2. GHANA

Creating awareness on the EUTR in EU

member states

A team from the Ghana Forestry Commission (GFC) visited key importers in EU

member states to exchange views and inform buyers, officials from EU

competent authorities, customs and timber trade federations on the interim

arrangements Ghana is putting in place before it is in a position to provide

FLEGT Licensed wood products.

It is expected that the arrangement being put in place in Ghana will meet

the due diligence requirements of the EUTR and will facilitate the entry of

wood product from Ghana into the EU. The GFC anticipates that FLEGT licensed

timber will be available in the first quarter of 2014.

The GFC is encouraging exporters to continue close interaction with thei

r buyers in the EU and to be ready to provide

documentation the importers may need to satisfy the EUTR.

Due diligence explained to local industry

The Ghana Forestry Commission (GFC) has organised workshops to provide

information to the timber industry and other stakeholders on the

requirements of the EUTR.

The workshop provided industry with information on the documentation that

exporters may need to provide to their customers in the EU as the importers

address the due diligence requirements of the EUTR.

Minister visits Forestry Commission

The Minister of Lands and Natural Resources, Alhaji Inusah Fuseini, has

called on the Forestry Commission (FC) to continue its partnership with the

ministry and other allied institutions to promulgate laws and regulations

which will promote sustainable forest management in the country.

The Minister made this statement when he paid his first visit to the FC

headquarters in Accra, where he interacted with the executive management of

the commission headed by Mr. Samuel Afari Dartey.

The Minister reminded the FC that the country¡¯s forest resources are a

strategic asset which needs a sustained legislative backing to guarantee its

sustainable management and utilisation.

Trimming the financial deficit

Ghana's 2013 budget aims to trim the deficit to 9 percent from the 12

percent of Gross Domestics Product (GDP) in 2012 by enhancing tax revenues

and controlling expenditures.

In his first budget statement to the nation, the Minister of Finance said

the focus in the current budget is revenue generation through expanding the

tax base and improving the efficiency of tax administration.

3. MALAYSIA

Growth in furniture exports to the US

Preliminary figures for Malaysian timber exports in 2012 suggest they

totalled RM 19.9 billion (approximately US$ 6.3 billion) however, the

statistics are still being finalised.

The Plantation Industries and Commodities Minister Bernard Dompok was

reported by the Star newspaper as saying the furniture sector contributed RM

8 billion (approximately US$ 2.5 billion) or around 40% of the total value

of wood product exports in 2012.

The minister emphasised the growing importance of export earnings by the

furniture sector. In 2012 Malaysian furniture was exported to 199 countries

worldwide and the value of furniture exports increased more than 4% over

levels in 2011. An almost 11% increase in furniture exports to the United

States was recorded.

New Customs regulations introduced

Kuala Lumpur regularly plays host to two international furniture fairs which

attract thousands of international buyers.

These furniture fairs come at a time when the timber industry is struggling

to meet new Malaysian regulations for exports to Europe.

As of March 2013 furniture exporters in Malaysia must apply for an export

permit from the Malaysia Timber Industry Board to satisfy revised Malaysian

Customs requirements.

The new Malaysian Customs Prohibition List applies to wooden furniture and

11 other types of wood products such as laminated scantling, flooring, etc.

The new Malaysian export regulations are aimed at providing EU importers

with credible evidence to satisfy the due diligence requirements of the EUTR.

Industry analysts are expecting exports to EU markets to dip in the short

term as Malaysian exporters gradually become familiar with the new

regulations and as information on what is required and the procedures to be

followed by exporters.

Despite the efforts of the trade associations and government agencies over

the past few months some exporters are still not totally familiar with the

new procedures.

Sabah releases export figures for 2012

The Sabah state government recently released official statistics on the 2012

FOB value of wood product exports. Plywood exports were valued at RM

1,018,134, 684 (approx. US$ 474 million), sawntimber RM 395,455,670 (approx.

US$ 126 million), mouldings RM 98,360,775 (approx. US$ 31 million),

laminated board RM 81,301,973 (approx. US$ 26 million), and veneer RM

73,335,818 (approx. US$ 23 million).

The top buyers of Sabah plywood in 2012 were Japan 21.1%, followed by

Peninsular Malaysia 18.3%, South Korea 9.7%, Mexico 9.6% and USA 8.5%.

