Japan Wood Products

Prices

Dollar Exchange Rates of

11th February 2013

Japan Yen

94.32

Reports From Japan

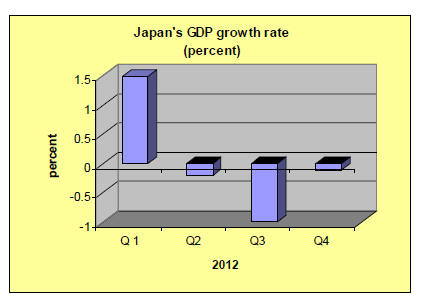

Negative GDP growth fuels new stimulus measures

Japan’s fourth quarter 2012 GDP data was released on February 14th 2013

showing the economy shrank by 0.1 percent. This disappointing result is

fuelling the ruling party’s case for more monetary stimulus to end

deflation. The 2012 annualized GDP was worse than expected at minus 0.4

percent.

With three quarters of 2012 recording negative growth the government seems

even more determined to push for a weaker yen to reverse the negative growth

and achieve positive economic output in the first quarter of 2013.

Japanese industrial output has been falling for the past six months, dragged

down by the euro crisis and by the island dispute with China which has

negatively affected trade between the two countries.

The fourth quarter decline in GDP growth was a surprise to most analysts who

had been forecasting an improvement after the two previous quarter declines.

The monetary and fiscal stimulus measures introduced by the new government

are expected to result in a recovery in 2013.

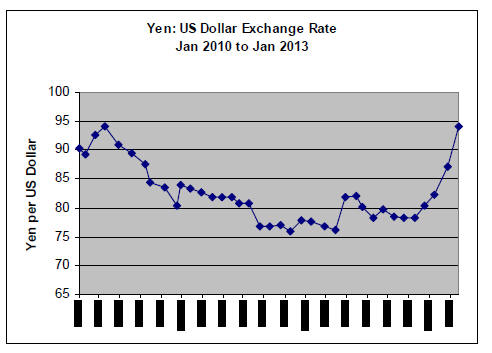

As further monetary easing is expected the yen continues to weaken against

major currencies. This apparent deliberate weakening of the yen has stirred

an international debate on whether the Japanese government was simply

printing money to drive the yen lower to boost export competitiveness.

In mid February the slide of the yen eased but a comment by a possible

candidate for the job of governor of the Bank of Japan that an exchange rate

from 90-100 per US dollar would be reasonable target, drove the yen weaker.

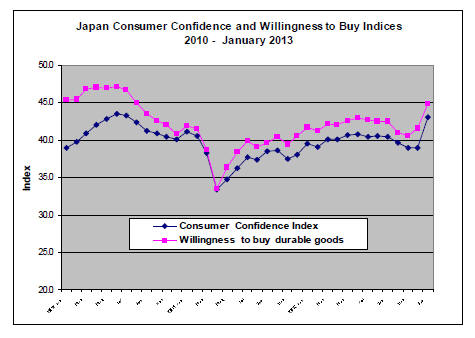

Stock market strength drives up consumer confidence

The Japanese Cabinet Office recently released the results of its consumer

survey. The survey, which is used to compile the consumer confidence index,

showed an improvement in sentiment in January 2013 with the index rising for

the first time in five months.

The consumer confidence index for, what the survey identifies as, ‘general

households’ increased to 43.3 in January 2013 compared to the level of 39.2

in December 2012.

The survey, conducted in mid January, also indicated that the Japanese

public expects inflation to rise in the coming months.

Analysts point out that the improvement in sentiment, while still below the

50 point (neutral level), is the result of the weakening of the yen to drive

up exports, this has resulted in a surge in the Japanese stock market.

Put together, consumers seem to interpret the stock market improvement as

positive for job security.

Increased consumer spending gives rise to optimism

The Japanese government has revised upwards its forecast for private

consumption for the early part of 2013. In November and December 2012

consumer spending remained stable.

