Japan Wood Products

Prices

Dollar Exchange Rates of

21th February 2013

Japan Yen

93.41

Reports From Japan

Economic outlook from the Bank of Japan

The Bank of Japan (BoJ) Monetary Policy Board met in mid February and

released its assessment of the Japanese economy. The BoJ report can be found

at: http://www.boj.or.jp/en/mopo/gp_2013/gp1302b.pdf. The following is a

summary of the main features of the report.

It is the view of the BoJ that Japan's economy appears to have stopped

weakening. However, the economies in the main countries with which Japan

trades, except China, remain weak but are showing signs of bottoming out,

says the report. While Japan’s exports continue to fall the pace of decline

has been easing recently. Private sector fixed investment remains weak but

investment by the non manufacturing sector is encouraging, says the BoJ.

Public investment continues to increase and housing starts have improved and

this, along with the steady pace of private consumption, is fuelling

optimism that perhaps the worst of the economic stagnation is over.

In the words of the BoJ: “reflecting on these developments in demand both at

home and abroad, industrial production appears to have stopped decreasing”.

Japan's economy, says the BoJ report, is expected to level off and remain

stable, eventually returning to a moderate recovery path as domestic demand

improves due to the effects of various economic measures and as overseas

economies begin to show positive signs of growth.

When overseas demand begins to strengthen Japan’s export performance will

start to improve. In the short-term it will be domestic demand and public

investment that supports the economy. Business investment, says the BoJ is

projected to remain weak especially in the manufacturing sector.

Energy imports drive up trade deficit

The weaker yen has adversely affected Japan’s trade deficit which rose to a

record US$17 billion in January 2013. The rise was not wholly unexpected as

the weaker yen had a big impact on import bills plus the fact that January

is, traditionally, a slow month for exports.

The impact of the weaker currency was most apparent for energy imports which

have soared since the shutdown of almost all the nuclear reactors in the

country. Power generation is now almost entirely dependant on oil and gas,

both of which have to be imported. Recent data shows that imports of natural

gas increased by around 12% and oil imports were up over 30%.

Japan’s export performance in January was encouraging, growing 6.5% from

levels in 2012; however this was the first increase in eight months. This

good news was tempered however by the 7% plus rise in the cost of imports.

Many observers expect the Japanese government to push to restart some

nuclear reactors to cushion the impact of the weaker yen on energy import

bills.

Weak yen, unexpected consequences for Japanese manufacturers overseas

The Trade and Industry Ministry is forecasting trade with China, the number

one trading partner, should recover this year. In 2012 trade levels between

the two neighbours fell for the first time in three years because of a

territorial dispute and the slowdown in the Chinese economy.

The weaker yen also affected the trade deficit with China because Japan

imports so much from the country. Much of the imports from China are of

goods manufactured there by Japanese companies which fled Japan during the

time the yen was so strong.

Because the yen has weakened, this ‘escape’ has the unexpected consequence

of making imports from Japanese manufacturers located in China more

expensive on the Japanese domestic market.

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

Extracted from the Japan Lumber Reports:

Plywood supply in 2012

Imported South Sea plywood

South Sea logs

Plywood supply in 2012

Total plywood supply in 2012 was 6,074,400 cbms, 1.2% less than 2011 but

total supply exceeded 6 million cbms for two straight years.

The market weakened since November 2011 by aftermath of heavy supply for

restoration of earthquake and tsunami damage in March 2011 so that domestic

softwood plywood manufacturers started production curtailment since mid 2012

to restore the market.

Meantime, the shipment remained rather high so that the production recovered

in the second half of 2012.With bullish demand, imported plywood showed

steady supply with share of import being 58% in 2012.

Total imported plywood was 3,525,900 cbms, 3.7% less than 2011 while

domestic supply was 2,548,500 cbms, 2.5% more.

Overseas plywood suppliers have always demanded high prices but they have

kept small price increase considering deflation in Japan so the buyers in

Japan could keep buying.

Domestic softwood plywood production was 2,327,400 cbms, 5.9% more than

2011. The market had kept weak almost through 2012 due to heavy inventories

but the shipments have kept high level since last April and the shipments

recorded over 210 M cbms a month for three consecutive months since last

October, supported by aggressive purchase by house builders and precutting

plants.

The manufacturers increased the production to cope with active demand and

the production has kept over 200 M cbms for three consecutive months since

last October. With the shipment surpassing the production, the inventories

have kept dropping.

