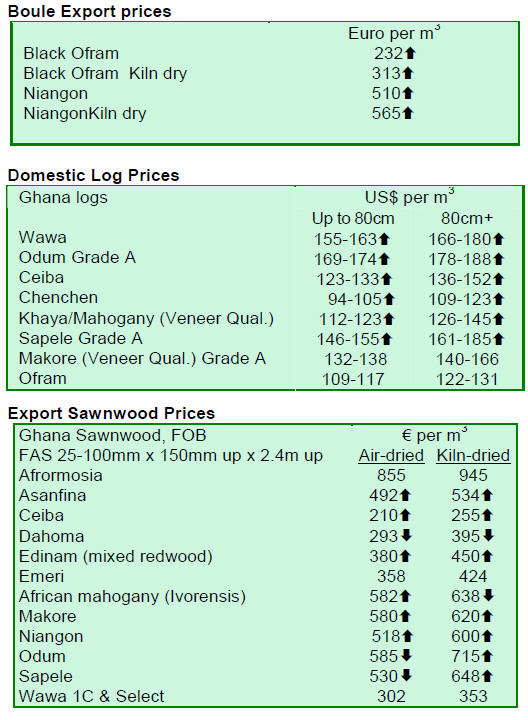

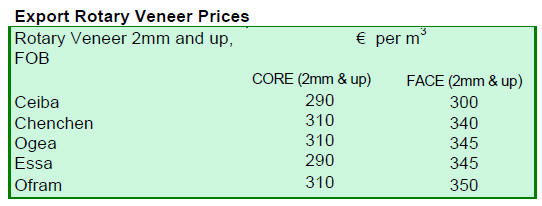

2. GHANA

FC drafts policy to rein in illegal wood

in domestic market

The Forestry Commission (FC) of Ghana and Tropenbos International Ghana are

jointly working together to draft a policy that will ensure a supply of

legal timber to the domestic market.

This joint effort is the result of long consultations between stakeholders,

including the Ministry of Land and Natural Resources, aimed at finding a

viable and lasting solution to the flow of illegally harvested wood products

to the domestic market.

The policy is looking to eliminate illegal chainsaw operations while at the

same time ensuring an adequate supply of timber to the domestic market.

A key principle of the policy draft is a framework to improve the supply of

legal timber to meet annual domestic demand of more than 600,000 cu.m. It is

envisaged that existing local mills will supply at least 40% of the demand

in the domestic market.

Access to resources through appropriate administrative and legal

arrangements will be provided to artisanal mill owners. The policy will also

provide for the introduction of a wood-tracking system for the domestic

market.

Takoradi Port development to benefit exporters

The port at Takoradi was the first port to be built in Ghana and is now the

second largest in the country. The port has, for decades, handled Ghana*s

traditional exports which include timber and wood products.

The volume of traffic through Takoradi Port has grown in recent years as

much of the oil drilling and exploration equipment comes into the port and

there has been an expansion of outgoing shipments such that the port has

become increasingly congested.

To address the problem of congestion at the port the Ghana Ports and

Harbours Authority (GPHA) has entered into an agreement with the China

Harbour Engineering Company (CHEC) for work on a first phase of a US$150

mil. Takoradi Port infrastructure development project.

Currently, Takoradi Port has seven berths 每 four multipurpose and one each

specifically for manganese, bauxite and oil. Draughts range from nine to 10

metres.

The port has a covered storage area of 140,000 square metres, 250,000 square

metres of open storage space and container-holding capacity of 5,000 TEUs.

Takoradi Port handled 53,041 TEUs (twenty-foot equivalent unit) in 2010 up

9% from 47,828 TEUs in 2009. In coming container traffic amounted to 24,127

TEUs and outgoing traffic amounted to 28,914 TEUs.

Vessel movements jumped 33.6% to 1,277 in 2010 from 956 the previous year.

Vessel turnaround time in 2010 averaged 2.1 days, down from 3.3 days in

2006.

Total cargo traffic rose 19% to 4.01m tons in 2010, up from 3.37m tons in

2009. Imports totalled 1.72m tons and exports 2.29m tons in 2010 up from

1.26m tons and 2.11m tons respectively in 2009.

The first phase of the port infrastructure development project has already

started with the demolition of old structures; dredging of existing berths;

construction and extension of breakwaters; building of new berths for bulk

cargo such as bauxite, manganese, clinker, etc; building of oil terminals

and improvement of access to the port.

When the work is completed the port will be able to handle more traffic and

larger vessels. In addition vessel turnaround time should be reduced leading

to reduced freight a bonus when shipping traditional commodity products from

the port.

President outlines plan to expand manufacturing

In his national address to parliament, Ghana*s President, John Mahama,

provided assurances that the government will marshal the collective energy

of all stakeholders to facilitate the emergence and growth of a strong

manufacturing sector.

He mentioned some key areas that need to be addressed to achieve this goal

namely; a review of current tax structure for manufactures to improve

competitiveness, establishment of an industrial development fund to support

ailing and struggling manufacturing industries and provision of fully

serviced industrial plots, especially in the regional capitals.

Fuel prices hike to impact timber sector

The government has announced that prices must be raised by 15 每 20% on all

petroleum products because of the soaring price of crude oil on world

markets and the cedi/US dollar exchange rate developments over recent

months.

Analysts report that an increase in fuel prices will have a negative

knock-on effect on prices of all goods and services. Fuel costs are a

significant element in wood production costs and an increase in fuel costs

will negatively impact profitability in the sector.

﹛

3. MALAYSIA

Launch of Malaysian timber legality

assurance system (MYTLAS)

Malaysia has not yet concluded a Voluntary Partnership Agreement (VPA) with

the EU and negotiations between the two parties continue.

It appears that the Peninsular Malaysia states (11 states and two federal

territories) and the state of Sabah are likely to be the first to conclude a

VPA and that the Malaysian state of Sarawak will make arrangements to

participate in a VPA later.