Reports suggest that car sales in October levelled out and were seen

improving in November and December 2012 such that domestic car production

started to recover.

However the Cabinet Office report says the risk to the Japanese economy from

negative developments in overseas economies could still affect the

sustainability of growth. To maintain the recovery of the Japanese economy

analysts say the government needs to address deregulation and possible

participation in the Trans-Pacific Partnership (TPP) free trade agreement.

Japanese businesses want the government to join the TTP, allowing exporters

to compete more effectively with overseas rivals however; there is strong

opposition to the TTP from the politically powerful agricultural sector in

Japan which fears a big increase in imports of low cost agricultural

products.

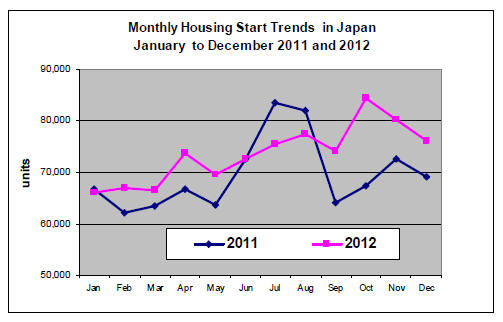

Despite some recovery, 2012 housing starts remain one of the lowest since

1965

December 2012 starts were 75,944 units, 10% more than December

2011.Condominium starts were higher with more than 10,000 units being made

available for three consecutive months. Wood framed housing starts totalled

43,552 in December 2012, 7.4% up on levels in 2011.

While there has been some recovery in housing starts in Japan, the level in

2012 is the sixth lowest level of housing starts since 1965.

Impact of weaker yen

The new government in Japan has introduced economic measures which

triggered a plunge in the yen dollar exchange rate. The yen has dropped by

about 19% from 75 yen to the US dollar to over 90 yen to the US dollar in

four months.

This devaluation of the yen pushes up the costs of all Japan’s imports and

is affecting the timber sector. The demand for new housing in Japan is firm

and this is driving demand for wood products. Currently, imported European

redwood laminated beams are in short supply and market prices are rising

rapidly.

Wholesale prices of whitewood laminated posts were around yen 1,700 -1,750

per piece in early February and analysts expect these to rise to yen 1,850

per piece in March.

Extracted from the Japan Lumber Reports:

1. Domestic logs and lumber

2. Plywood

1. Domestic logs and lumber

Log market in Northern Japan and Tokyo region continues bearish. Log

production has been high but sawmills are not able to increase the

production because logs are frozen solid.

In normal years, this is demand slow season so slower lumber output poses no

problem but after European lumber prices climbed by weakening yen, there are

active demand for lumber of domestic species such as KD cedar post and stud.

Therefore lumber prices are firming but log prices are weakening, which is

abnormal pattern. Post cutting cedar log prices in Tochigi and Fukushima

prefecture, north of Tokyo are down by 500 yen from January.

Log price drop in winter is nothing unusual but a degree of drop is large

this winter. Compared to the same period of last year, Fukushima prices are

1,000 yen lower.

Meanwhile, lumber prices are escalating. In Tokyo market, 105 mm post and

stud prices are over 50,000 yen, 5,000 yen higher than the bottom price last

year so sawmills want to increase the production but cannot saw frozen logs

so they are not able to take advantage of low log prices.

