Japan Wood Products

Prices

Dollar Exchange Rates of

10th May 2013

Japan Yen

101.60

Reports From Japan

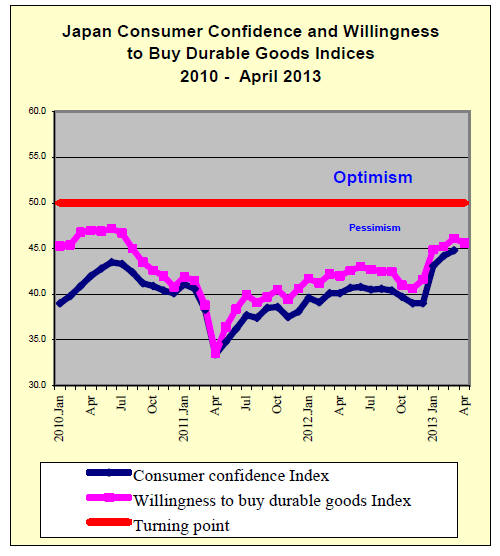

Consumer confidence unexpectedly slides

The Cabinet Office released the latest Confidence Index for Japanese

consumers. Unexpectedly the latest results show that consumer confidence has

slipped since the March survey.

The seasonally adjusted consumer confidence index fell to 44.5 in April from

44.8 in March. The index of willingness to buy durable goods also declined.

Analysts had expected the index to continue to improve and were forecasting

an index level of over 45 for April.

Cabinet Office claims improvement in economy

The Japan Monthly Economic Report from the Cabinet Office provides a summary

of the economic outlook. See: Executive Summary (Apr 2013)

http://www5.cao.go.jp/keizai3/getsurei-e/2013apr.html.

The report says the Japanese economy is showing signs of picking up but

weakness remains in some areas. The positive signs are that:

exports are levelling off

industrial production is showing signs of improvement

corporate profits show signs of improvement, mainly among large firms

business investment is levelling off

business sentiment shows signs of improvement

the employment situation shows signs of improvement but some severe

aspects still remain

private consumption is picking up

Recent price developments indicate that the Japanese economy is still in a

mild deflationary phase.

In the short-term prospects for recovery are expected to improve gradually,

supported by an improvement in corporate and public confidence driven by a

stronger export performance and the impact of the government stimulus

package and new monetary policy. However, weak overseas demand remains a

downside risk for the Japanese economy.

Private consumption picking up

Private consumption is picking up according to the monthly report. One of

the factors behind this is that while real incomes remain broadly flat,

consumer confidence is improving.

In the short-term private consumption is expected to continue to strengthen

however, employment levels and income growth, or lack thereof, must be

carefully monitored.

Signs of improvement in business investment

Business investment, which has been severely dampened by the current state

of the domestic and global economy, is starting to level off.

The quarterly financial statements of corporations suggest that business

investment increased for the first time in four quarters. In the October -

December quarter of 2012, investment by manufacturers fell but increased for

non-manufacturers.

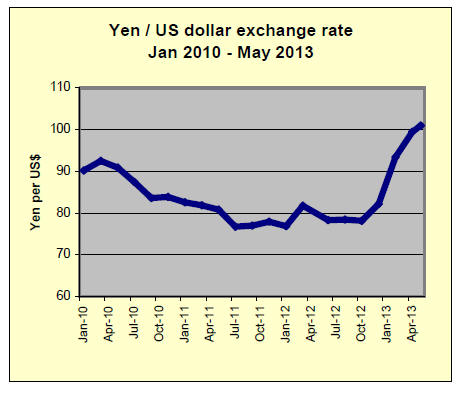

G7 accepts yen exchange rate not being manipulated

On foreign exchange markets the yen fell to a four year low against the US

dollar on May 9. An exchange rate of 101 yen to the dollar marked a turning

point for the yen as the government’s stimulus measures and the Bank of

Japan’s efforts to expand liquidity start to have a greater impact.

The trigger for the yen to break the 100 yen to the dollar mark seems to

have been in response to the improved US jobless claims reported on May 3

showing that first-time unemployment numbers fell to the lowest level since

January 2008.

This news, coming on top of suggestions that the Federal Reserve may begin

unwinding its quantitative easing schedule as early as June this year,

altered the outlook in the yen:dollar currency markets. Many analysts

believe a new round of yen weakness will now set in.

