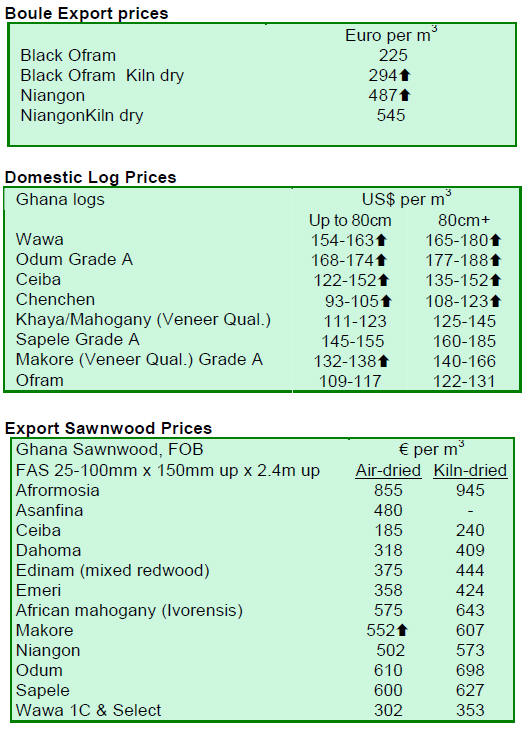

2. GHANA

Takoradi Port development to benefit

exporters

The port at Takoradi was the first to be built in Ghana and is now the

second largest in the country. The port has handled Ghana*s traditional

exports such as timber and wood products for decades.

The volume of traffic through Takoradi Port has grown in recent years as

much of the oil drilling and exploration equipment comes into the port and

there has been an expansion of outgoing shipments such that the port has

become increasingly congested.

To address the problem of congestion at the port the Ghana Ports and

Harbours Authority (GPHA) has entered into an agreement with the China

Harbour Engineering Company (CHEC) for work on a first phase of an

US$150mil. Takoradi Port Infrastructure Development Project.

Currently, Takoradi Port has seven berths 每 four multipurpose and one each

specifically for manganese, bauxite and oil. Draughts range from 9 to 10

metres. The port has a covered storage area of 140,000 square metres,

250,000 square metres of open storage space and container-holding capacity

of 5,000 TEUs (twenty-foot equivalent unit).

Takoradi Port handled 53,041 TEUs in 2010, up 9% from 47,828 TEUs in 2009.

In-coming container traffic amounted to 24,127 TEUs and outgoing traffic

amounted to 28,914 TEUs.

Vessel movements jumped 33.6% to 1,277 in 2010 from 956 the previous year.

Vessel turnaround time in 2010 averaged 2.1 days, down from 3.3 days in

2006.

Total cargo traffic rose 19% to 4.01m tons in 2010, up from 3.37m tons in

2009. Imports totalled 1.72m tons and exports 2.29m tons in 2010 up from

1.26m tons and 2.11m tons respectively in 2009.

The first phase of the port infrastructure development project has already

started with the demolition of old structures; dredging of existing berths;

construction and extension of breakwaters; building of new berths for bulk

cargo such as bauxite, manganese, clinker, etc; building of oil terminals

and improvement of access to the port.

When the work is completed the port will be able to handle more traffic and

larger vessels. In addition, vessel turnaround time should be reduced

leading to lower shipping costs a bonus when shipping traditional commodity

products from the port.

President outlines plan to expand manufacturing

In the national address to parliament, the President, John Mahama, provided

assurances that the government will marshal the collective energy of all

stakeholders to facilitate the emergence and growth of a strong

manufacturing sector.

The President mentioned some key areas that need to be addressed to achieve

this goal namely; a review of current tax structure for manufactures to

improve competitiveness, establishment of an industrial development fund to

support ailing and struggling manufacturing industries and to provide fully

serviced industrial plots, especially in the regional capitals.

Fuel prices to go up

The government has announced that prices must be raised by 15 每 20% on all

petroleum products because of the soaring price of crude oil on world

markets and the cedi/US dollar exchange rate developments in recent months.

Many analysts believe the increase in fuel prices will have a negative

knock-on effect on prices of all goods and services. Fuel costs are

significant elements in wood production costs and the increase in fuel costs

could negatively impact the sector.

﹛

3. MALAYSIA

Inflation is in check and 2013 prospects

appear good

The Malaysian economy grew by 5.6% in 2012 compared to 5.1% in 2011

according to a recent report from the Central Bank. Growth in the last

quarter of 2012 was 6.4% and there was an increase of 1.3% in the consumer

price index.

Private sector investments grew by 20.2% while public investment went up by

11.1% in the last quarter. The Central Bank report said that investments

were robust and were the main drivers of growth in the last quarter.

Growth in the construction sector continued to be strong, pushed up by civil

engineering and building in the residential sector. A sustained growth in

the domestic economy is expected to support positive growth in 2013, despite

expected weak economic growth in the advanced economies.