The main buyers of Sabah sawnwood were Thailand 30.1%, followed by China

13.3%, Taiwan P.o.C 11.8%, Japan 10.8% and South Africa 9.2%.

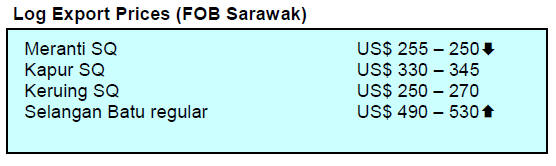

Low log and plywood prices squeeze 2012 profits

In Sarawak, two major listed timber companies are in the news as they have

just released their financial reports. Jaya Tiasa Holdings was reported by

the Star newspaper as expecting a better year in 2013 after a weak 2012.

The company says it is optimistic that the improved housing starts in USA

and the tight log availability, which is driving up log export prices, will

help boost this year¡¯s earnings.

The company¡¯s profits fell in 2012 because the price of logs and plywood

fell by 21% and 11% respectively compared to levels in 2011.

The Star also reported on the financial reports from WK Holdings and stated

that profits were down in 2012 due to lower log production and lower than

expected income from log sales.

WTK said in notes attached to its latest financial results: ¡°Average round

log prices dropped by 7.8% and at the same time sales volume decreased by

3.4%. The Group¡¯s key export markets for round logs in 2012 were India at

79% and China (11%) while the remaining 10% was exported to ASEAN

countries¡±.

On plywood, WTK sales volume increased by 26% in 2012 but any gain from the

increase in sales volume was offset by a 7.6% drop in average prices. The

bulk WTK plywood sales (88%) were to Japan, the balance going to Taiwan

P.o.C.

¡¡

¡¡

4. INDONESIA

Debate rages on forest concession

moratorium

Officials at Indonesia¡¦s Forestry Ministry have said the country should

continue with its ban on the issuance of new forest concessions to fully

participate in international efforts on climate change mitigation.

However, the proposal to extend the government moratorium on granting

concessions, which comes to an end in May, is being opposed by some who say

the extension of the ban will hurt the economy.

National media reports say that some Indonesian politicians are calling for

a freeze on the Reforestation Fund if a decision is made to continue the

moratorium.

The challenge to continuation of the moratorium is being supported by the

Agriculture Ministry and the palm oil and mining sectors that fear this is a

business unfriendly policy which risks weakening economic growth.

The Agriculture Ministry would prefer, say media reports, to see stricter

enforcement and new controls to protect peatland and primary forest areas

rather than a ban on concessions.

A coalition of non-governmental environmental organizations has also entered

the debate urging the government to remain firm in its commitment to protect

the forests of Indonesia and uphold its commitment to reduce green house gas

emissions by between 26 percent and 41 percent by 2020. The NGOs say that if

the moratorium is not extended this goal cannot be achieved.

Several publications by the Center for International Forestry Research (CIFOR)

also call for extension of the policy and document benefits that the policy

has already brought.

International Furniture and Craft Fair Indonesia

The 2013 International Furniture and Craft Fair Indonesia (IFFINA) was held

in Jakarta from March 11-14. The four-day fair featured over 500 domestic

and overseas exhibitors.

The organizers expect business deals worth around US$400 million to be

concluded this year.

Indonesia¡¦s 2012 furniture exports grew over ten percent to around US$2

billion on the back of improved demand in US and European markets.

Speaking at the event the Industry Minister said last year¡¦s exports to the

US were worth over US$500 million while sales to Germany and the Netherlands

were around US$200 million each.

Analysts remarked that demand was initially coming from the furniture

replacement segment of the US market but, as US housing growth is expanding,

demand is now also coming from the new home furnishing segment of the

market.

To achieve growth in Indonesia¡¦s furniture exports the government has

indicated it will assist exporters seeking to diversify further into new

markets in India, China and emerging economies in South America and Africa.

ASMINDO to assist members enter new markets

Commenting on the response of buyers at IFFINA a spokesperson from the

Indonesian Furniture Industry and handicraft Association (ASMINDO) said

that, because there was a 30 percent rise in the number of buyers visiting

the fair especially those from non-traditional markets, an improvement in

the export performance of the sector seems assured.

ASMINDO intends to work with its 700 members to plan penetration of

non-traditional markets in South America and Africa without abandoning

opportunities which have recently been created for Indonesia furniture in

China, Malaysia and South Korea.

