|

Report

from

Europe

Slight signs of rising optimism

Prospects for the European economy seem more positive now than this time

last year. The worst fears of a destructive domino effect that might

have resulted from Greece or another country being forced out of the

euro-zone have failed to materialise. The effects of the financial

crises were largely contained within the most afflicted economies of

southern Europe.

The countries of central and north-western Europe, while experiencing

higher than normal levels of economic volatility, have so far managed to

weather the storm. Their relative stability has prevented the effects of

the financial crises from spreading throughout Europe.

In recent months, several economic indicators in the EU, such as the

Economic Sentiment Indicator and the Construction Confidence Index, have

improved. There is cautious optimism that economic reforms in the most

troubled EU countries are beginning to work.

But while confidence has risen, it is starting only from a very

depressed level and remains well below pre-recessionary levels. Many

serious underlying constraints to market growth remain. Financing and

credit are still tight. Companies remain highly risk aversive.

Activity in the construction sector remains very slow and may even

decline further this year. Latest data for the Eurostat building permits

index - a key forward indicator of likely future levels of construction

- has yet to show any sign that the market has turned a corner.

Fourth quarter 2012 GDP data for the large euro-zone economies - France,

Germany, Italy, and Spain - has yet to be published, but economists are

already pencilling in likely declines across the board. After a bouyant

3rd quarter of 2012, the UK economy shrank again (by 0.1%) in the last

quarter of the year.

Mario Draghi, president of the European Central Bank, was gloomy in his

comments to the media on 7 February, suggesting that economic risk

remains skewed to the downside and that there is likely to be further

weakness in 2013.

Short-term increase in tropical hardwood imports

Nevertheless, several factors have encouraged a slight increase in

European imports of tropical hardwood products during the opening weeks

of 2013. The euro exchange rate has strengthened, hitting $1.3657 in

mid-February, its highest level since November 2011.

This trend has generally reduced the costs of imports. At the same time,

European stocks of tropical wood products were very low at the start of

the year following low import volumes in the second half of 2012.

Another factor is the imminent enforcement of the EU Timber Regulation

on 3 March 2013. After that date, European importers will be liable for

prosecution if the European authorities are able to demonstrate that the

wood is from an illegal source, or that the importer has failed to

implement due diligence procedures in line with the regulatory

requirements.

This last factor has encouraged some European tropical wood importers to

take steps to rebuild stocks earlier rather than later.

Unfortunately all these factors are likely to be short-lived and few in

the European tropical wood importing industry are expecting any

significant upturn in real consumption during 2013.

Decline in EU hardwood veneer market

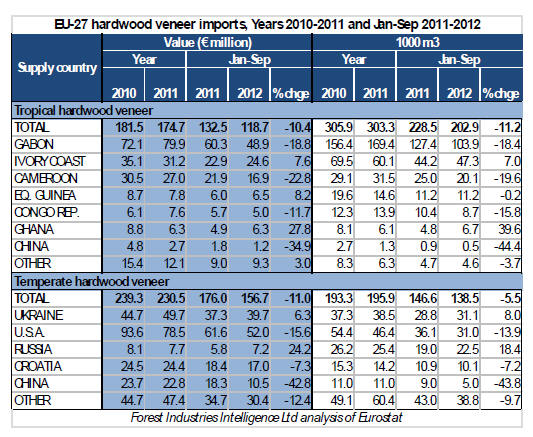

In the first 9 months of 2012, the EU imported 203,000m3 of tropical

hardwood veneer with a value of €119 million, down 11% and 10%

respectively compared to the same period in 2011 (Table).

Imports from Gabon, Cameroon and the Congo Republic were declining in

2012, while imports from Ivory Coast, Equatorial Guinea and Ghana were

stronger than in 2011.

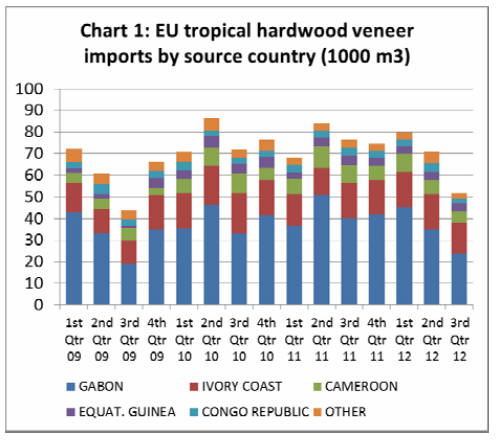

The quarterly data (Chart 1) reveals that there was a particularly

dramatic fall in tropical hardwood veneer imports from Gabon in the 3rd

quarter of 2012.