Domestic demand has been stimulated by some expansionary government policies

which are slowly being wound down. Malaysia was one of the few S. E. Asian

economies to achieve a substantial expansion of exports during the final

quarter of 2012.

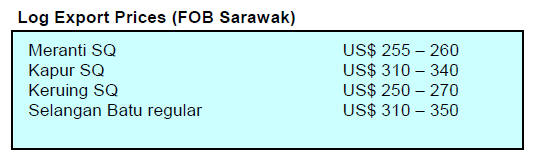

Despite low log stocks prices remain flat

The timber industry in Malaysia is slowly getting back to business after the

long Chinese New Year holiday but trading remains quiet at the moment. Log

stocks are reported low at present, the combined result of the rainy season

and the long industry shut-down for the New Year festival.

Some plywood factories are complaining that the flow of logs is inadequate

for production and this is resulting in some upward pressure on log prices.

Analysts report that these pressures will grow if market demand picks up

however, at the moment trade is too thin for there to be any major shift in

prices.

The Chinese market is still quiet as the industries there slowly get back

into production after the holiday period while Indian buyers are only in the

market to meet immediate demand.

Markets in Asian &growth engines* waiting for some good news from EU and

US

Analysts anticipated an improvement in timber prices as log stocks fell due

to the disruption to logging activities but there has been little change.

Lingui Development Bhd, a major timber company in Malaysia was quoted by the

Malaysian Star newspaper saying ※demand for plywood and veneer from Japan in

the fourth quarter of last year was generally lackluster, partly due to the

weakened yen§.

Timber exporters such as Lingui have been severely impacted by the

considerable slowdown in demand from Asia*s &growth engines*, China and

India. All eyes are on Europe and USA to deliver a prosperous year of the

snake.

﹛

﹛

4. INDONESIA

Indonesia*s timber legality assurance

system promoted to UK trade

The Ministry of Forestry and the Indonesian Embassy in the UK recently held

an event to promote Indonesia*s timber legality assurance system (SVLK). The

event, billed as an &Interactive Market Dialogue on Indonesia*s timber

legality assurance system (SVLK), was held in London and attracted over 60

timber importers. These importers praised Indonesia for taking the

initiative to provide information on the readiness of Indonesian exporters

for the EUTR.

This multi-sector dialogue was the first conducted in UK after it became

mandatory for timber companies in Indonesia to comply with the Indonesian

legislation on timber legality verification.

The meeting in London focused on presenting Indonesia*s SVLK in the

framework of the Indonesian and UK trade and involved private enterprises

and NGO*s.

Imports have confidence in Indonesian V-legal license

A mission from Indonesia led by Agus Sarsito visited the EU to provide first

hand information to the EU trade on progress in the implementation of the

VPA between Indonesia and EU.

Importers in the UK and Belgium confirmed that Indonesia*s timber shipped

with the V-Legal license is recognised as meeting the EUTR.

The head of the mission said he was sure that EU importers will have

complete confidence in the Indonesian timber legality assurance system.

Indonesia is now shipping wood products with a V-legal license and up until

February 19 some 8,000 licenses have been issued.

Group certification allows legality audit costs to be shared

A number of exporters in Bali have secured SVLK Certification confirming the

legality of their wood products and so assuring their customers that the

wood used has been legally sourced.

Six companies in Bali took the initiative to establish a cooperative,

Koperasi Bersama Indonesia (KBI) to facilitate cost sharing for the process

of securing the V-Legal certificate.

The companies that are now certified are PT. Putri Ayu, PT. Mitra Bali Fair

Trade, PT. Kriya Jaya International, CV. Maharani, UD. Margono and UD Bali

Shine Wood.

The Indonesian legislation provides for small enterprises to form a group

such as KBI to share the cost of certification. A Lead Auditor at one of

Indonesia*s independent certification companies said the cost of securing

SVLK certification could be from US$2500 to US$5000 depending on the

complexity of the operation.

The V-Legal certificate is now mandatory for exporters and there have been

cases in Surabya where shipments have been stopped because the appropriate

V-Legal license was not obtained by the exporter.

﹛

﹛

5. MYANMAR

Teak dealers scramble to stock up on teak

logs

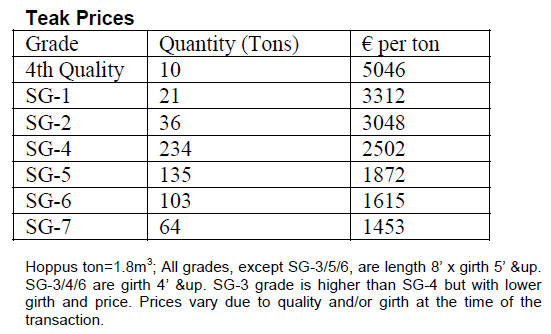

The Myanma Timber Enterprise open tender sales were held on 22 and 25

February and the following average prices were recorded.

