|

Report

from

Europe

EU Timber Regulation is major concern for European tropical

wood trade

This is an unusual and uncertain time for the European tropical hardwood

trade. Hanging over the trade is the imminent prospect of enforcement of

the EU Timber Regulation (EUTR) on 3 March 2013 and this already seems

to be having a significant impact on buying behaviour.

The EUTR imposes an obligation on all companies that ※first place§ timber

on the EU market to implement a due diligence system which ensures a

negligible risk of any derives from an illegal source.

It also makes importers legally liable and subject to sanctions ranging

from fines to prison sentences if they place timber on the market which

is subsequently shown to have been illegally harvested.

Direct importers of wood from tropical countries generally seem

confident that they can cope with the new demands of EUTR. Most have

been undertaking due diligence for years, either due to direct pressure

from customers and investors or to maintain their good reputation, so

the changes required are relatively minor.

Problems are greater for those importing products containing tropical

hardwoods 每 such as plywood and flooring 每 from manufacturers in third

countries.

EUTR reinforcing trend for small companies to stop direct imports of

tropical hardwood

On the other hand, EUTR is expected to reinforce an existing trend in

the European trade for smaller importers to withdraw from direct imports

in tropical hardwood and to rely instead on indirect purchases from

larger European importing companies.

These large importers are taking on the specialist role of due diligence

on the part of smaller distributors in the EU, while also shouldering

the financial risks associated with carrying large stock holdings of

valuable tropical wood.

Some of these larger companies report reasonably good demand for

tropical hardwood lumber in Europe 每 however it is difficult to know

whether this is due to robust consumption, or simply due to a decline in

n the number of European companies now dealing direct in tropical wood.

EU tropical wood imports fall again in 2012

Inventories of sawn tropical hardwood were run down across much of

Europe during 2012 as consumption for most species remained low overall.

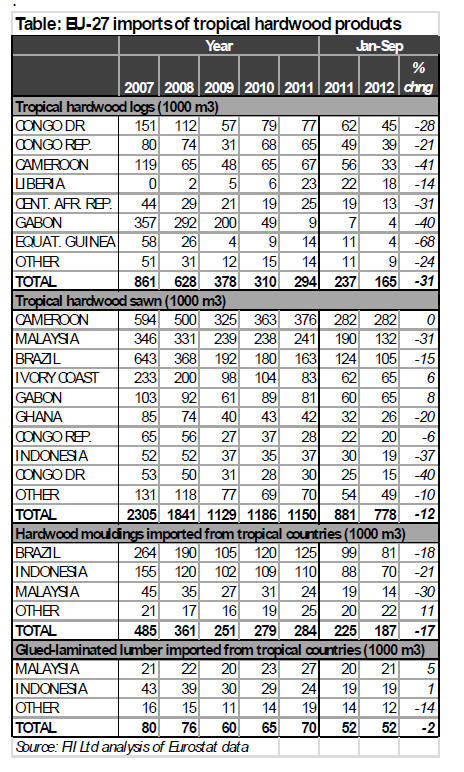

In the first 9 months of 2012, EU imports of tropical sawn hardwood were

only 778,000 m3, 12% down on the previous year (Table). The latest

quarterly data shows a consistent fall in EU-27 imports of tropical sawn

hardwood during the course of 2012 (Chart 1).

The level of imports last year is now almost certain to be less than in

2009, the previous low point in the immediate aftermath of the financial

crises. The biggest decline was in imports from Malaysia (-31%) and

Brazil (-15%) as the EU has continued to refocus purchases of tropical

rough sawn lumber on African countries, particularly Cameroon.

