|

Report

from

North America

Sight improvement in US employment

Employment improved slightly in March. The unemployment rate was 7.6% in

March, down from 7.7% in February, according to the US Bureau of Labor

Statistics.

The number of jobs in construction increased, as the housing market

recovers and demand for new homes and remodelling grows.

Higher home prices support consumer confidence

Rising home prices, stock prices and improving employment contributed to

higher consumer confidence in March.

The Thomson Reuters/University of Michigan consumer sentiment index rose

from 77.6 in February to 78.6 in March.

Personal income levels are unlikely to increase this year. But higher

home prices increase household wealth and support spending. Consumers

appear less worried about an economic downturn despite the cuts in

federal spending.

Decline in home buildersí» confidence despite housing market recovery

Home builder confidence fell by two points to 44 in March, despite

higher demand for houses. Only when the Housing Market Index by the

National Association of Home Builders/Wells Fargo climbs over 50, the

majority of home builders regard market conditions as good.

The association attributes the decline in confidence in the market for

single-family homes to the following factors:

• Difficult access to credit

• Rising prices and shortage of building materials

• Shortage of skilled labour in construction

February home sales down

Home sales slowed in February following the strong sales activity in

January. Sales of new homes declined by 4.6% in February this year

however, the inventory of new, unsold homes remains below normal levels.

US housing starts increased slightly from the previous month.

Construction started on 917,000 homes in February (seasonally adjusted

annual rate), up by 0.8% from the previous month.

The number of starts were almost a third higher than in February 2012.

Single-family starts grew by 0.5% from January. The share of

single-family homes in total starts remained stable at 67%.

The number of building permits issued for new single-family homes was

946,000 in February (seasonally adjusted annual rate), up 4.6% from

January. The number of permits issued is usually an indicator of future

building activity.

Canadian housing starts increase again

Canadaí»s housing starts increased by 14% in February, following a

decline in January. Home sales slowed, but resale market prices remain

relatively stable.

High home prices contribute to Canadaí»s very large household debt, which

reached over 150% of disposable income in 2012, compared to about 140%

in the US.

Non-residential construction expected to grow in 2013

Spending on non-residential building construction was unchanged in

February. Compared to the same time last year, private non-residential

construction is 6% higher, while public construction is lower due to

lower public spending.

Non-residential construction spending is expected to grow in the second

half of 2013, according to the Architecture Billings Index. In February

the index registered its strongest growth since early 2008. Architecture

firms reported growth in all major building sectors.

Two thirds of the firms surveyed also reported that building codes and

regulations have become more stringent. Energy codes and regulations for

building accessibility have changed the most, which can increase design

and construction cost.

US imports of processed wood products slowed in February

The growth in wood product imports slowed from the previous month, but

imports remain significantly higher than at the same time last year.

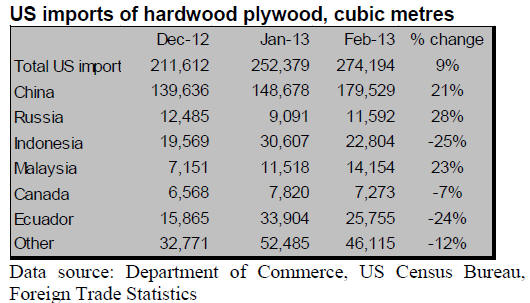

Hardwood plywood

US imports of hardwood plywood continued increasing in February. Total

imports were 274,194 m³, up 9% from January and 50% higher than

year-to-date 2012. The growth was mainly due to higher imports from

China, which rose to 179,529 m³ (+49% year-to-date).

Imports from Indonesia (22,804 m³) and Ecuador (25,755 m³) declined from

January, but on a year-to-date basis Ecuador is still the second largest

supply source after China. Imports from Malaysia were 14,154 m³ in

February (+45% year-to-date).

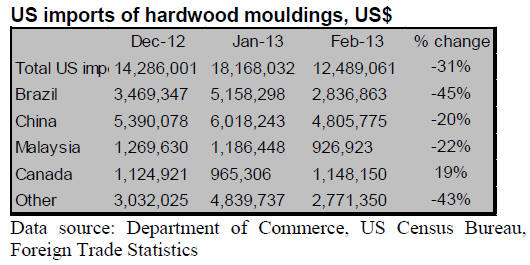

Hardwood moulding

Hardwood moulding imports declined to $12.5 million (-5% year-to-date).

Imports from China were worth $4.8 million (-7% year-to-date). Imports

from all other major suppliers also declined. Hardwood moulding imports

from Brazil were $2.8 million, down 15% from year-to-date 2012.