Prices are quoted in euro per ton, hoppus measure.

﹛

Traders are reporting that the current market for

teak logs is very firm. The prospect of a complete log export ban is driving

dealers to increase their stocks of teak logs.

Average prices at the most recent auction were firm despite some

inconsistent grading which was of concern to buyers. Some buyers said that

reasonably good log parcels were made available for the sealed bid part of

the February sale.

In contrast to the better than expected price levels for logs for export,

average prices for logs for use by local millers were much lower however,

the grades that were purchased by the domestic mills were also lower than

those purchased by exporters.

Fresh Gurjan logs, especially those suitable for veneer, were in strong

demand. Analysts say that buyers have started to take the prospect of the

log export ban seriously judging from the trend in demand and price levels.

Buyers of Gurjan prefer fresh logs as they are mainly used for veneer.

Timber legality workshop

The Minister for Environmental Affairs and Forestry (MOECAF) recently opened

a workshop on &Timber Legality Assurance Systems* (TLAS) and his address was

reported in the state owned vernacular daily newspaper the &Mirror Daily*.

The minister highlighted the need for Myanmar to implement a TLAS to ensure

Myanmar exporters can secure access to the EU market. He stated that Myanmar

has had many years of experience in harvesting timber and downstream

processing in accordance with national forest laws and regulations.

In December 2012, the Myanmar Certification Scheme was introduced and he

mentioned that formation of a timber certification committee has been

proposed. He mentioned the need to establish independent auditing agencies

to certify that harvesting, logging and transportation is in accordance with

the laws and is conducted in an open and transparent manner.

Recently an EU delegation visited the MOECAF and discussed the EU Timber

Regulation. The minister also welcomed the plan by the EU and the Myanmar

Timber Merchants Association to jointly organise a &Timber Certification

Training Workshop*.

Discussions continue with international bodies with a view to securing

assistance in the field of forest conservation, legalisation and the

development of the Myanmar wood industry.

﹛

6.

INDIA

Call for budget to stimulate housing

sector

Developments in India*s housing sector reflect the state of the economy.

Sales of new homes have fallen and developers are seeing margins shrink as

the availability of mortgages has fallen and interest rates have climbed.

According to some estimates around 20 mil. homes are required in urban areas

to meet demand but activity in the sector has slowed.

As the Indian parliament begins to discuss the next fiscal budget the real

estate sector is looking for a tax break similar to the 10 year tax holiday

given to infrastructure companies. Representatives of the real estate sector

say that providing the tax holiday will encourage them to market affordable

homes on which margins are small. Increasing the stock of low cost homes is

a priority for the government as it tries to reverse the expansion of slums

in urban areas.

In addition to the tax relief sought, the real estate companies are calling

on the government to allow greater tax deductions by home buyers on housing

loan interest payments. Analysts point out that if interest rates decline

this will have an immediate impact on demand.

India ranked high in Nielsen Global Consumer Confidence Index

Consumer confidence in India improved in the final quarter of 2012 according

to the Nielsen Global Survey of Consumer Confidence and Spending Intentions.

See press release:

http://www.nielsen.com/in/en/news-insights/press-room.html.

The press release says ※54% of respondents in India indicated they would put

spare cash into savings, eight percentage points lower than last quarter

(62% in Q3). Thirty-nine percent said they would invest in new technology

and products, while 36% reported they would spend spare cash on new

clothes§.

In terms of job prospects the Nielsen press release says ※In the final

quarter of 2012, 76 percent of online respondents in India were optimistic

about their job prospects over the next 12 months, a point below the 77

percent in Q3 2012, and two points below the same period last year (78% Q4

2011)§.

Achieving a balance between mining and forestry

The planting of commercial tree species on wasteland, unused areas in

non-forest lands, in agro-forestry and social forestry areas as well as

along canals, roads and railway tracks offers an opportunity to meet the

growing demand for timber, wood products and for raw materials for the paper

and rayon industries.

Eucalyptus, casuarina, varieties of bamboos as well as shade trees such as

neem, ashoka, bombax and others could contribute to improving the

environment and bio-diversity.

Most of the states of India have been successfully establishing tree crops

on non-forest lands, an effort that is commendable given the low forest and

tree cover in the country. Currently the national tree cover is around 23%

but the target is to increase this to 33%.

The success of these activities needs to be documented and promoted so that

additional degraded and otherwise fallow and unused land could be identified

and made available for tree crops.

The struggle to maintain the national forest cover is complicated by demands

for expansion of mining concessions for iron ore and coal, many of which are

in forest areas.

To try and achieve a balanced development Forest Survey of India has been

given the task of identifying and mapping national pristine forests so

informed decisions can be made on mining concession allocation.