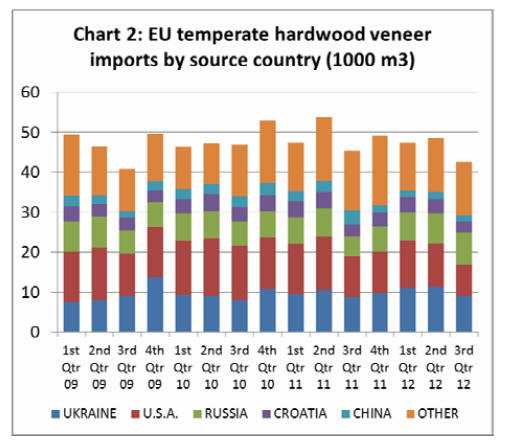

The decline in imports is not confined to tropical hardwood veneer. EU

imports of temperate hardwood veneer were 138,500 m3 with a value of

€157 million in the first nine months of 2012, down 6% and 11%

respectively compared to the same period in 2011.

Imports of this commodity fell sharply from the USA and China in 2012,

but were rising from Ukraine and Russia. As for tropical hardwood

veneer, the quarterly data indicates that imports of temperate hardwood

veneer were particularly weak in the third quarter of 2012 (Chart 2).

Falling veneer imports is a symptom of long term weakness in the

European plywood and veneer industries. European manufacturing of

tropical hardwood plywood has been declining under pressure from weak

construction sector growth in the key markets of France, Netherlands,

Italy and Spain.

Okoume plywood manufactured in the EU is also struggling to compete

against cheaper imported plywood, particularly from China, and

alternative panel products.

As a result the fall in okoume log imports following the Gabon log

export ban in May 2010 has not been offset by any increase in rotary

veneer imports.

The European market for decorative sliced veneers is also suffering.

According to the German trade journal EUWID, European domestic

manufacturers of this product were only operating at around 60% capacity

during 2012.

There was a short-lived upturn in the European market for decorative

sliced veneer in the first quarter of 2012 after a poor year in 2011.

However this recovery failed to gain traction and demand slowed again in

April/May 2012.

A major factor contributing to the slowdown in European decorative

sliced veneer market was a decline in orders by furniture manufacturers,

notably IKEA which plays a critical role in the market. At the end of

2012, EUWID reported that IKEA is planning to slash veneer orders over

the next two years and that the furniture giant may halve its use of

veneer by 2014.

Demand from furniture companies other than IKEA also fell dramatically

during the second half of 2012.

Demand from the European door sector was weakening. The only industrial

sector EUWID reckons was performing reasonably well during 2012 was the

high-end market for veneer in car interiors.

With Europe¡¯s industrial markets for sliced veneer seemingly in

long-term decline, European manufacturers and traders are selling more

veneer products for bespoke joinery and interior remodelling projects.

According to the 2012 GD Holz survey of the German veneer trade, this

sector accounts for 42% of all veneer sold by the 39 veneer mills and

veneer traders located in Germany.

Only around 34% of sales volume is now destined for industrial users

(including doors, furniture, flooring, and board producers). This

compares to a figure of 47% only three years ago.

The GD Holz survey also provides an insight into species preferences in

the German veneer sector. Species usage by surveyed companies in 2012

was as follows: European oak (22%), tropical hardwood (16%), European

maple (10%), European beech (9%), European ash (6%), American white oak

(9%), American walnut (8%), American hard maple (4%), American cherry

(3%), and others (13%).

Niche markets for tropical wood in Spain

In the years up to 2007, Spain was one of Europe's largest markets for

tropical hardwood products. However Spain's hardwood consumption has

nose-dived since then following the very sharp decline in construction

activity and weak domestic and export demand for Spanish furniture.

Nevertheless, hardwood continues to be consumed in Spain, with much

demand now driven by renovation and refurbishment in the building sector

and by exports of the larger joinery and furniture manufacturers.

