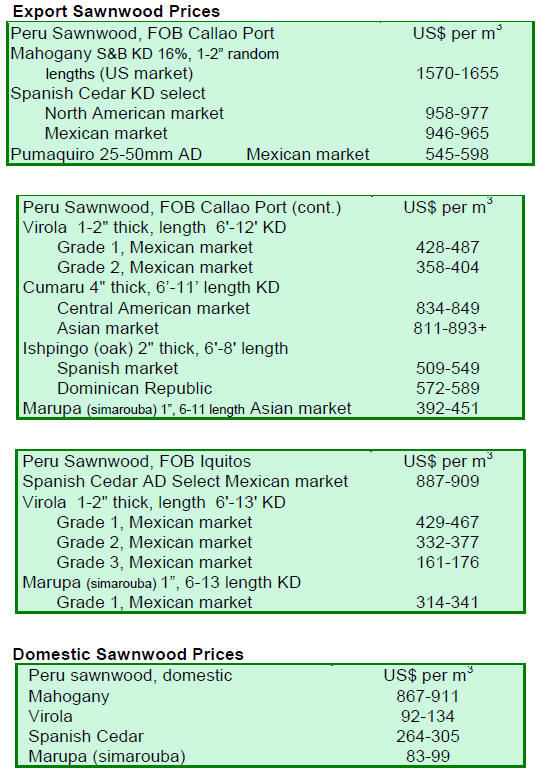

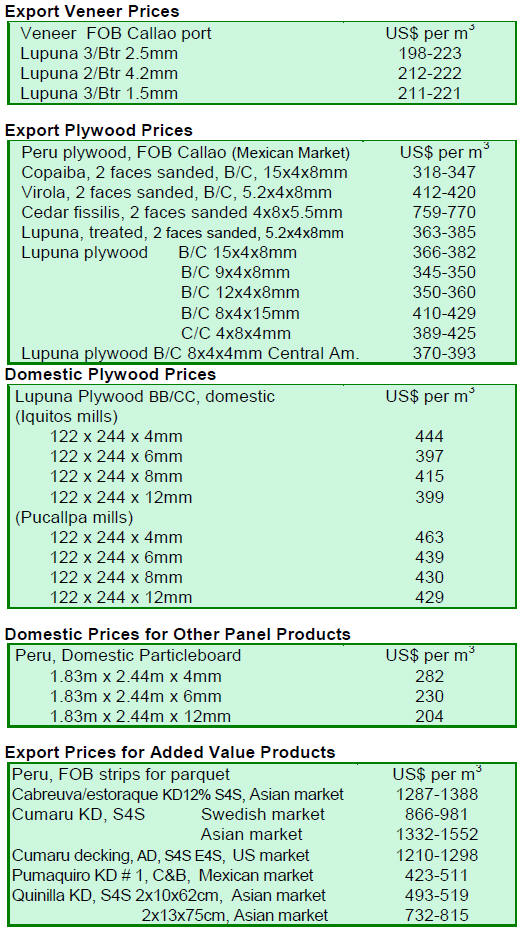

8. PERU

Forum for sustainable development created

in Loreto

In the first week of June a wide range of stakeholders met to discuss the

future of Loreto after reviewing the findings of a study "Sustainable Loreto

to 2021" prepared by researcher Marc Dourojeanni.

This study recommended integrated planning as critical to achieving

development in Loreto and for minimising conflicts, irrational use of

natural resources and the proliferation of illegal activities.

Dourojeanni, said what happens in Loreto in the coming years will have an

impact nationally as this region has nearly a third of the land area of the

country.

He said "although it is an important area in Peru, Loreto has the worst

power supply in the country, the worst infrastructure for telecommunications

and is almost completely isolated from the rest of the nation¡±.

At the moment there are at least 36 different plans for development of the

region, some of which are contradictory. It is hoped these anomalies can be

addressed through the newly established "Forum for Sustainable Development

Loreto ".

The Forum will address substantive issues such as

communications, energy planning, mining activities and land tenure amongst

others.

Forest concession atlas launched

The Council of Ministers has launched an atlas of forest concession as a

tool to identify deforestation from various practices.

The Council will, by utilising the resources of OSINFOR, seek to prevent the

misuse of the forest resources.It took around 10 years for an institutional

system for forest concession allocation to be enactment into law (Law No.

27308, Law of Forestry and Wildlife) and the new atlas is perceived as

providing an integrated view of forest management and utilization.

French government consulting firm opens office in Peru

ONF International, the international arm ONF of France (www.onfinternational.org/en.html),

is a consulting company and it will open an office in Peru.

ONF International (ONFI) is an international environmental consulting

company specialising in sustainable ecosystem management. ONFI undertakes

work in more than fifty countries in Latin America, Africa and Asia.

9.