Imported South Sea plywood

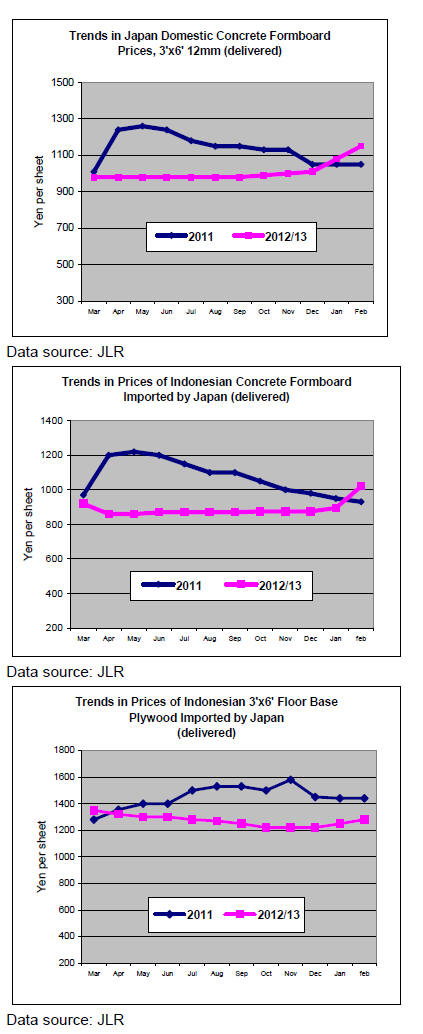

Prices of Japanese market and the suppliers’ proposals are firming. In

particular, prices of concrete forming panel are sharply climbing in Japan.

Prices of 3x6 concrete forming and concrete forming panel for coating

increased by 120 yen per sheet due to ongoing depreciation of the yen.

The prices in Japan went up since late January because of considerable

depreciation of the yen and future contract prices with the suppliers are

much higher than current

market prices. This causes speculative purchase supported by brisk demand

and delayed shipment caused supply shortage.

Exchange rate of the yen dropped by 16% since mid November from 79 yen to 94

yen. 3x6 JAS concrete forming panel prices in mid November were 860-870 yen

per sheet delivered but now they are 1,020 yen, 18% up. Prices of 3x6

concrete forming for coating are 1,150-1,160 yen, 100-130 yen higher than

January. 12 mm structural panel prices are 1,020-1,050 yen, 70-100 yen

higher than January.

Both floor base and standard panel are firm. Bullish floor manufacturers

placed large orders but dollar based prices makes yen prices much higher due

to rapid depreciation of the yen and floor manufacturers are not able to

absorb cost increase.

Suppliers’ prices on 12 mm x 945mm x 1,840 mm are in last December were $670

per cbm C&F, $20 up.

The prices in Japan now are 1,280 yen per sheet delivered, 20 yen up from

January. Thin panel prices of 2.4 mm are 370-380 yen per sheet (type 2/F 4

star). 3.7 mm are

about 480 yen (type one/F☆☆☆☆). 5.2 mm are about 590 yen (same as 3.7

mm).Both are 10-20 yen up from January.

South Sea logs

Log market in Japan has been firming since last month due to cost up by weak

yen and the suppliers’ offer prices are also firming.

Current market prices in Japan are about 8,200 yen per koku CIF on Sarawak

meranti regular, 400 yen higher than January. January arrived Sabah kapur

regular log prices are about 12,200 yen. Log prices have to go higher yet

which squeezes plywood mills’ profitability severely.

Mills are asking 10% higher prices on plywood but further hike is necessary.

Log producing regions are in rainy season. Sabah weather is particularly

poor. Log production is down everywhere. Log prices are firm and inching up

while demand in China is not so active and India buys necessary volume only

as they are making,

inventory adjustment in India so there is no panic buying in limited supply.

Log inventories are way down in Malaysia and some plywood mill in Sarawak

shut down because of shortage of logs.

Japanese buyers want to reduce FOB log prices to offset weak yen but on the

contrary, log suppliers’ offers are about $5 up. India does not chase higher

log prices.

Sarawak meranti regular prices are $255-260 per cbm FOB. Meranti small

prices are $215-220 and super small are $195-200. Ocean freight is up by $1

per cbm since January, which pushes CIF cost up higher.

|