At the recent G7 meeting of representatives from members - the U.S.,

Germany, France, Italy, Japan, Canada and the U.K steered clear of

discussions of ‘currency wars’ instead focused on how each member should put

in place policies balancing austerity measures with growth-enhancing

measures.

Prior to the meeting there was concern in Japan that the government’s

aggressive monetary easing, which has resulted in a sharp weakening of the

yen, would attract criticism. However the sentiment expressed after the G7

meeting seemed to provide support for the policies adopted by the Japanese

government and this could pave the way for a further weakening of the yen.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

The JLR requires that ITTO reproduces newsworthy text exactly as it appears

in their publication.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

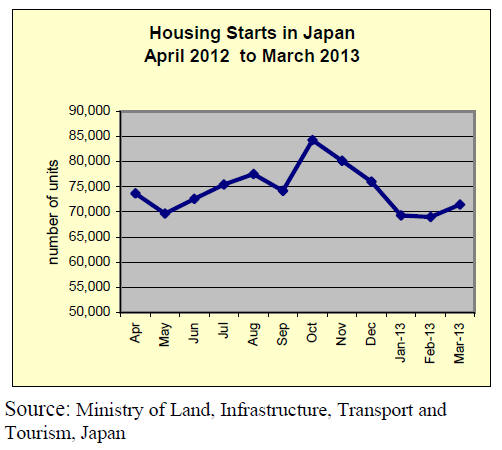

March new housing starts

March starts were 71,456 units, 7.3% more than March last year, seven

consecutive months increase. Owners units and rental units recorded double

digit increase.

Seasonally adjusted annual starts were 904,000 units, 4.2% less than

February because of decline of condominium starts.

This seems to be temporary drop and the Ministry of Land, Infrastructure and

Transport commented housing market continues gradual recovery. In March

starts, owners’ units showed 11.4% more and rental units 10.7% more. Owners’

units increased in populated regions like Tokyo and Nagoya then starts in

three quake stricken prefectures of Iwate, Miyagi and Fukushima were

considerably high.

Meantime, in units built for sale, condominium starts were down because

of high starts in February but detached units increased for seven

consecutive months and maintained more than 10,000 units level since last

June.

Wood based units were 39,637, 11.3% more with the share of 55.5%, 3.7 points

up from February.

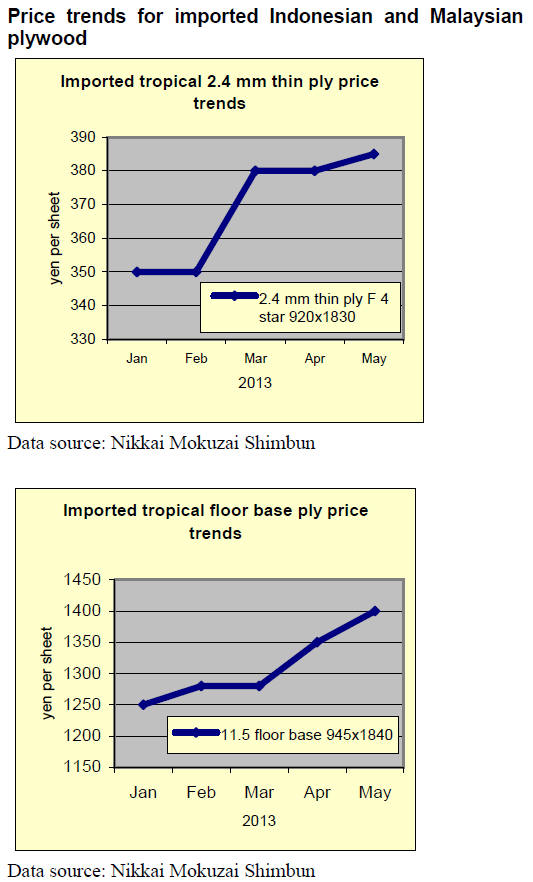

Movement of plywood is getting stable after excitement is fading.

Inquiries in domestic softwood plywood are slowing by dealers. In the first

quarter, wholesalers and retailers built up inventories in speculation but

actual demand did not appear as expected so the inventory depletion is not

progressing.

March was busy month as order balances of January and February were

delivered all at one time then the shipment was high with 218,900 cbms so

compared to March, April was quiet month. However, the shipment by the

manufacturers continues high for precutting plants and house builders.