Change in Forest Act brings huge benefits to forest communities

With the introduction of a Forest Rights Act and through efforts of the

Tribal Affaires Ministry, the Environment Minister, Ms.Jayanthi Natarajan,

succeeded in correcting the definition of bamboo from that of a tree, as

defined in the Indian Forest Act of 1927, to its technical classification as

a grass. This small but obviously necessary change will have a significant

impact on the livelihood of rural communities.

Because of the change in definition the management, harvesting and sale of

bamboo will no longer be the responsibility of the Forest Department but

will fall under the Tribal Affairs Ministry. Bamboo is a major raw material

for the paper and pulp industry and is thought to be worth around Rs.100

billion annually.

Because of this change in definition the benefits from bamboo production and

sales, rather than going to government revenue will now be enjoyed by the

rural communities where the bamboo is grown.

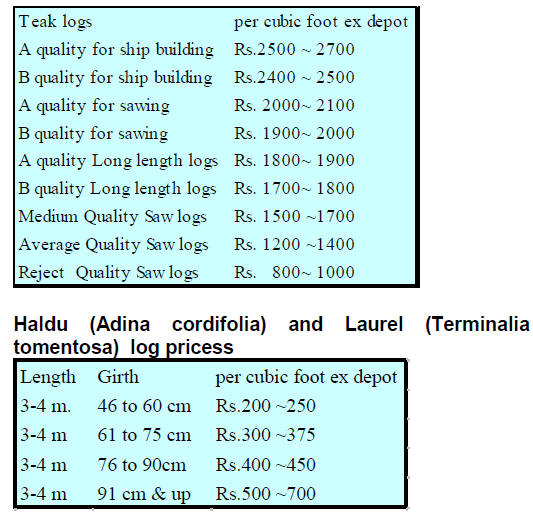

Sales of Teak and other hardwoods from Indian forests

During the log auctions held on 30th January 2013 approximately 14,000 cubic

metres of teak logs were sold in the depots of Dang forests of Western

India. Analysts report that, while overall the quality was satisfactory, the

prices offered were lower than in the past auctions reflecting the current

domestic economic uncertainties.

Average prices realised at the most recent auction are shown below. Prices

are per cubic foot ex depot.

﹛

Auction of such large quantities of logs is a

relief to sawmillers who have been experiencing raw material availability

problems.

Increased volumes of logs are being delivered to the depots. Depots in

Central India expect to auction around 30,000 cubic metres of fresh logs and

the dates for the next auction are soon to be announced.

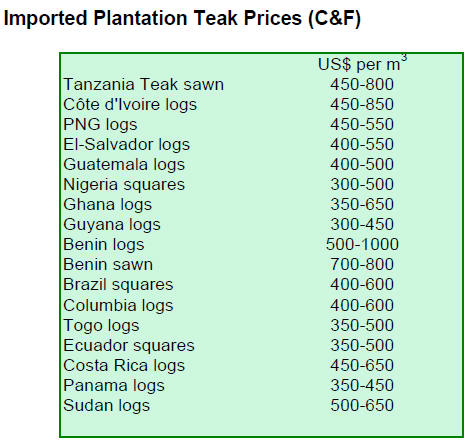

Imported Teak logs

The availability and shipment of teak logs from overseas suppliers remains

steady and prices have not changed significantly.

Current C & F prices per cubic metre, delivered Indian ports are shown

below:

Variations are based on quality, log length and the

average girth.

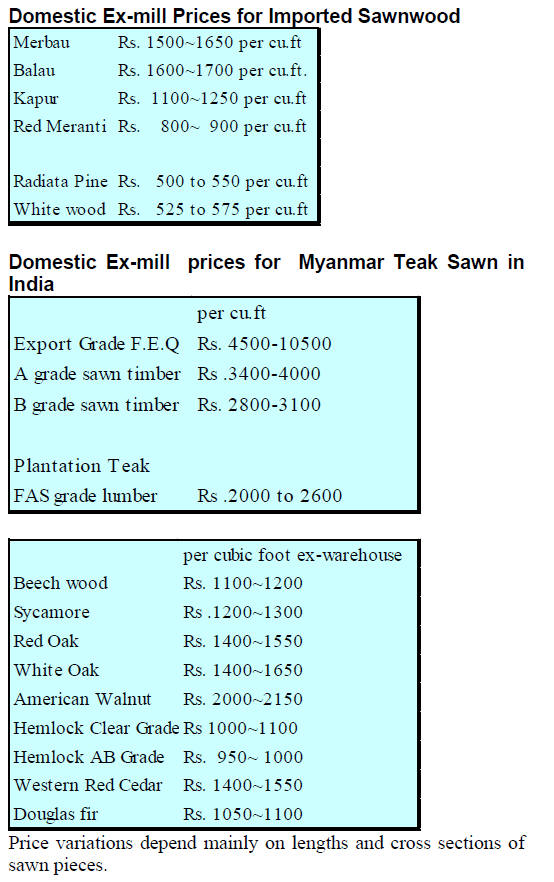

Domestic prices for air dried sawn timber remain

unchanged as indicated below. Prices are shown as per cubic foot,

ex-sawmill. Prices for imported KD (12%mc) sawn wood remain steady.