In other news ASMINDO is undertaking training on internal tracking for

members in the Solo area to strengthen the capacity of members as they apply

for the external audit required before enterprises can secure the timber

legality license (SVLK).

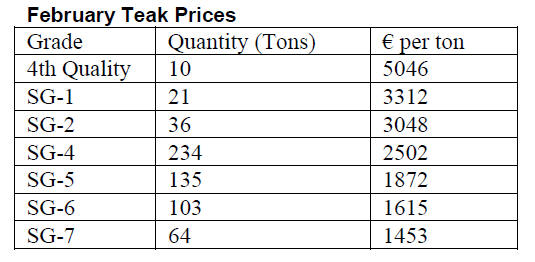

5. MYANMAR

Firm and stable market demand for teak

The market situation remains the same as reported throughout the first

quarter of 2013. Teak market is firm and there is good demand for fresh cut

hardwood (i.e. non-teak) logs. It is expected that business will remain

steady for the next few months.

Household use of wood fuel the cause of deforestation

The Myanmar Weekly Eleven, a local journal, reported that Forestry Minister

U Win Tun said Myanmar is one of the countries in the region where the rate

of deforestation is the highest, adding that the major cause is illegal

cutting for household fuelwood and charcoal production.

Association and ETTF to undertake legality assessment

The Joint Secretary of the Myanmar Timber Merchants Association U Bar-Bar

Cho has been quoted as saying the association is working with the European

Timber Trade Federation (ETTF) to agree a MOU for an independent assessment

of the systems in place in Myanmar to ensure that all timber is legally

harvested.

The MOU is being developed in response to the introduction of the EUTR.

Myanmar intends to demonstrate that it has adequate systems to ensure

compliance with the criteria for ¡®Due Diligence¡¯ thus ensuring access to the

EU market. The Myanmar industry is optimistic that an agreement can be

worked out in the coming months.

Exporters mull abandoning EU market

It has been reported in the domestic press that some timber industrialists

say they may cease timber export to the EU preferring to concentrate on

sales to countries where timbers from Myanmar are used to satisfy local

market demand rather than for re-export to EU markets.

Several Myanmar timber merchants have expressed the view that, due to the

growth in domestic demand, even if log exports are banned the country may

soon have little excess wood products to export.

On the other hand other analysts point out that, though log exports are no

longer a major foreign exchange earner, the industry is still an important

source of foreign exchange and provides thousands of jobs.

¡¡

6.

INDIA

Budget offers support to home buyers

The budget for 2013-14, presented by the Finance Minister Mr.P.Chidambaram,

has not increased import duties on wood in the rough, sawn timber, plywood

and other panel products.

The good news in the budget for the timber industry is that it provides

support for home buyers. This should give a boost to the housing sector

which is a significant market for wood products. The assessment of analysts

is that the budget is well balanced and will stimulate investment.

Timber Processing Zone experiment a success

To prevent illegally felled domestic logs entering the supply chain all wood

working industries are required to obtain clearance from a ¡®Central

Empowered Committee¡¯, whose task is to verify the source of the logs.

This is a time consuming and costly process for the timber industry and

discourages new investment in wood based enterprises.

To ease the burden on industry and minimize the bureaucracy, an experiment

has been launched. A Timber Processing Zone has been created where

enterprises can be established to process only imported logs, sawnwood and

veneers.

The first such processing zone was developed in Kandla, home to a major port

servicing the timber industry on the west coast of India in the state of

Gujarat.

The procedures for establishing a wood processing plant in the Zone have

been made easy to encourage companies to invest in processing capacity.

The indications are that this experiment proved a success as about 1,000

factories of various types and sizes have been established in and around the

Zone.

The technical and marketing advantages of such a cluster of wood processing

industries are now being felt and employment opportunities have expanded.

Given the positive experience in Kandla, Paradeep Port on the east coast of

India in Odisha state has been selected for establishment of a second Timber

Processing Zone.

The government of Odisha has identified land for this project and

construction planning is underway.

IKEA investment in retailing outlets likely to get approval

The Swedish company IKEA has submitted a proposal to the Indian authorities

for investment in retail sales outlets across India for its home and office

furnishing products.

