US Dollar Exchange Rates of 25th January 2013

China Yuan 6.223

Report from China

Solid 2012 real estate sales reported

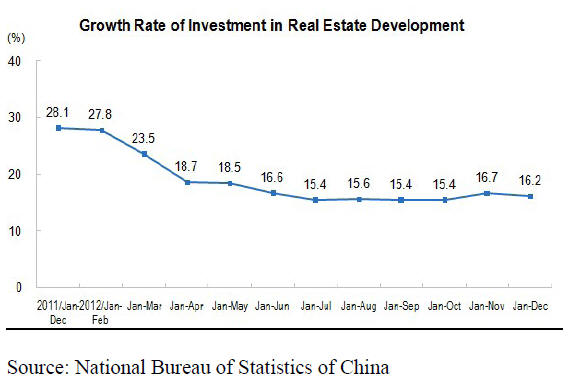

Total investment in Chinese residential real estate in 2012 was RMB

7,180.4 billion a year-on-year growth of 14.9 percent according to a

press release from the National Bureau of Statistics of China. The full

press release can be seen at:

http://www.stats.gov.cn/english/pressrelease/t20130118_402867355.htm

The total investment in residential buildings was RMB 4,937.4 billion,

up by 11.4 percent accounting for 68.8 percent of all real estate

development investment.

¡¡

In 2012, investment in real estate in the eastern region of China stood at

RMB 4,054.1 billion, up 13.9 percent year-on-year.

Investment in the central region stood at RMB 1,576.3 billion, up by

18.3 percent while in the western region investment was recorded as RMB

1,550.0 billion, a 20.4

percent increase year on year.

Sales of commercial buildings

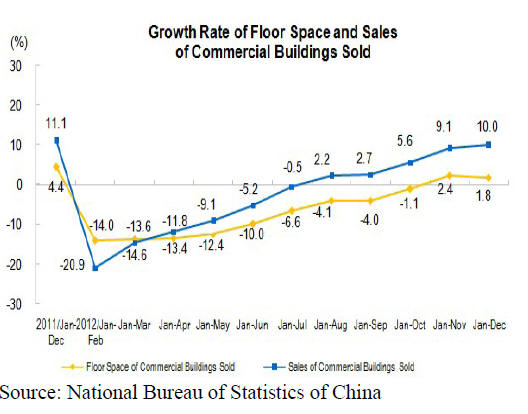

Sales of commercial buildings also increased in 2012. The total floor

area of office building sold in 2012 increased 12.4 percent but there

was a 1.4 percent drop in the area of buildings for other commercial

uses.

The overall sales of commercial buildings in 2012 amounted to RMB

6,445.6 billion.

¡¡

Debt servicing weighs on company finances

Chinese companies have borrowed so heavily in recent years that they now

face huge problems in servicing these debts.

In the latest financial statements, the cumulative debt levels of

publicly traded companies stand at around US$1.5 trillion, up from

around US$60 billion in 2007.

Debt levels last year, as a percentage of GDP, were the highest ever

recorded. This means more and more of the financial resources of

enterprises have to be channelled into debt servicing.

A Bank of China report indicates that Chinese banks provided around

US$1.0 trillion in new loans in 2012, 10 percent higher than in 2011 and

the second-highest level on record.

Towards an economy driven by domestic consumption

The Chinese economy grew by 7.8 percent in 2012, the slowest rate of

growth for the past decade when annual double digit growth was the norm.

The Chinese government has adopted policies aimed at creating a shift to

a consumer-driven economy and away from one dependent on exports. The

current challenge facing the government is how to support economic

recovery without, once again, triggering inflation and unmanageable debt

levels.

Analysts suggest that the Chinese economy is being steered towards

slower growth to better reflect the declining working-age population and

the declining availability of low cost raw materials upon which many of

the export oriented sectors depend.

Yuzhu timber market launches price index

In November last year a timber price index was launched by the Guangdong

Provincial Price Bureau. This index was developed in cooperation with

the South China Normal University.

The new index is intended to aid enterprises as they plan production,

guide policy makers and inform international markets of trends in the

timber sector.

The establishment of the Yuzhu Timber Price Index is seen as an

important means to provide greater transparency in the timber market as

well as a means for national macro-economic management and development

of timber import and industrial policies.

Domestic and international subscribers use the index to follow the Yuzhu

timber price trends. In 2011, shipments to local and overseas markets by

manufacturers in the Guangdong Yuzhu were just over 4 million cubic

metres and were worth more than RMB 16 billion, accounting for about 50%

of the national wholesale timber market.

It has been reported that Yuzhu timber market will continue cooperation

with other timber markets and a database for a national timber wholesale

markets could be developed to improve timber price information.

The Yuzhu timber market also plans for the development of an e-commerce

capacity. The managers of the market are aiming for the Yuzhu Timber

Market to account for up to 70% of China¡¯s timber trade within 3-5

years.

Particleboard investment planned

The Sichuan based Guodong Group intends to invest some RMB700 million in

a particleboard plant with an annual production capacity of 500 000

cubic metres.

Guodong Construction Group Co. Ltd. is the controlling shareholder of

Sichuan Guodong Construction Co., Ltd. According to company¡¯s plan the

plant will be constructed within a period of one year and when fully

operational the annual revenue will be around RMB65 million.

New logging license system introduced

The State Forestry Administration (SFA) has developed a new forest

logging license scheme which will become effective from March 2013. This

will further standardise forest logging management systems and is part

of the forestry reform undertaken by the SFA.

The new license scheme has five essential elements:

the provincial forestry authorities are responsible for immediate

application of the new scheme and must print the new license forms,

inform users of the new scheme and verify the information provided by

forest operators. To effect a smooth change to the new scheme the old

forest logging licenses can be used until June 2013 after which it will

be replaced by the new license.

the new forest logging license will be used nationwide and a uniform

license numbering system will be applied to avoid the risk of forgery or

trade in forest logging licenses.

the licensing authority must maintain records of the old and new licenses

issued.

Forest logging licenses which have been issued should be registered to

ensure standardization and transparency and to facilitate verification.

the issuance and verification procedures for the forest logging license

by the local authorities must follow the SFA rules to ensure uniform

application pattern.

all local forest authorities must ensure training of staff responsible

for implementing the new license procedures.

All forest authorities which have introduced electronic license

application and issuance systems are required to modify these to meet

the requirements of the new license procedures.

¡¡

¡¡

|