Japan Wood Products

Prices

Dollar Exchange Rates of

26th May 2013

Japan Yen

101.31

Reports From Japan

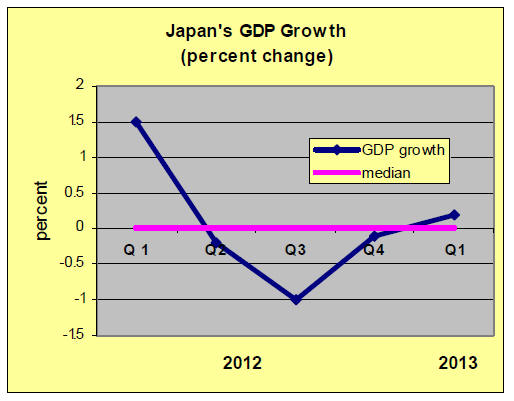

First quarter GDP beats analyst’s expectations

Japan's economy grew at an annual rate of 3.5% in the first three months of

2013 according to the latest information from Japan's Cabinet Office.

On a quarterly basis GDP increased by 0.9% beating analysts expectations.

Consumer spending and exports were particularly strong. Private consumption

accounts around 60% of the economy.

The latest GDP data are seen as validating the government’s economy policies

and adding strength to the argument for a rise in consumption tax within a

year.

Market volatility a threat to ‘Abenomics’

Japanese shares fell sharply recently marking the steepest decline since

August 2011. The Topix (Tokyo Stock Price Index) lost 2.6% percent in a day

and the Nikkei 225 (another stock index in Japan) dropped just over 3%.

The immediate effect of the share sell-off was a strengthening of the yen

which gained around half a percent on the dollar.

Stock market volatility could undermine the campaign by the Japanese

government and Central Bank to lift the Japanese economy out of its decade

long state of deflation.

Analysts are saying that Japanese policy makers need to keep up the momentum

for change if there is to be a sustained growth following on after the

success in the first quarter of this year.

Japan’s Economy Minister was reported as saying the recent correction, while

faster than expected, does not mean there is a fundamental change in the

economic outlook.

The Bank of Japan has signaled it is in close communication with financial

markets around the world and will increase its efforts to present investors

with details of its long-term policy plans. The yen strengthened against all

major currencies in mid May.

Economic Outlook report highlights optimism among manufacturers

The Japanese government has upgraded its assessment of the economy and

according to the May Economic Outlook from the Cabinet Office there are

signs of an improvement in exports and industrial output which, says the

update, suggests the government’s aggressive monetary polices are having the

desired results.

The previous Economic Outlook in April said the economy was improving but

was still showing signs of weakness in some areas but the latest report is

more optimistic.

Increasing optimism among manufacturers was one positive sign says the

report as exporters in the electric and precision machinery sectors are

benefiting from the weak yen.

To temper the positive news the report notes that while there are positive

indications of an improvement in the economy, some companies are not as

optimistic as there has been little growth in ‘real’ demand which, they say,

could mean a sustained recovery is some way off.

The Cabinet Office says the economy will continue to recover as exports

improve and as economic stimulus and monetary policy continue to lift

sentiment.

See

http://www5.cao.go.jp/keizai3/getsurei-e/index-e.html

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

The JLR requires that ITTO reproduces newsworthy text exactly as it appears

in their publication.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

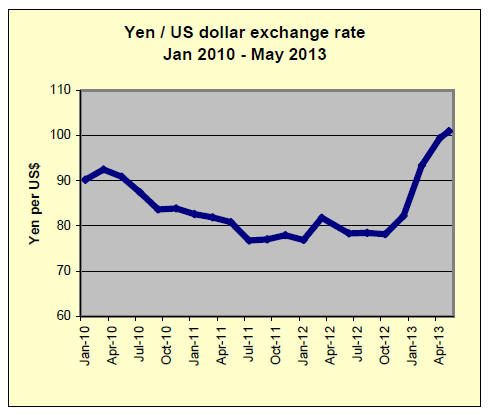

Impact of depreciation of the yen

To stop long lasting deflation, the Abe regime and the Bank of Japan took

monetary easing policy, which depreciates yen’s exchange rate sharply in

short time.

The yen was 78 yen to the dollar in last fall then it plunged to 102 yen,

about 30% drop in six months. Also the yen depreciated to the Euro by about

25%.

Wood industry is facing inflation of imported wood materials by weakening

yen.

Not only wood products but cost of other materials like adhesive for plywood

and laminated lumber and fuel cost of transportation is climbing.

Housing market this year looks positive with coming hike of consumption tax

and recovery of general economy as stock market is booming and corporate

revenue is increasing particularly on export business but transferring of

rising cost of materials is not fast enough as speed of depreciation is too

fast.