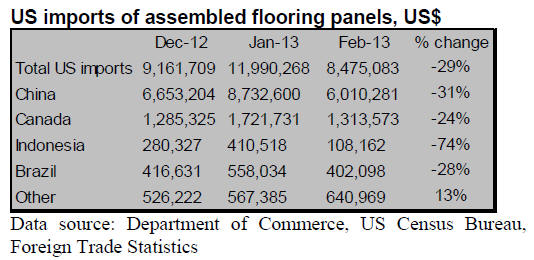

Wood flooring

US imports of assembled flooring panels declined to $8.5 million in

February, but they remain 27% above year-to-date imports in February

2012.

Imports from China were $6.0 million (+30% year-to-date). Year-to-date

imports from Canada and Indonesia grew more moderately, while Brazilí»s

shipments surpassed Indonesia at $0.4 million (+80% year-to-date).

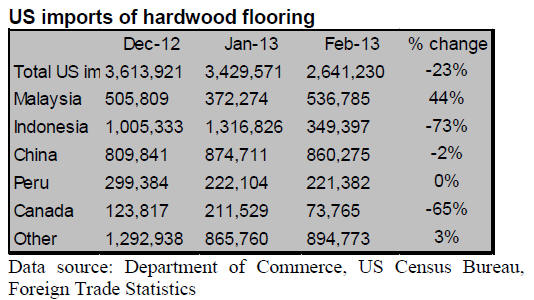

Hardwood flooring imports declined further to $2.6 million in February

(+54% year-to-date). China is the largest supply source ($0.9 million in

February, +87% year-to-date).

Indonesia has been the second-largest supplier in 2013, although

February shipments declined to less than $0.4 million. Malaysian

hardwood flooring exports increased to $0.5 million in February (-30%

year-to-date).

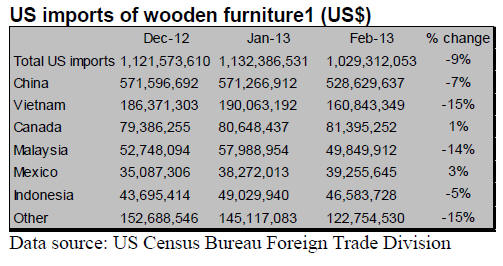

Wooden furniture

US imports of wooden furniture declined in February after trending

higher in December and January. February imports were worth $1.029

billion, 9% down from the previous month.

Much of the decline is in furniture imports from China, Vietnam and

Malaysia, while imports from Canada and Mexico increased. Year-to-date

February imports of wooden furniture are 12% higher than in 2012.

1 Excluding furniture parts

Includes:

940161 Seats W Wooden Frames, Upholstered, Nesoi

940169 Seats W Woodn Frames, Not Upholstered, Nesoi

940330 Wooden Office Furniture, Except Seats

940340 Wooden Kitchen Furniture, Except Seats

940350 Wooden Bedroom Furniture, Except Seats

940360 Wooden Furniture, Nesoi

Chinaí»s furniture exports to the US decreased to $528.6 million in

January (+17% year-to-date). Vietnamí»s shipments were $160.8 million

(+13% year-to-date), while imports from Malaysia declined to $49.8

million (-1% year-to-date).

US producers raise wood flooring prices

The National Wood Flooring Association reported on April 1 that large US

manufacturers of engineered and solid wood floors will raise prices by

up to 10%. This would be the second or third price increase for many

producers since November 2012. According to the manufacturers, price

increases are necessary because of the rising cost of raw materials.

Remodelling market outlook

The remodelling, renovation and repair of homes, is a significant

market for processed wood products. The majority of kitchen and bath

cabinets are sold for remodelling, and in recent years over half of the

wood flooring sold was used for remodelling, according to the National

Wood Flooring Association.

Demand for a range of other wood products, such as furniture, mouldings,

stairs and doors, is also linked to the remodeling of homes.

The Joint Center of Housing Studies of Harvard University expects growth

in remodelling spending to accelerate in 2013. The Hardwood Review

Weekly has analysed how the economy and the housing market will affect

the remodelling sector:

Homeowners are more likely to remodel when home prices are rising, as is

the case now.

A large number of foreclosed homes are still likely to come on the

market. A large share (one third) of foreclosed homes was bought by

investors in 2012. Investors tend to spend more on the remodeling of

foreclosed homes than banks or homeowners.

Existing homes need more improvements since homeowners spent less money

on remodeling during the recession and fewer new homes were built.

Low interest rates encourage more homeowners to take out a loan for

remodeling projects.

The following obstacles for the remodeling market were identified:

The inventory of existing and new homes is below average. This limits

sales and therefore remodeling by sellers and buyers of houses.

Access to credit is still tight, which also limits home sales.

Remodeling depends on consumer confidence. If unemployment grows and

economic growth slows, spending on remodeling can quickly decline.

Employment in the construction sector grew in March, but many home

builders and contractors still report a lack of skilled workers to carry

out remodeling projects.

* The market information above has been generously provided by the

Chinese Forest Products Index Mechanism (FPI)

|