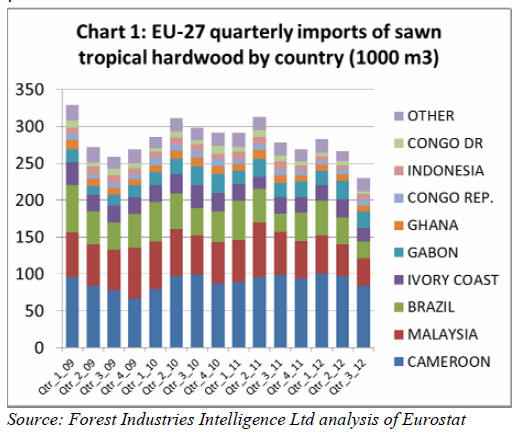

EU imports of tropical hardwood mouldings, sourced primarily from

Brazil, Indonesia and Malaysia were also falling sharply last year

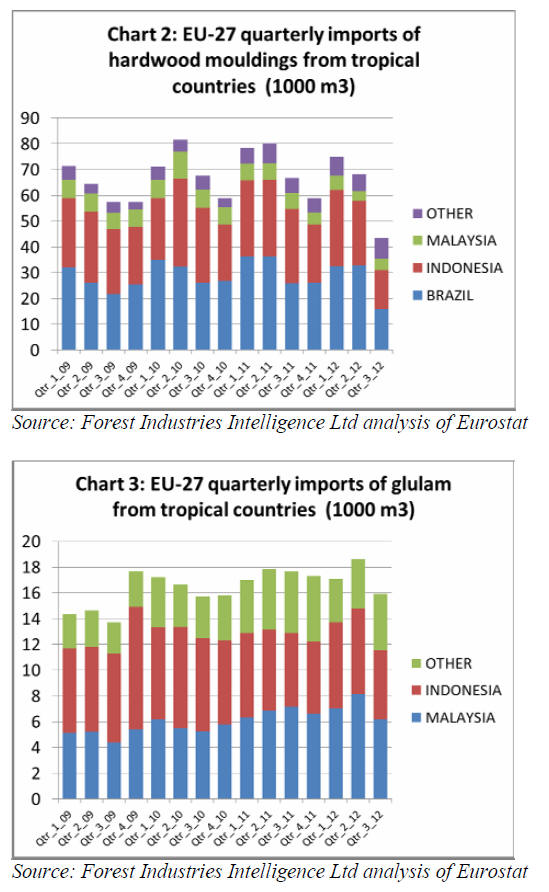

(Chart 2). However imports of laminated tropical hardwood, mainly from

Malaysia and Indonesia, were holding steady (Chart 3).

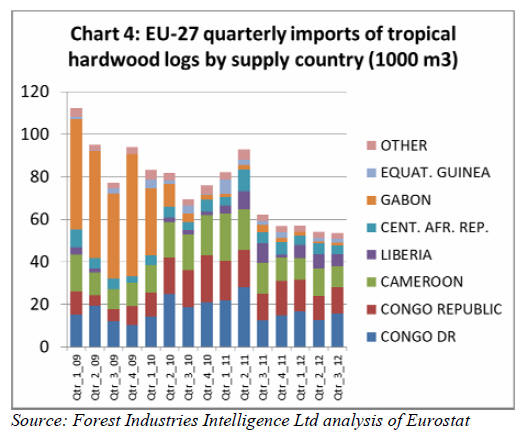

EU imports of tropical hardwood logs continue to fall, as the numbers of

plywood and custom cutting mills engaged in processing these logs in

Europe has declined further (Chart 4).

The decline has been universal across all the major supply countries.

For many species, the cost of logs is now high relative to lumber making

log imports increasingly unattractive to European buyers.

Nevertheless logs are readily available to those European companies

wishing to buy and prices remain stable.

Some moves to restock African sawn hardwood in 2013

During the opening weeks of 2013 some large importers moved to replenish

depleted stocks of key species of tropical sawn hardwood, notably

African sapele.

They were encouraged by reports of lengthening delivery times from

Africa and rising demand from other global markets which is expected to

push prices higher during 2013.

Delivery periods for sapele lumber to the EU, typically around 10 weeks

in the second half of 2012, are expected to double during 2013. Some

mills in Africa are already now only taking sapele orders for the second

half of this year.

The short supply of sapele lumber for European buyers is partly due to

imminent enforcement of the EUTR. This is encouraging greater focus of

EU buying on a more limited number of mainly larger exporting companies

based in Africa which are better able to provide credible legality

assurances.

At the same time demand for sapele in other areas of the world, notably

the United States, has been more robust in recent months, further

reducing availability to European buyers.

Shortages of sapele have encouraged greater European interest in sipo

which at present is more readily available. Iroko is also reported by EU

importers to be easier to source than sapele. However existing stocks of

iroko in Europe are already considered sufficient in the face of quite

subdued demand.

Fairly significant volumes of framire, which remains popular in the UK,

arrived in Europe from the Ivory Coast late last year under delayed

contracts. As a result stock levels are generally regarded as quite high

relative to demand.

Introduction of the EUTR is now raising questions about the long-term

viability of EU trade with the Ivory Coast which is generally considered

less able than many other African supplying countries to meet stringent

new requirements for legality verification.