Media reports indicate that the Foreign Investment Promotion Board has

recommended IKEA¡¯s proposal to the Cabinet Committee of Economic Affaires.

India¡¯s foreign investment rules require a mandatory sourcing of at least

30% of the value of goods sold in India from domestic small and medium

enterprises.

When the IKEA investment goes ahead it could boost sales of locally

manufactured panel products, hardwood products and handicrafts.

Strong demand for imported teak despite quality issues

The availability of imported teak and other hardwoods has improved since the

beginning of the year and this has meant companies have been able to

maintain healthy stock levels.

However, analysts say hardwoods from domestic forests are preferred by

industry as the quality is better.

Teak and other hardwood logs from Myanmar are of larger girth than imported

plantation teak logs but the availability of high quality teak from Myanmar

is said to be declining.

However, due to the scarcity of domestic teak logs even poor quality logs

from Myanmar are purchased immediately on arrival at Indian ports.

Only option - switch to SE Asian hardwood alternatives

In the absence of large quantities of Haldu (Adina cordifolia), Laurel (Terminalia

tomentosa), Sal (Shorea robusta),Bija (Pterocarpus marsupium) end-users have

been switching to Balau, Rengas, Meranti, Merbau and Kempas from South East

Asia. There is a firm demand for these timbers in India.

Imports of Radiata pine help meet the shortage of local species for

production of boxes and crates, pallets and for concrete shuttering. The

flow of Radiata shipments from New Zealand is steady and prices are stable.

Active trade in imported plantation teak

Supplies and shipments of imported plantation teak logs and squares are

steady and prices remain unchanged. The trade in imported timber is very

active due to the shortage of local hardwoods.

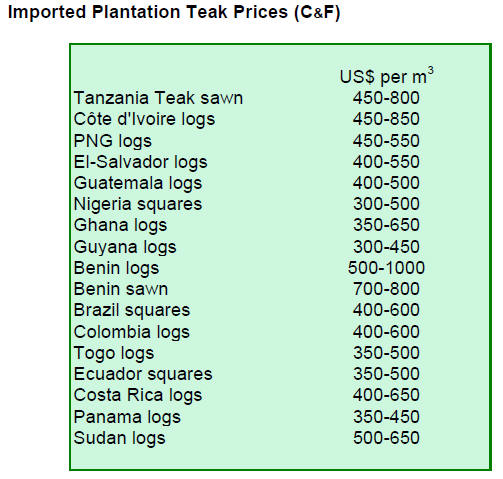

Prices C & F Indian ports, per cubic metre are shown below.

Variations exist based on lengths and average girths of logs in a parcel.

Prices also vary with measurement allowances given for bark and sap in

different countries of origin.

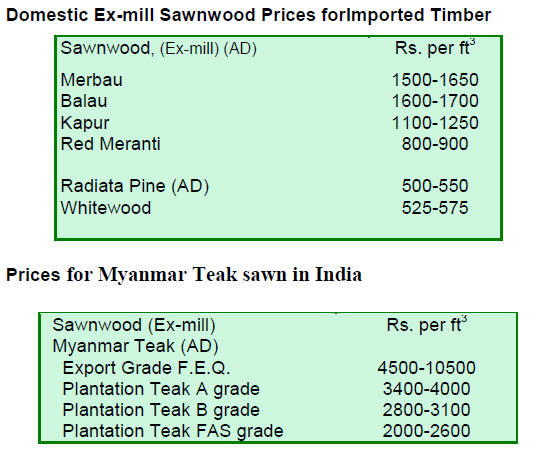

Domestic sawnwood prices

Prices for air dried sawnwood remain unchanged. Prices are shown below as

per cubic foot, ex-sawmill.

The price range is the result of variations in length and cross section.

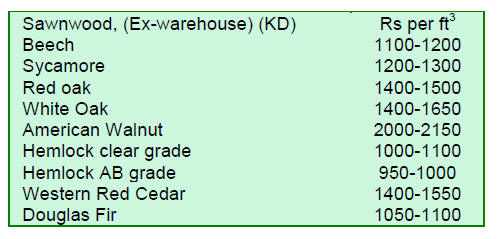

Prices for imported kiln dry (12% mc) sawnwood

Prices remain unchanged.