The prices of European structural laminated lumber have been fixed the yen

for the second quarter. Whitewood laminated post prices are 2,050 yen per

piece delivered and redwood laminated beam prices are 62,000 yen per cbm so

that there is no influence of exchange rate on those items until summer but

the focus is climbing cost of European lamina, which pushes manufacturing

cost of laminated lumber by domestic laminated lumber mills.

Prices of Canadian SPF dimension lumber (2x4-8) for the second quarter are

about $610 per MBM C&F, 37% higher than the same quarter last year. With

exchange rate of 102 yen, it would coat about 46,000 yen while current

market prices are about 45,000 yen per cbm FOB truck port yard.

Second quarter prices of Douglas fir baby square are about US$510 per cbm

C&F, which costs about 52,000 yen then May prices are about US$550. With

exchange rate of 102 yen, the cost would be over 60,000 yen. Current

wholesale prices have gone up to 57,000 yen but further hike is necessary.

If the prices go up over 60,000 yen, there will be competition with domestic

cypress square.

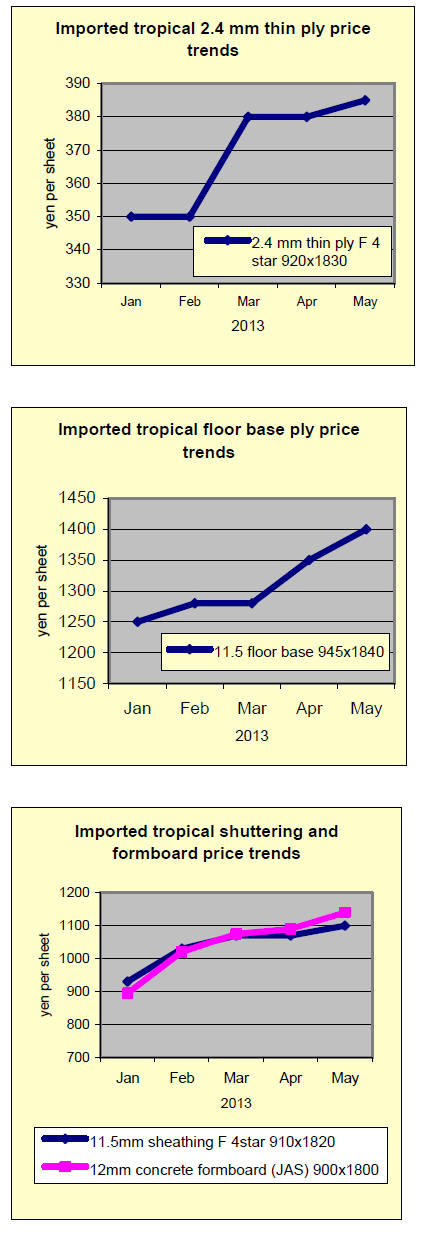

South Sea imported plywood export prices are about US$550 per cbm C&F on JAS

concrete forming panel. This costs about 1,220 yen per sheet but the market

prices are

1,130-1,150 yen so another 100 yen price increase is necessary. Since log

supply shortage in South East Asian countries is critical, export prices

seem to go up more.

Domestic softwood plywood manufacturers’ cost depends on how much imported

materials mills use. Domestic cedar is becoming the main materials but some

mills still use North American Douglas fir and Russian larch logs, which

cost is higher by weak yen.

South Sea (tropical) log prices continue climbing

According to Sarawak Timber Association, log production in January and

February was 16% less than the same months a year earlier. Current FOB

export prices are $300 on meranti regular, $250 on meranti small and

$230-235 on super small.

Market log prices in Japan are about 9,400 yen per koku on meranti regular

but June and July arrivals would cost about 10,700 yen, 14% higher than

current prices and 40% higher than the prices in last fall.

North American log export prices have been escalating by active housing

starts in the U.S.A. so that the lumber prices in Japan have been going

up.Chugoku Lumber, the

largest Douglas fir lumber manufacturer has raised the prices three times

successively since last February but increase of export log prices and

depreciation of the yen continue so that it has to increase the prices

further.

With busy demand, buyers have to accept higher prices. Prices of DF dry beam

have gone up to 54,000 yen per cbm delivered and of green beam to 42,000

yen.

Orders for dry beam Chugoku Lumber makes are brisk so that it has no extra

production of high demanded baby squares.

Russian lumber prices were high even without exchange rate of weak yen. The

suppliers’ prices have been climbing by log shortage.

Russian made red pine taruki (30x40 mm) prices shot up to 63,000 yen per cbm

FOB truck port yard and domestic mills’ product prices are 68,000 yen

delivered. They are about 10,000 yen higher compared to beginning of the

year.

March plywood supply

Total supply of plywood in March was 549,300 cbms, 15.6% more than March

last year and 10.0% more than February.