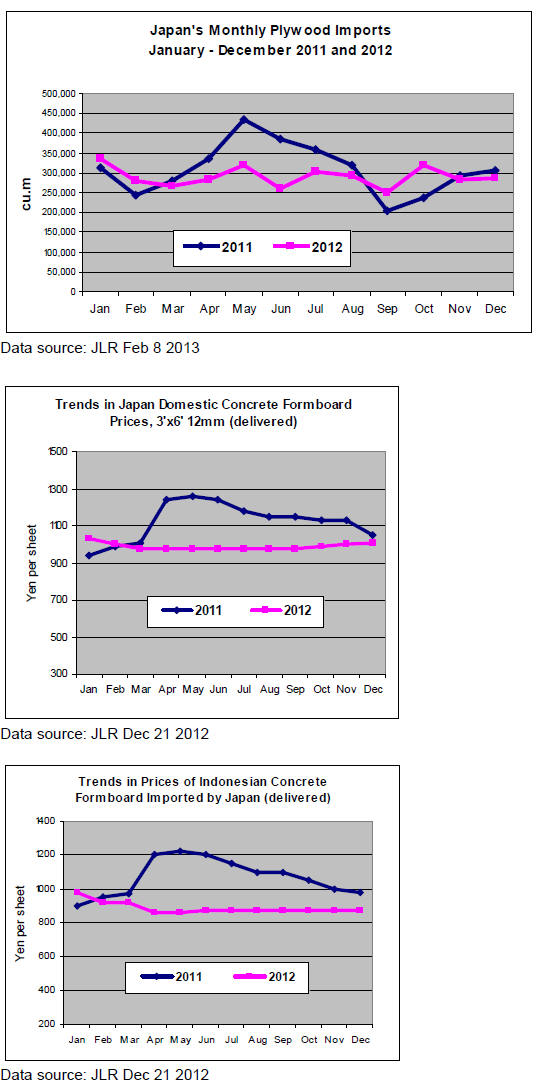

2. Plywood

Demand for plywood continues brisk but in Northern Japan and Japan Sea side

had much heavier snow this winter so that surface transportation is hampered

since last December.

Also rough sea in Japan Sea bothers inland freighters’ trip from Northern

Japan to Western Japan. In Western Japan, inventories of manufacturers and

distributors are way down due to robust orders by house builders and

pre-cutting plants.

Under this situation, in Tokyo market, delivery time from the manufacturers

to distributors became uncertain up until late January so that the supply

got short at retail level. Therefore, securing the volume becomes priority

matter rather than the prices.

The manufacturers, which carry heavy order files, are cautiously increasing

the sales prices little by little. In fact, shipment volume has been more

than mills’ production for more than six months now. December production was

202 M cbms while the shipment was 211 M cbms.

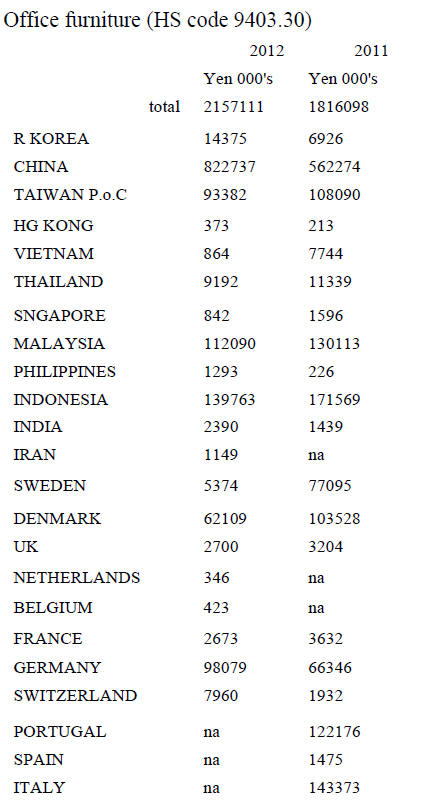

Current prices are780-800 yen per sheet delivered on 12 mm 3x6 panel, 30 yen

up from January. 1,520-1,650 yen on 24 mm thick panel.