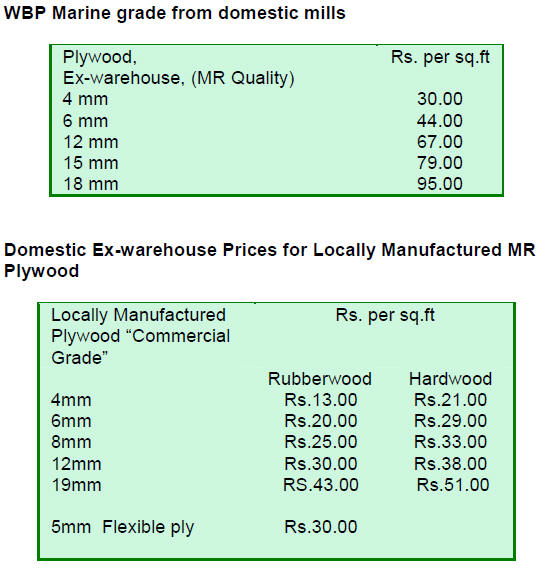

Plywood manufactures undeterred by Chinese

plywood imports

The level of taxes and stamp duty on newly built homes continues to deter

prospective home buyers and this affects the timber sector, especially

plywood and other woodbased panel manufacturers.

Imports of plywood from China continue but as the quality is perceived as

low such imports are not seriously affecting sales of domestically made

plywood.

Current market prices are shown below.

7.

BRAZIL

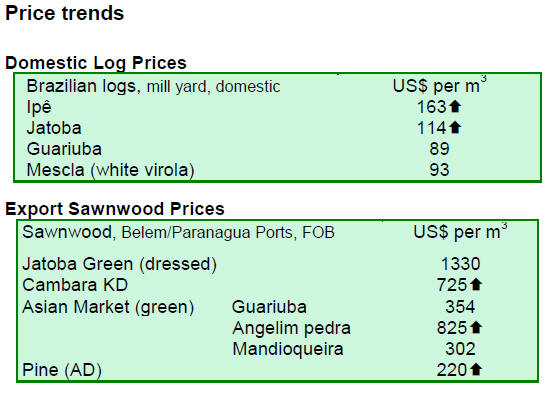

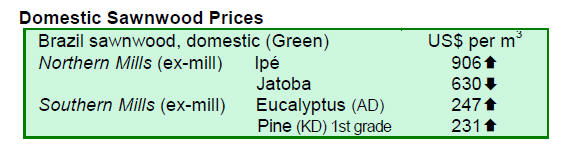

Domestic price trend puzzle because

of Real/US$ exchange rate

On the domestic market wood product prices in Brazilian reals have increased

by an average 2.0% over the past three months.

However, average prices, in US$ shown in the tables below, illustrate that

in dollar terms there has been a downward movement in prices of 3.9%. This

is due to the appreciation of the Brazilian currency against the US dollar

during the period reported.

New Forest Concession in Rondônia State

The result of competitive public bidding for forest concessions in the

national forest of Jacund?in the state of Rondônia (Jacund?FLONA ) was made

public by the Brazilian Forest Service (SFB) on March 5, 2013.

The Madeflona Industrial Wood Company won the bid for forest management

units (FMUs) 1 and 2, covering 55,000 and 32,700 hectares, respectively.

The forest concessions available also included a third FMU of 23,600

hectares, but there were no bids from qualified candidates for this FMU.

There were a total of 11 bids for the available concessions and the bids

were opened in public to ensure transparency in the selection of

concessionaries.

With the completion of the allocation process the next step will be the

signing of concession contracts. Each concession agreement is valid for up

to 40 years for the sustainable harvesting of timber and non-timber

products.

The JacundaFLONA is the second national forest in which harvesting

concessions have been made available in Rondoia state.

IBAMA Seizes illegal timber in Para state

Inspectors of the Brazilian Institute of Environment and Renewable Natural

Resources (IBAMA) seized 8,000 cubic metres of illegally harvested timber in

an area 200 kilometres from the city of Santarem, in the Par?state, in the

Amazon region.

The volume seized is equivalent to about 320 truckloads of logs. This

seizure was the result of one of the first operations of IBAMA in this state

in 2013.

Part of confiscated timber will be transported by the Civil Defence Force

but, because of access problems, some logs will be destroyed where they have

been stored after seizure.