On the other hand, companies in the Ivory Coast operating their own

concessions, and which can more readily demonstrate legal origin than

smaller trading companies, are apparently still receiving good orders

from the EU.

Recent reports also suggest that the Ivory Coast and the EU may soon

enter into formal discussions towards development of a Forest Law

Enforcement Governance and Trade (FLEGT) Voluntary Partnership Agreement

(VPA). If so, this would entail eventual development of legality

licensing systems in the Ivory Coast facilitating continued trade with

the EU.

EUTR provides impetus to marketing secondary species

Imminent implementation of EUTR also seems to be giving added impetus to

the marketing of secondary and lesser-known tropical species supported

by proof of legality and sustainability. For example, in the UK efforts

are being made to boost interest in OLB/FSC certified movingui as an

alternative to framire.

Rougier a French company is now promoting osanga (Pteleopsis hylodendron)

for decking and other garden products. Large Belgium-based imported

Vandecasteele is also now marketing movingui, fixed dimension iroko and

South American guariuba for decking.

Not all these efforts to find substitutes are to the benefit of tropical

wood. For example, there are renewed efforts to boost demand for

plantation grown Eucalyptus Grandis lumber as a tropical wood

substitute.

European demand for Malaysian meranti sawn lumber has remained low as

prices have, in recent times, been uncompetitive in Europe compared to

African alternatives.

Malaysian mills are now less reluctant to cut for the European market,

particularly as there is reasonable demand from other regional markets

in Asia and the Middle East.

Nevertheless standard sizes of meranti lumber are currently readily

available for prompt shipment. Delivery times are longer for smaller

dimension meranti lumber. Prices have been stable in recent months.

More robust market for laminated tropical hardwood

The market for laminated meranti window scantlings is generally more

robust than the market for meranti lumber. The trend towards laminated

wood at the expense of solid timber in the European window frame market

has continued and is affecting tropical wood as much as other species.

This trend is most apparent in central Europe where laminated Malaysian

and Indonesian hardwood has been widely accepted for many years.

Acceptance of laminated wood is generally less widespread in the UK.

European importers report that meranti laminates are now more readily

available.

Supplies eased considerably during 2012 after shortfalls experienced in

2011. Surplus supplies of meranti window scantlings combined with lower

freight rates are contributing to weakening European CIF prices.

European orders of tropical hardwood decking timbers in advance of the

coming spring season are comparatively low. Consumption expectations are

quite low as forecasts of European construction activity have been

repeatedly downgraded in recent months.

In some parts of Europe there is also a hangover of unsold stock from

last year. A few larger importers placed orders for Indonesia bangkirai

decking profiles before the end of 2012, taking advantage of ready

availability and prices which were low compared to previous seasons.

However expectations that prices might fall further encouraged some

importers to hold back. Importers are also keen to avoid putting further

downward pressure on prices for existing landed stocks.

On-going uncertainty in European teak market

The European market for natural forest teak 每 which remains a key

component in the European yacht building industry 每 is going through a

period of uncertainty. Expectations that the lifting of EU sanctions on

importation of teak from Myanmar in May last year might increase

availability have yet to be realised.

On the contrary European importers believe supply may be even more

constrained in the future.

According to a recent article in superyachtnews.com, fears of supply

shortfalls have arisen following the Myanmar Ministry of Forestry

announcement in October last year that it will ban the export of raw

teak from 2014.

The proposed ban will form part of Myanmar*s efforts to increase exports

of higher-earning finished products. This is combined with enforced

reduction in logging to preserve the country*s teak forests.

European importers quoted in the article suggest they are already seeing

an impact in the form of rising prices as suppliers in India, Thailand,

and Malaysia are stockpiling Myanmar logs in anticipation of shortfalls

of finished wood when the ban is introduced.

European importers predict prices will rise even higher from 2014

because the legislation will enable Myanmar-based businesses to charge a

marked up price for the labour involved in milling and finishing their

teak, rather than simply selling the raw log at a much lower cost.

European importers also suggest in the article that the quality of

natural forest teak available to European buyers has been falling in

recent months.

There is a fear that this will become more of a problem if less

efficient operations in Myanmar take over the role of processing teak

from more modern mills in neighbouring countries.

One European teak trader commented that he is considering opening a mill

in Myanmar itself to ensure good quality finishing. However he also

suggested this is not an easy option due to political unrest and

uncertainty over how the new regulations will pan out in practice.

﹛

|