Total imported plywood arrivals in March were 317,900 cbms, 19.3% more and

11.9% more.Volume from Malaysia was 153,000 cbms, 53.0% more and 11.7% more.

That from Indonesia was 96,200 cbms, 5.5% more and 19.8% more.

Average monthly arrivals of imported plywood in last twelve months were

297,500 cbms so March arrivals exceeded average monthly volume.

In March, shipments by the largest Malaysian supplier increased and

unloading at port of Yokohama delayed and several thousand cbms are carried

over into April so that

April arrivals would be over 300 M cbms. Then after April, import volume is

estimated to drop sharply because of log shortage in producing regions and

purchase curtailment by Japan.

Domestic plywood production in March was 231,400 cbms, 10.9% more and 7.6%

more, out of which softwood plywood was 216,400 cbms, 14.1% more and 9.7%

more. This is the largest monthly production since June 2007.

Shipment of softwood plywood was 218,900 cbms, 35.0% more and 6.8% more.

This is six consecutive months that the shipment exceeded 200 M cbms. The

inventories were 125,100 cbms, about 2,500 cbms less than a month ago.

South Sea (tropical) log supply

Weather in Sarawak, Malaysia is improving but imbalance of log supply

and demand remains. Log supply should recover shortly but the demand is

brisk. India is active in log purchase since late March so that export log

prices continue climbing.

Sarawak meranti regular log supply is tight and FOB prices are as high as

US$300-305 per cbm on yellow meranti. Small meranti prices are over US$250

and super small are about US$230. They are all firm and strong.

Meanwhile, purchase by Japan is slow. Plywood mills in Japan try to avoid

high log prices by skipping regular purchases. Or they are seeking other

sources to buy logs if the prices continue going up. The importers have

trouble because the suppliers’ prices and Japanese buyers’ idea prices are

too far apart.

Weather in PNG is still in rainy season and heavy rain falls hamper log

production. Meantime, China continues aggressively purchasing logs in PNG

and many log ships for China are tied up in ports, waiting for logs.

There are busy inquiries in Sabah to replace Sarawak logs and some plywood

mill is preparing to buy serayah logs in Sabah, which is often short in

scale measurement.

Log prices in Japan are firming because of weak yen. Price negotiations

between log importers and plywood mills are tough going.

Meranti regular log prices are 9,400 yen per koku CIF, 500 yen up from

April. Plywood mills suffer high log and adhesive cost and beg customers to

accept higher plywood prices.

Price trends for imported Indonesian and Malaysian plywood

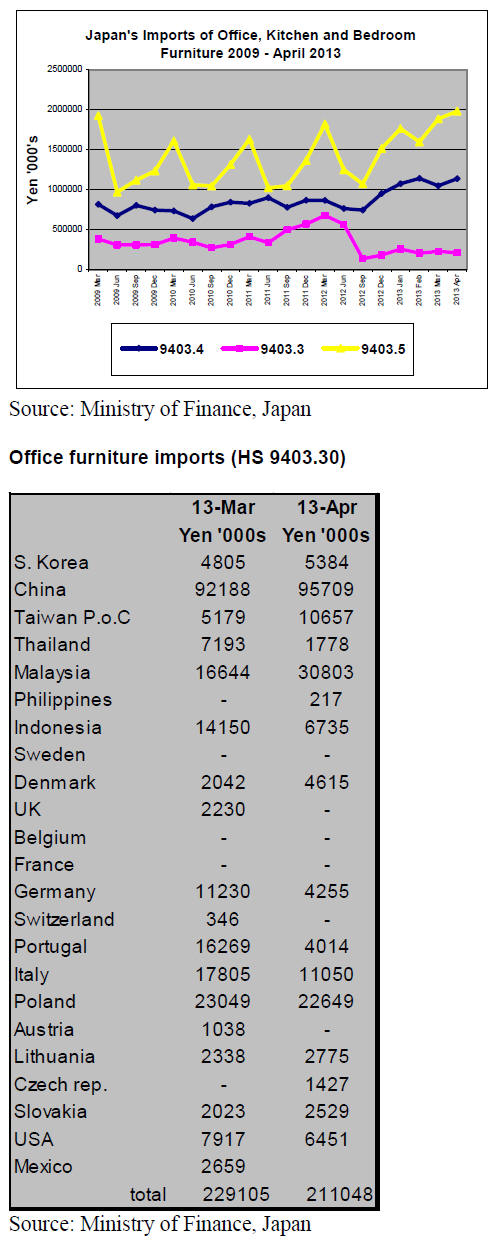

Japan’s April furniture imports

The source and value of Japan’s office, kitchen and bedroom furniture

imports for April 2013 are shown below. Also illustrated is the trend in

imports of office furniture (HS 9403.30), kitchen furniture (HS 9403.40) and

bedroom furniture (HS 9403.50) between 2009 and April 2013.

