|

Report

from

North America

Tropical sawn hardwood imports

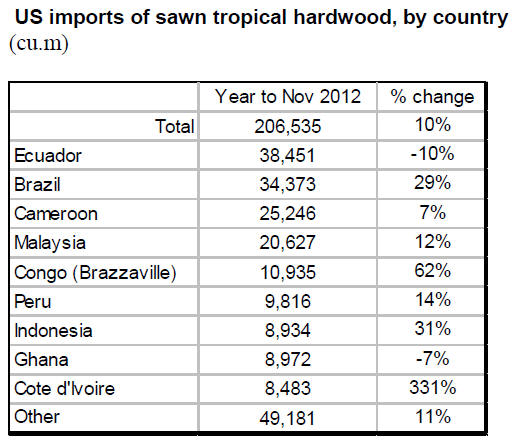

The US tropical hardwood market continued to recover in 2012, and

year-to-date imports of tropical sawn hardwood were up 10% in November

compared to 2011. November imports were 18,554 cu.m. in November, down

22% from October.

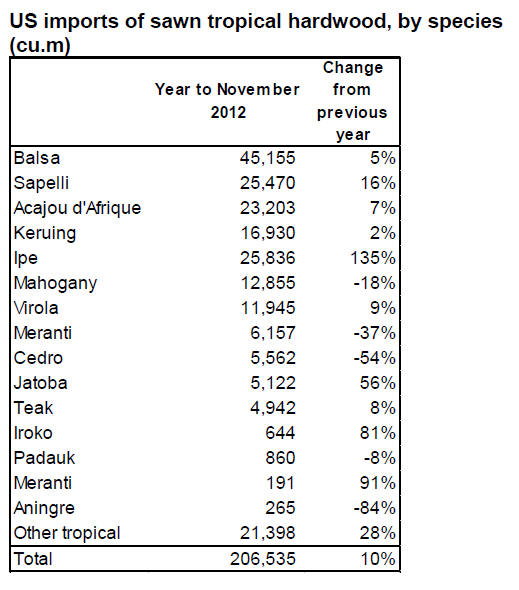

Imports of Ipe showed the strongest recovery ,with November year-to-date

imports more than twice that of 2011 volumes. Jatoba and sapele imports

also grew, while imports of cedro and meranti declined from the previous

year.

Ecuador remains the largest supplier of tropical sawn hardwood with

balsa accounting for all shipments to the US in November 2012 (3,609

cu.m.). Brazilí»s ipe exports declined to 1,185 cu.m. in November after

reaching over 4,000 cu.m. last summer.

Camerooní»s sawn sapele shipments remained relatively strong at 1,748

cu.m. in November.

Malaysiaí»s exports of sawnwood to the US increased in November mainly

because of higher keruing sawnwood shipments (1,855 cu.m.).

The Hardwood Review reports good demand for African mahogany, sapele and

cedro from South America.

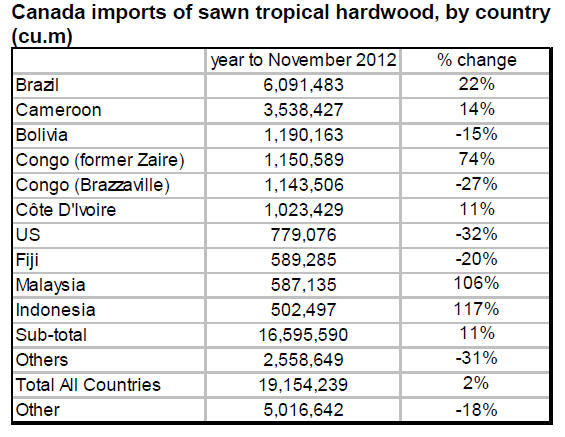

Canadian imports of tropical sawnwood declined to US$1.2 million in

November, the lowest level since January 2012. Year-to-date imports

remain 2% above 2011.

Quebecí»s hardwood flooring manufacturers are the key users of sawn

tropical hardwood in Canada. With the US housing market rebounding,

Canadian imports of tropical hardwoods are expected to grow at a faster

pace.

US manufacturing expanding, led by furniture

The US manufacturing sector expanded towards the end of 2012 according

to the latest survey by the Institute for Supply Management.

The manufacture of furniture and related products was the

fastest-growing sector of the US economy in December.

The US Census Bureau reports a 4.6% growth in new orders for December

compared with the previous month, while shipments increased by 1.3%.

New tax on sawnwood and engineered wood products

California has introduced a 1% tax on the retail price of sawnwood and

engineered wood products sold in the state. The new tax came into effect

January 2013 and is expected to raise US$30 million annually.

The money will be used for regulatory supervision of forest harvesting

in California, thereby shifting the cost burden from the timber industry

to consumers.

The new tax is assessed on so-called primary wood products with a wood

content of at least 10%, but not on products assembled or processed from

primary wood products.

All grades of sawnwood are taxed, also decking, railings and plywood.

The following products are not taxed: furniture, moulding, millwork and

hardwood flooring. The full list of products is available at::

http://www.boe.ca.gov/industry/lumber_products.html

í«Build Americaní» initiative launched

A í«Build Americaní» initiative was launched in January, modeled on Buy

American efforts targeted at consumers. The initiative is supported by

more than 180 building material manufacturers, suppliers and home

builders from across the US.

On average a US home contains an estimated 65% of US-made materials (by

value). The goal of the initiative is to increase this share both in new

house construction and in repair and renovation of existing homes.

íí

|