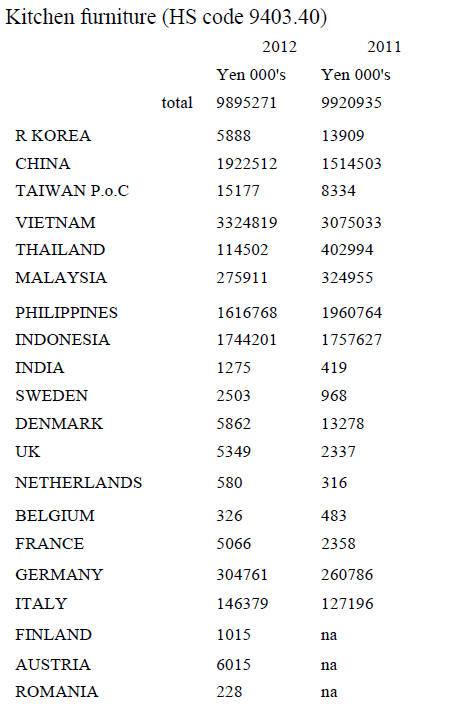

Import plywood market is also vigorous with the prices ascending. FOB export

prices have been climbing since late December but the prices in Japan did

not react so the major importers decided to push the prices up in mid

January then the market prices took off sharply.

Regardless of higher prices, it is hard to source the volume in the market

and the dealers are frantically looking for panels in demand.

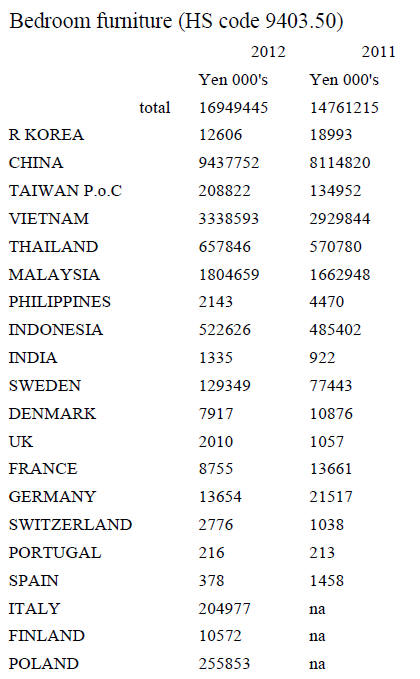

2011 and 2012 furniture imports

The source and value of Japan’s 2011 and 2012 imports of Office Furniture

(HS 9403.30), Kitchen Furniture (HS 9403.40) and Bedroom Furniture (HS

9403.50) are shown below. The data are for 2012 and 2011 and represent

imports by Japan from main suppliers in each year.

Total imports of Office Furniture by Japan totalled yen 2,157 mil. in 2012

up 19% from levels in 2011. The main suppliers were China (38%), Indonesia

(6.5%), Malaysia (5.2%) and Taiwan P.o.C (4.3%). Asian suppliers dominated

the market. Of EU suppliers to the Japanese Office Furniture market, Germany

led the way supplying yen 98 mil. in 2012, just 4.5% of total imports of

Office Furniture.

The Kitchen Furniture market in Japan is huge and imports account for a

significant market share. China, Vietnam, Philippines and Indonesia are

major suppliers. Germany and Italy contribute together around 5% of total

imports and other EU suppliers include Denmark, France and Sweden.

The largest supplier of Kitchen Furniture to the Japanese market is Vietnam

(2011, yen 3,075 mil. and 2012 yen 3,325 mil.) China, Philippines, and

Indonesia each provide around yen 1500 mil. and together account for some

yen 5,282 mil. or around 53% of the total imports of Kitchen Furniture.

The value of Japan’s imports of Bedroom Furniture in both 2011 and 2012

was approximately twice that of the value of Kitchen Furniture imports and

some eight times that of Office Furniture imports.

Manufacturers in Vietnam supplied around 34% of all of Japan’s Bedroom

Furniture imports in 2011 and in 2012. After Vietnam the main suppliers of

Bedroom Furniture to the Japanese market in 2012 were China (yen 1,922

mil.), Indonesia (yen 1,744 mil.), and Philippines (yen 1,616 mil.)

|