A recent survey of Spanish hardwood importers by the Spanish Timber

Importers Association (AEIM) with support from the American Hardwood

Export Council (AHEC) highlights where different types of hardwood

continue to be used.

The AEIM/AHEC survey shows that tropical species account for nearly all

the hardwood used by Spanish windows manufacturers. Iroko alone accounts

for two thirds of all hardwood consumed in this sector, with the

remainder mainly comprising a mix of African and Brazilian species.

Naturally durable tropical species, mostly from Brazil, still account

for around 97% of the Spanish wood decking market, although there is a

small but growing demand for heat-treated ash which is being adopted now

for both technical and environmental reasons.

Tropical wood is less widely used in the interior joinery sector,

although it still occupies some important niche markets. Around 45% of

the hardwood used for stair components in Spain comprises tropical wood,

mostly from Brazil and Africa. Much of the rest of this market is served

by American white oak, European oak and beech.

Oak, including both U.S. white oak and European oak, is also the leading

hardwood consumed in Spain's flooring sector. But the survey also shows

that darker tropical species sell better than oak in northern Spain

where traditionally there has been a strong market for solid hardwood

flooring.

In the interior doors sector, formerly a large consumer of hardwood

lumber and veneer in Spain but now much diminished, tropical wood

species account for around one third of hardwood usage.

The dominant hardwood species in this sector is American white oak, but

sapele and a range of Brazilian species continue to be used by the

surviving manufacturers.

Tropical timbers - notably iroko - are also used for shop-fitting in

Spain and account for around a quarter of all hardwood used in this

sector. The main temperate hardwoods used in this sector are European

beech and oak, with smaller volumes of US white oak.

Tropical species contribute only a relatively small proportion of

hardwood used in the Spanish interior furniture sector. About 15% of

hardwood used to manufacture classic furniture in Spain is tropical,

nearly all from Africa.

The modern furniture sector in Spain uses mainly beech and pine, but

about 10% is comprised of tropical wood, mainly a mix of African and

Brazilian species. Manufacturers of high class solid hardwood kitchens

typically use American white oak, European oak and beech, with tropical

wood accounting for around 8% of hardwoods used.

Environmental NGO highlights improvements in tropical forest

governance

Ten years on since the EU Forest Law Enforcement Governance and

Trade (FLEGT) Action Plan was launched, and one month before the

introduction of the EU Timber Regulation (EUTR) which makes it a

criminal offence to put illegally sourced timber on the EU market, new

research by FERN, an EU-based environmental NGO, has shown strong forest

governance improvements have already been achieved.

The FLEGT Action Plan, launched by the EU in 2003, includes the

development of voluntary partnership agreements (VPAs) with timber

producing countries. VPA negotiations have so far been concluded with

six timber producing countries: in chronological order, Ghana, the

Republic of Congo, Cameroon, the Central African Republic, Indonesia and

Liberia.

Six more VPAs are currently being negotiated. A key part of the VPA

process is development of procedures to ensure credible legality

licensing procedures for all timber exported by partner countries into

the EU.

FERN report that "international and national NGOs have been part of

their design, and have helped ensure VPAs include essential principles

of forest governance. FERN¡¯s research shows these have been largely

respected....One of the most startling findings was that all the VPAs

concluded to date have been negotiated in a multi-stakeholder process

involving representatives from local human rights and environmental

organisations, the private sector and government. This is the first time

that legally binding trade agreements have been negotiated and agreed in

such an inclusive, consensus-based process. The process has therefore

been perceived as empowering local civil society actors".

FERN¡¯s analysis has shown that every VPA concluded so far covers all

exports (not just those to the EU), and all timber products. With the

exception of the Central African Republic, all concluded VPAs also

include the domestic

market. FERN comment "this could have a large impact on local

communities in these timber-producing countries. Most VPAs also include

reforms concerning community forests, the domestic market, and to some

extent improved recognition of customary rights".

In their report, FERN emphasise the importance of successful

implementation of the EUTR in order to build on the work already done

through VPAs.

They suggest that "if this legislation is not effective in reducing

illegal timber imports, producer countries may lose interest in a VPA.....To

ensure the EUTR and the FLEGT VPAs become mutually supportive, the EU

and the Member States have to ensure a robust and effective

implementation of the EUTR across all Member States. If illegal timber

continues to be imported into the EU, the effectiveness of the VPAs will

be undermined.¡±

¡¡

|