Good financial returns from plantations

More and more plantations of Poplar and Eucalyptus are being established to

meet the growing needs for raw material. The financial returns to plantation

owners are good as prices have been increasing.

Indian plywood manufacturers continue to source core and face veneers from

Vietnam, Thailand, Malaysia, and Myanmar. Factories in Myanmar are said to

be supplying good quality veneers and adequate quantities.

As the trend for Indian companies to build mills overseas continues more raw

materials will become available enabling domestic mills to better utilize

their installed capacity and meet the growing domestic demand.

﹛

7.

BRAZIL

Growth estimates portray renewed

optimism

The Brazilian Central Bank is forecasting that economic growth in 2013 will

reach 4 percent. In December 2012 the economy expanded by 0.26% compared to

levels in November and this reflected the overall slowdown in the economy

towards the end of the year.

In 2012, the Brazilian government acted to lower interest rates, cut taxes

for industry and ease credit but these measures did not spark a recovery in

the economy.

In recent weeks the government has been targeting the availability of

consumer credit as it views a recovery in credit as a key element in its

efforts to reverse the economic slowdown.

While several financial institutions foresee an expansion of consumer credit

in the coming months, interest rates on consumer loans are very high and

this dampens demand for credit.

Inflation worries emerge once again

According to the Brazilian Institute of Geography and Statistics (IBGE), the

inflation rate surged in January recording the highest monthly variation

since April 2005.

The January 2013 inflation rate at 2.25% was also the highest for the month

of January since 2003. Over the past 12 months the inflation rate rose to

6.15%, well above the maximum of 5.8% registered for the previous 12 months.

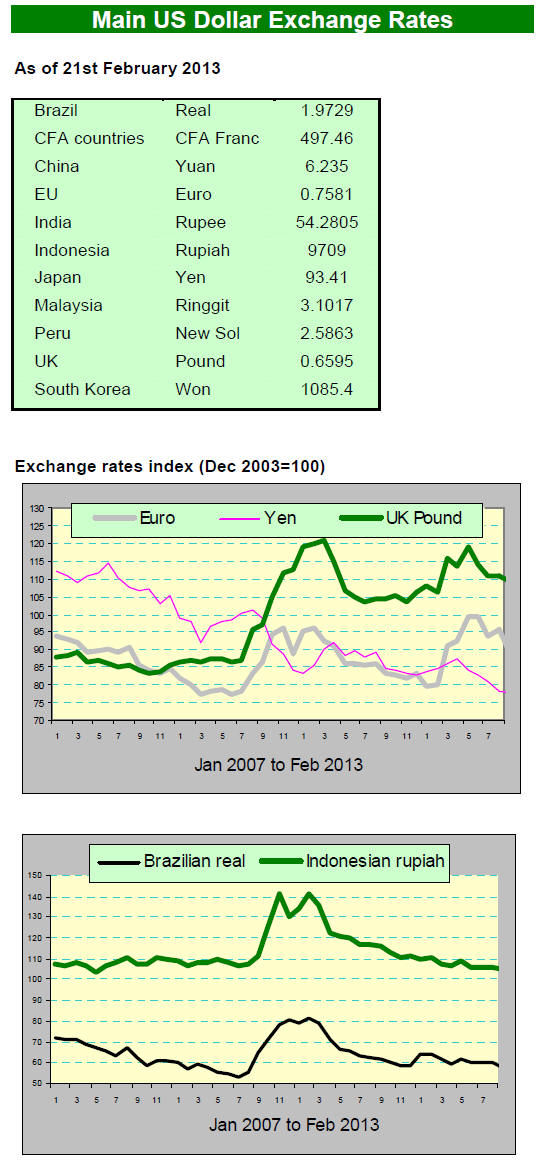

Currency weakens slightly against the dollar

In January 2013, the average exchange rate was BRL 2.03/USD compared to

BRL1.79/USD during the same month in 2012. The 2013 rate reflects a slight

depreciation of the Brazilian currency against the US dollar.

Interest rates a key to recovery

A decision to hold the prime interest rate (Selic) at 7.25% was made by the

Monetary Policy Committee (Copom) of the Central Bank (BC) at its last

meeting.

Most financial analysts consider that the Selic rate should be maintained at

its current level, at least during the first quarter of this year and that

consideration should be given to lowering the rate to 7% in the second

quarter if the economy does not show signs of recovery.

