Japan Wood Products

Prices

Dollar Exchange Rates of

27th June 2013

Japan Yen 99.15

Reports From Japan

JCER Outlook signals caution on inflation prospects

Analysts at Japan Center for Economic Research (JCER) are more cautious in

their forecasts for the Japanese economy than the Bank of Japan (BoJ), as is

evident in the latest JCER Outlook Report.

www.jcer.or.jp/eng/pdf/sa154-eng2.pdf

This report recommends caution regarding the likely effectiveness of the

“virtuous circle of production, income, and spending” and inflation

expectations.

The JCER report says “virtuous circle was one of the key terms used during

the previous economic recovery in the early 2000s.

However at that time terms of trade losses meant that the mechanism did not

function effectively and although GDP moved from negative to positive, this

was not enough to lift the economy out of its deflationary spiral”.

The similarity is drawn with conditions in early 2000 and today in Japan

where import bills are rising sharply because of the weaker yen and the

deficit is widening.

The JCER has doubts about inflation expectations also asking, do

expectations cause inflation, or does actual inflation uplift expectations?

Compounding the difficulty in making projections is the planned increase in

consumption tax.

The JCER says the looming increase in tax will result in ‘last minute

demand’ growth which could exceed expected levels such that afterwards there

is a sharp decline in consumer and business spending, perhaps even enough to

cause a slump in 2014.

Exports to US and China increased in May

Industrial output in Japan strengthened in May moving to a level not

recorded since 2011. The Cabinet Office report also shows retail sales grew

and the consumer price index remained flat bringing to an end the continuous

decline over the past six months.

Japan's exports also improved in May growing by around 10 percent, aided by

a weak yen and the better stability and modest improvement in overseas

demand. Exports to the US rose 16 percent from a year earlier while

shipments to China rose 8 percent.

This performance is seen as evidence that the efforts of the government to

break the deflationary spiral may be working.

But the weaker yen added to Japan’s already massive energy import costs,

leaving the country with a US$10 bil. trade deficit. However, analysts

consider the net effect of the weaker yen as offering promise for future

industrial expansion so remain positive on prospects for the economy.

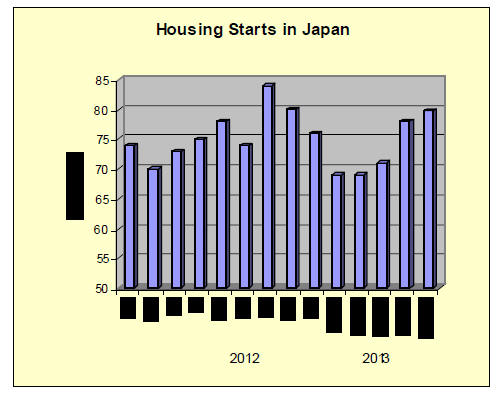

Housing starts surge as buyers act to beat consumption tax hike

May housing starts in Japan totaled 79,751 a nearly 15% rise from April

bringing annualized starts to 1,027,000 starts, well above the forecast

950,000 units. May orders received by the 50 top construction companies in

Japan rose 26% year on year

The full details of housing starts in Japan can be found at:

http://www.e-stat.go.jp/SG1/estat/NewListE.do?tid=000001016966

Analysts attribute the steep rise as a reaction of buyers to the anticipated

increase in consumption tax due next year and to the desire of buyers to

secure mortgages at the cheapest rate possible.

Banks providing home loans in Japan are already imposing increased interest

rates for fix rate mortgages.

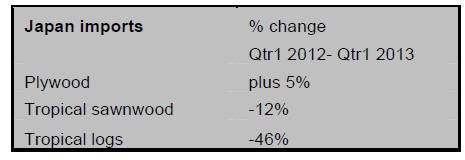

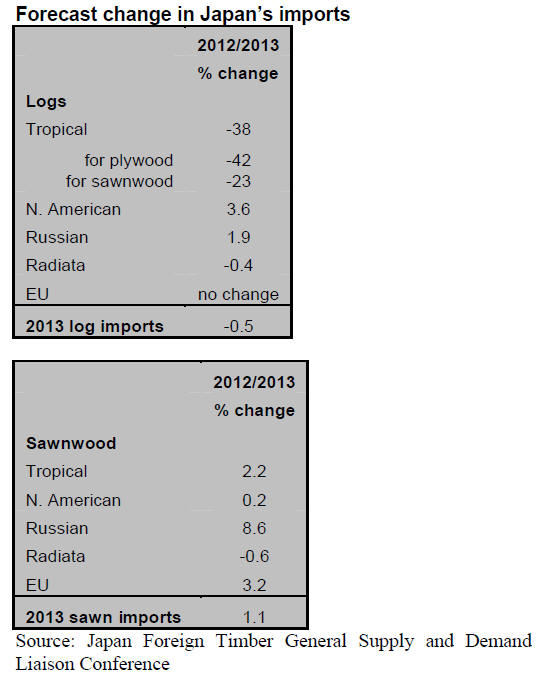

Japan’s tropical log imports forecast to fall sharply in 2013

The Japan Foreign Timber General Supply and Demand Liaison Conference has

released forecasts for timber imports in 2013.

While total demand for logs in 2013 is forecast to be as much as it was in

2012, demand for tropical logs is expected to fall by around 40% largely

because of the closure of one Japan’s major tropical plywood mill.

Statistics for first quarter imports shown below bear out the forecasts by

the Conference.

North American logs are utilised in Japan for sawnwood production and

2013 imports are expected to rise around 3%. Demand for Russian logs and

radiate pine logs is estimated to be about the same level as in 2012.

Japan imports significant volumes of tropical plywood and demand in 2013 is

forecast to be higher than in 2012 driven by increased activity in the

construction and house building sectors.

|