In April 2013 Japan’s imports of office furniture from China and Malaysia

accounted for more than half of total imports of this category of furniture.

If imports from Poland are added to those from China and Malaysia then three

countries account for 71% of office furniture imports.

Apirl imports from China were at around the same level as in March but

imports from Malaysia jumped from yen 16,6mil. to yen 30.8 mil. Imports from

EU member states accounted for just 25% of Japan’s office furniture imports

in April. The main EU suppliers were Poland at yen 22 mil. followed by Italy

at yen 11mil.. Office furniture imports from the EU all declined in April.

In April, Japan’s total office furniture imports totaled yen 211 mil a

decline of 7.8% from March mainly because of the drop in imports from the EU

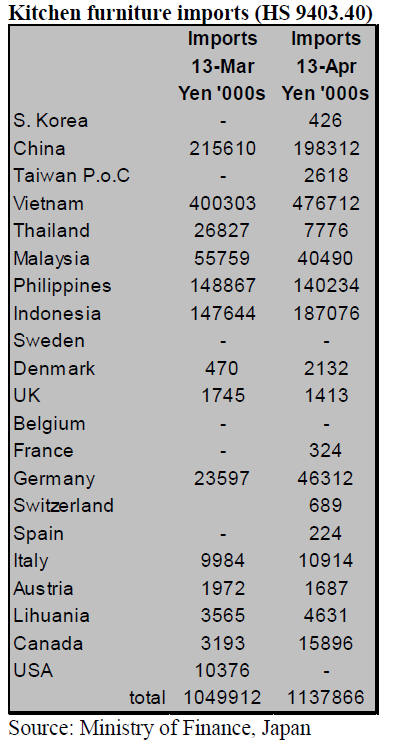

Kitchen furniture imports (HS 9403.40)

Kitchen furniture imports remain the second largest segment of all wooden

furniture imports into Japan after bedroom furniture.

Vietnam continues to be the number one supplier of kitchen furniture to

Japan. In April the value of imports from Vietnam totaled yen 476 mil. up

around 20% from levels in March this year representing alost 42% of all

kitchen furniture imports.

Three suppliers Vietnam, China and Indonesia accounted for 75% of total

kitchen furniture imports by Japan in April and if shipments from the

Philippines is included, then four suppliers provided 88% of the total

Shipments of kitchen furniture from Europe in April were dominated by those

from Germany, yen 46 mil. almost double the value of March shipments. Italy

was the second largest supplier in Europe at yen 10 mil. a figure close to

that for March shipments.

Canada feature as supplier of kitchen furniture to Japan in April and the

value of shipments at almost yen 16 mil. were around three times the level

in March this year.

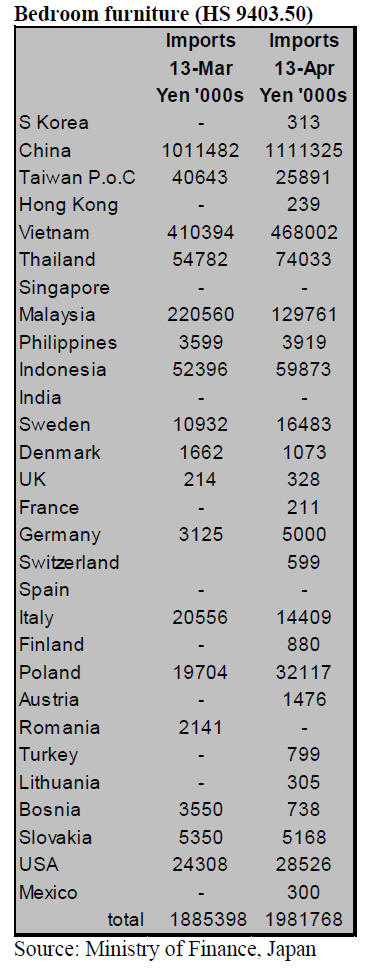

Bedroom furniture (HS 9403.50)

Japan’s imports of bedroom furniture are close to yen 2 bil. monthly.

Imports in April were valued at yen 1.98 bil. up from the yen 1.88 bil. in

March this year.

As in March the top suppliers were China and Vietnam which together

accounted for around 79% of all wooden bedroom furniture imports to Japan.

Shipments of bedroom furniture to Japan from China in April were up over 9%

and shipments from Vietnam, the second largest supplier, were up 12%.

The performance of exporters in SE Asia was mixed in April with Malaysia

shipping yen 13 mil. down a massive 45% while companies in Indonesia shipped

13% bedroom furniture in April (yen 59.8 mil.) compared to levels in March.

|