Removing bureaucratic hurdles will stimulate the timber sector

According to the Center of Industries of Wood Producers and Exporters (Cipem)

the timber sector in the state of Mato Grosso is expected to grow tenfold

over the next ten years due mainly to increased output from reforested areas

and through improved forest management.

According to the Mato Grosso Reforestation Association (AreFloresta), the

area of teak plantations in the state increased 20% between 2007 and 2010

and the area of eucalypt plantations more than doubled in the same period.

The supply of raw materials from plantations will more than compensate for

the reduced harvest in the natural forest says the Association. At present

the timber sector represents the fourth largest sub-sector in the state*s

economy after agriculture, livestock and manufacturing.

In 2012, the income generated through trade in forest products increased 9%

compared to 2011, from R$ 256.1 million to R$ 278.9 million.

It is expected that in 2013 growth will be higher than last year supported

by the State Environment Secretariat (SEMA) project &Restructuring of Land

Regularization and Environmental Licensing Procedures in the State of Mato

Grosso*. This project aims to remove bureaucratic hurdles in the timber

sector so as to stimulate expansion in the sector.

Acre State gets German funds to combat deforestation

The rate of deforestation in Acre State in the Amazon region has fallen by

half over the past 25 years and the efforts of the state are a model for

combating deforestation. Over the years the state has implemented an

economic development model that includes forest protection and combating

poverty.

For its efforts in the protection of the environment the German Government

awarded Acre State euro 16 million to finance further environmental

projects.

The contribution was forthcoming because the state administration is

exploring the development of a REDD project, the international mechanism to

financially compensate for the maintenance of tropical forests and

mitigating greenhouse gases emissions.

The German donor has a specific programme called &REDD Early Movers* to

contribute to efforts to halt deforestation.

This is the first time project funding has been provided to a state

administration in Brazil and it is anticipated that this effort will attract

a lot of national and international attention since Acre is a focus of

attention when it comes to deforestation in Brazil.

Sources familiar with the project say that the State Government will use

much of the project funds to support an existing scheme called the System of

Incentives for Environmental Services (Sisa), created by the government of

Acre to eradicate deforestation.

Pine exporters performed well in January

In January 2013, timber products exports (except pulp and paper) increased

3.2% compared to values in January 2012, from US$ 163.9 million to US$ 169.1

million.

Pine sawnwood exports increased 6.2% in value in January 2013 compared to

January 2012, from US$ 9.7 million to US$ 10.3 million. In terms of volume,

exports increased 12.5%, from 42,300 cu.m to 47,600 cu.m over the period.

Exports of tropical sawnwood fell 16% in volume, from 29,800 cu.m in January

2012 to 25,000 cu.m in January 2013 and in value the decline was 3.4% from

US$ 14.7 million to US$ 14.2 million, over the same period.

Pine plywood exports increased 23% in January 2013 compared to January 2012,

from US$ 25.2 million to US$ 31.0 million. Plywood exports also increased by

21.5% during the same period, from 69,300 cu.m to 84,200 cu.m.

On the other hand, exports of tropical plywood dropped from 5,800 cu.m in

January 2012 to 5,400 cu.m in January 2013, a 7% decline. There was no

change in the value of tropical plywood exports for the same period.

Data shows that the value of furniture exports dropped from US$ 29.5 million

in January 2012 to US$ 28.5 million in January 2013, representing a 3.4%

decline.

Brazilian Furniture Project delivers positive results

In 2012, furniture exports to Mexico under the ※Brazilian Furniture Project§

were outstanding according to analysts.

Brazilian furniture exports to Mexico fell by 14% between 2011 and 2012

while during the same period companies participating in the ※Brazilian

Furniture Project§ increased their sales by 43% to the Mexican market. This

result proves the effectiveness of the export model which aims to provide

greater visibility to the Brazilian furniture industry in key international

markets.

Companies participating in the project also saw demand in other countries

improve. Sales to the United States grew by 8% in 2012 reaching US$78

million, compared to US$72.1 million in 2011.

Another significant increase was recorded in sales of Brazilian furniture to

Peru which jumped from US$ 21.5 million in 2011 to US$ 27.4 million in 2012,

an increase of approximately 27%. Sales to Angola also rose 13%, reaching

US$ 52.9 million in 2012 compared to US$ 46.8 million in 2011.

Countries such as Chile, Colombia, the United Arab Emirates, Russia and

South Africa are also included in the list of target markets under the

project.

Brazilian furniture industry seeking capitalise on success in Mexico

The Brazilian furniture industry participated in the latest fair "Expomueble

Invierno" held in February in Guadalajara, Mexico.

"Expomueble Invierno" is a long running furniture trade fair which has been

held for the past 32 years. The fair brings together more than 500 local and

foreign exhibitors in an area of over 52,000 square metres and this year

recorded more than 10,000 buyers and visitors.