In regions monitored by IBAMA, inspection teams have located illegal log

storage sites and have removed illegal logging camps and seized boats that

were used to transport illegal products. This year five clandestine loading

points were shut down.

In the state of Mato Grosso IBAMA inspectors are working with security force

troops to ensure greater surveillance. IBAMA says that with the help of the

troops it will be able to double the number of inspection teams in the

region.

Satisfying EU requirements on legal origin

According to ABIMCI the EUTR, which requires proof of origin of the wood raw

materials used to manufacture products, will not affect trade from Brazil as

Brazilian entrepreneurs comply with requirements on the legal origin of

timber.

ABIMCI reaffirmed that there is no illegal timber or wood products being

exported from Brazil.

The EUTR, says ABIMCI, could result in a marketing advantage for Brazilian

exporters as some of its competitors?in the European market may find it

difficult to meet the requirements of the EUTR.

Europe is the main destination for Brazilian wood products. In 2012, Europe

purchased 65% of exported plywood.

ABIMCI is working with the timber associations in Europe as well as the

European Timber Trade Federation and other federations in the EU member

states to provide information on the capacity of Brazilian exporters to

satisfy the new EU legal requirements.

International funds to preserve forests not reaching Brazil

A recent analysis of the flow of funds for forest conservation shows that

only around 39% of the US$ 597 million pledged by four private foundations

and five government agencies were disbursed during the period 2009 to 2012.

Most of the funds reportedly went to NGOs and government agencies for three

purposes; support for projects on Reducing Emissions from Deforestation and

Forest Degradation (REDD+), empowering communities and for developing new

national policies.

Despite the low level of funding for practical conservation, the flow of

funds in Brazil is said to be higher than other countries that also have

REDD+ programmes. The flow of funding is said to be as low as 18% in

Vietnam, 3% in Ghana and just 1% in Ecuador.

The main reasons cited for the slow flow of funds are excessive bureaucracy

in the recipient countries and the poor capacity of recipient organizations

to manage the funds in an open and transparent manner.

It is pointed out by analysts that the lack of a clear regulatory framework

for REDD projects in Brazil makes disbursement of development funds

difficult.

¡¡

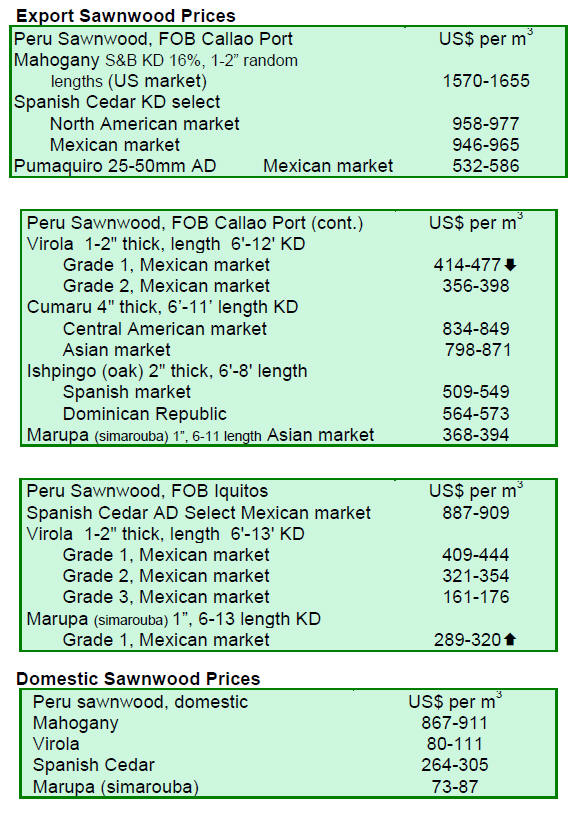

8. PERU

2012 trade figures from ADEX

The Exporters Association of Peru (ADEX) has just released 2012 wood product

export statistics. The cumulative FOB value of exports by the timber sector

was US$164.8 million down 2.5% on 2011.

In 2012 the three main wood export destinations were China, Mexico and

United States and these three markets accounted for 72.5% of all sector

exports. Growth was recorded in exports to the USA, Dominican Republic and

France, much of this growth was from increased sales of parquet.

Among the markets that weakened during 2012 were China, down 11% and Mexico,

down 12%.