Because Malaysia has not yet concluded the VPA negotiations no FLEGT

licensed timber is available for export from Malaysia to the EU.

The result of this is that, since the coming into force of the EUTR in March

this year, Malaysian exporters have to provide evidence of the legality of

exported wood products to EU importers so they can satisfy the due diligence

requirements of the EUTR.

To ensure an uninterrupted flow of wood product exports to the EU until a

VPA is concluded the Malaysian government has launched its Malaysian Timber

Legality Assurance System (MYTLAS) as a credible domestic system to verify

the legality of Malaysian wood products.

Though based on the Timber Legality Assurance System (TLAS) developed under

the framework of the FLEGT VPA negotiations with the the EU, MYTLAS and its

implementation is a Malaysian initiative without linkage to the EU FLEGT VPA.

Implementation of MYTLAS is subjected to a third party annual auditing to

ensure its credibility and acceptance by EU operators in meeting the EUTR

due diligence requirements.

The MYTLAS is operated by the Malaysia Timber Industry Board (MTIB) for

exporters in Peninsular Malaysia while for exporters in Sabah the MYTLAS

will be implemented by the Sabah Forestry Department.

The Secretary General of the Ministry of Plantation Industries and

Commodities, Nurmala Abdul Rahim, announced on 28 March, the formation of a

MYTLAS Advisory Group comprising forestry experts and key MYLAS implementing

agencies.

Nurmala said ※the advisory group will consider all aspects in the

implementation of MYTLAS and measures to improve it taking into account

feedback from stakeholders, market response and capacity building needs§.

Authority for timber licensing in Sabah to move from MTIB to Sabah

Forestry Department

The industry in Sabah has been carefully observing the impending shift of

licensing authority from the Malaysia Timber Industry Board to the Sabah

Forestry Department.

It is now expected that all aspects of licensing of

the timber industry will be smoothly transferred to the Sabah Forestry

Department by 1 May 2013.

Analysts report that the timber industry in Sabah is working hard with

federal and state authorities to get a timber tracking and management

systems arranged so that the MYTLAS can function effectively in the state to

ensure exporters can satisfy the needs of EU importers who must meet the

requirements of the EUTR.

Poor weather conditions hamper harvesting in Sabah

Over the past weeks Sabah log FOB prices have increased slightly due to

a scarcity of supply caused by unfavourable weather which is disrupting

harvesting operations.

The weaker yen has added around US$ 10 每 20 per cu.m to log FOB prices for

the Japanese market. As trading conditions are subdued, it is reported that

kapur regular quality logs for the Japanese market are priced at around US$

130 per cu.m CIF.

Sarawak industry struggles to attract local workers despite increased

minimum wage

The Sarawak Timber Association (STA) chairman, Wong Kie Yik, in addressing

the association*s annual general meeting on 28 March, called on the

government to help solve the labour problems faced by the timber industry.

He said that despite the introduction of a higher minimum wage, STA members

are still facing problems in finding workers. The STA believes the problem

is mainly that working in the timber industry is not attractive to the

domestic workforce especially as most enterprises are located in remote

rural locations.

As a result said Wong, the industry has relied mostly on foreign labour.

Log exporters encouraged by active buying from India and China

Sarawak timber exports in 2012 totalled RM 7.46 billion (approximately US$

2.39 billion), a 5% increase on levels in 2011.

Plywood made up 53% of total exports, logs just 24% and sawntimber 11%.

Japan remained the state*s biggest buyer of wood products accounting for 38%

of all exports in 2012.

STA statistics show that log production in 2012 was 9,458,563 cu.m, down

from 9,610,434 cu.m in 2011. In the first two months of 2013, Sarawak

produced 1,185,371 cu.m of logs.

Indicative export prices for Sarawak 2.7mm MR, BB/CC plywood are US$550 per

cu.m FOB while for 9 mm and up plywood panels the price is US$430-450 per

cu.m.

FOB export prices of Sarawak logs in March were as follows:

meranti SQ US$ 250 每 265 per cu.m

kapur SQ US$ 340 每 360 per cu.m

keruing SQ US$ 300 每 315 per cu.m

selangan batu regular US$ 500 每 540 per cu.m

Log prices in Sabah and Sarawak are steadily moving higher as the

availability of logs for export in the two states has declined because of

poor weather conditions and because of active buying by local plywood plants

and sawmills.

Buyers from India and China are chasing Sabah and Sarawak logs as the

availability of logs from Papua New Guinea has reportedly fallen.

