|

Report

from

Europe

Except for small purchases to fill occasional gaps in stocks, most are

content to delay major purchases for the time being.

Demand in Europe is also constrained because some importers built stocks

in advance of implementation of the EU Timber Regulation (EUTR) from 3

March 2013.

It¡¯s conceivable that, after two years of historically low purchases,

any significant upturn in demand could quickly transform into shortages

on the ground in Europe. However, such an upturn seems unlikely at

present.

Mounting economic and political uncertainty has meant particularly weak

demand in Italy this year. Markets in north-western Europe are a little

better, although importers reckon that consumption is no better than,

perhaps even slightly less, than last year.

There is stronger demand in parts of Eastern Europe, but these markets

are not traditionally big buyers of tropical wood and can¡¯t compensate

for weak buying in Western Europe.

Some larger European importers are reporting reasonable levels of sales

during 2013, although this is at least partly due to a decline in the

numbers of European distributors involved in direct imports from Africa.

Due to the legal risks associated with EUTR and costs of compliance,

more European companies are choosing to buy from stocks landed by larger

trading companies.

Despite low production and relatively long delivery times for some

species, the supply situation is not problematic for European importers

due to slow consumption. Times for delivery of sapele sawn lumber to

Europe, currently up to 5 months, are longer than those for sipo, iroko

and wawa.

Sapele is now strongly favoured as the leading tropical hardwood species

for joinery applications in many European countries. FOB prices for

sapele on offer to European importers have been rising in recent weeks,

although importers are not in a position to pass on price increases to

their customers in the current market environment.

European demand for Malaysian sawn meranti has picked up a little in

recent weeks as construction activity has increased in the spring

weather.

However the EU market for this commodity is now much reduced compared to

previous years, partly owing to the preference now shown for sapele and

partly to substitution by engineered wood and other alternatives.

Nevertheless prices for sawn meranti on offer to European buyers have

remained firm and stable due to reduced production and good demand in

other markets such as the Middle East.

With the onset of spring in Europe, there has been an increase in demand

for decking sizes of Asian bangkirai, South American cumaru, ipe and

garapa, and African azobe, okan and bilinga.

However, volumes are expected to be lower than in previous years. Partly

this is due to an unexpectedly large carry-over of stocks after a very

slow garden season in 2012.

Prices for Asian bangkirai on offer to European buyers have weakened in

recent months. However, producers have reacted by reducing manufacturing

for the European market.

Therefore the price trend could quickly reverse if there were any

significant increase in demand once the European summer gets underway.

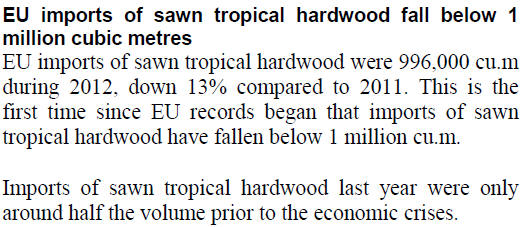

EU imports of mouldings and glulam

Over the last decade, the decline in Brazilian, Malaysian and Indonesian

share of the EU market for rough sawn tropical hardwood has been partly

offset by these countries¡¯ role in supply of mouldings and glulam.

This is aligned with a general trend towards value added production

which has progressed further in these countries than in most other

tropical hardwood supplying countries.

It is also linked to efforts by manufacturers to reduce waste and

improve consistency of supplied wood through progressive tightening of

material specifications.