GUYANA

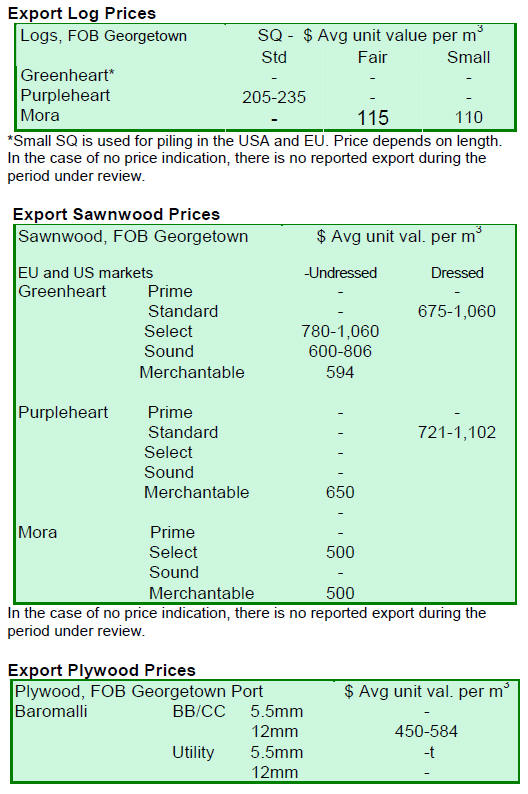

Wamara logs attract good prices

from Chinese buyers

During the period reviewed there were no exports of greenheart logs and only

a small volume of Standard sawmill quality purpleheart were exported. Prices

for purpleheart logs were around US$235 per cubic metre.

Mora log export prices remain firm and during the period reviewed. Exports

of wamara (Swartzia leiocalycina) logs made a positive contribution to

overall export earnings attracting prices as much as US$160 per cubic metre

for Fair Sawmill quality logs. China was the main destination for logs from

Guyana.

Sawnwood prices vary in market with little direction

Sawnwood exports made a fair contribution to total export earnings and FOB

prices have been encouraging prices during the past weeks.

Undressed greenheart (Select category) top end FOB prices dipped from

US$1,357 to US$ 1,060 per cubic metre. During the period of this report FOB

prices for Undressed greenheart (Sound category) earned a top end price of

US$806 per cubic metre while Undressed greenheart (Merchantable category)

FOB prices moved up from US$551 to US$594 per cubic metre.

There was little trade in Undressed purpleheart sawnwood with only the

Merchantable category being traded however FOB prices were satisfactory at

US$650 per cubic metre.

Mora sawnwood FOB prices remained stable at around US$500 per cubic metre

FOB for both the Select and Merchantable Undressed categories. Undressed

sawnwood is traded to markets in the Caribbean, Europe and North America.

Dressed greenheart sawnwood top end FOB prices fell significantly from

US$1,500 to US$ 1,060 per cubic metre, while Dressed purpleheart sawnwood

top end FOB prices remain firm at US$1,102 per cubic metre. The Caribbean

was the prime market for Dressed sawnwood.

Exports of Guyana¡¯s ipe (locally called washiba) yielded a record high FOB

price of US$2,900 per cubic metre in the US market.

Guyana¡¯s plywood export prices continues to hold firm at US$584 per cubic

metre while prices for splitwood (shingles) earned US$909 per cubic metre

FOB with the Caribbean being the main market.

Exports of piling and posts continue and favourable prices were achieved.

Prices for posts went as high as US$700 per cubic metre in the Caribbean

market while piling prices were at US$586 per cubic metre FOB for the US

market.

Technical Working Group meets with key stakeholders

The VPA process is moving within the agreed timeline in the ¡®roadmap¡¯.

The National Technical Working Group (NTWG) held meetings with key

stakeholder groups to continue consultations and address concerns raised.

National consultations will commence on key aspects such as the Legality

Definition and the structure of a Legality Assurance System.

A third Technical Meeting (video conference) was held on the 5th of June and

focused on the updated Legality Definition, the Wood Tracking System (WTS)

and the Legality Assurance System (LAS).

It was agreed that another video conference would be required in order to

address some of the details and concerns in relation the Legality

Definition.

Preparations are being made for the second round of negotiation scheduled

for the 15th - 19th July, 2013 which will be attended by the NTWG. The

disussions in Brussels will allow members of the NTWG to better understand

the processes involved when wood products enter the EU market.

Guyana will participate in the Chatham House

meeting in July and representatives from the private sector, government and

civil society will also attend.

Developing the VPA communication strategy and scoping

The process of recruiting consultants for the design of the communication

strategy and the scoping impacts of the VPA has commenced.

It is expected that the consultants selected will have a very good

understanding of the local situations to adequately address the needs of the

sector.

The Communication Strategy is an integral aspect in the VPA since provides

for the most appropriate means of communication with stakeholder groups to

ensure the right messages go out and provide for feedback.

¡¡