﹛

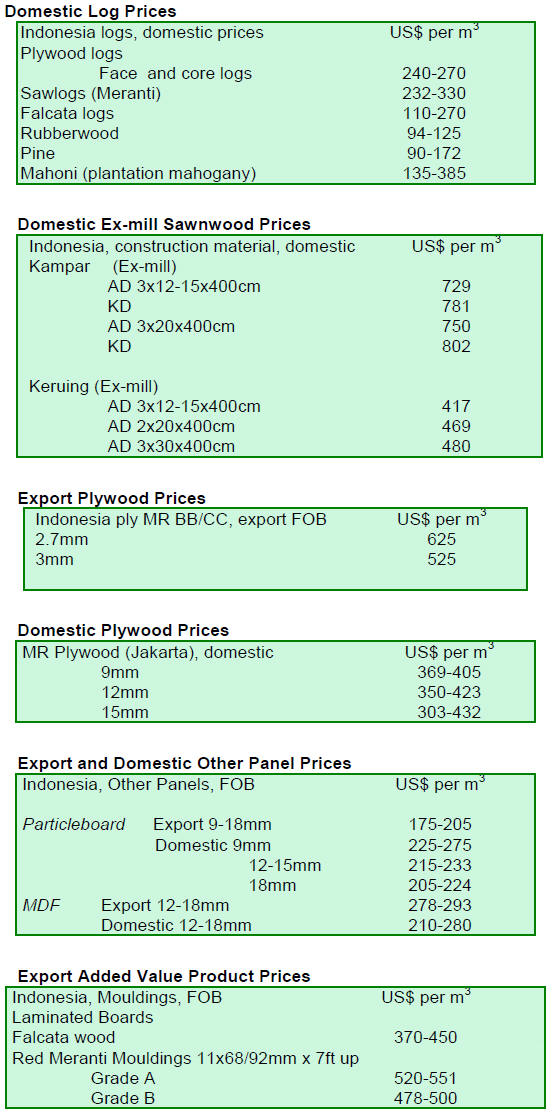

4. INDONESIA

FSC certification promoted as aiding

concessionaires satisfy SVLK

Rahardjo Benjamin, Deputy Chairman of the Indonesian Concession Holder*s

Association (APHI) said that the timeframe for the entry into force of the

SVLK certification system was such that members of the Association are

having great difficulty complying.

In an effort to assist concession holders secure SVLK certification the NGO

Borneo Initiative (TBI) has suggested that its own work on SFM certification

goes a long way to addressing many of the requirements of the SVLK as the

two initiatives are complementary.

TBI is a non profit organization promoting FSC Certification. Jesse Kuijper

of TBI said that Indonesia*s SVLK is of a very high standard and a

significant initiative by Indonesia.

TBI has made a commitment to find a bridge between the mandatory SVLK system

and voluntary FSC certification. This was announced at a recent signing of a

protocol between TBI-APHI on Combined Certification for Legality (SVLK) and

Sustainability (PHPL-FSC) in Natural Forest Management in Indonesia.

TBI announced that it has facilitated FSC certification for 37 forest

concessionaires in Indonesia covering area of 3.7 million hectares.

Exports to EU jump as V-legal products enter the market

Dwi Sudharto, of Indonesia*s Ministry of Forestry stated that trading

verified legal wood products is yielding profits for the timber sector.

Data compiled by Indonesia*s Timber Legality Information System indicates

that total revenue from export of V-Legal wood products in January and

February 2013 was more than US$534 million compared with revenue of US$237

mil. reported in the same period in 2012.

Colin Crooks, from the EU Delegation in Jakarta said that the EU member

states import around 15% of Indonesian output of wood products and that

V-legal products from Indonesia are highly regarded in the EU since the

legality of these products has been verified in Indonesia prior to shippment.

Furniture SMEs reel under cost of SVLK certification

Many SMEs in Indonesia are complaining of the difficulty, time taken and

high cost of meeting the requirements for SVLK certification.

UD Zakky, a furniture exporter in Sukoharja, Central Java recently began the

process of SVLK certification, not as an individual company but as part of a

group. Group certification is allowed under the SVLK regulations.

Despite attempting group certification the management of UD Zakky pointed

out that the cost to undertake all the administrative work is high. The

company reported that even with group certification the cost could be as

high as IDR 50 million (approx US$ 5,000).

The Chairman of ASMINDO-Solo, David Wijaya said that he sympathises with the

SMEs who are trying to secure SVLK certification as the process is very

difficult as even for larger companies.

He added that there are only 10 companies out of the 200 in Solo that have

secured SVLK certificates.

MFP and WWF offer support to companies during IFFINA

IFFINA is the annual trade fair and exhibition for the Indonesian furniture

and wood-base handicrafts sectors. During IFFINA 2013 the Multi-stakeholder

Forestry Program (MFP) collaborated with WWF and the Indonesian furniture

and handicraft manufacturers

association (ASMIDO) in offering advice and support to Indonesian companies

attending IFFINA.

MFP, WWF and ASMINDO also arranged a seminar on Indonesian preparedness to

meet the new demands in the global market.

Since the SVLK regulations came into force at the end of 2012 until the end

of February 2013, Indonesia has issued around 11,000 V-Legal export permits

for goods destined for 124 ports around the world of which 24 were ports in

the EU.

﹛

5. MYANMAR

Licensing conditions to be eased for

timber enterprises

Market conditions remain unchanged from last month report analysts in

Myanmar.

The domestic newspaper, Weekly Eleven of 27 March reported that licenses to

operate sawmills and other wood processing industries have all been extended

and only need to be renewed every five years in place of the present annual

renewals.

It also reported that some procedural requirements for export of timber will

be relaxed. These changes are expected to be formalised in the coming

months.

In other news, the Myanma Timber Enterprise is planning to switch to pricing

in US dollars instead of Euro during the coming financial year.

Analysts say, that while this will save time for the importers, it is still

problematic for overseas importers to make payment in dollars as sanctions

for remittance of US dollars have not been totally removed.

The change to pricing in dollars is still being discussed but looks

inevitable say analysts.

April will bring the Myanmar New Year and the long official holidays will

start from April 12 to 21.