2012 Sawnwood and plywood exports grew in an otherwise slow market

The FOB value of sawnwood exports in 2012 was just over US$66 mil.,

representing 40% of all exports. In contrast to the export performance of

other products, sawnwood sales increased 14% from US$58 mil. in 2011.

The single most important market for sawnwood from Peru was Mexico, a market

that accounted for around 31% of all 2012 sawnwood exports.

Exports of semi-manufactured wood products earned US$56.3 mil. in 2012 but

were down around 19% on levels in 2011.

The main destination for semi-manufactured products was China which

accounted for 60% of all sales. Encouraging signs were seen in demand from

Belgium for semi-manufactured products in 2012.

Exports of veneer and plywood in 2012 were worth US$ 22 mil. FOB, this

represented an increase in earnings of US$2.4 mil. or almost 13% over levels

in 2011. Mexico accounted for most (58%) of the veneer and plywood exports

from Peru in 2012.

The exports of furniture and furniture parts fell in 2012 to US$ 7.5 mil.

FOB, down 9.7% compared to 2011. The US was the main market accounting for

57% of exports followed by Italy (21%).

¡¡

9.

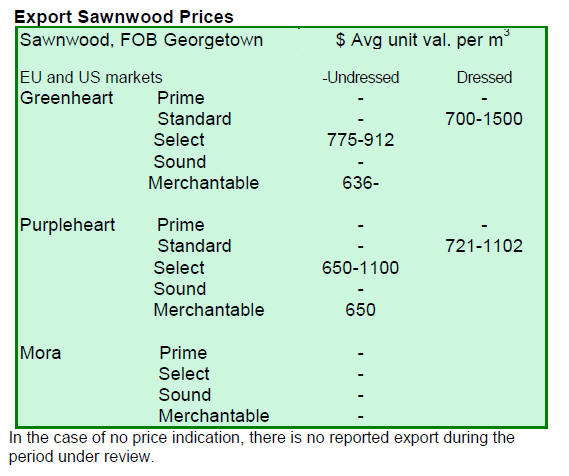

GUYANA

Log market quiet but sawnwood market

active

In the period reviewed there were no exports of greenheart or mora logs.

Standard sawmill quality purpleheart logs were exported but at lower prices

than recorded recently.

Standard sawmill quality purpleheart log prices dropped from US$385 to US$

350 per cubic metre FOB.

While the log market was quiet, active business was seen in sawnwood export

markets but, as for the log market, some prices weakened.

Shippers of greenheart (undressed, select) experienced a decline in top end

price from US$950 to US$912 per cubic metre FOB. Greenheart (undressed,

merchantable) sawnwood prices were around average in the region of US$636

per cubic metre FOB.

In contrast, purpleheart (undressed, select) sawnwood prices held firm at

US$1,100 per cubic metre FOB, marginally better than levels recorded

recently.

Export prices for purpleheart (undressed, merchantable quality) moved as

high as US$650 per cubic metre FOB. Mora sawnwood was not exported in the

period reviewed.

Dressed Greenheart sawnwood top end FOB prices improved significantly,

moving from US$1,060 to US$1,500 per cubic metre FOB. The main markets for

dressed greenheart sawnwood were Asia and the Caribbean.

Dressed purpleheart sawnwood prices were encouraging at around US$1,102 per

cubic metre FOB.

Plywood, shingles and piling dominate added value exports

Plywood export prices have weakened slightly recently. BB/CC quality plywood

was traded at US$584 just US$5 lower than for the previous two week period.

Splitwood (shingles) prices remain at attractive levels and the main markets

are the Caribbean and Middle East.

Round (piling) prices were favourable on the export market moving to as much

as US$651 per cubic metre FOB for the markets in Europe and North America.

External funding for CoC and LUS promotion

The Forest Products Development and Marketing Council of Guyana (FPDMC) has

received external funding to support marketing, promotion and product

development of Guyana¡¯s timbers within the forest sector.

One of the major aims of the Council is the strengthening of the timber

industry in Guyana through developing strategic marketing plans.

A key activity of the Council will be the production of a promotional video

targeting the local and overseas consumer. The aim in producing the video is

illustrate all aspects of the chain of custody controls from harvesting to

export of value added products.

The FPDMC will include in its plan further awareness raising and promotion

for domestic and overseas consumers of the opportunities offered by Guyana¡¯s

lesser used species.

¡¡

¡¡