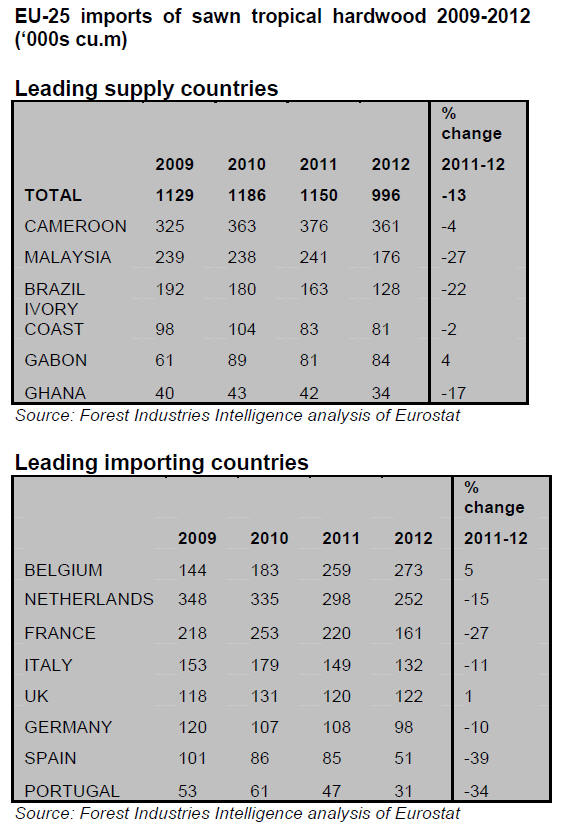

In 2012, EU imports of hardwood mouldings (both temperate and tropical)

declined 20% to 290,000 cu.m. Imports of this commodity declined

substantially from both Brazil and Indonesia, the two largest external

suppliers to the EU, but recovered slightly from China.

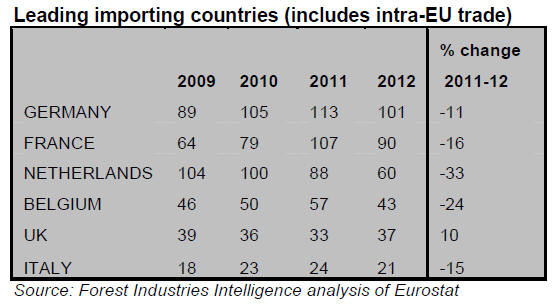

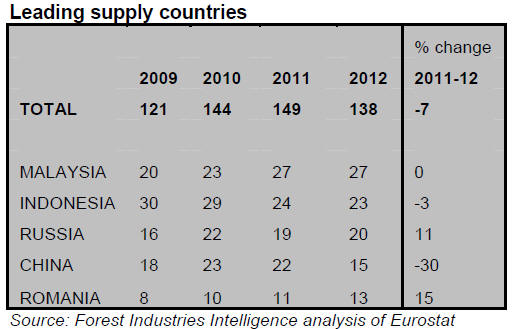

EU-25 imports of hardwood mouldings 2009-2012 (1000 cu.m)

During the recessionary period in Europe, EU imports of glulam have

remained more stable than imports of both rough sawn timber and

mouldings. Imports in 2012 were 138,000 cu.m, only 7% down on the

previous year.

Most of the decline in 2012 was in imports from China, while imports

from Malaysia and Indonesia were stable compared to the previous year.

EU-25 imports of glulam 2009-2012 (1000 cu.m)

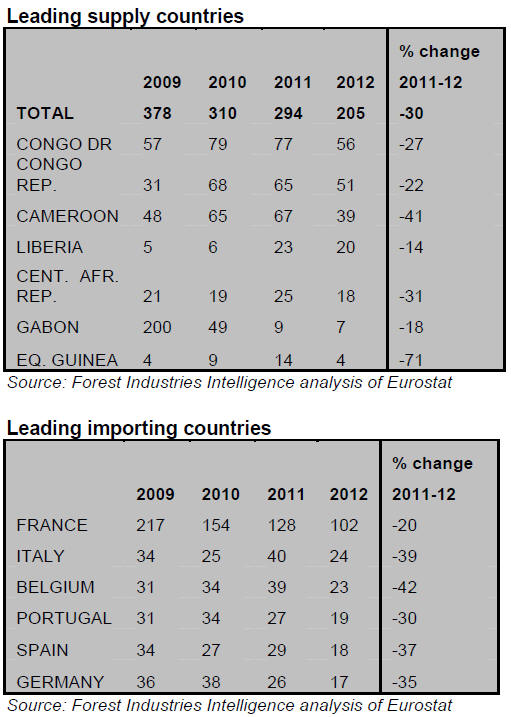

EU tropical hardwood log imports down 30% in 2012

EU imports of tropical hardwood logs in 2012 were only 205,000cu.m, 30%

down on the previous year and less than a quarter of the volume

prevailing prior to the economic crises.

The decline in European imports forms part of a wider transformation in

the international tropical log market over recent years.

Europe has always looked to Africa for supply of tropical hardwood logs.

However the key traditional exporters in central Africa have

increasingly tightened controls on log exports of the most valuable

commercial species.