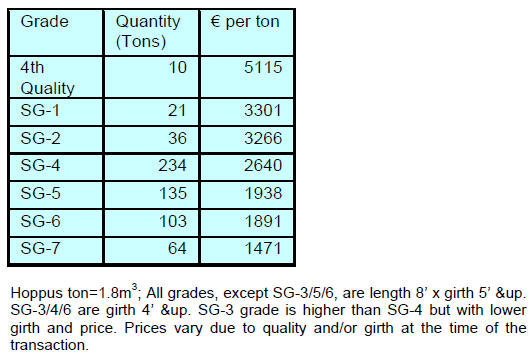

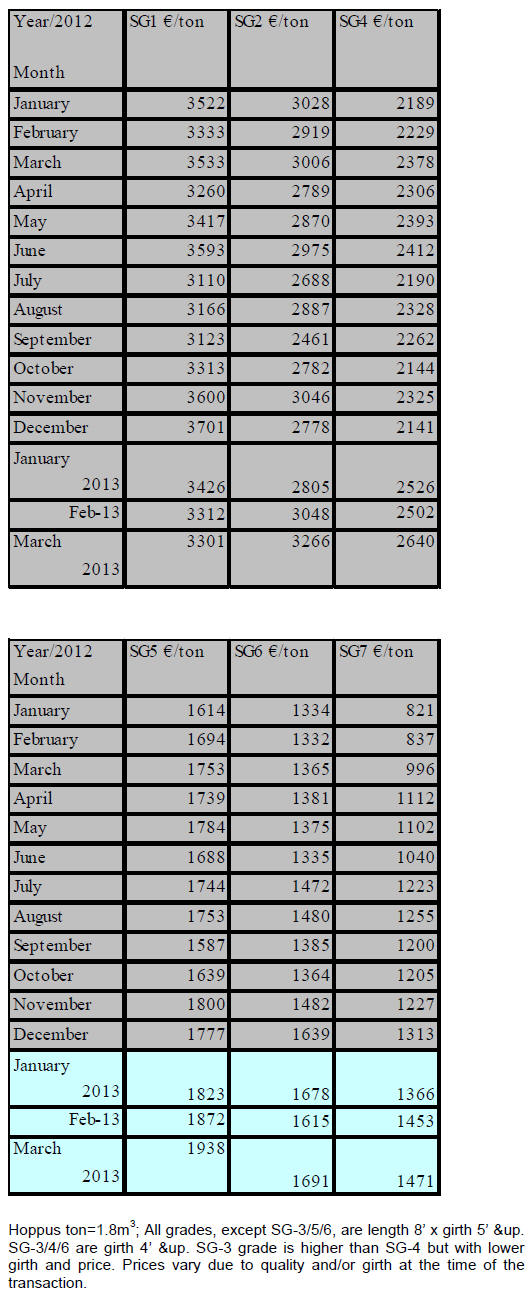

The following average prices were recorded during March 22 and 25 sales.

Average teak prices in 2012

Average Prices in Euro € per hoppus ton during 2012 and 1st quarter 2013

prices are shown below.

﹛

6.

INDIA

Reserve Bank of India releases latest

monetary policy review

The Reserve Bank of India's (RBI) recently issued a press release on its

March, mid-quarter economic review:

http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=28335

It outlines the rationale for the 25 basis point cut to 7.5% in the rate at

which it lends to banks, with other rates remaining unchanged.

The review notes that since the Third Quarter Review January 2013, global

financial market conditions have improved. However, domestic growth has

decelerated significantly, affected by relatively high levels of inflation.

The review indicates that India*s GDP growth in Q3 of 2012-13, at 4.5 per

cent, was the slowest in the past 15 quarters. Of particular concern is the

weaker output of the services sector, the mainstay of overall growth.

While growth in industrial production was positive in January, capital goods

production and mining activity continued to contract.

Lower GDP growth forecast

In the quarter under review India*s trade deficit narrowed significantly as

exports increased and non-oil imports fell. However, between April 2012 and

February 203 the trade deficit was higher than a year ago.

The review notes that there are still major risks in the global economy.

Nevertheless, leading global indicators are positive but future growth is

expected to be very slow.

On the domestic front, the priorities are to raise the growth rate, restrain

inflation pressures and mitigate the possible impact on the economy from

external forces.

The Central Statistics Office has projected GDP growth for 2012-13 to be

lower than the Reserve Bank*s baseline projection of 5.5 per cent,

reflecting slower than expected growth in both industry and services.

The key to reinvigorating growth, says the RBI, is accelerating investment.

The challenge in returning the economy to a high growth trajectory is

revival of investment. A competitive interest rate is necessary for this,

but lower interest rates alone cannot solve the problem. Issues such as

bridging supply constraints, fiscal consolidation and improving governance

need to be addressed says the RBI.

Extending new areas under rubber plantations

Kerala state is the centre for latex production in India. Tripura in the

north east of the country is the second Indian state to follow the example

of Kerala in developing rubberwood plantations.

To-date around 57,600 hectares of plantations have been established

generating employment for more than 50,000.

Having witnessed the benefits of investment in rubberwood plantations, the

state of Arunachal also aims to establish a commercial rubberwood plantation

sector. In collaboration with the Rubber Board of India, the state

government in Arunachal aims to produce 100,000 tonnes of latex.

The rubberwood plantations will yield roundwood and also facilitate

production of minor forest products such as honey.

Currently, Gujarat state has only a small area of rubberwood plantations but

that may soon change. The state has a received a proposal from a tyre

manufacturer to build a factory in the state. To encourage this investment,

the state government plans to invest in rubberwood plantations to provide

the latex raw material for this new industry.

The establishment of commercial rubberwood plantations will also provide an

opportunity for growth in the wood processing sector in the state as

rubberwood logs will be available when the plantations are periodically

felled and replanted.

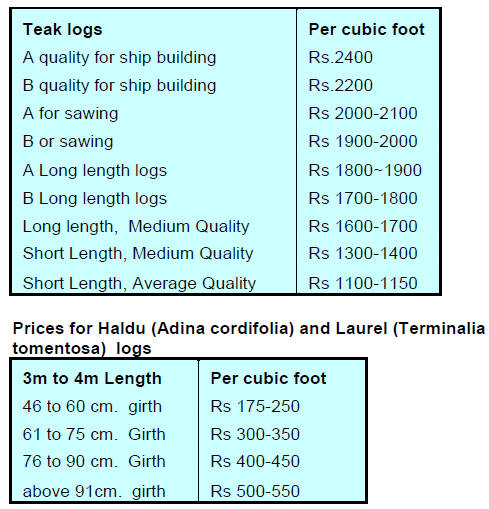

Sales of Teak and other hardwoods from Indian forests

Auction sales of teak and other hardwoods were concluded in the government

forest depots in Western India during March. Prices for freshly harvested

logs were good but the price received for log lots felled some time ago were

low.