Mexico is one of the most important overseas markets for Brazilian furniture

and the industry was determined to participate in the fair to enhance the

image of Brazilian furniture and consolidate the Brazilian presence in the

Mexican market.

Price trends

The domestic market remains rather quiet and average prices in lira have not

changed over the past weeks.

﹛

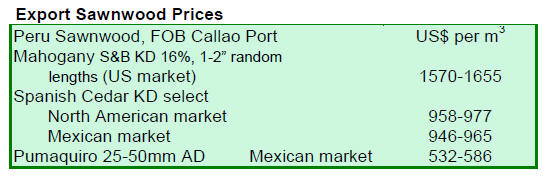

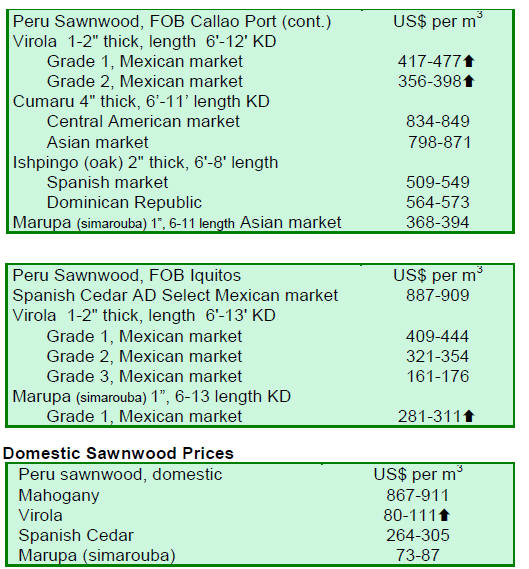

8. PERU

Wood exports fell 3% in 2012, says

Adex

Erik Fischer, chairman of the Wood and Wood Industry Committee of the

exporters association, Adex, has reported that timber exports in 2012

reached US$ 164 million and that this represented a 3% decline on levels one

year earlier.

He also reported on a meeting with the Deputy Minister of Foreign Trade and

Forestry Union representatives where a commitment was made for all parties

to work together to stimulate the forestry and forest industry sectors.

In this regard he stressed the importance of a sound legal framework to

encourage investment and the importance of ensuring regulations for the

sector do not become a deterrent to investment.

While export demand was subdued in 2012 the domestic economy was robust.

Andina, the state news agency, has reported that GDP in 2012 grew by 6.3%

with an especially strong performance (plus 5.9%) in the final quarter of

the year.

The expansion of the economy, says Andina, was driven by growth in

non-primary sectors, especially by increased activity in the construction

(12.6 percent), commerce (6.4 percent), and services (7.1 percent) sectors.

Add more value to timber production, recommended expert

Jessica Moscoso, Executive Director of the Center for Technology Innovation

- Wood (CITEmadera) explained that the main challenges for the Peruvian

timber industry are to add greater value to their production and to take

advantage of the diversity of timber species in Peru.

According to Moscoso, the lack of technology and research support and poor

communication between forest authorities and industry is another challenge

that must be addressed.

Streamlining bureaucracy to ease burden on business

Businesses in Peru have long complained about the burden of satisfying

bureaucratic procedures which they say are endless and a serious handicap to

industrial development in the country.

Recognizing that the bureaucracy is overwhelming business the government has

plans to streamline government agencies and simplify the paperwork required

for everything from applying for licenses to paying taxes.

The State News Agency, Andina, says the government plan by 2016 to reduce by

50% the time it takes for businesses to satisfy regulations. The government

wants to simplify the procedures as part of its government modernization

plan.

Fast economic growth in Peru attracts EU business delegation

The EU Vice President Antonio Tajani recently traveled to Peru with a large

business delegation representing 37 European companies and industry

associations from 10 EU member states.

In a press release the EU said the members of the business delegation had a

combined turnover of some euro 320 billion, while the business associations

in the delegation represented more than 64,000 companies.

This mission was part of the series of "Missions for Growth" designed to

help European enterprises, in particular small and medium sized enterprises,

to profit from fast growing emerging international markets. The visit to

Peru was aimed at reinforcing partnerships to help industry and SMEs to

fully exploit the potential for commercial relations between Peru and the EU.

During the visit agreements were concluded in the areas of raw material

extraction and supply, industrial cooperation, small and medium sized

enterprises development and construction. A further joint declaration was

aimed at boosting tourism.

﹛

﹛

9.