Meanwhile demand for African logs has continued to escalate in China.

China¡¯s imports of African hardwood logs increased from 2.1 million cu.m

in 2011 to 2.7 million cu.m in 2012, the supply being diversified both

in terms of species and countries.

These now include ¨C in order of importance in 2012 ¨C Congo

(Brazzaville), Cameroon, Equatorial Guinea, Mozambique, Benin, Liberia

and Gambia.

India has also overtaken Europe as the second largest international market

for African hardwood logs, importing around 530,000 cu.m in 2012 ¨C

although this mostly comprises plantation teak from Ghana, Ivory Coast

and Nigeria.

EU-25 imports of tropical hardwood logs 2007-2012 (1000 cu.m)

The recent growth in Chinese and Indian demand for African logs has meant

that prices are now relatively high compared to sawn timber. This is

making log imports increasingly unattractive to European buyers.

At the same time, the numbers of plywood and custom cutting mills

engaged in processing tropical logs in Europe has declined very rapidly

in recent years.

European based plywood mills have consistently struggled to compete in a

market increasingly impacted by Chinese plywood and a broadening range

of substitute products.

As a result, following the Gabon log export ban imposed in May 2010,

which led to a huge fall in French okoume log imports, there has been no

move in Europe to seek to replace this volume by importing from other

sources.

Europe¡¯s imports of tropical logs in 2012 fell substantially from all

the leading supply countries and into all the main consuming European

countries.

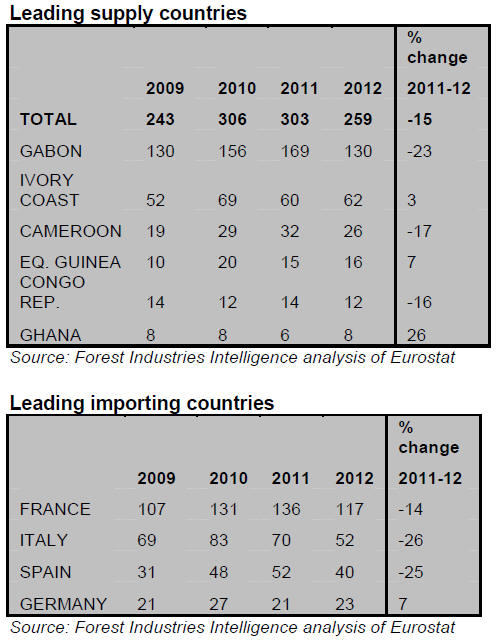

European imports of tropical hardwood veneer down 15%

EU imports of tropical hardwood veneer were 259,000 cu.m in 2012, 15%

down on the previous year. A large proportion of European tropical

veneer imports consist of rotary veneer from Gabon destined for French

plywood mills.

This trade declined last year as European okoume plywood production

capacity and consumption continued to fall.

Europe¡¯s market for decorative sliced tropical hardwood veneers also

slowed last year. There was a range of contributing factors including:

weak European furniture consumption, particularly in the face of

competition from Chinese manufacturers; very low levels of activity in

the southern European door sector - formerly a significant market; an

ever increasing focus on oak in the furniture and finishing sectors; and

intense competition from artificial surfaces.

EU-25 imports of tropical hardwood veneer 2007-2012 (1000 cu.m)

A recent analysis by the European veneer marketing campaign, the

Initiative Furnier + Natur (IFN), shows that the latest fall in tropical

hardwood veneer imports to Europe forms part of a long term decline in

European veneer consumption.

IFN show that in the 15 years prior to 2011, there was a dramatic fall

in veneer consumption in nearly every major European market. Consumption

in Germany fell from over euro 300 mil. in 1995, to euro 200 mil. by the

end of the 1990s, before slipping below euro 100 mil. in 2002.

Since then, German consumption has remained at around euro 50-60 mil. per

year. Veneer consumption in Italy fell from euro 450 mil. in 2004 to

euro 187 mil. in 2011. Spanish consumption fell from euro 260 mil. to

euro 124 mil. over the same period.

Of all the large European markets, only France has maintained veneer

consumption at reasonably consistent levels ¨C at around euro 100 mil.

over the last decade.

These trends are due to the combined effects of a movement of veneer and

wood product manufacturing facilities to lower cost locations, and

continuing substitution of ¡°real wood¡± veneer for artificial surfaces.

|