Average prices during the March auction are shown below. Prices are per

cubic foot ex depot.

Imported Teak logs

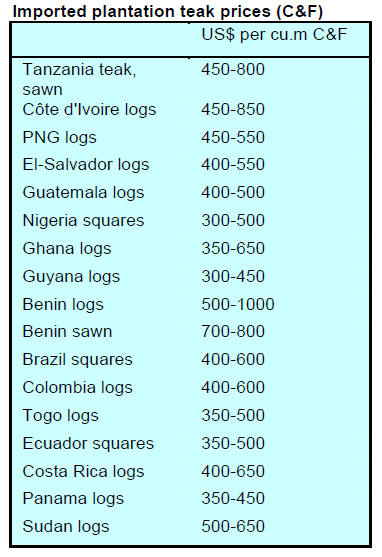

Supplies and shipments remain stable as do price levels. The turnaround in

imported timber is very quick due to the shortage of domestic hardwoods.

Variations are based on quality, lengths of logs

and the average girth of the logs.

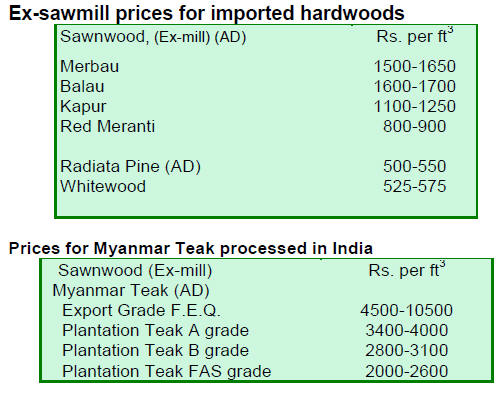

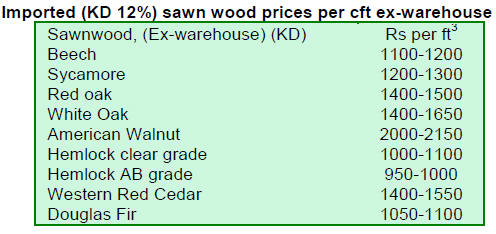

Prices for air dried sawnwood per cubic foot, ex-sawmill are unchanged.

The price range is the result of variations in

length and cross section.

The trend of replacing Teak with other durable tropical hardwoods, continues

because of high prices.

Plywood market news

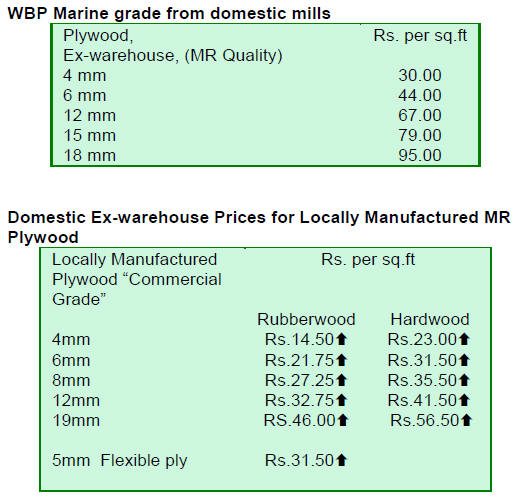

The rising costs of peeler logs, glues and other chemicals, transport

charges and labour charges are affecting profitability in the plywood

industry.

Manufacturers from Punjab and Kerala recently met and agreed that price

increases are inevitable. Analysts are concerned that the market may react

negatively to this proposed price increase.

Plywood prices after the agreed increases are shown below.

7.

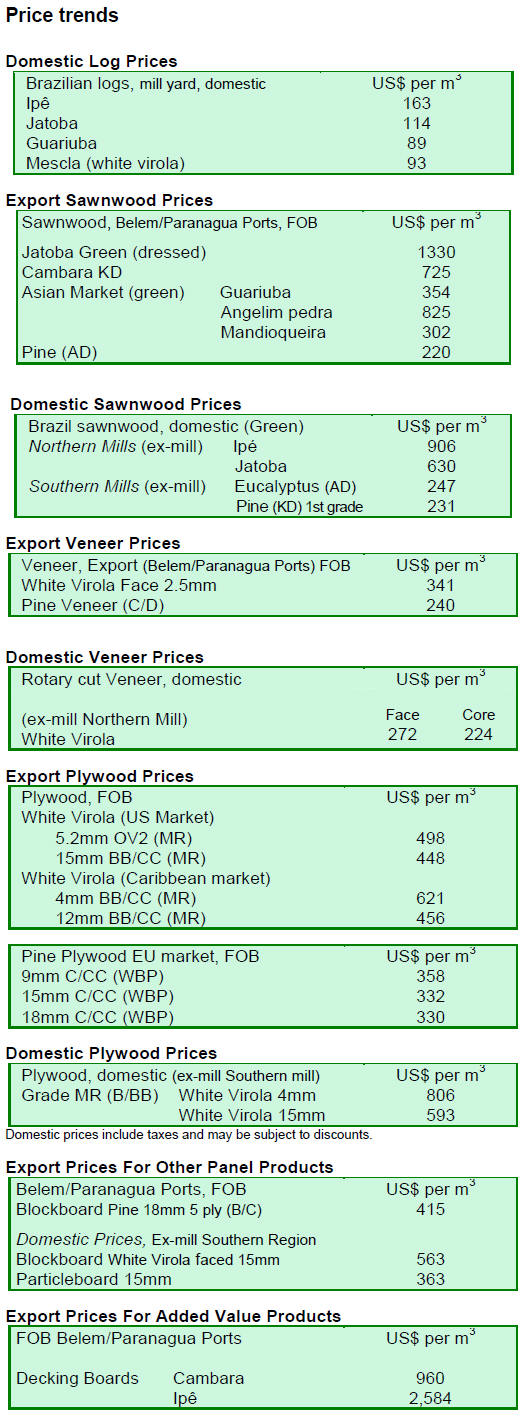

BRAZIL

Central Bank maintains record low

interest rates

According to the Brazilian Institute of Geography and Statistics (IBGE), the

rate of inflation increased in February but at a slower rate than the 0.86%

rate recorded in January.