GUYANA

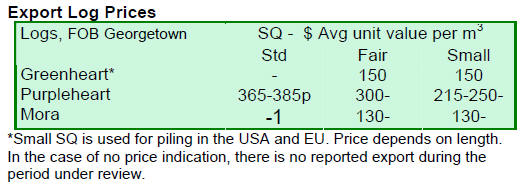

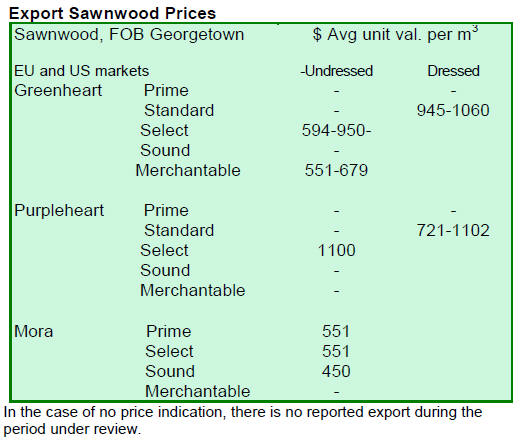

Greenheart logs shipped after a lull

During the period reviewed Greenheart fair and small sawmill quality logs

were exported at fairly good average prices.

Purpleheart log export prices remain very favourable especially for the top

qualities (standard and fair sawmill grades). On the other hand prices for

small sawmill category Purpleheart logs dipped.

Mora log export prices remained stuck at the lower end of the export price

range which was a disappointment.

Encouraging market interest in sawnwood

The demand from export markets for sawnwood was encouraging for both dressed

and undressed timber.

Greenheart (Select, Undressed) prices fell from US$ 1,145 to US$ 950 per

cubic metre. The good market demand for Greenheart (Merchantable, Undressed

quality) drove top end prices to US$ 679 per cubic metre.

Purpleheart sawnwood (Select, Undressed) traded at US$ 1,060 to US$ 1,100

per cubic metre, an increase in its top end price from levels recorded two

weeks earlier.

Mora sawnwood (Undressed) prices moved up during the period under review.

Dressed Greenheart sawnwood prices recorded a decline in the higher range

price levels of the recent past. Prices fell from US$ 1,272 to US$ 1,060 per

cubic metre. However, Dressed Purpleheart sawnwood export prices managed to

move up compared to levels seen over the past month.

Processed wood products selling well in Caribbean markets

Demand for BB/CC quality Plywood market was noteworthy and export prices as

high as US$ 589 per cubic metre were recorded during the period reviewed.

Guyana*s Splitwood (shingles) continued to attract buyers and markets now

extend to regions in the Pacific and Indian Oceans.

Guyana made Purpleheart doors attracted buyers in the Caribbean. For the

first time in a long while some indoor furniture and door components found

their way into the Suriname market.

First step in VPA 每 legality verification processes

The EU FLEGT Facility News of December 2012 / January 2013 headlined that

the Guyana 每 EU VPA negotiations have begun with a focus on verification

systems.

The first VPA negotiation session between Guyana and the EU was held in

Georgetown on 5 December. The parties aim to have the VPA ratified by

September 2015.

The parties agreed that the VPA should build upon Guyana*s existing timber

legality verification systems. These verification systems, which have been

functioning for years, are likely to provide a sound basis for developing a

legality assurance system, to be defined as part of the VPA.

It was agreed that the final legality assurance system should be locally

appropriate and should serve the needs of the people without putting undue

burden on them.

The Guyana Forestry Commission has set up a national technical working group

composed of representatives from the public sector, the private sector and

indigenous groups to follow the negotiations and participate in

consultations.

This working group represents the first step towards broad consultation with

stakeholders, an essential aspect of the VPA process. The parties agree that

effective and genuine stakeholder involvement is the key for ensuring a

solid basis for the country*s definitions of legal timber and the

legality assurance system.

By entering into the VPA process, Guyana aims to demonstrate to

international timber and wood-product markets that it can ensure robust

timber legality and to strengthen its credibility in timber exporting. The

next negotiation session will be held in June or July 2013.

Community Forestry a major development thrust for the Forest Sector

The Guyana Forestry Commission (GFC) has identified, as a priority action,

the continuation of support to Community Forestry Associations to ensure the

maximisation of benefits to forest based communities.

The support proposed will comprise training in sustainable forest management

practices and participatory forest management as well as support for

drafting operational guidelines for community forest activities.

2012 a very positive year for Community forestry in Guyana

The GFC recorded a total of 65 Community Forestry Organizations (CFOs) with

State Forest Permissions (SFPs) 每 these are forest concession leases of

under 20,000 acres in State Forests.

To-date, community organisations in Guyana have been allocated 120

concessions or 25% of the total small concessions allocated. It is estimated

that at least 6,000 persons gain employment through these community

organisation operations in the forest which, in 2012, produced over 25% of

the total production from all small forest concessions .

Many community organisations are also now exporting forest products to

international markets and have expressed plans to expand business.

Empowerment of communities to manage forests in a sustainable manner is a

crucial aspect of the GFC Community Forestry programme. Community forestry

will continue to be a focal area for the GFC in 2013.