Considering low level inventory of 125,000 cbms, some are building inventory

as the supply shortage may occur again once the demand takes off. Thus, the

manufacturers are bullish and plan to increase the sales prices in May

again.

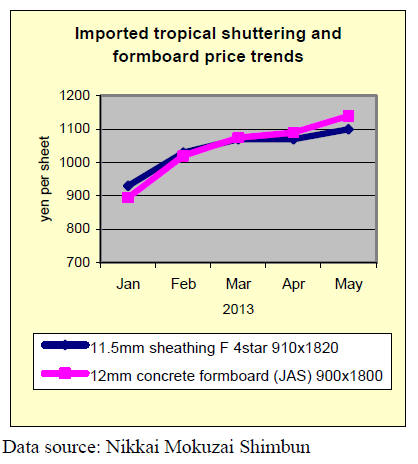

In Tokyo regional market, the prices of JAS 12 mm 3x6 are 890-900 yen per

sheet delivered, 20-30 yen up from April. 1,790 yen on 24 mm thick panel, 50

yen up. 1,350 yen on 9 mm 3x10 long panel, 50 yen up.

On imported plywood, supplying mills suffer log shortage and high log

cost in Malaysia and Indonesia so that export prices continue climbing but

the market in Japan is slow to follow by lack of demand. Dealers’

inventories are still high so that they are not able to buy future cargoes.

The supply side plans to increase the export prices again in May but the

prices in Japan are slow to go up. Suppliers’ price increase is too much too

fast so that the Japanese buyers are beginning to lose interest and the

future purchase volume has been declining since last February.

In Tokyo market, the prices of 3x6 JAS concrete forming panel are 1,100

yen per sheet delivered, 20 yen up from April. 12 mm structural panel are

1,150 yen, 50 yen up. JAS 3x6 coated concrete forming panel are1,200 yen, 20

yen up.

TPP participation and reaction by Japanese forest industry

Japan has been expressing intention to participate TPP (Trans Pacific

Partnership) and there are pro and con in Japan regarding the participation.

The National Federation of Forest Owners Cooperative Association recently

met the Minister of Agriculture, Forestry and Fisheries and expressed the

comment of the

Association. The Association held the general meeting in late March and made

up the resolution regarding participation of TPP.

The Association handed the resolution to the Minister. The resolution says

that it is necessary to take maximum consideration of maintaining import

duty on plywood and

lumber, which is indispensable for maintaining forest industry and for

taking measures preventing global warming.

It fears participation may trigger further deterioration of forest and

forest industry by free trade. Also the Committee on Agriculture, Forestry

and Fisheries passed the resolution in April 19, which says that important

items of agriculture such as rice, wheat, beef, pork, dairy products and

sugar cane are excluded from the negotiation or should be renegotiated

later.

Abolition of the import duty is not conceded including gradual abolition

over ten years. It also includes the same resolution as the Forest Owners

Association’s resolution of maintaining the duty on plywood and certain kind

of lumber.

On April 29, Canada agreed to let Japan in for TPP so all of eleven

countries now support participation of Japan. After approval by U.S.

congress, Japan will join the TPP Japan has been expressing intention to

participate TPP (Trans Pacific Partnership) and there are pro and con in

Japan regarding the participation.

The National Federation of Forest Owners Cooperative Association recently

met the Minister of Agriculture, Forestry and Fisheries and expressed the

comment of the

Association.

The Association held the general meeting in late March and made up the

resolution regarding participation of TPP.

The Association handed the resolution to the Minister. The resolution says

that it is necessary to take maximum consideration of maintaining import

duty on plywood and

lumber, which is indispensable for maintaining forest industry and for

taking measures preventing global warming. It fears participation may

trigger further deterioration of forest and forest industry by free trade.

Also the Committee on Agriculture, Forestry and Fisheries passed the

resolution in April 19, which says that important items of agriculture such

as rice, wheat, beef, pork, dairy products and sugar cane are excluded from

the negotiation or should be renegotiated later.

Abolition of the import duty is not conceded including gradual abolition

over ten years. It also includes the same resolution as the Forest Owners

Association’s resolution of maintaining the duty on plywood and certain kind

of lumber.

On April 29, Canada agreed to let Japan in for TPP so all of eleven

countries now support participation of Japan. After approval by U.S.

congress, Japan will join the TPP meeting in late July.

|