The Monetary Policy Committee (Copom) of the Central Bank decided for the

third consecutive time to maintain the current interest rate (Selic) at

7.5%.

At this level the interest rate is the lowest for many years and is the

result of the gradual reductions in rate that began in August 2011 and

continued for 10 months up to October last year.

The average exchange BRL/US4 exchange rate in February was BRL 1.97/USD

significantly down on the rate of BRL1.72/USD during February 2012.

Furniture sector bullish on prospects for 2013

The furniture sector in Brazil is optimistic about growth in 2013 both in

terms of production and sales. The Institute of Study and Market

Intelligence (IEMI) is projecting that industrial production, which expanded

by 2% in 2012, is expected to register a 5.5% growth this year.

The projected scenario for sales is also quite optimistic as 2013 could see

an almost 10% increase in revenues compared to the 8% growth achieved in

2012 says the IEMI report.

A survey of Brazilian consumer furniture buying behaviour conducted by IEMI

in 2012 reveals that the majority of survey respondents (41%) usually buy at

least one item of furniture every year.

Such purchases, says the report, are generally motivated by an event such as

moving home (30%), children outgrowing current furniture (15%) and marriage

(13%).

Brazilian consumers spent an average of R$ 1,170 on furniture in 2012. In

choosing furniture, 41% mentioned appearance as a main factor at the time of

purchase, only 19% mentioned durability and strength. Manufacturers are

aware that design is most important for consumers.

Sinop to have new industrial district for timber enterprises

The Timber Industry Association of Northern Mato Grosso (SINDUSMAD) recently

met to identify the first steps required for creating a new timber

industrial and commercial district in the Sinop municipality.

The wood processing industries ideally need a dedicated area away from the

residential parts of the city. The problem is that the city has expanded and

the residential developments now surround the locations of the wood

processing plants.

With over 220 wood companies in Sinop the area is facing environmental

problems mainly the result of the constant movement of heavy vehicles

transporting wood products. It has been identified that these problems could

be overcome by establishing a timber processing district outside the urban

areas.

Mixed trends in February exports

In February 2013, the value of timber product exports (except pulp and

paper) fell 1.6% compared to values in February 2012, from US$189.7 million

to US$186.6 million.

Pine sawnwood exports dropped 1.6% in value in February 2013 compared to the

same month in 2012, from US$12.9 million to US$12.7 million. In volume

terms, pine sawnwood exports declined 0.7% to 57,900 cu.m in the same

period.

Export volumes of tropical sawnwood fell sharply by almost 20% from 34,300

cu.m in February 2012 to 27,700 cu.m in February this year. The value of

exports fell 14.6% from US$ 17.8 million to US$ 15.2 million, over the same

period.

In contrast, the value of pine plywood exports increased 11.4% in February

2013 compared to February 2012, from US$27.1 million to US$ 30.2 million.

The volume of exports also increased and was up 11% over the same period

from 73,000 cu.m to 81,100 cu.m.

Exports of tropical plywood also increased from 2,500 cu.m in February 2012

to 4,500 cu.m in February 2013, representing an 80.0% increase. In term so

value, a 47% increase in earnings was recorded from US$1.7 million to US$2.5

million over the twelve month period.

The value of wooden furniture exports dropped from US$35.7 million in

February 2012 to US$34.8 million in February 2013, a 2.5% decline.

Rio Grande do Sul leads in furniture exports

The furniture sector of the state of Rio Grande do Sul has recovered from

the weak international market over the past few years and began 2013 with

positive results. Exports by manufacturers in the state in January amounted

to US$11.86 mil. representing almost 27% of all Brazilian furniture exports.

Rio Grande do Sul was the only Brazilian state that reported growth in

furniture exports in 2012, thus maintaining its position as the top ranked

exporter.

Although the state exported more furniture in January 2013, compared to

January 2012 exports are still below record levels.

The main destination for Brazilian furniture remains Argentina, followed by

the United States and the United Kingdom. Colombian imports of Brazilian

furniture have more than doubled compared levels in the same period last

year.

Expectations for 2013 are high according to the Association of Furniture

Industries of the State of Rio Grande do Sul (MOVERGS). While trade during

the early part of 2013 was still hampered by global economic weakness the

situation is expected to improve this year.

35 Italian machinery suppliers participate in FIMMA Brazil 2013

Italy is the main supplier of woodworking machinery to Brazil and exports

amounted to euro 52.3 million last year. Italian suppliers captured a market

share of almost 36% of Brazilian demand for wood working machinery.

Thirty-five Italian wood working machinery suppliers participated in the

International Trade Fair for Machinery, Raw Materials and Accessories for

the Furniture Industry (FIMMA Brazil 2013).

Italian exports of wood working machinery to Brazil are estimated at euro 52

mil. and companies in the states of Rio Grande do Sul and Santa Catarina

were the main buyers, accounting for around 45% of all imports of

woodworking machinery.

The Italian woodworking machinery sector ended 2012 with a turnover of

euro1.53 bil., a significant value but 9.8% below the previous year. In

contrast Brazilian imports of Italian wood working machinery rose about 10%

in 2012.

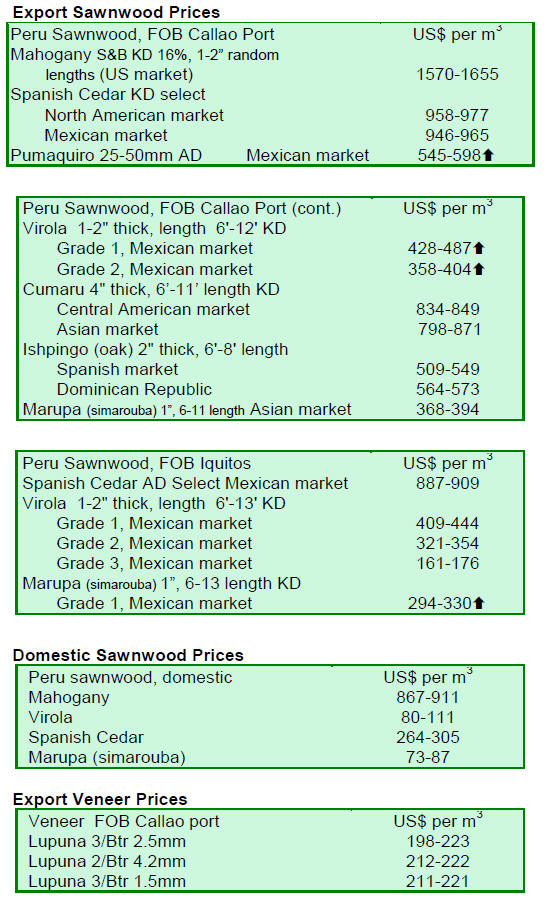

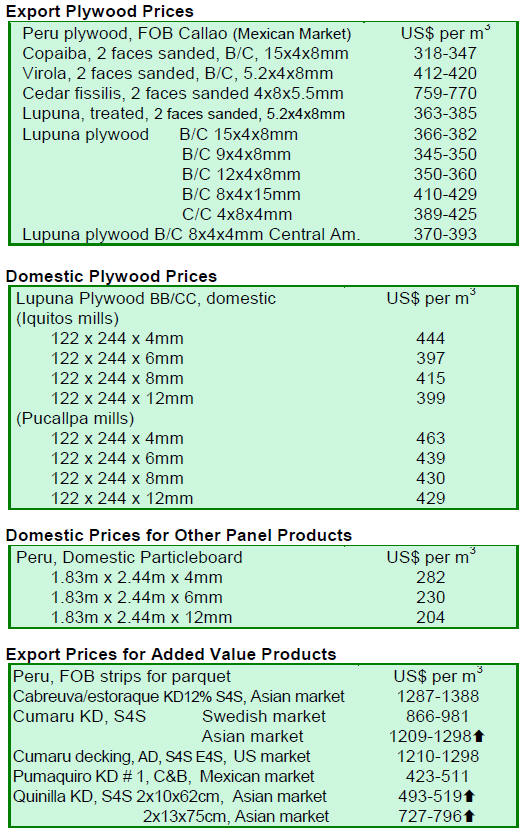

8. PERU

Peru loses 150,00 ha of forest a

year

Jose Dance, general coordinator of the National Forest Inventory Project and

Sustainable Forest Management of Peru to the FAO Climate Change office has

estimated that annually about 150,000 hectares of forest are destroyed in

Peru and that since 1990 a total of 12 million hectares has been deforested.

The areas most affected are San Martin, Ucayali, Madre de Dios, Loreto,

Cusco, Jun赤n and Tacna.

Over-logging and harvesting/clearing by communities are the main causes of

deforestation.

First national forest inventory launched

To obtain a clear picture of the state of the forest the first national

forest inventory will began this month. This effort is being supported by

the Ministry of Environment, Ministry of Agriculture, FAO and the Government

of Finland.

A spokesperson in the ministry said ※this inventory will help us understand

the current state of Peruvian forests and implement a monitoring system for

land use change to promote their conservation across 66 million hectares.

Until now we did not have a complete picture of the reality of the state of

the forest.

With this inventory, we can identify development opportunities offered by

our forests and, more importantly, the communities that depend on them may

be benefit directly and inclusively".

In the Sierra forest work will be undertaken during the months of April/May

until October. Interim results of the INF are to be presented annually.

The results will be available to the government for the introduction of

policies that contribute to the conservation of biological diversity, the

development of the climate change strategy and improvement in the use and

management of forest resources and ecosystem services.

Mincetur reports progress in forest management

The Ministry of Foreign Trade and Tourism (Mincetur), in cooperation with

the Ministries of Environment (Minam) and Agriculture (Minag), has presented

a report on progress made in implementation of Annex 18.3.4 of the Forest

Sector Appendix to the Peru/US Free Trade Agreement.

The report provided information on policies adopted and on implementation

and monitoring of harvesting and trade of tree species listed in the

Convention on International Trade in Endangered Species of Wild Fauna and

Flora (CITES).

Information was provided on efforts to design and implementation timber

traceability systems, in particular the chain of custody for CITES species.

The National Anti-Corruption Plan for forestry and wildlife was explained

and details of ongoing action on capacity building for indigenous

communities to manage the forest were outlined.

The Mincetur report was presented to a wide audience including

representatives of the private and public institutions such as the

Association of Exporters (ADEX), Lima Chamber of Commerce (CCL) and the

Foreign Trade Society of Peru (ComexPer迆).

The audience also included the Peruvian Society for Environmental Law (SPDA),

the Peruvian Society for Ecological Development (SPDE), the National Forest,

the Confederation of Amazonian Nationalities of Peru (CONAP), the People's

Ombudsman and the Public Ministry.

Several speakers and participants highlighted the progress made by the

Peruvian government in the implementation of the FTA Annex on Forests

especially as regards the management of CITES timber species (mahogany and

cedar).

9.

GUYANA

No log exports in March amid encouraging

demand for sawnwood

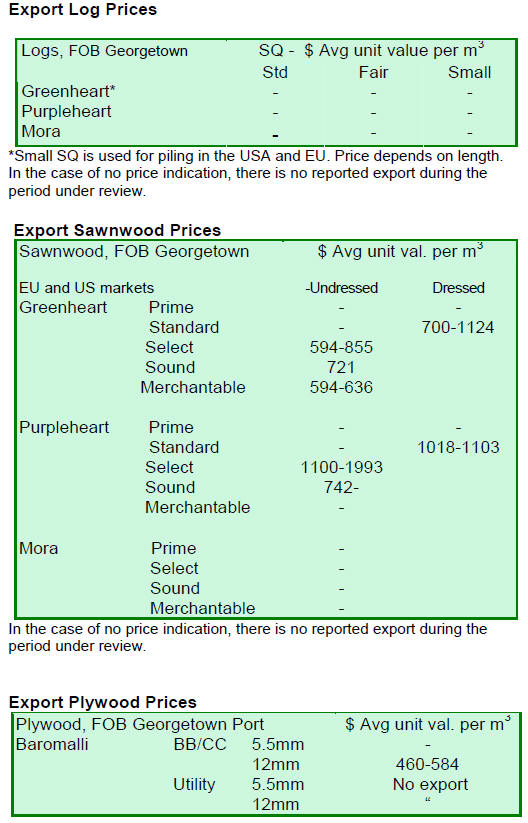

In the period reviewed there were no log exports of the main commercial

species. The only logs exported were wamara (Eperua grandiflora) in fair and

small sawmill qualities.

However, sawnwood exports made a notable contribution towards the total

export earnings as FOB prices were at attractive levels.

Undressed greenheart (select quality) sawnwood prices ended off recent highs

at US$855 down from US$912 per cubic metre FOB.

Undressed greenheart (sound quality) sawnwood attracted a favourable price

of US$721 per cubic metre FOB during the period reviewed while Undressed

greenheart (merchantable quality) sawnwood prices held firm at US$636 per

cubic metre FOB.

On the other hand, Undressed purpleheart (select quality) sawnwood was

traded at a significantly higher price of US$1,993 per cubic metre FOB in

the period reviewed. The primary market for purpleheart sawnwood was North

America.

Undressed purpleheart (sound quality) sawnwood prices averaged US$742 per

cubic metre FOB.

There were no exports of Undressed mora sawnwood during the period under

review.

Prices for Dressed greenheart sawnwood fell slightly from the high of

US$1,500 to US$1,124 per cubic metre FOB.

Dressed purpleheart sawnwood prices remained unchanged at US$1,103 per cubic

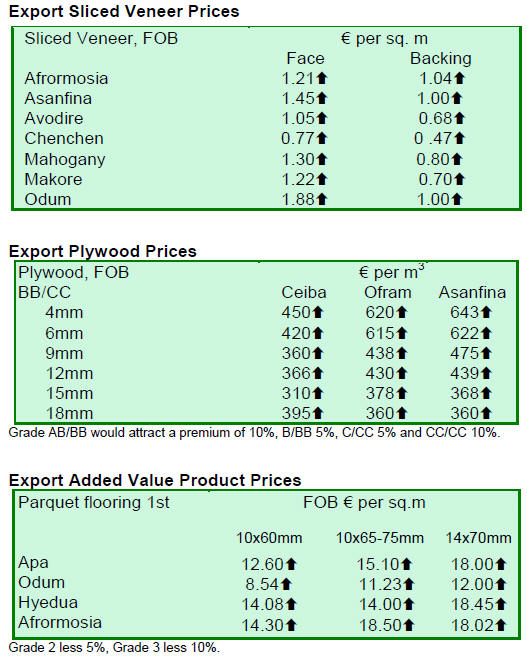

metre FOB. Similarly, plywood prices held firm on the export market,

maintaining a favourable price of US$584 per cubic metre FOB.

Guyana celebrates International Day of Forests and the Tree

The International Day of Forests and the Tree is held annually on 21st March

to raise awareness of sustainable management, conservation and sustainable

development of all types of forests for the benefit of current and future

generations.

The United nations General Assembly adopted a resolution on 21st December

2012, which declared, that starting in 2013, 21st March of each year is to

be observed as the International Day of Forests and the Tree. The resolution

encourages all member states to organize activities relating to all types of

forests, and trees outside forests.

To celebrate, the Guyana Forestry Commission and the Forest Products

Development and Marketing Council, along with other relevant agencies under

the Ministry Natural Resources and Environment, hosted an exhibition

displaying value added and other products derived from the forests.

Presentations were made by representatives of indigenous communities in

Guyana highlighting the sustainable development of Guyana*s forest and the

contribution made from sustainable practices to indigenous communities.

First draft of scope of VPA and definition of legality ready for

stakeholder assessment

Work has advanced in Guyana on the Guyana/EU VPA. Over the past month the

main areas that were advanced were the first draft of the Definition of

Forest Legality and the draft Scope of the Agreement. These documents are

both undergoing national stakeholder assessment.

The draft Scope focuses on wood products that are currently being exported

to the EU and those likely to be exported to the EU within the near future.

Traceability of such products through the supply chain is an important

element in the Scope of the VPA.

Over the course of the coming months, these key technical documents will be

subject to extensive stakeholder discussions.

Stakeholder participation is a core part of the EU FLEGT process in Guyana.

In this regard, plans are in motion in two other critical areas of the VPA:

the Communication Strategy and the Assessment/Scoping of the Impacts of the

EU FLEGT VPA in Guyana.

The National Technical Working Group, in addressing the Communication

Strategy and Impact, will provide inputs on the Terms of Reference developed

for these two items.

To this end, a Workshop is planned to engage stakeholders in the two areas.

This Workshop will focus on reaching out to more than 120 participants from

a total of thirty indigenous communities, indigenous NGOs and the

constitutional bodies for indigenous people.

A further round of negotiations between Guyana and the EU is scheduled for

July 2013.

There were no log exports in the period reviewed